A foundation, Sharing Education and Learning for Life (SELL), on Wednesday, called on all Nigerian banks to employ signs language interpreters across the country.

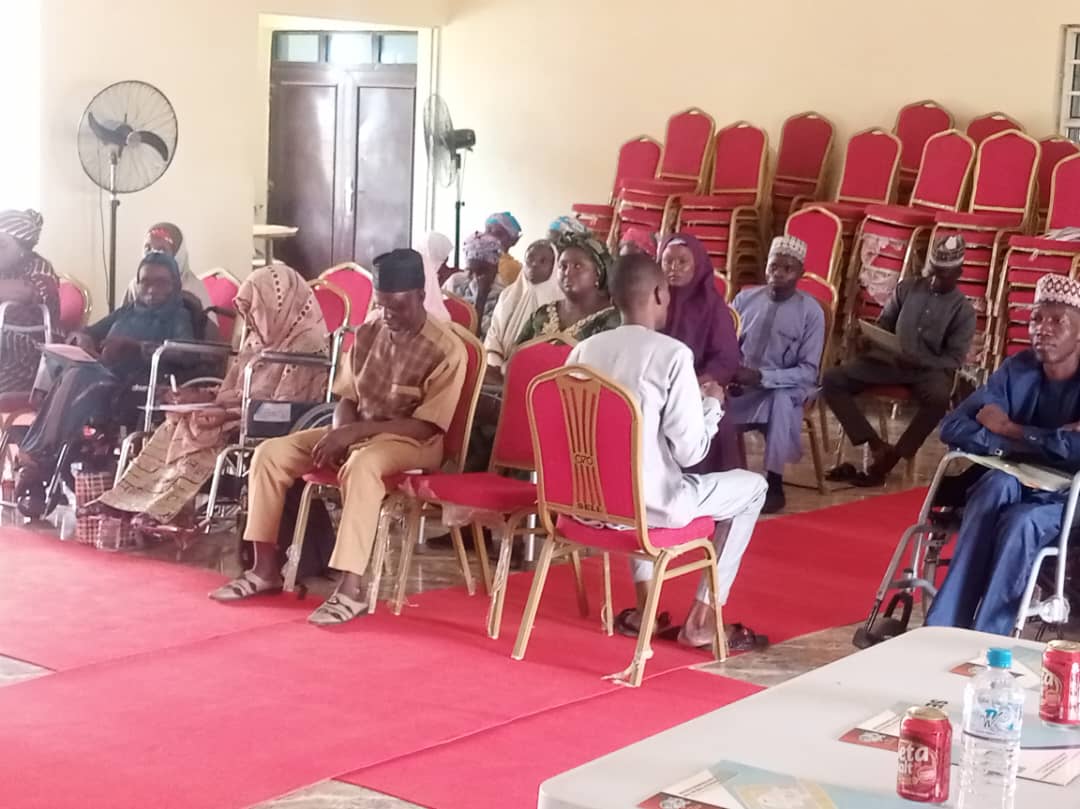

Mr Benji Benjamin, the Programme Manager of the foundation made the call in Bauchi during a one-day programme focused on policy discussions, compliance and awareness regarding inclusive services for Persons With Disability (PWD).

According to him, the move would greatly help and make banking services more accessible to people with disabilities especially, the hearing impaired individuals.

He explained that the one-day programme would add to the several conversations that were already ongoing on how to make communities, societies and infrastructures, whether public or private, more inclusive for everybody, including PWDs.

READ ALSO: FG Renews Exploration License Of Oil In Bauchi – Minister

“At the end of the day, each and everyone of us that has been invited for this conversation will add to the discussions.

“It is expected that we leave here with a direction on how each and everyone of us will contribute to making our public and private spaces more inclusive for everybody,” he said.

Similarly, Mr Mainas Ayuba, from Bauchi State Network of Disability Forum, observed that there would always be people with impairments but it shouldn’t be seen as a barrier.

He recounted how someone complained bitterly about the non availability of sign language interpretation in banks as he had an issue with his account and was going to the bank without resolving the issue.

“Apart from not resolving the issue, they didn’t give him correct information, apart from not getting the right information, sometimes if he went there, he will be asked to sit down and they will forget about him.

READ ALSO: How To Use Basic Design Principles To Decorate Your Home

“A lot of persons with disabilities who yearn to have bank accounts are resolving to opening online banking as they can’t go to the conventional banks because they are not getting well treated as expected.

“Sometimes, some services of banks are upstairs and someone who is on the wheelchair or crutches can’t go there and sometimes if they are told that there are customers downstairs, they won’t come down.

“They rather give them forms to fill and that’s how they will end up walking around in the bank with the form and usually, the person that is subjected to that rigour is the one who takes the customer to the bank,” he said.

He called on all and sundry to conceptualise disability as this would bring change in the way people see and treat persons with disabilities in their various environments.

Ayuba also called on institutions of learning to allow people on wheelchair to use their chairs while receiving lectures and writing examinations instead of taking them off their chairs to sit on desks.

READ ALSO: IGP Launches Safe School Initiative In Bauchi

Also, Malam Haruna Pali, Chairman, Joint National Association of Persons With Disabilities, expressed concern on how his people are being marginalised and denied inclusivity by some quarters.

Responding, Mr Morris Choji, a representative from Ecobank Nigeria Limited, Bauchi branch, said they learned a lot of things by coming to the programme.

He promised that when they assemble for the next bankers committee’s meeting, all the issues discussed would be tabled for them to be effectively addressed.

Other stakeholders present at the programme included a representative from Wema Bank, Ministry of Women Affairs and Child development, Civil Society Organisation, state’s Agency for Persons With Disabilities, among others.

Some of the participants in their separate remarks, also advocated for the full implementation of the Discrimination Against Persons With Disabilities Prohibition act, 2018.