Business

Finance Bill 2021: Tax System Must Work For Every Nigerian, FIRS Chairman Tells Reps

Published

2 years agoon

By

Editor

The 2021 Finance Bill must be tailored towards enabling an efficient tax system that works for every Nigerian.

This was the position of the Federal Inland Revenue Service (FIRS) Executive Chairman, Muhammad Nami to journalists after a stakeholder engagement on the Finance Bill 2021, at the House of Representatives, Abuja.

“Our laws and policies must first and foremost work for the Nigerian people who we have either been elected or appointed to serve”, Nami stated.

“Whatever proposals have been submitted for consideration should be looked at critically vis-a-vis what works for Nigeria, the business community, the taxpayers, tax consultants, and the Nigerian system altogether. It will help us more if we realise that our collective effort and service is not about us. It is about our country.

“We must build a tax system that is not only robust but that will outlive our respective services to this nation; whether as members of the executive, the judiciary or the legislature. In other words, these laws must be made in a manner that reflects not just what we feel is right, but what is indeed right—yesterday, today, and continues to be right tomorrow.”

Muhammad Nami further appealed that the Fiscal Policy Reform Committee and the House Committee on Finance should continue to make laws that stand the test of time and reflect economic realities. He further called for laws that will not only assist the government at the three levels in mobilising revenue but will also assist small and medium scale enterprises to grow, and become taxpayers in the future.

The FIRS Executive Chairman also commended the leadership of the National Assembly and members of the Executive for the annual review of the Finance Act which he said has afforded the Federal Government the opportunity to deploy new ways of enhancing domestic revenue mobilisation and improving tax administration in the country.

“The Finance Bills have accorded the Federal Government and the Fiscal Policy Reform Committee the opportunity to annually review and identify gaps in our tax system, to fix them and ensure that government can earn the much-needed revenue for the execution of its mandate. Without the commitment of the National Assembly leadership and members of the Executive, from day one to the fiscal reforms that the Finance Bills were aimed to achieve, we would not have been able to attain the resounding successes we have recorded since 2020.” Nami stated.

READ ALSO: Insecurity: Group Wants Buhari Resigned, Impeached

Describing the annual review as a “clear demonstration of political will for the actualisation of good governance,” Nami highlighted that it was the enablement provided by the Finance Act 2020 that gave the FIRS the powers to deploy its own digital tax administration solution, TaxPro Max with its attendant results.

“That single revolutionary amendment to the FIRS Establishment Act gave us the power to deploy our home gown digital Tax Administration Solution called the TaxPro-Max. This platform allows for seamless electronic registration of taxpayers, electronic filing of returns and payment of taxes.

“Consequently, it is not surprising that the FIRS was able to collect over N5 trillion between January this year to date while we are confident that we will achieve our total VAT target for the year”, Nami stated.

You may like

Business

FULL LIST: 16 Banking Transactions Exempted From CBN’s New

Published

19 hours agoon

May 7, 2024By

Editor

The Central Bank of Nigeria on Monday directed all banks to commence charging a 0.5 per cent cybersecurity levy on all electronic transactions within the country.

The apex bank stated this in a circular signed by the Director, Payments System Management Department, Chibuzo Efobi; and the Director, Financial Policy and Regulation Department, Haruna Mustafa; a copy of which was obtained by The PUNCH.

The circular, which was directed to all commercial, merchant, non-interest, and payment service banks, among others; noted that the implementation of the levy would start two weeks from Monday, May 6, 2024.

READ ALSO: Five Things To Know About The New Cybersecurity Levy To Be Paid By Nigerians

“The levy shall be applied at the point of electronic transfer origination, then deducted and remitted by the financial institution. The deducted amount shall be reflected in the customer’s account with the narration, ‘Cybersecurity Levy,’” the circular partly read.

In this piece, The PUNCH highlights all the 16 banking transactions that are exempted from the CBN’s new cybersecurity levy:

Loan disbursements and repayments

Salary payments

Intra-account transfers within the same bank or between different banks for the same customer

Intra-bank transfers between customers of the same bank

Other Financial Institutions instructions to their correspondent banks

Interbank placements,

Banks’ transfers to CBN and vice-versa

Inter-branch transfers within a bank

Cheque clearing and settlements

Letters of Credits

READ ALSO: FG To Delist Naira From P2P Platforms

Banks’ recapitalisation-related funding – only bulk funds movement from collection accounts

Savings and deposits, including transactions involving long-term investments such as Treasury Bills, Bonds, and Commercial Papers.

Government Social Welfare Programmes transactions e.g. Pension payments

Non-profit and charitable transactions, including donations to registered non-profit organisations or charities

Educational institutions’ transactions, including tuition payments and other transactions involving schools, universities, or other educational institutions

Transactions involving bank’s internal accounts such as suspense accounts, clearing accounts, profit and loss accounts, inter-branch accounts, reserve accounts, nostro and vostro accounts, and escrow accounts.

Business

Five Things To Know About The New Cybersecurity Levy To Be Paid By Nigerians

Published

20 hours agoon

May 7, 2024By

Editor

The Central Bank of Nigeria, on Monday, directed banks and other financial institutions to start charging a cybersecurity levy on all banking transactions.

According to the circular sighted by The PUNCH, the implementation of the levy would start in two weeks.

The circular read in part, “Following the enactment of the Cybercrime (Prohibition, Prevention, etc) (amendment) Act 2024 and pursuant to the provision of Section 44 (2)(a) of the Act, ‘a levy of 0.5% (0.005) equivalent to a half percent of all electronic transactions value by the business specified in the Second Schedule of the Act,’ is to be remitted to the National Cybersecurity Fund, which shall be administered by the Office of the National Security Adviser.”

READ ALSO: CBN Orders Banks To Charge 0.5% Cybersecurity Levy

Here are some things to know about the cybersecurity levy to be paid by Nigerians, according to the CBN circular:

1. A new levy of 0.5%, equivalent to half per cent, is applied to electronic transactions as mandated by the Cybercrime (Prohibition, Prevention, etc) (amendment) Act 2024.

2. The levy is paid by the originator of the electronic transaction and deducted by the financial institution. The deducted amount shall be reflected in the customer’s account with the narration: “Cybersecurity Levy.”

READ ALSO: FG To Delist Naira From P2P Platforms

3. Financial institutions will deduct the levy and remit it to the National Cybersecurity Fund administered by the Office of the National Security Adviser.

4. Deductions shall commence within two weeks from the date of the circular, May 6, and financial institutions must remit collected levies in bulk to the NCF account domiciled at the CBN monthly by the fifth business day of the following month.

5. Financial institutions have deadlines to update their systems to handle levy deduction and remittance. Failure to remit the levy can result in penalties, including a fine of up to 2% of a financial institution’s annual turnover.

Business

FG Gives Deadline To PoS Operators To Register With CAC

Published

20 hours agoon

May 7, 2024By

Editor

The Corporate Affairs Commission has set a two-month deadline for Point of Sale operators in the country to register their agents, merchants and individuals, latest by July 7, 2024.

The Registrar-General/Chief Executive Officer, CAC, Hussaini Magaji, SAN, met with some fintech companies, also known as PoS, on Monday in Abuja, during which the agreement was reached.

Magaji said the measure aims at safeguarding the businesses of fintech customers and strengthening the economy, the commission stated via its X handle, tweeting as @cacnigeria1.

Magaji stated that the move complies with “Section 863, Subsection 1 of the Companies and Allied Matters Act, CAMA 2020 as well as the 2013 Central Bank of Nigeria’s guidelines on agent banking.”

READ ALSO: CBN Orders Banks To Charge 0.5% Cybersecurity Levy

The tweet partly read, “Hussaini Magaji, therefore, said that the timeline for the registration, which will expire on July 7, 2024, was not targeted at any groups or individuals but genuinely aimed at protecting businesses.

“Several speakers from the fintech industry pledged to collaborate with the Commission to ensure hitch-free implementation of the directive.

“Some of them, however, stressed the need for adequate and collective sensitisation to ensure that the exercise achieved the desired results.”

In his remarks, Tokoni Peter, the Special Adviser to President Bola Tinubu on ICT Development and Innovation, “pledged to ensure the smooth facilitation of the process in line with the Renewed Hope Initiative of the present administration.”

READ ALSO: CBN Orders Banks To Charge 0.5% Cybersecurity Levy

Present at the meeting were representatives of fintech companies, including Opay, Momba, Palm Pay, Moniepoint, Paystack, among others.

Aside from being an avenue for job creation, PoS operators play a significant role in financial transactions nationwide.

The move to compel the registration of the fintech companies with the CAC has come at a much-needed time as the companies have also been a key part of fraudulent transactions.

READ ALSO: Pandemonium During Church Service As Man Pulls Gun, Attempts To Shoot Pastor [VIDEO]

In its Annual Fraud Landscape (January to December 2023) report, the Nigeria Inter-Bank Settlement System has said that financial institutions lost about N17.67 billion to fraud in 2023.

It was also reported that the Web and PoS channels were the most exploited payment channels by fraudsters in 2023.

The count of Web Fraud decreased by 38 per cent and ATM fraud recorded a 64 per cent reduction from 2022 to 2023.

‘I’m Considering Having 4th Child’ – Mother Of Three Who Breastfeeds Husband , 3 Kids [PHOTOS]

VIDEO Newly Appointed LG Supervisors, Advisers In Ekiti Take Oath Of Office With ‘Ogún’

JUST IN: DSS Arrests Wanted Oyo Motorpark Boss, Auxiliary

Trending

News5 days ago

News5 days ago15-year-Old Public School Student Scores 362 In UTME

Headline3 days ago

Headline3 days agoPHOTOS: Moment 23-year-old Miss Ecuador Beauty Queen Is Gunned Down In Hail Of Bullets

Metro1 day ago

Metro1 day agoKidnappers Sleep Off After Abducting Pastor’s Wife, Others In Ondo

News2 days ago

News2 days agoJUST IN: SERAP Drags 36 Govs, Wike To Court Over N5.9tn, $4.6bn Loans

Headline4 days ago

Headline4 days agoShock As Woman Who Visited Hospital For Scan Was Told She’s Dead

Metro2 days ago

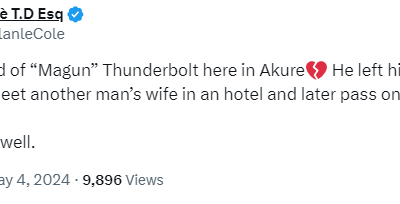

Metro2 days agoMan Dies On Top Of Married Woman In Akure

Headline3 days ago

Headline3 days agoVIDEO: Arsenal Pay Tribute To 14-year-old British-Nigerian Fan Daniel Anjorin Killed In UK

Headline3 days ago

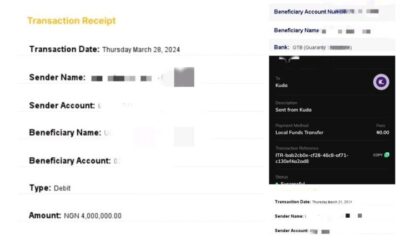

Headline3 days agoFind The Man Who Stole $30000 From Me, Get $2000 Reward – Nigerian Man Cries Out

Metro4 days ago

Metro4 days agoDelta Lady Dies After Friends Allegedly Pushed Her Into Pot Of Boiling Pepper [Photos]

News3 days ago

News3 days agoWhy I Refused To Return Govt Vehicles – Ex-Edo Gov, Shaibu