Business

Forex Scarcity Sends Naira Tumbling Unprecedentedly

Published

8 months agoon

By

Editor

There are indications that exchange rate crises that trailed the foreign exchange market reforms in June 2023 may linger further as supply gap led to further depreciation of Naira in the parallel market yesterday to N930/ $1, down from N925 mid last week.

However, the exchange rate improved week-on-week in the Investors and Exporters (I&E) window to N758.1 from N775.6.

The prevailing exchange rates indicates a rising parallel market premium which is the gap between the parallel market rate and that of the I&E window.

The gap, as at last week Wednesday, was N153.41 per dollar, but has risen to N171.9 per dollar by yesterday, a development which has created a huge incentive for round-tripping and arbitraging in the foreign exchange market ecosystem.

READ ALSO: Naira Gains At Investors, Exporters Window

Moreover, market observers have also noted that the Bureau de Changes, BDCs, have not helped the market as envisaged a month ago when the segment was re-admitted into the Central Bank Of Nigeria, CBN, official trading window for the purpose of opening the market to more independent forex supply and better access for individual retail end users.

The BDCs have, instead, lamented that the renewed depreciation of the local currency was mainly due to the scarcity of the foreign currencies.

A BDC operator told Vanguard that the scarcity is so much that ‘‘even some Nigerians are unable to withdraw forex from their domiciliary accounts in banks”.

He said the lifting of the ban by the CBN on sales of forex to BDC operators has failed to help resolve the scarcity as the banks are not selling to the BDCs.

READ ALSO: Naira Tumbles Against Dollar As CBN Vows BDC Operators Clampdown

Data from FMDQ showed that the market opened at N761.24 to the dollar, recording a high of N807.15 and a low of N738.

A total of $42.26 million was traded in foreign exchange at the I&E window.

On Tuesday, CBN said a review of the change in the forex regime showed that banks are in a position to profit from its potential to significantly increase the naira value of banks’ foreign currency (FCY) assets and liabilities.

The apex bank directed deposit money banks, DMBs, to stop utilising gains from the revaluation of the naira to pay dividends or finance operations.

Some financial market analysts

CBN should reduce BDCs through mergers, acquisition—Prof Uwalake

Commenting on the renewed depreciation of the naira even with the lifting of ban on sale of forex to BDCs, Prof Uche Uwaleke, President. Association of Capital Market Academics of Nigeria, ACMAN said: “Recall that the ban was placed in the first place due to the abuses associated with the selling of Forex to BDCs due to their large and unmanageable number.

READ ALSO: Naira Appreciates As NNPCL Boosts Forex Supply With $3bn Loan

‘‘If the CBN has established a need to resume such sales, then it should first trim the over 5000 BDCs to a controllable number of less than 1000 through a regulatory-induced merger and acquisition.

‘‘It is only then that the CBN can be in a position to effectively supervise the BDCs else the CBN ends up going round in circles.”

Allocation of forex to BDCs may not address scarcity- Adonri

Also commenting, David Adonri, analyst and Executive Vice Chairman at Highcap Securities Limited, said: “Since BDCs are authorized retail dealers licensed by CBN, sale of forex to them is in order.

‘‘However, CBN should endeavor to sell to all its authorized buyers at the prevailing open market price in order to avoid rent seeking abuses. This U-turn may not address scarcity but provide a level playing field for participants in the foreign exchange market.”

READ ALSO: CBN May Lose Control Of The Naira

I doubt there will be any improvement Chiazor

Another financial expert, Victor Chiazor, Head of Research and Investment at FSL Securities Limited, said: “The CBN’s decision to lift the ban on sale of Forex to BDCs would have aided liquidity in the FX market if the CBN actually had enough FX in its vaults.

‘‘But I doubt there will be any change to the current pressure on the Naira.

“The case today is that our FX reserves which is at around $33 billion while the net liquid position is far lower, which means that in real terms the CBN does not have the required FX liquidity to meet the current FX demand, not also forgetting the existing backlog of FX payments owed to businesses.”

VANGUARD

You may like

Find The Man Who Stole $30000 From Me, Get $2000 Reward – Nigerian Man Cries Out

Dangote Speaks On Devaluation Of Naira

Mixed Reactions Trail Video Of Couple’s Customised N200 Notes

Naira Abuse: EFCC To Arraign Cubana Chief Priest Wednesday

Naira Abuse: ‘Ask Bob For Update’ – EFCC Issues Threat To Culprits

Naira Appreciation Continues Despite Drop In FX Turnover

Business

CAC Opens Centre For Registration Of PoS Operators

Published

4 days agoon

May 9, 2024By

Editor

The Corporate Affairs Commission has inaugurated a centre for bulk registration of Point of Sale operators in its database.

The CAC Registrar-General, Hussaini Magaji, said this while inaugurating the centre stationed at its Federal Capital Territory Office in Abuja on Wednesday.

According to Magaji, the importance of registering the PoS operators in the commission’s database cannot be over emphasised.

He said the centre was well equipped with all the necessary facilities to operate 24 hours a day and ensure the commission’s achievement of its purpose.

READ ALSO: ICYMI: FG To Delist Naira From P2P Platforms

“What we did was accommodate the request from the Fintechs.

“We have allowed them to integrate with the Corporate Affairs Commission; they have developed their structure, and we gave them access.

“Once they supply the necessary details for registration on their platform, the certificate is generally generated and transmitted directly to their platform without them having to contact anyone.

“We have done this to ensure that everyone gets it easy without hitches, but if they choose to apply manually, we have a secretariat open for them to do so,” he stated.

READ ALSO: ICYMI: FG Gives Deadline To PoS Operators To Register With CAC

Recall that the Federal Government through the CAC on Tuesday issued a two-month registration deadline to Point of Sales companies, to register their agents, merchants, and individuals with the commission in line with legal requirements and the directives of the Central Bank of Nigeria.

Meanwhile, at the event, the registrar-general reiterated that the centre would be opened to all operators in the fintech industry who voluntarily submitted their agents and merchants for regularisation with the CAC.

Magaji said that the registration was in line with President Bola Tinubu’s desire to ensure financial inclusion for the youth and strengthen the fight against fraud, finance and other crimes in the country.

He further expressed his resolve to ensure compliance with the provisions of Section 863 (1) of the Companies and Allied Matters, CAMA 2020, and the CBN guidelines for Agent Banking, 2013.

READ ALSO: ICYMI: Five Things To Know About The New Cybersecurity Levy To Be Paid By Nigerians

On security, the CAC boss said that if a crime were committed using the PoS, the government would easily trace the perpetrators to the CAC data platform if such machines were registered.

“If an incident happens and they report it to CAC, if we do not have the operator’s details, we cannot respond, and that is the essence of this registration.

“The registration ensures that every detail of the person is provided, including NIN, passport photograph and all other useful documents.

“And it is an opportunity for more people to be captured into the formal sector,” he said.

The News Agency of Nigeria reports that the Special Adviser to the President on ICT Development and Innovation, Tokoni Peter attended the event.

The event was attended by Dr Salihu Dasuki, the Special Adviser to the President on ICT Policy Office, the PoS operators, and other stakeholders.

(NAN)

Business

FULL LIST: CBN Publishes List Of Licensed Deposit Money Banks

Published

5 days agoon

May 8, 2024By

Editor

The Central Bank of Nigeria has released a comprehensive list of licensed Deposit Money Banks operating within the country.

The list, which was made public on the CBN’s official website on Tuesday, provides insights into the banking landscape in Nigeria.

Banks with international authorisation include Access Bank Limited, Fidelity Bank Plc, First City Monument Bank Limited, First Bank Nigeria Limited, Guaranty Trust Bank Limited, United Bank of Africa Plc, and Zenith Bank Plc.

READ ALSO: BDC Operators Arrested As Naira Sells 1,416/$

Commercial banks with national authorisation include Citibank Nigeria Limited, Ecobank Nigeria Limited, Heritage Bank Plc, Globus Bank Limited, Keystone Bank Limited, Polaris Bank Limited, Stanbic IBTC Bank Limited, Standard Chartered Bank Limited, Sterling Bank Limited, Titan Trust Bank Limited, Union Bank of Nigeria Plc, Unity Bank Plc, Wema Bank Plc, Premium Trust Bank Limited and Optimus Bank Limited.

Commercial banks with regional licenses are Providus Bank Limited, Parallex Bank Limited, Suntrust Bank Nigeria Limited, and Signature Bank Limited.

Players in the non-interest banking sector with national authorisation include Jaiz Bank Plc, Taj Bank Limited, Lotus Bank Limited, and Alternative Bank Limited.

READ ALSO: [ICYMI]FULL LIST: 16 Banking Transactions Exempted From CBN’s New

In the merchant banking category, the apex banks listed, are Coronation Merchant Bank Limited, FBN Merchant Bank Limited, FSDH Merchant Bank Limited, Greenwich Merchant Bank Limited, Nova Merchant Bank Limited, and Rand Merchant Bank Limited.

The financial holding companies listed were Access Holdings Plc, FBN Holdings Plc, FCMB Group Plc, FSDH Holding Company Limited, Guaranty Trust Holding Company Plc, Stanbic IBTC Holdings Plc, and Sterling Financial Holdings Limited.

The Mauritius Commercial Bank Representative Office (Nigeria) Limited was listed as the sole representative office.

Business

[ICYMI]FULL LIST: 16 Banking Transactions Exempted From CBN’s New

Published

6 days agoon

May 7, 2024By

Editor

The Central Bank of Nigeria on Monday directed all banks to commence charging a 0.5 per cent cybersecurity levy on all electronic transactions within the country.

The apex bank stated this in a circular signed by the Director, Payments System Management Department, Chibuzo Efobi; and the Director, Financial Policy and Regulation Department, Haruna Mustafa; a copy of which was obtained by The PUNCH.

The circular, which was directed to all commercial, merchant, non-interest, and payment service banks, among others; noted that the implementation of the levy would start two weeks from Monday, May 6, 2024.

READ ALSO: Five Things To Know About The New Cybersecurity Levy To Be Paid By Nigerians

“The levy shall be applied at the point of electronic transfer origination, then deducted and remitted by the financial institution. The deducted amount shall be reflected in the customer’s account with the narration, ‘Cybersecurity Levy,’” the circular partly read.

In this piece, The PUNCH highlights all the 16 banking transactions that are exempted from the CBN’s new cybersecurity levy:

Loan disbursements and repayments

Salary payments

Intra-account transfers within the same bank or between different banks for the same customer

Intra-bank transfers between customers of the same bank

Other Financial Institutions instructions to their correspondent banks

Interbank placements,

Banks’ transfers to CBN and vice-versa

Inter-branch transfers within a bank

Cheque clearing and settlements

Letters of Credits

READ ALSO: FG To Delist Naira From P2P Platforms

Banks’ recapitalisation-related funding – only bulk funds movement from collection accounts

Savings and deposits, including transactions involving long-term investments such as Treasury Bills, Bonds, and Commercial Papers.

Government Social Welfare Programmes transactions e.g. Pension payments

Non-profit and charitable transactions, including donations to registered non-profit organisations or charities

Educational institutions’ transactions, including tuition payments and other transactions involving schools, universities, or other educational institutions

Transactions involving bank’s internal accounts such as suspense accounts, clearing accounts, profit and loss accounts, inter-branch accounts, reserve accounts, nostro and vostro accounts, and escrow accounts.

Man Kidnaps 6-year-old Cousin, Kills Victim For Recognising Him

Five-year-old Boy Shot Dead By Hijackers In South Africa

American Comedian, James Gregory Is Dead

Trending

News5 days ago

News5 days agoThe New Masquerade’ Actress, Ovularia Is Dead

News5 days ago

News5 days agoBREAKING: Rivers State House Of Assembly Gets New Speaker

Business5 days ago

Business5 days agoFULL LIST: CBN Publishes List Of Licensed Deposit Money Banks

Metro5 days ago

Metro5 days agoEdo: Police Patrol Van Pursuing ‘Yahoo Boys’ Rams Into Motorcycle Convening Passenger

News5 days ago

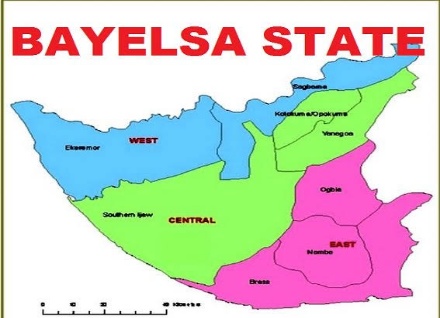

News5 days agoFather Of 12 Found Dead Inside Brothel In Bayelsa

Politics1 day ago

Politics1 day agoRivers Crisis: Why Gov Fubura Got Into ‘Trouble’ – Secondus

News4 days ago

News4 days agoVIDEO: Nigerian Man Exhumed After Completing 24-hour Buried Alive Challenge

Metro2 days ago

Metro2 days agoKogi University Lecturer Stripped Over Alleged Sexual Harassment

News4 days ago

News4 days agoNigerian Emerges First Black Woman To Bag PhD In Robotics At Michigan Varsity

News4 days ago

News4 days agoNigerian’s Request To Be Buried Alive For 24 Hours Causes Stir Online [VIDEO]