News

ERA Chides Shell For Slow Response To Multiple Crude Oil Spills In Bayelsa Community

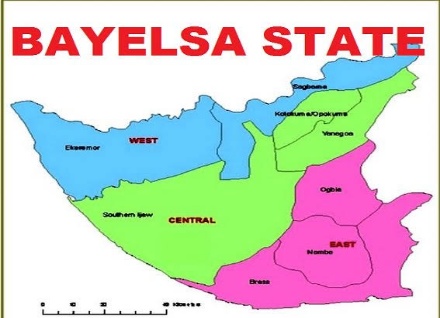

The Environmental Rights Action/ Friends of the Earth Nigeria (ERA/FoEN) has expressed shock over Shell Petroleum Development Company (SPDC) slow response to multiple crude oil spills that occurred in Diebu Creek in Peremabiri community, Southern Ijaw Local Government Area of Bayelsa State.

This is coming after a team led by the organisation’s Programme Manager, Niger Delta Resource Center, Comrade Alagoa Morris, paid an on-the-spot visit to the area following a save-a-soul call from the community about multiple spills along the Diebu creek.

A statement signed by Elvira Jordan, Communication Officer, ERA/FoEN said the visit was sequel to an information received from the community that Shell said a Joint Investigation Team [JIT] was to visit the site of the spill but failed to keep to the date promised; including the very date ERA/FoEN visited.

According to the statement, after “two unkempt Joint Investigation Visit [JIV], the JIV only took place a day after the field visit by ERA/FoEN’s with Shell sponsored news statements that attributed one of the spills to equipment failure and the other tagged inconclusive.”

Speaking to the team, the youth president of the community, Benjamin Ebinibo expressed his dissatisfaction over the conducts of Shell and their response to spill issues.

READ ALSO: Edo: Need For Waste Management Policy Takes Centre Stage As ERA/FoEN Convenes Stakeholders’ Workshop

According to him, the people of Peremabiri are not known for sabotaging crude oil pipelines and so the leak must have been from faulty Shell equipments.

Describing the plight of the women of the community, the Assistant Women Leader of Peremabiri, Favour Morgan lamented over the reoccurring spills in their community, and how it has destroyed their environment and collapsed fishing and farming activities, which is their primary source of livelihood.

“Our women who are fishing and farming are unhappy with what is happening to our land and water. This is our means of livelihood. Our traps for fish and crayfish have been affected by the crude oil. Even our fishing nets no longer catch fish, our plantain and cassava farms too have been affected by the oil spill,” she lamented.

She called on Shell to take rise up to their responsibilities, with a warning from the women who have vowed to take action against Shell if the company is not proactive with their response to oil spills.

“We are begging Shell and the government to come and clean up the environment. If they fail to come and do the needful, we the women will take action against them. When oil spills occur they hardly respond in time. And this is not good. If they had their mothers here they will come and do the needful instantly. But, because they know it is other people’s mothers that are here that is why they are acting this way. So, they should come and clean up the environment; it is not good to see it like this. The survival of the people depends on the environment.’’ She said.

READ ALSO: Oil Palm Companies: RSPO Deceptive, Promotes Communities Rights Violations, Says ERA/FoEN

On his part, the CDC Chairman of the community, Basil Young narrated the ordeal of the people of Peremabiri, citing issues ranging from neglect suffered by the community as host community in terms absence of basic amenities to negative impacts of the current oil spill incidents.

He revealed that since the inception of Shell in 1957, the community has suffered several levels of negligence with peanuts as benefits provided by the company, despite the huge income generated from the oil wells situated 8nnthe community.

“It is a pity that since 1957 Shell has been operating in this community, we don’t have anything. No social amenities. We have a cottage hospital, but if you go to that place [the cottage hospital], you will pity the community. No portable water, coastal erosion is eating off the community.

“The spill has affected the community economically, socially and otherwise. Our poor mothers, wives, our children survive through this swamp and the river. We ought to have received relief materials. This spill has been there for some days now; no Shell staff, nobody. We are all here on our own.”

He appealed to Shell to clamp its leaking pipeline and to restore the environmwnt. He called on the government at all levels to intervene in the matter to ensure peace and order in Peremabiri community.

READ ALSO: N81.9bn Compensation: ERA/FoEN Wants ExxonMobil To Obey Court Judgement

Reacting to the spill incident, the Executive Director of ERA/FoEN, Chima Williams said “we have it on record that the promise by Shell to visit the Spill site for JIV on 10th and 11th October, 2023 did not happen. Rather, we were duly informed that the JIV took place a day after the field visit by the ERA/FoEN led team; on the 12th October.”

According to him, going to sites and communities of interest with the media by ERA/FoEN is a deliberate strategy to enable stakeholders come face to face with victims of incidents and get information from primary sources.

Williams further stated that while booming crude oil to prevent spreading on the surface of water is commendable, such actions do not prevent the soluble elements of crude oil to have chemical reaction within the marine ecosystem, adding that this is why effective and prompt clean up should follow booming of crude oil in any marine ecosystem.

He called on Shell to take immediate action to clean up and restore the environment around Peremabiri community.

He also admonished NOSDRA and the Bayelsa State Ministry of Environment to follow up on spill incidents and ensure clean up and compensation matters are effected within reasonable time frame.

News

YULETIDE: Edo Sports Commission Boss Preaches Unity, Peace

The Executive Chairman of the Edo State Sports Commission, Hon. Amadin Desmond Enabulele, has extended warm Christmas greetings to athletes, coaches, sports administrators, journalists, and the people of Edo State, urging them to uphold the enduring values of love, peace, and unity that define the festive season.

In a statement issued by his Media Officer, Edoko Wilson Edoko, Hon. Enabulele described Christmas as a period of reflection, gratitude, and renewed commitment to collective progress and shared responsibility.

“I sincerely appreciate all stakeholders in the sports sector for their cooperation, resilience, and unwavering support throughout the year. Your contributions have been instrumental to the growth and success of sports in Edo State,” he said.

READ ALSO:Edo SWAN Distances Self From Online Publication Against Enabulele

He further commended Edo athletes for their dedication and discipline, noting that their consistent performances have continued to bring pride and recognition to the state at both national and international levels.

According to him, the Commission remains committed to athletes’ welfare, grassroots sports development, and the creation of opportunities that will enable talents to flourish.

Enabulele also called on residents of the state to celebrate responsibly and show compassion to one another, particularly the less privileged, emphasizing that unity and peaceful coexistence are vital for sustainable development.

READ ALSO:How Enabulele Is Driving Okpebholo’s Agenda In Edo Sports Commission

He reaffirmed the Edo State Sports Commission’s resolve to strengthen collaboration with partners and stakeholders in the coming year, with increased focus on excellence, transparency, and inclusive sports development.

The Sports Commission boss concluded by wishing everyone a joyous Christmas celebration and a prosperous New Year filled with hope, good health, and greater achievements.

News

MOWAA: Okpehbolo Receives Edo Assembly Resolution Indicting Obaseki

Edo State Governor, Monday Okpebholo, received report and resolutions of the Edo State House of Assembly which indicted former Governor Godwin Obaseki on the Museum of West African Art (MOWAA) and the Radisson Hotel projects.

Recall that the Edo Assembly raised a five-man committee to investigate funding and ownership of both projects following a request by Governor Okpebholo.

Okpebholo, who spoke after receiving the report said its findings and recommendations would be fully implemented.

Okpebholo said the Economic and Financial Crimes Commission (EFCC) would be invited to further examine issues raised in the recommendations.

READ ALSO:MOWAA: Why I Will Not Appear Before Edo Assembly Panel — Obaseki

According to him, the Edo State Government has significant stakes in the MOWAA and Radisson Blu hotel having invested ₦3.8bn respectively in both projects.

He said changes in the structure and nomenclature of the MOWAA project made the investigation unavoidable.

Okpebholo said it was unacceptable to suggest Edo State has only 10 per cent stake in the Radisson Blu hotem despite investing over ₦28bn.

“Edo State has spent over ₦3.8 billion on this project, yet some people are saying the state has no stake in it. That is totally unacceptable. I will work with your recommendations and forward them to the relevant authorities to investigate what truly happened. We will also involve the EFCC.

READ ALSO:MOWAA Controversy: Edo Assembly Threatens Arrest Warrant On Obaseki, Others

“Our investment in this project is over ₦28 billion. We must invite the EFCC to step in and determine if this is how businesses are conducted in Nigeria,” he said.

In its recommendations passed by the Assembly, the five-man committee headed by Hon Addeh Isibor, urged the Edo State Government to take possession of both projects.

It asked Governor Okpebholo to contract competent hands to complete renovation of the Hotel and take all steps to put the Hotel to use.

The recommendations urged the Edo State Government to revoke “the fraudulent Certificate of Occupancy to the property issued in the name of Hospitality Investment and Management Company Limited and revert same to the Edo State Government that purchased the property.

READ ALSO:Edo Assembly Charges Contractor Handling Ekekhuan Road To Accelerate Work

“That the Edo State Government initiate legal action and work with relevant Anti-graft Agencies to retrieve both the complete statement of account and the balance of the Seventeen Billion, Five Hundred Million Naira (N17,500,000,000.00) Bond proceeds still in the possession of the Escrow Agents. Meristen Trustees Limited and Emerging Africa Trustees Limited.

“The title to the MOWAA Property having never been revoked, same remains the property of the Central Hospital, Benin City

“That the Edo State Government immediately takes all necessary step to put the property to good use in the best and overriding public interest of the people of Edo State.”

Speaker of the Assembly, Hon. Blessing Agbebaku, said the facts about MOWAA and Radisson Blu Hotel were now clearly documented in resolutions and outcomes.

News

Sheikh Gummi Sues Two Over Alleged False Facebook Publication

Prominent Islamic scholar, Sheikh Ahmad Gummi, has approached the Chief Magistrate Court in Kaduna, seeking the issuance of a criminal direct complainant summons against two Facebook users over alleged criminal conspiracy, attempt to cause public disturbance and criminal defamation.

The application, filed at the Chief Magistrate Court sitting on Ibrahim Taiwo Road, Kaduna, listed the defendants as George Udom and Bello Isiaka.

According to him, the defendants allegedly published a “Breaking News” statement on their respective Facebook pages on December 23, 2025, between 7:00 am and 10:00 am, attributed to him, threatening that the family of the Minister of Defence, General Christopher Musa, would be eliminated if military operations against bandits were not stopped.

Gummi alleged that the publication was falsely attributed to him, as his photograph was allegedly used alongside the statement, giving the impression that he issued the threat against the Defence Minister.

READ ALSO:Nigeria Army Alone Cannot Defeat Bandits — Sheikh Gumi

The Islamic scholar stated that following the publication, he received numerous phone calls from concerned members of the public who believed he authored the statement and was attempting to intimidate the Minister of Defence in the discharge of his official duties.

He further maintained that the publication portrayed him as a troublemaker and a threat to public peace, despite his long-standing reputation as a cleric known for preaching peace and harmony within and outside Nigeria.

The complainant argued that the alleged publication was capable of inciting public disorder in Kaduna State, particularly Southern Kaduna, and could expose him to danger by presenting him as a prime suspect in the event of any attack on the Defence Minister’s family.

READ ALSO:Insecurity: What Sheikh Gumi Told Me After Visiting Bandits Hideouts — Obasanjo

He also contended that the actions of the defendants amounted to an attempt to cause public disturbance and criminal defamation of his character.

Dr Gummi told the court that the alleged acts contravened Sections 59, 57, 372, 116 and 117 of the Kaduna State Penal Code Law, 2017.

The application, dated December 24, 2025, was filed by a team of lawyers led by Suleiman Danlami Lere, with the complainant urging the court to summon the defendants to answer to the allegations.

News2 days ago

News2 days agoPHOTOS: New Era In Furupagha-Ebijaw As Okpururu 1 Receives Staff Of Office

Metro5 days ago

Metro5 days agoJUST IN: Former Edo Information Commissioner Is Dead

News2 days ago

News2 days agoUBTH CMD Marks 120 Days In Office, Expresses Commitment To Providing Conducive Working Environment

News2 days ago

News2 days agoFG Declares Public Holidays For Christmas, New Year Celebrations

Metro5 days ago

Metro5 days agoShe Grabs, Pulls My Manhood Anytime We Fight — Husband

News5 days ago

News5 days agoCoordinator, Edo First Lady Office, Majority Leader, Rights Lawyer, Others Bag 2025 Leadership Award

News2 days ago

News2 days agoOPINION: Gumi And His Terrorists

News2 days ago

News2 days agoFIRS Confirms NIN As Tax ID

Metro5 days ago

Metro5 days agoWhy I Charged My Husband Money For Sex —Woman

News2 days ago

News2 days agoOPINION: My Man Of The Season