News

$22bn Needed To Turn Around Free Zones In Delta, Other States

To fully realise the gains of economic zones, an investment of about $22 billion is required in Delta and other states of the federation to revamp the sector, the Managing Director of the Nigeria Export Processing Zone Authority, Prof Adesoji Adesugba, has said.

The NEPZA boss stated this on Wednesday in Abuja at the official licence presentation ceremony of the Delta State Special Economic Zone to Governor Ifeanyi Okowa. The event attracted eminent personalities particularly officials of the Delta State government.

In his remarks, Prof Adesugba called for massive investment in the sector, noting that some countries are already addressing their developmental challenges by harnessing the huge advantages in their economic zones.

READ ALSO: Delta: Tricycle Driver Crushed To Death On ‘One-Way’

He said, “Everybody is talking about Lagos. In Lagos, there is $22 billion investment in free zones and we believe that we can replicate what is happening in Lagos in Delta and other states. Delta State stands to gain and is well-positioned. All it needs is that leadership; the vision which Governor Okowa has shown, and we are praying that whoever is taking over from him will key into this and make sure that we actualize this. NEPZA is willing and capable of giving you all the necessary support.”

Lead consultant of the Delta Special Economic Zone and former Minister of Justice, Adetokunbo Kayode, in his brief address, commended Governor Okowa for the initiative, noting that Delta State would reap bountifully from the scheme in years to come.

“The essence of having a special economic zone goes beyond the free zones that we have in Lagos and Ogun states. The special economic zone gives a dynamic platform for Delta State to harness its huge opportunities, especially in petrochemicals and agriculture. It can become a hub for manufacturing across the board and I think the state is well placed for this,” he said.

READ ALSO: Man Commits Suicide In Delta Community Over Wife’s Separation

Speaking shortly after receiving the licence on behalf of the state, Governor Okowa spoke of the economic advantages that await the people of the state saying, “We are in a hurry to get the Special Economic Zone work for Delta State and for Nigeria, and we also realise that it will create advantages in our state because we produce a lot of gas. We also produce a lot of oil. We are very much involved in agriculture, and putting up these things together, I believe that we are set for this nation and for the world.”

He expressed readiness on the part of the state government to partner with NEPZA to fully develop her economic zones even as he pledged that the incoming administration will continue with the scheme even after the end of his tenure on May 29.

News

PAP Sends Additional 34 Foreign Post-graduate Scholarship Beneficiaries To UK Varsities

The Presidential Amnesty Programme (PAP) has deployed an additional 34 foreign post-graduate scholarship beneficiaries to various universities in the United Kingdom for the 2025-2026 academic year.

This was contained in a statement made available to newsmen in Warri by Mr Igoniko Oduma, Special Assistant on Media to Dr. Dennis Otuaro, the Administrator, PAP.

According to the statement, the scholars’ programmes include data science, fintech analytics, cyber security, international energy law and policy, construction project management, public health, agri-food technology, electrical and petroleum engineering, among others.

The statement added that more foreign post-graduate scholars will be sent to UK universities in the current academic session.

“In December 2025, nine students, who were the first set of offshore post-graduate scholarship developments by the PAP Administrator, Dr Dennis Otuaro, for the 2024-2025 academic year, graduated from their various programmes in UK universities.

READ ALSO:PAP Scholarship Scheme Vehicle For Better Future For Niger Delta —Otuaro

“Otuaro has deployed over 9000 students to universities within and outside Nigeria for different industry-relevant programmes since he assumed office in March 2024,” the statement partly reads.

Speaking at the pre-departure orientation programme for the scholars at the PAP headquarters in Abuja, on Thursday, Otuaro said that the large-scale deployment was aimed at making the Niger Delta a knowledge-driven region.

He said that his leadership reinvigorated the programme to give it a new momentum in service delivery to the people of the region based on the mandate of President Bola Tinubu.

Otuaro said, “We are sending all of you for post-graduate studies in various universities in the United Kingdom.

“The PAP now has a new momentum and direction because of the repositioning and broad reforms that we carried out in line with the mandate of His Excellency, President Bola Ahmed Tinubu GCFR.

READ ALSO:Otuaro Tasks Media On Objective Reportage

“The objective behind the huge scholarships deployment is to ensure that we develop the needed human capital to transform the Niger Delta and generate knowledge-wealth.

“We want to develop relevant manpower in critical disciplines for our region and by extension, the country, because you are expected to contribute your quota to national development after successful graduation.”

The PAP boss, who was represented at the event by his Technical Assistant, Mr Edgar Biu, advised the scholars to study hard to achieve academic excellence in their various fields of research.

According to him, the scholars have an obligation to justify the Federal Government’s investment in their education and future.

READ ALSO:I’m Not Distracted By Anti-Niger Delta Elements, Says PAP Boss, Otuaro

He reiterated his warning that beneficiaries should not take for granted the opportunity to further their academic pursuits in the interest of the Niger Delta and indeed the country.

Otuaro expressed appreciation to President Tinubu for his “enormous interest and support for the Programme”, particularly the approval of an upward review of the programme’s budget from N65billion to N150billion.

He also expressed gratitude to the National Security Adviser, Mallam Nuhu Ribadu, for his impeccable guidance and supervision of the programme’s initiatives.

Otuaro, therefore, cautioned the scholars to obey their host country’s laws and the rules and regulations of their various institutions, stressing that they are ambassadors of Nigeria, the Niger Delta and their communities and families.

Highpoint of the orientation programme was the presentation of laptops to the scholars to help them in their studies.

News

Industrial Court Bars Resident Doctors From Strike

The National Industrial Court in Abuja has issued an interim injunction restraining the Nigerian Association of Resident Doctors (NARD) and its agents from embarking on any form of industrial action, including strikes, go-slows, picketing, or preparatory steps for protest, from Monday, January 12, 2026.

Justice E.D. Subilim ordered that the injunction remain in force pending the hearing of the motion on January 21. The suit was filed by the Attorney General of the Federation (AGF) and the Federal Government against NARD, its president, Dr Mohammad Suleiman, and Dr Shuaibu Ibrahim.

The court order comes days after resident doctors at the Usmanu Danfodiyo University Teaching Hospital (UDUTH), Sokoto, declared their full support for the nationwide strike announced by NARD over the government’s alleged failure to honour critical welfare and training agreements.

UDUTH doctors cited the non-reinstatement of five disengaged resident doctors at the Federal Teaching Hospital, Lokoja, unpaid promotion and salary arrears, and incomplete implementation of the Professional Allowance Table as key grievances. Other unresolved issues include withheld specialist allowances, delayed house officers’ salaries, postgraduate training certification delays, and deteriorating hospital infrastructure.

READ ALSO:Resident Doctors Suspend Strike, Issue Fresh Four-week Ultimatum

However, NARD had on Tuesday noted that there was no going back on the industrial action, insisting that the strike is necessary and not politically motivated. Speaking in Abuja, Dr Suleiman said the withdrawal of services from midnight on Monday is a response to “unmet commitments, shifting government positions and worsening working conditions for resident doctors, not partisan considerations.”

He argued that none of the demands outlined in the Memorandum of Understanding signed with the Federal Government on November 27, 2025, have been implemented.

“Every issue is either at the same point where it was when we signed the MoU or we have even gone backwards,” Dr Suleiman said, adding that claims by the Ministry of Health that some issues had been resolved were misleading.

He further challenged the government to show where N90 billion, allegedly allocated in the 2026 budget for health workers’ professional allowances, has been provided.

READ ALSO:Doctors’ Strike Continues As NARD Demands Fair Deal, Better Pay

The association also demanded the immediate reinstatement of the five disengaged resident doctors at FTH Lokoja with full back pay and rejected plans to redeploy them elsewhere.

Other grievances include delayed promotion arrears across 62 tertiary institutions, non-recognition of specialist certificates, and outstanding salary and allowance payments affecting nearly 40 percent of resident doctors.

While NARD remains open to dialogue and has appealed to President Bola Ahmed Tinubu for decisive intervention, it warned that unless concrete action is taken, the planned industrial action will go ahead, potentially disrupting healthcare services nationwide. Dr Mujitaba Umar, President of the UDUTH chapter, described the situation as “difficult but unavoidable,” while the chapter’s General Secretary, Dr Muhammad Abdulrahman Hassan, urged the Federal Government to act swiftly “in the interest of the Nigerian populace and the healthcare system.”

News

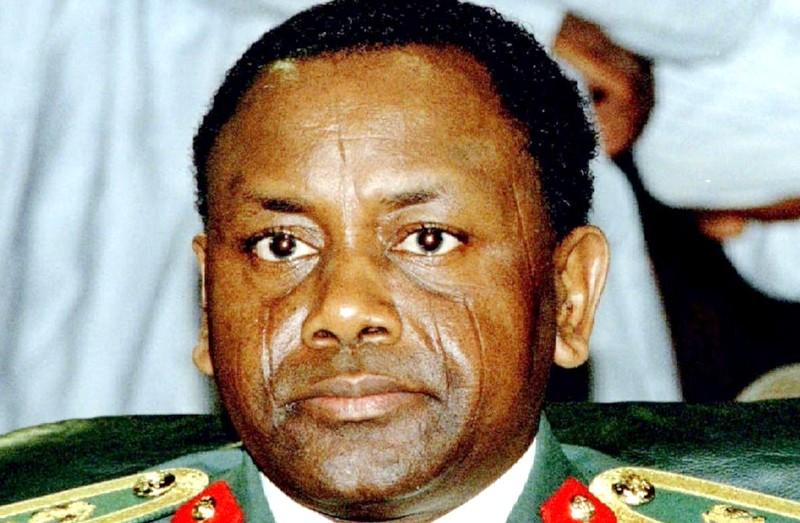

Nigeria To Get Fresh $9.5m Abacha Loot From UK’s Jersey

Nigeria to receive fresh $9.5 million (£7 million), believed to be stolen funds linked to former military Head of State, Sani Abacha, from the United Kingdom’s Jersey.

According to the BBC, Jersey has agreed to repatriate the fund to the Nigerian government.

The money, described as proceeds of “tainted property,” is said to be part of the vast fortune stolen by Abacha, who ruled Nigeria between 1993 and 1998.

READ ALSO:How I Transited From Abacha’s Friend To prisoner — Lamido

The funds were kept in a bank account in Jersey and had been tied up in legal proceedings for several years.

Although the assets were first recovered during the administration of former President Goodluck Jonathan, court challenges stalled their return to Nigeria. Progress was made in December 2025 when Jersey’s Attorney-General, Mark Temple, signed a memorandum of understanding, MoU, with Nigerian authorities to enable the repatriation.

The latest agreement builds on two earlier arrangements between Jersey and Nigeria that led to the return of more than $300 million (£230m) in recovered assets.

News3 days ago

News3 days agoHow To Calculate Your Taxable Income

Business4 days ago

Business4 days agoNNPCL Reduces Fuel Price Again

Metro4 days ago

Metro4 days agoEdo: Suspected Kidnappers Kill Victim, Hold On To Elder Brother

Metro4 days ago

Metro4 days agoAAU Disowns Students Over Protest

Metro2 days ago

Metro2 days agoEdo widow-lawyer Diabolically Blinded Over Contract Seeks Okpebholo’s Intervention

Metro3 days ago

Metro3 days agoJUST IN: Court Grants Malami, Wife, Son N500m Bail Each

Headline3 days ago

Headline3 days agoRussia Deploys Navy To Guard Venezuelan Oil Tanker Chased By US In Atlantic

Metro4 days ago

Metro4 days agoNine Soldiers Feared Dead In Borno IED Explosion

Entertainment3 days ago

Entertainment3 days agoVIDEO: ‘Baba Oko Bournvita,’ Portable Drags His Father, Alleges Bad Parenting, Extortion

Politics3 days ago

Politics3 days ago2027: Details Of PDP Leaders, Jonathan’s Meeting Emerge