Business

CBN Gives Out N8trn In Interventions To Private Sector In Last 5 Years – Emefiele

Published

11 months agoon

By

Editor

The governor of the Central Bank of Nigeria, CBN, Godwin Emefiele, has revealed that the CBN had given out about N8 trillion in interventions to the private sector in the last five years.

Emefiele made this revelation while speaking at the end of the 291st Monetary Policy Committee, MPC, meeting in Abuja on Wednesday.

He said, “In the last four to five years, we have done about N8 trillion in interventions to the private sector of the economy. The loans have been granted for 10 years, with a two-year moratorium and at single digit”.

The CBN boss disclosed, however, that going forward, the apex bank would reduce its quasi-fiscal activities.

Meanwhile, as the Dangote Refinery set to deliver its first products in July, Emefiele said that the refinery would be persuaded to sell foreign exchange earnings to banks at a good rate.

READ ALSO: CBN Increases Interest Rate To 18.50%

Emefiele said his team would engage the promoter of the refinery, Alhaji Aliko Dangote, to ensure that Nigerians benefitted from the venture, adding that the CBN, the Federal Government and, indeed, the country helped him set up the refinery.

The CBN boss expressed optimism that the refinery would ease the foreign exchange scarcity in the country, noting that with local refining, about 20 per cent cost of the total cost of importing petroleum products could be saved, thereby reducing prices in the long run. He, however, said it was time to exit the fuel subsidy regime.

His words, “By the time the Dangote Refinery comes on stream, the price at which it (fuel) will be dispensed will be lower than what it is when we spend dollars to import because there will be no freight cost, no storage and all other logistics expenses.

READ ALSO: CBN Revokes Operating Licenses Of 132 MFBs, Others (FULL LIST)

“So we will be lucky to be having about 20 per cent savings from refining locally, rather than importing.

“But the important thing is that we have reached a point, whether we like it or not when we must exit subsidy.

“Dangote Refinery coming at this time gives us the confidence that even if we exit subsidy, the products will be available. And eventually, the interplay of market forces will also moderate the prices to a level that will help the country.

“So we are expecting that, no doubt, by the time he produces for domestic consumption, the excess will be exported by the numbers that he talked about, which we agree with.

READ ALSO: CBN Lists Four Firms To Print Cheques, Excludes NPSMC

‘’We should be able to save, conservatively, close to about $5 billion to $10 billion in foreign exchange that will come into the country.

“Whether it comes to our reserves or not is not the point, it is the fact that the dollar is available and it will be sold in the domestic market so that customers of banks who need to import do not necessarily resort to CBN for dollars.

“They can go to their banks and Dangote will sell dollars to their banks and we are going to ensure that it is done at a good market rate.

“What I would have loved to say on Monday (at the Dangote Refinery Commissioning) which I didn’t say was that the CBN, the government and the country have helped Dangote to set up that refinery.

“He is a Nigerian; Nigerians must benefit from that venture and we are going to engage him and talk to him and I am sure that being the richest man in Africa, he is going to throw a few crumbs so that the price will be lowered.”

You may like

CBN Sells Fresh Dollars To BDCs At N1,021/$

CBN Gives New Directive On Lending In Real Estate

How I Collected Dollars In Cash For Emefiele, Dispatch Rider Tells Court

UPDATED: Lagos Court Grants Emefiele N50m Bail

BREAKING: Lagos Court Grants Emefiele N50m Bail

JUST IN: CBN Sells FX To BDCs At N1,101/$1

The Central Bank of Nigeria (CBN) started fresh and direct sales of US dollars at N1,021 per dollar to Bureau De Change operators.

Nigeria’s apex bank disclosed this in a circular signed by its Director of Trade and Exchange Department Hassan Mahmud.

“We write to inform you of the sale of $10,000 by the Central Bank of Nigeria (CBN) to BDCs at the rate of N1,021/$1. The BDCs are in turn to sell to eligible end users at a spread of NOT MORE THAN 1.5 percent above the purchase price,” the circular posted on its website read.

READ ALSO: Tinubu Unveils African Counter-Terrorism Summit

“ALL eligible BDCs are therefore directed to commence payment of the Naira deposit to the underlisted CBN Naira Deposit Account Numbers from today, Monday, April 22, 2024, and submit confirmation of payment, with other necessary documentations, for disbursement of FX at the respective CBN Branches.”

CBN’s move is coming as the naira is recording a slight depreciation against the dollar after weeks of gains.

In late March, the bank also sold $10,000 to each of the eligible Bureau De Change (BDC) operators in the country at the rate of N1,251/$1.

READ ALSO: Mixed Reactions Trail Video Of Couple’s Customised N200 Notes

Like in the most recent sales, it warned BDCs against breaching terms of the dollar sales, vowing to sanction defaulters “including outright suspension from further participation in the sale”.

The fortunes of the naira have fallen sharply since President Bola Tinubu took over in May. Inflation figures have reached new highs and the cost of living hitting the rooftops.

Nigeria’s currency slid to about N1,900/$ some months ago at the parallel market. But in recent weeks, it has gained against the dollar.

The Nigerian authorities have also doubled down on their crackdown against cryptocurrency platform Binance and illegal BDCs.

On March 1, the CBN revoked the licences of 4,173 BDCs over compliance failures.

Olusegun Alebiosu has been appointed as the Acting Managing Director/Chief Executive Officer of First Bank of Nigeria Limited (FirstBank Group), effective April 2024.

Alebiosu steps into this pivotal role from his previous position as the Executive Director, Chief Risk Officer, and Executive Compliance Officer, a position he held since January 2022.

Alebiosu brings to the helm of FirstBank over 28 years of extensive experience in the banking and financial services industry. His expertise spans various domains including credit risk management, financial planning and control, corporate and commercial banking, agriculture financing, oil and gas, transportation, and project financing.

READ ALSO: JUST IN: Access Holdings Names New Acting CEO

Having embarked on his professional journey in 1991 with Oceanic Bank Plc. (now EcoBank Plc.), Alebiosu has held several notable positions in esteemed financial institutions.

Prior to joining FirstBank in 2016, he served as Chief Risk Officer at Coronation Merchant Bank Limited, Chief Credit Risk Officer at the African Development Bank Group, and Group Head of Credit Policy & Deputy Chief Credit Risk Officer at United Bank for Africa Plc.

Alebiosu’s academic credentials further enrich his professional profile. He is an alumnus of the Harvard School of Government and holds a Bachelor’s degree in Industrial Relations and Personnel Management. Additionally, he obtained a Master’s degree in International Law and Diplomacy from the University of Lagos, as well as a Master’s degree in Development Studies from the London School of Economics and Political Science.

READ ALSO: Meet Newly Appointed Union Bank CEO

A distinguished member of various professional bodies, including the Institute of Chartered Accountants (FCA), Nigeria Institute of Management (ANIM), and Chartered Institute of Bankers of Nigeria (CIBN), Alebiosu is renowned for his commitment to excellence and ethical practices in the banking sector.

Beyond his professional endeavors, Alebiosu is known for his passion for golf and adventure. He is happily married and a proud parent.

With Alebiosu’s appointment, FirstBank of Nigeria Limited anticipates continued growth and innovation under his leadership, reinforcing its position as a leading financial institution in Nigeria and beyond.

Business

CBN Gives New Directive On Lending In Real Estate

Published

1 week agoon

April 17, 2024By

Editor

The Central Bank of Nigeria, CBN, has released a new regulatory directive to enhance lending to the real sector of the Nigerian economy.

The directive, issued on April 17, 2024, with reference number BSD/DIR/PUB/LAB/017/005 and signed by the Acting Director of Banking Supervision, Adetona Adedeji, signifies a notable shift in the bank’s policy towards a more contractionary approach.

In line with the new measures, the CBN has reduced the loan-to-deposit ratio by 15 percentage points, down to 50 per cent.

This move aligns with the CBN’s current monetary tightening policies and reflects the increase in the Cash Reserve ratio rate for banks.

READ ALSO: JUST IN: CBN Gov Sacks Eight Directors, 32 Others

The LDR is a metric used to evaluate a bank’s liquidity by comparing its total loans to its total deposits over the same period, expressed as a percentage.

An excessively high ratio may indicate insufficient liquidity to meet unexpected fund requirements.

All Deposit Money Banks are now mandated to adhere to this revised LDR.

The CBN has stated that average daily figures will be utilised to gauge compliance with this directive.

Furthermore, while DMBs are encouraged to maintain robust risk management practices in their lending activities, the CBN has committed to continuous monitoring of adherence and will adjust the LDR as necessary based on market developments.

READ ALSO: JUST IN: CBN Increases Interest Rate To 24.75%

Adedeji has called on all banks to acknowledge these modifications and adjust their operations accordingly. He emphasised that this regulatory adjustment is anticipated to significantly influence the banking sector and the wider Nigerian economy.

The circular read in part, “Following a shift in the Bank’s policy stance towards a more contractionary approach, it is crucial to revise the loan-to-deposit ratio policy to conform with the CBN’s ongoing monetary tightening.

“Consequently, the CBN has decided to decrease the LDR by 15 percentage points to 50 per cent, proportionate to the rise in the CRR rate for banks.

“All DMBs must maintain this level, and it is advised that average daily figures will still be applied for compliance assessment.

“While DMBs are urged to sustain strong risk management practices concerning their lending operations, the CBN will persist in monitoring compliance, reviewing market developments, and making necessary adjustments to the LDR. Please be guided accordingly.”

JUST IN: Tinubu Arrives Riyadh For World Economic Forum

Tinubu Sacks NESREA, NDRBDA MDs, Appoints New Heads

Don Advocates Drug Test For Lecturers

Trending

Entertainment4 days ago

Entertainment4 days agoBridesmaids’ Dance At Wedding Causes Stir On Social Media [VIDEO/PHOTOS]

Metro4 days ago

Metro4 days agoVIDEO: ‘UNN Lecturer’ Caught Pants Down With Married Student

News2 days ago

News2 days agoDrama! Supporters Of Yahaya Bello Perform Rituals to Prevent His Arrest By EFCC [Video]

News2 days ago

News2 days agoVIDEO: Force PRO Orders Arrest Officers Caught On Video Bashing Driver’s Car

Headline3 days ago

Headline3 days agoDrama As Women Fight Dirty, Breasts Fall Out During Spring Break Outing In US [PHOTOS/VIDEO]

Entertainment3 days ago

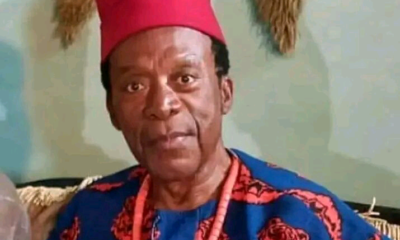

Entertainment3 days agoNollywood Actor, Zulu Adigwe Is Dead

Headline3 days ago

Headline3 days agoMeet 17-year-old Nigerian Who Won $3.5m Worth Of Scholarships From Harvard, 13 Other Foreign Universities

Metro2 days ago

Metro2 days agoEdo Cultists Kill Rival In Daughter’s Presence, Abandon Getaway Car

News4 days ago

News4 days agoIGP, Jonathan Disagree Over State Police

News5 days ago

News5 days agoOutrage As Chinese Supermarket In Abuja Denies Nigerians Entry