Business

Amazon Set To Steal Jumia, Others’ Market Share

Published

3 years agoon

By

Editor

Amazon is set to steal some of the market share of major e-commerce players in Nigeria such as Jumia and Konga.

Leaked documents revealed that the company plans to expand into five new countries across Africa, South America, and Europe. The five countries include Belgium, Chile, Colombia, Nigeria, and South Africa according to a report by businessinsider.com.

The firm is investing in long-term growth even as it scales back parts of its United States retail. Amazon currently has marketplaces in 20 different countries.

The timing of the rollouts revealed the company is set to roll out in Nigeria in April 2023.

“The timing of the rollouts were detailed in an internal timeline: Belgium’s marketplace, called Project Red Devil, is slated for late September,” the report said.

READ ALSO: Tobacco Industries Cost World 8 Million Lives, 600 Million Trees Annually – Official

“The one in Colombia, dubbed Project Salsa, is scheduled for February 2023. South Africa, codenamed Project Fela, is also expected in February 2023. The marketplace in Nigeria is due to launch in April 2023. That project shares the codename Project Fela with South Africa. Chile is planned for April 2023, too. That shares the Project Salsa name with Colombia.

“All countries are planning to launch with their own marketplace and access to Amazon’s fulfilment service called Fulfillment by Amazon, one of the documents said.”

According to the report, Amazon’s Prime membership program is expected to be available after the firm’s launch in Belgium, while the other four countries will get it shortly after their introductions.

The Naira experienced a slight depreciation on Friday at the official market, trading at N1,528.56 to the dollar.

Data obtained from the website of the Central Bank of Nigeria (CBN) showed that the Naira lost N2.73.

This represents a 0.17 percent loss compared to the N1,525.82 recorded on Thursday.

READ ALSO:Naira Appreciates At Official Market

The Naira, which opened the week on Monday with a gain of N9.52 against the dollar, held steady gains until Thursday.

On Wednesday, the local currency gained N3.42 against the dollar and received commendation from the International Monetary Fund (IMF).

The IMF, in its 2025 Article IV Consultation report on Nigeria, commended the CBN for its reforms to the foreign exchange market, which supported price discovery and liquidity.

Business

JUST IN: Dangote Refinery Hikes Petrol Ex-depot Price

Published

2 weeks agoon

June 20, 2025By

Editor

Nigerians may soon pay more for petrol as the Dangote Petroleum Refinery on Friday increased its ex-depot price for Premium Motor Spirit to N880 per litre, raising fresh concerns over fuel affordability and price volatility in the downstream sector.

Checks on petroleumprice.ng, a platform tracking daily product prices, and a Pro Forma Invoice seen by The PUNCH confirmed the hike, representing a N55 increase from the previous rate of N825 per litre.

The increment would ripple across the entire fuel distribution chain, likely pushing pump prices above N900/litre in some parts of the country, especially in areas far from the distribution hubs.

The hike comes despite global crude prices falling. Brent crude dipped by 3.02% to $76.47, WTI fell to $74.93, and Murban dropped to $76.97 on Friday. The decline in benchmarks offers little relief due to persistent fears of sudden supply disruptions.

READ ALSO: JUST IN: Dangote Refinery Sashes Petrol Gantry Price

The refinery has increased its reliance on imported U.S. crude and operational costs amid exchange rate instability, which adds to its pricing pressure.

On Thursday, the President of the Dangote Group, Aliko Dangote, said his 650,000-barrel capacity refinery is “increasingly” relying on the United States for crude oil.

This came as findings showed that the Dangote Petroleum Refinery is projected to import a total of 17.65 million barrels of crude oil between April and July 2025, beginning with about 3.65 million barrels already delivered in the past two months, amid ongoing allocations under the Federal Government’s naira-for-crude policy.

Dangote informed the Technical Committee of the One-Stop Shop for the sale of crude and refined products in naira initiative that the refinery was still battling crude shortages, which had led it to resort to imports from the United States.

READ ALSO:Dangote Stops Petrol Sale In Naira, Gives Condition For Resumption

On Monday, the president of the Petroleum and Natural Gas Senior Staff Association of Nigeria, Festus Osifo, accused oil marketers of exploiting Nigerians through inflated petrol prices, insisting that the current pump price of PMS should range between N700 and N750 per litre.

He criticised the disparity between falling global crude oil prices and the stagnant retail price of petrol in Nigeria.

“If you go online and check the PLAT cost per cubic metre of PMS, convert that to litres and then to our Naira, you will see that with crude at around $60 per barrel, petrol should be retailing between N700 and N750 per litre.”

He asserted that if Nigerians bear the brunt of higher fuel costs, they should be allowed to enjoy the benefit of low pricing.

His forecast of increased costs now appears spot on, considering the latest developments.

Marketers are already adjusting. Depot owners and fuel distributors in Lagos and other cities anticipate a domino effect, with new price bands expected to follow Dangote’s lead.

Many had held back pricing decisions since Tuesday, when the refinery halted sales and withheld fresh PFIs. The delay fueled speculation, allowing opportunistic price hikes across various depots.

The Naira, which has seen steady appreciation against the Dollar all week, closed stronger on Friday, trading at ₦1,580.44 in the official forex market.

Data from the Central Bank of Nigeria’s website show the Naira gained ₦4.51k against the Dollar on Friday alone.

This marks a 0.28 per cent appreciation from Thursday’s closing rate of ₦1,584.95 in the official foreign exchange window.

The local currency maintained consistent strength throughout the week, recording gains daily.

READ ALSO: Naira Appreciates Against Dollar At Foreign Exchange Market

On Monday, May 19, it traded at ₦1,598.68; on Tuesday, at ₦1,590.45; and on Wednesday, at ₦1,584.49.

These gains suggest increased investor confidence and improved forex supply, contributing to the naira’s performance.

Meanwhile, the CBN, at its 300th Monetary Policy Committee meeting held Monday and Tuesday, retained the Monetary Policy Rate at 27.5 per cent.

- Online Reports On Protest False, Intent To Tarnish Our Image – AAU Ekpoma

- Obi In Benin, Donates N15m To St Philomena School of Nursing Sciences

- What To Know About Rashidi Ladoja, The Next In To Become Olubadan

- Tension In Kano As Sanusi, Bayero Loyalists Clash Near Emir’s Palace

- Tension As FG Strips FAAN, NCAA, NAMA Of Revenue Collection Powers

- Flash Flood Warning: Sokoto, Edo, Akwa Ibom, 17 Other States At Risk In July — NiMet

- Trump Threatens Extra 10% Tariff On BRICS Nations

- Tiwa Savage Shares Emotional Moment With Son

- JUST IN: Gunmen Kill Policeman, Abduct Other In Imo

- INEC Announces Dates For Commencement Of Continuous Voter Registration In Osun

About Us

Trending

Sports5 days ago

Sports5 days agoBREAKING: Liverpool Star Diogo Jota Is Dead

Politics3 days ago

Politics3 days agoCoalition: Why Tinubu Must Not Sleep —Primate Ayodele

Entertainment2 days ago

Entertainment2 days ago2Baba’s New Romance In Trouble As Natasha Fumes Over Loyalty Remark

Politics5 days ago

Politics5 days agoCoalition: Abure-led LP Gives Obi 48 Hours To Leave Party

Politics3 days ago

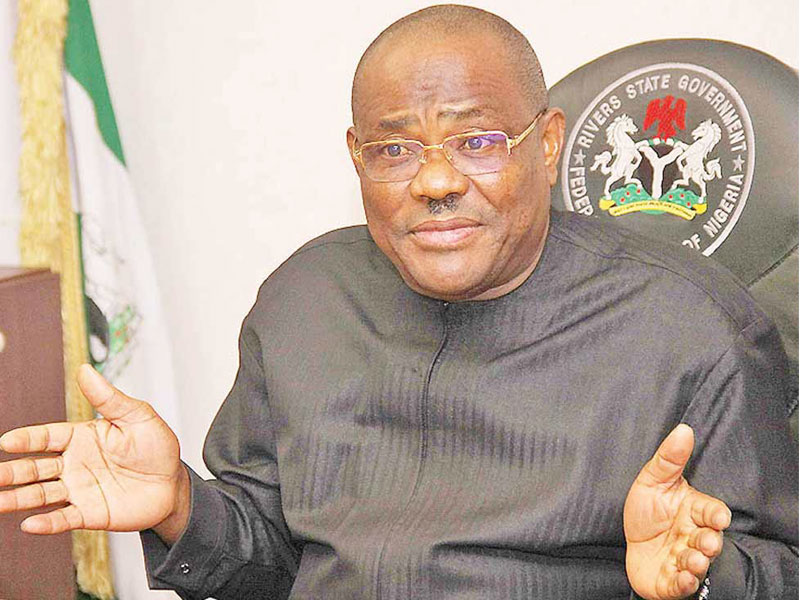

Politics3 days agoAmaechi: I Will Resign As FCT Minister If… Wike

Sports5 days ago

Sports5 days ago5 ‘Big’ Recent Events Diogo Jota Had Before His Death

Metro2 days ago

Metro2 days agoTragedy As Navy Boat Capsizes After Free Medical Outreach In Delta

Metro5 days ago

Metro5 days agoThree-storey Building Collapses On Lagos Island, Many Injured

Metro4 days ago

Metro4 days agoVIDEO: Police Arrest Varsity Student For Stabbing Colleague, Demanding Ransom In Delta

Politics5 days ago

Politics5 days agoADC, A Coalition Of Failed Politicians – Wike