News

Custodian Of Olumo Rock Deity Dies At 137

Custodian of the deity inside the popular Olumo Rock in Abeokuta, the Ogun State capital, Chief Mrs. Sinatu Aduke Sanni, popularly known as ‘Iya Olumo’ is dead.

Sanni, also known as the mother goddess of the tourist centre, died on Wednesday, reportedly at the age of 137 years.

Her son, Solomon Adio, who confirmed her death, said his mother died at her Itoko residence in Abeokuta after a brief illness.

According to history, Olumo Rock is a mountain used as a natural fortress during an inter-tribal war many years ago.

History has it that after the Egbas hid within the rock, they became invisible to their enemies, who searched everywhere with a view to killing them.

Since then, the Olumo Rock, which saved the Egba people from their adversaries, has become an attraction to many interested individuals visiting Abeokuta, the Ogun State capital.

For many years, Sanni had been another attraction to tourists as she furnished people with peculiar information about the popular Olumo Rock.

As she aged, she remained the cynosure of all eyes by not showing any sign of tiredness in her duty at the tourist centre.

READ ALSO: Why I Left Saraki For Atiku – Dino Melaye

However, the aged woman died a few months to her 138 birthday.

According to her son, Adio, the doyen lived in one of the enclaves under the rock for more than 40 years where she served the gods of the rock.

“Mama will be 138 years old by August 5. She died after a brief illness.

“She was the mother of the deity. We are going to miss her a lot. Mama lived her life for the rock, for the deity. She was dedicated to the gods,” Adio said.

News

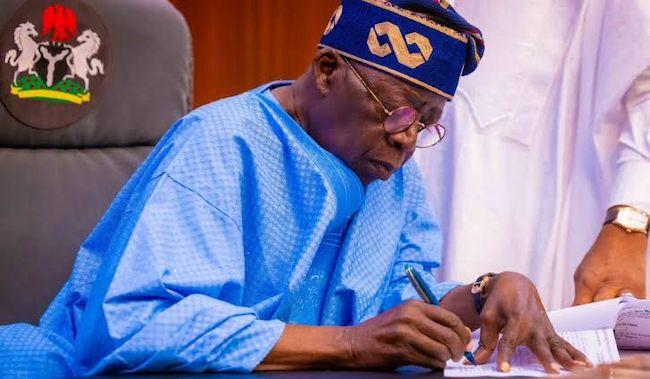

Full List: FG Releases Names Of 68 ambassadorial Nominees Sent To Senate For Confirmation

President Bola Ahmed Tinubu has forwarded a list of 68 ambassadorial nominees to the Senate for approval, signalling a major reshuffle of Nigeria’s diplomatic corps.

The list, read during Thursday’s plenary by Senate President Godswill Akpabio, comprises 34 career diplomats, 31 non-career appointees, and three candidates previously cleared by the Senate Committee on Foreign Affairs. The President is seeking swift confirmation to enable Nigeria to fill several key foreign missions.

According to the letter, the appointments aim to strengthen Nigeria’s international representation and reposition its diplomatic engagements. The Senate has referred the list to the Committee on Foreign Affairs, directing it to screen the nominees and submit a report within one week.

Among the non-career nominees are former Chief of Naval Staff and ex–Sole Administrator of Rivers State Vice Admiral Ibok-Ete Ibas (rtd.), former presidential aide Ita Enang, former Imo First Lady Chioma Ohakim, and former Minister of Interior Lt. Gen. Abdulrahman Dambazau (rtd.).

Others include former Lagos Deputy Governor Olufemi Pedro, former Edo lawmaker Abbasi Brahma, media personality Reno Omokri, Senator Jimoh Ibrahim, and former Minister Femi Fani-Kayode.

READ ALSO:BREAKING: Tinubu Nominates New Defence Minister

The career nominees, representing all 36 states and the Federal Capital Territory, are serving diplomats and senior foreign service officers recommended for ambassadorial postings.

The appointments follow ongoing efforts by the Federal Government to bolster Nigeria’s diplomatic presence globally and ensure representation in critical foreign missions.

The full list, as transmitted by the President, includes nominees for all states, with details of career and non-career appointments as well as the three candidates cleared earlier by the Senate Committee.

CAREER AMBASSADORS (34)

1. Abia – Mwaobiola Ezeuwo Chukwuemeka

2. Adamawa – Maimuna Ibrahim

READ ALSO:

3. Anambra – Enpeji Monica Okochukwu

4. Bauchi – Mohammed Mahmoud Lele

5. Bayelsa – Endoni Sindup

6. Borno – Ahmed Mohammed Monguno

7. Cross River – Jen Adams Ni Okun Michael

8. Delta – Clark Omeru Alexandra

9. Ebonyi – Chima J. Leoma Davies

10. Edo – Oduma Yvonne Ehinose

11. Edo – Wasa Shogun Ige

12. Ekiti – Adeyemi Adebayo Emmanuel

13. Enugu – Onaga Ogechukwu Kingsley

14. Jigawa – Magaji Umar

15. Kaduna – Mohammed Saidu Dahiru

16. Kano – Abdul Salam Abus Zayat

17. Katsina – Ambassador Shehu

18. Katsina – Aminu Nasu

19. Kebbi – Abubakar Musa Musa

20. Kebbi – Haidara Mohammed Idris

READ ALSO:Tinubu Submits Fresh Ambassadorial List To Senate, Ibas, Dambazau Make Cut

21. Kogi – Bako Adamu Umar

22. Kwara – Sulu Gambari

23. Lagos – Romata Mohammed Omobolanle

24. Nasarawa – Shaga John Shama

25. Niger – Salau Hamza Mohammed

26. Niger – Ibrahim Dan Lamy

27. Ogun – Adjola Ibrahim Mopolola

28. Ondo – Ruben Abimbola Samuel

29. Osun – Akonde Wahab Adekola

30. Oyo – Ariwani Adedokun Esther

31. Plateau – Gedagi Joseph John

32. Rivers – Luther Obomode Ayokatata

33. Taraba – Danladi Yakubu Yaku

34. Zamfara – Bidu Dogondagi

NON-CAREER AMBASSADORS (31)

1. Dr. Victor Okezie Ikpeazu (Abia)

READ ALSO:BREAKING: Ex-CDS Musa meets Tinubu At Aso Villa

2. Barr. Ogbonnaya Kalu (Abia)

3. Senator Grace Bent (Adamawa)

4. Senator Ita Enang (Akwa Ibom)

5. Nkechi Linda Okocha (Anambra)

6. Mahmoud Yakubu (Bauchi)

7. Philip K. Ikurusi (Bayelsa)

8. Paul Olga Adiku (Benue)

9. Vice Admiral Ibok-Ette Ibas (rtd.) – Cross River

10. Reno Omokri (Delta)

11. Abbasi Brahma (Edo)

12. Erelu Angela Adebayo (Ekiti)

13. Barr. Olumilua Oluwayemika (Ekiti)

14. Rt. Hon. Ifeanyi Ugwanyi (Enugu)

15. Chioma Ohakim (Imo)

16. Lt. Gen. Abdulrahman Dambazau (rtd.) – Kano

17. Tasiu Musa Maigari (Katsina)

18. Abubakar Sanusi Aliu (Kogi)

19. Olufemi Pedro (Lagos)

20. Barr. Mohammed Obanduma Aliu (Nasarawa)

21. Senator Jimoh Ibrahim (Ondo)

22. Ambassador Joseph Yusuf Shara’aji (Ondo

23. Femi Fani-Kayode (Osun)

24. Ajimobi Fatima Florence (Oyo)

25. Lola Akande (Oyo)

26. Yakubu N. Gambo (Plateau)

27. Senator Prof. Nora Ladi Daduut (Plateau)

28. Onweze Chukwudi (Rivers)

29. Dr. Kulu Haruna Abubakar (Sokoto)

30. Rt. Hon. Jerry Samuel Manwe (Taraba)

31. Adamu Garba Tarba-Nagri (Yobe)

FIRST BATCH CLEARED BY SENATE COMMITTEE (3)

1. Ayodele Oke – Oyo

2. Amin Mohammed Dalhatu – Jigawa

3. Retired Colonel Lateef Kayode Are – Ogun

News

9 Common Resume Mistakes Graduates Make – And How To Avoid Them

Graduates entering today’s job market face intense competition, and the first challenge is often getting their resume noticed.

Many employers spend only a few seconds scanning each application, which means even small mistakes can cost candidates valuable opportunities. Unfortunately, a large number of graduates unknowingly submit resumes that are poorly structured, unfocused, or not aligned with the roles they’re targeting.

Understanding the most common resume errors is the first step toward creating a document that truly reflects your strengths and potential. This guide by the experts at ResumeWriterDen highlights these mistakes and how to avoid them.

Mistake #1: Using a Generic Resume for Every Job

Many graduates make the mistake of using one generic resume to apply for every job. Recruiters can easily spot a one-size-fits-all application, and it often signals a lack of genuine interest in the role.

Each position has unique requirements, preferred skills, and keywords that employers expect to see. When your resume doesn’t reflect these details, it becomes less relevant and may be filtered out early in the process.

READ ALSO:Gunmen Kill Three In Zamfara Community Over N3,500 Yoghurt

To avoid this, graduates should tailor their resume for each application by aligning their skills, achievements, and summary with the job description. Personalization consistently increases interview chances.

Mistake #2: Overloading the Resume With Personal Information

Most graduates mistakenly believe that adding plenty of personal details makes their resume look complete, but it actually distracts employers and wastes valuable space.

Information like age, state of origin, religion, marital status, or home address adds no value to your application and may even introduce unconscious bias.

Recruiters care about your skills, education, and achievements, not personal details that don’t relate to the job. A professional resume writer ensures your resume remain strictly professional and focused on what you bring to the role.

How to Avoid It: Keep personal information minimal and stick to contact details, location (city only), and professional links.

Mistake #3: Poor Resume FormattingMistake #3: Poor Resume Formatting

A lot of graduates underestimate how much resume formatting affects first impressions. Recruiters often skim documents in seconds, so a cluttered layout, unusual fonts, or inconsistent spacing can make your resume look unprofessional or difficult to read.

Poor formatting also confuses Applicant Tracking Systems, causing important details to be missed. A clean structure helps your strengths stand out quickly.

To avoid this mistake, use a simple, modern layout with clear headings, consistent spacing, and readable fonts. Keep sections well-organized and avoid unnecessary graphics. Good formatting doesn’t just improve appearance — it increases your chances of getting noticed.

READ ALSO:Appeal Court Upholds Ban On Vehicle Impoundment, Awards N1m Damages

Mistake #4: Not Highlighting Relevant Skills

Most graduates either list too many unrelated skills or fail to showcase the ones employers actually care about.

Recruiters and Applicant Tracking Systems scan resumes for specific skills that match the job description, so a generic list weakens your chances. Instead of filling the skills section with every tool or software you’ve ever used, focus on abilities that align directly with the role. Prioritize skills that demonstrate problem-solving, communication, technical proficiency, or industry-specific knowledge. Through presenting the right strengths clearly, you make it easier for employers to immediately see your value.

Mistake #5: Weak or Vague Career Summary

Several jobseekers and graduates fill their resumes with generic statements like “Hardworking and motivated” without showing real value.

A weak summary fails to grab an employer’s attention and doesn’t communicate why the candidate is a strong fit. Recruiters often spend seconds scanning this section, so vague phrases are easily overlooked.

How to Avoid It: Craft a concise, results-oriented summary that highlights your key skills, achievements, and career goals. For example, instead of generic words, describe your expertise, relevant experience, and what you bring to a prospective employer.

Mistake #6: Listing Responsibilities Instead of Achievements

The error of simply listing what they did in previous roles or internships, rather than highlighting what they accomplished is common amongst many graduates. For example, stating “Handled customer inquiries” is vague and unimpressive. Employers want to see results, impact, and measurable contributions.

How to Avoid It: Frame experiences as achievements using action verbs and quantifiable outcomes. Instead of “Managed social media accounts,” write “Increased social media engagement by 30% in three months through targeted campaigns.” This approach demonstrates value and sets your resume apart from the competition.

READ ALSO:MOWAA Controversy: Edo Assembly Threatens Arrest Warrant On Obaseki, Others

Mistake #7: Typos and Grammar Errors

Underestimating how critical a flawless resume should be is common among graduates. Even minor typos or grammatical mistakes can make a candidate appear careless or unprofessional, often causing hiring managers to discard the resume immediately.

Recruiters typically spend only a few seconds reviewing each application, so errors stand out instantly.

How to Avoid It: Always proofread your resume multiple times and consider using grammar tools like Grammarly. Asking a friend or a professional to review it can also catch mistakes you might overlook. A polished resume reflects attention to detail and professionalism.

Mistake #8: Making the Resume Too Long

Many fresh graduates think more is better, but overly long resumes can actually hurt their chances.

Recruiters often skim resumes in seconds, so unnecessary details bury key achievements. Including every course, internship, or extracurricular activity makes the document cluttered and hard to read.

How to Avoid It: Focus on the most relevant experiences and skills. One well-structured page is usually enough for a graduate.

Highlight achievements that demonstrate your value, and remove anything that doesn’t directly support your application. Concise resumes leave a stronger, more memorable impression.

Mistake #9: Not Including Keywords for ATS

This is highly underestimated. Many graduates don’t realize that most employers use Applicant Tracking Systems (ATS) to screen resumes before a human ever sees them.

If your resume lacks the right keywords such as relevant skills, job titles, or industry terms, it may be automatically filtered out, no matter how qualified you are. To avoid this, carefully review each job description and include the exact terms employers use.

According to experts at https://www.resumewriterden.com tailoring your resume with targeted keywords significantly increases the chances of passing ATS filters and landing interviews.

Final Thoughts

A well-crafted resume can open doors that might otherwise remain closed. Graduates should avoid common mistakes, tailor their content, and highlight achievements clearly.

For those seeking expert guidance, executive resume writers can provide the structure and insight needed to stand out in a competitive job market. Remember, your resume is often the first impression an employer has: make every word count.

(GUARDIAN)

News

Food Security: 14,000 Smallholder Farmers To Benefit From N4bn Smart Agriculture Training In Bauchi

The Heineken Africa Foundation, through Nigerian Breweries Plc is investing N4 billion to train 14,000 smallholder farmers on smart agriculture across seven Local Government Areas of Bauchi state for three years.

Mr Chukwuemeka Aniukwu, Head of Public, External and Government Affairs, Nigerian Breweries Plc, disclosed this in Bauchi on Thursday during the official Launch of the ‘empowerment of Smallholder farmers to thrive and build climate resilience through regenerative agriculture’.

Aniukwu, who explained that the foundation is in collaboration with the Foundation for Sustainable Smallholder Solutions (FSSS), added that the investment builds on the Foundation’s long-standing commitment to improving access to healthcare, water, sanitation, and hygiene across Africa.

“Our decision to invest in Bauchi is both deliberate and strategic. Bauchi is home to resilient, resourceful, and industrious smallholder farmers whose contributions are essential to Nigeria’s food security.

READ ALSO:Bauchi Records 75 Homicide Cases, 28 Kidnapping Cases, Others – Official

“The strength of your farming communities, combined with the natural potential of this land, gives us confidence that meaningful and lasting impact can take root here. We are here because we believe in the people of Bauchi.

“This project is designed to strengthen the livelihoods of smallholder farmers, particularly women and young people, by enhancing their capacity to generate sustainable income.

“It will deliver training, access to quality inputs, stronger market linkages, and opportunities across the agricultural value chain,” he said.

Also, Dr Isaiah Gabriel, Executive Director, Foundation for Sustainable Smallholder Solutions (FSSS), explained that the farmers would receive hands-on training through Farmer Field Schools and demonstration plots in.

According to him, out of the 14,000 smallholder farmers, 60 per cent were women and 40 per cent of youth.

The farmers, he said, would also be trained on regenerative and climate-smart agriculture, soil and water conservation, pest and disease management, crop diversification and post-harvest handling, among others.

“The project supports the restoration and protection of natural resources by promoting regenerative farming that rebuilds soil fertility, efficient water management and irrigation practices, and adoption of drought-tolerant crop varieties.

“We are here to make smallholder farmers big players and our target is to increase incomes by at least 30 per cent, but our dream is bigger.

“This programme spans seven Local government areas of Katagum, Shira, Jama’are, Giade, Itas-Gadau, Zaki, and Gamawa. Women and youth are not an afterthought, they are at the heart of this intervention because the future of agriculture depends on their strength, creativity, and leadership,” he said.

READ ALSO:Bauchi: Auto Crash Claimed 432, Injured 2,070 Persons In 1 Months — FRSC

The Executive Director commended the Bauchi state government for its partnership, support and provision of an enabling environment and promised that the programme would be effectively implemented.

In his address, Mr Iliyasu Gital, Bauchi state’s Commissioner for Agriculture commended the foundation for bringing the programme to the state and expressed the state government’s commitment to support the training in every capacity.

Some of the beneficiaries commended the gesture, adding it would transform agriculture and encourage productivity towards achieving food security in the country.

Maimunatu Sani, a farmer, who had benefited from the programme in Kano state, said that she learnt how to recycle farm residues and transform it into an effective organic fertilizer, calling smallholder farmers in the state to key into the programme.

She said she acquired practical skills to improve her farming activities and increase output.

Another farmer from Kano, Mama Mairam, said the introduction of new techniques assisted farmers to significantly reduce wastage and increase yields per hectare.

News5 days ago

News5 days agoInsecurity: What Sheikh Gumi Told Me After Visiting Bandits Hideouts — Obasanjo

News3 days ago

News3 days agoBREAKING: Ex-CDS Musa meets Tinubu At Aso Villa

News5 days ago

News5 days agoFULL LIST: Wike revokes land belonging to Ilorin Emir, Lamido, Fayose, Iyabo Obasanjo, Others In Abuja

News3 days ago

News3 days agoMOWAA: Why I Will Not Appear Before Edo Assembly Panel — Obaseki

Metro3 days ago

Metro3 days agoOsun Monarch’s Burial Rites Turn Bloody

Headline5 days ago

Headline5 days agoUS: Four Killed, 10 Others Wounded In California Shooting

Entertainment3 days ago

Entertainment3 days agoFacebook, Instagram Suspend Idris Abdulkareem’s Accounts After New Song, Open Letter To Donald Trump

News5 days ago

News5 days agoVIDEO: Like Niger Delta Militants, Consider Amnesty To Bandits — ACF Chair Tells FG

News3 days ago

News3 days agoJUST IN: Defence Minister, Badaru Mohammed Resigns

Sports3 days ago

Sports3 days agoDavido Reacts As Gov Adeleke Dumps PDP