Business

El-Rufai, Soludo, Sanusi Insist On Fuel Subsidy Removal

Published

1 year agoon

By

Editor

The Kaduna State Governor Malam Nasir El-Rufai and his Anambra counterpart, Prof. Charles Soludo, have urged the Federal Government to end the fuel subsidy regime which has negatively affected Nigeria’s economy.

The governors made the call on Tuesday in Abuja during a panel session at the policy conversation on “How Nigeria Can Build a Post-Oil Economic Future”.

The News Agency of Nigeria (NAN) reports that the symposium was jointly hosted by Agora Policy, a Nigerian Think Tank and the Carnegie Endowment for International Peace.

It also featured the presentation of a recently published book titled “Economic Diversification in Nigeria: The Politics of Building a Post-Oil Economy”– selected as one of the Best Books of 2022 by the Financial Times.

The book was authored by Dr Zainab Usman, a senior fellow and Director of the Africa Programme at the Carnegie Endowment for International Peace in Washington, D.C.

READ ALSO: Subsidy: Salary Payment Unlikely After June, Says Obaseki

Speaking, El-Rufai emphasised on the need to end the subsidy on Premium Motor Spirit (PMS) known as fuel and to be pragmatic about solution to the problems instead of delay.

He recalled that in 2021, the National Economic Council (NEC) gave a committee he chaired an assignment to work out a framework on what to do with the resources if subsidy was removed including how much to be raised.

He listed the components of its recommendation to include framework on investments in security, social protection, infrastructure on health and education among others.

“We worked with experts and World Bank and came out with a report on what to do with the resources which would be transperently explained to Nigerians.

“In 2021 the Federal Government ‘s budget for road was N200 billion and in 2021 we were projecting to spend N1.2 trillion on subsidy and we saw the danger and I called for its removal.

READ ALSO: No Local Refining, No Subsidy Removal, NUPENG Warns

“We have a framework and the economic council agreed for it to be withdrawn because we had a clear plan on where the money should go which include federal, state and local government for interventions.

“Still it is on and currently we are looking at N6 trillion on subsidy but go and check the national budget on infrastructure on health and education, it is not up to that and does not make any sense, so we need to end the subsidy,” he advised

Soludo on his part also called for a transformational leadership and agenda adding that the new dispensation had a chance for a fresh start.

“It has to start by getting the team assembled and getting to work immediately with institutional reforms and competitive system.”

According to him, it will be necessary if we begin to mainstream case studies and utilise lessons from those case studies that worked before by replicating them.

The governor said that productive policies to achieve speed and sustainability prosperity for institutional reforms and change were the key.

READ ALSO: Fuel Subsidy Is Organised Crime, I’ll Remove It – Peter Obi

Also speaking, former Central Bank of Nigeria’s Governor, Sanusi Lamido Sanusi, who was a special guest, underscored the need to prepare the minds of Nigerians on bad decisions that have bankrupted the country and close that hole.

Sanusi said in order to get it right, the incoming government should place competent officials in suitable positions.

“We are going to have a government sworn in May 29 and I think we have to start stating what is expected of that government.

“What do we, as Nigerians, classify as a milestone that shows we are heading to the right direction.

“We also need a government that understands the depth of the crises that we are. We all have a responsibility of conveying the implications of the policies that we recommend.

READ ALSO: NNPCL Reveals How Subsidy Retarded Infrastructure Development

“We need to go back to that situation where politicians respect the independence, integrity and autonomy of these institutions and where these institutions are held accountable by the law setting them up to perform duties,” he said.

Speaking, Aigboje Aig-Imoukhuede, Co-Founder, the Aig-Imoukhuede Foundation and Chairman, Coronation Capital, explained that the fuel subsidy was not grounded on thinking rather it was purely political.

According to him, refining crude oil and producing refined petroleum products in Nigeria would actually drop the prices of petroleum.

He further explained that fiscal consideration, debt restructuring and massive private structure investment should be considered by the incoming government for economic growth.

The participants, who lamented on fuel subsidy removal, called for effective utilisation of resources after its removal in new dispensation. (NAN)

You may like

JUST IN: DSS Arrests El-Rufai’s Political Ally Over Post On Gov Sani

Soludo Admits Refusing To Construct Road Due To Political Affiliation

Collapsed Building: Soludo Orders Tests On Ongoing Projects In Onitsha, Demolishes 300 Shops

VIDEO: ‘You’re Incompetent’ — Soludo Chides LG Boss Over Road Construction

Anambra Bans Public Display Of Caskets

15 Things To Know About Anambra Burial Law

Business

CAC Opens Centre For Registration Of PoS Operators

Published

4 days agoon

May 9, 2024By

Editor

The Corporate Affairs Commission has inaugurated a centre for bulk registration of Point of Sale operators in its database.

The CAC Registrar-General, Hussaini Magaji, said this while inaugurating the centre stationed at its Federal Capital Territory Office in Abuja on Wednesday.

According to Magaji, the importance of registering the PoS operators in the commission’s database cannot be over emphasised.

He said the centre was well equipped with all the necessary facilities to operate 24 hours a day and ensure the commission’s achievement of its purpose.

READ ALSO: ICYMI: FG To Delist Naira From P2P Platforms

“What we did was accommodate the request from the Fintechs.

“We have allowed them to integrate with the Corporate Affairs Commission; they have developed their structure, and we gave them access.

“Once they supply the necessary details for registration on their platform, the certificate is generally generated and transmitted directly to their platform without them having to contact anyone.

“We have done this to ensure that everyone gets it easy without hitches, but if they choose to apply manually, we have a secretariat open for them to do so,” he stated.

READ ALSO: ICYMI: FG Gives Deadline To PoS Operators To Register With CAC

Recall that the Federal Government through the CAC on Tuesday issued a two-month registration deadline to Point of Sales companies, to register their agents, merchants, and individuals with the commission in line with legal requirements and the directives of the Central Bank of Nigeria.

Meanwhile, at the event, the registrar-general reiterated that the centre would be opened to all operators in the fintech industry who voluntarily submitted their agents and merchants for regularisation with the CAC.

Magaji said that the registration was in line with President Bola Tinubu’s desire to ensure financial inclusion for the youth and strengthen the fight against fraud, finance and other crimes in the country.

He further expressed his resolve to ensure compliance with the provisions of Section 863 (1) of the Companies and Allied Matters, CAMA 2020, and the CBN guidelines for Agent Banking, 2013.

READ ALSO: ICYMI: Five Things To Know About The New Cybersecurity Levy To Be Paid By Nigerians

On security, the CAC boss said that if a crime were committed using the PoS, the government would easily trace the perpetrators to the CAC data platform if such machines were registered.

“If an incident happens and they report it to CAC, if we do not have the operator’s details, we cannot respond, and that is the essence of this registration.

“The registration ensures that every detail of the person is provided, including NIN, passport photograph and all other useful documents.

“And it is an opportunity for more people to be captured into the formal sector,” he said.

The News Agency of Nigeria reports that the Special Adviser to the President on ICT Development and Innovation, Tokoni Peter attended the event.

The event was attended by Dr Salihu Dasuki, the Special Adviser to the President on ICT Policy Office, the PoS operators, and other stakeholders.

(NAN)

Business

FULL LIST: CBN Publishes List Of Licensed Deposit Money Banks

Published

5 days agoon

May 8, 2024By

Editor

The Central Bank of Nigeria has released a comprehensive list of licensed Deposit Money Banks operating within the country.

The list, which was made public on the CBN’s official website on Tuesday, provides insights into the banking landscape in Nigeria.

Banks with international authorisation include Access Bank Limited, Fidelity Bank Plc, First City Monument Bank Limited, First Bank Nigeria Limited, Guaranty Trust Bank Limited, United Bank of Africa Plc, and Zenith Bank Plc.

READ ALSO: BDC Operators Arrested As Naira Sells 1,416/$

Commercial banks with national authorisation include Citibank Nigeria Limited, Ecobank Nigeria Limited, Heritage Bank Plc, Globus Bank Limited, Keystone Bank Limited, Polaris Bank Limited, Stanbic IBTC Bank Limited, Standard Chartered Bank Limited, Sterling Bank Limited, Titan Trust Bank Limited, Union Bank of Nigeria Plc, Unity Bank Plc, Wema Bank Plc, Premium Trust Bank Limited and Optimus Bank Limited.

Commercial banks with regional licenses are Providus Bank Limited, Parallex Bank Limited, Suntrust Bank Nigeria Limited, and Signature Bank Limited.

Players in the non-interest banking sector with national authorisation include Jaiz Bank Plc, Taj Bank Limited, Lotus Bank Limited, and Alternative Bank Limited.

READ ALSO: [ICYMI]FULL LIST: 16 Banking Transactions Exempted From CBN’s New

In the merchant banking category, the apex banks listed, are Coronation Merchant Bank Limited, FBN Merchant Bank Limited, FSDH Merchant Bank Limited, Greenwich Merchant Bank Limited, Nova Merchant Bank Limited, and Rand Merchant Bank Limited.

The financial holding companies listed were Access Holdings Plc, FBN Holdings Plc, FCMB Group Plc, FSDH Holding Company Limited, Guaranty Trust Holding Company Plc, Stanbic IBTC Holdings Plc, and Sterling Financial Holdings Limited.

The Mauritius Commercial Bank Representative Office (Nigeria) Limited was listed as the sole representative office.

Business

[ICYMI]FULL LIST: 16 Banking Transactions Exempted From CBN’s New

Published

6 days agoon

May 7, 2024By

Editor

The Central Bank of Nigeria on Monday directed all banks to commence charging a 0.5 per cent cybersecurity levy on all electronic transactions within the country.

The apex bank stated this in a circular signed by the Director, Payments System Management Department, Chibuzo Efobi; and the Director, Financial Policy and Regulation Department, Haruna Mustafa; a copy of which was obtained by The PUNCH.

The circular, which was directed to all commercial, merchant, non-interest, and payment service banks, among others; noted that the implementation of the levy would start two weeks from Monday, May 6, 2024.

READ ALSO: Five Things To Know About The New Cybersecurity Levy To Be Paid By Nigerians

“The levy shall be applied at the point of electronic transfer origination, then deducted and remitted by the financial institution. The deducted amount shall be reflected in the customer’s account with the narration, ‘Cybersecurity Levy,’” the circular partly read.

In this piece, The PUNCH highlights all the 16 banking transactions that are exempted from the CBN’s new cybersecurity levy:

Loan disbursements and repayments

Salary payments

Intra-account transfers within the same bank or between different banks for the same customer

Intra-bank transfers between customers of the same bank

Other Financial Institutions instructions to their correspondent banks

Interbank placements,

Banks’ transfers to CBN and vice-versa

Inter-branch transfers within a bank

Cheque clearing and settlements

Letters of Credits

READ ALSO: FG To Delist Naira From P2P Platforms

Banks’ recapitalisation-related funding – only bulk funds movement from collection accounts

Savings and deposits, including transactions involving long-term investments such as Treasury Bills, Bonds, and Commercial Papers.

Government Social Welfare Programmes transactions e.g. Pension payments

Non-profit and charitable transactions, including donations to registered non-profit organisations or charities

Educational institutions’ transactions, including tuition payments and other transactions involving schools, universities, or other educational institutions

Transactions involving bank’s internal accounts such as suspense accounts, clearing accounts, profit and loss accounts, inter-branch accounts, reserve accounts, nostro and vostro accounts, and escrow accounts.

Man Kidnaps 6-year-old Cousin, Kills Victim For Recognising Him

Five-year-old Boy Shot Dead By Hijackers In South Africa

American Comedian, James Gregory Is Dead

Trending

News5 days ago

News5 days agoThe New Masquerade’ Actress, Ovularia Is Dead

News4 days ago

News4 days agoBREAKING: Rivers State House Of Assembly Gets New Speaker

Business5 days ago

Business5 days agoFULL LIST: CBN Publishes List Of Licensed Deposit Money Banks

Metro4 days ago

Metro4 days agoEdo: Police Patrol Van Pursuing ‘Yahoo Boys’ Rams Into Motorcycle Convening Passenger

News5 days ago

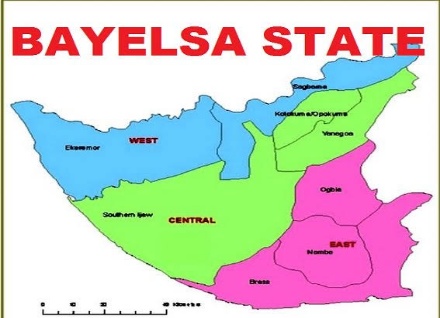

News5 days agoFather Of 12 Found Dead Inside Brothel In Bayelsa

Politics1 day ago

Politics1 day agoRivers Crisis: Why Gov Fubura Got Into ‘Trouble’ – Secondus

News4 days ago

News4 days agoVIDEO: Nigerian Man Exhumed After Completing 24-hour Buried Alive Challenge

Metro2 days ago

Metro2 days agoKogi University Lecturer Stripped Over Alleged Sexual Harassment

News4 days ago

News4 days agoNigerian Emerges First Black Woman To Bag PhD In Robotics At Michigan Varsity

News4 days ago

News4 days agoNigerian’s Request To Be Buried Alive For 24 Hours Causes Stir Online [VIDEO]