News

FULL LIST: NELFUND Clears 22 More Institutions For Student Loan

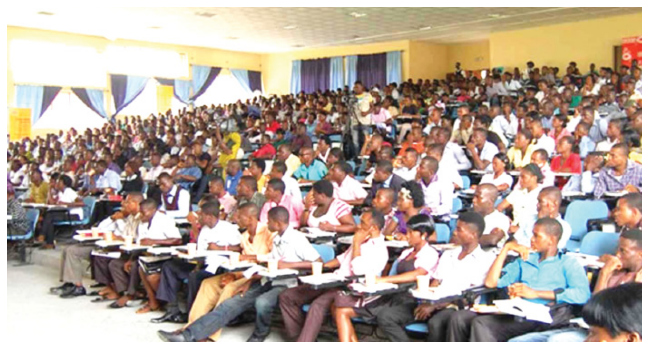

The Nigeria Education Loan Fund (NELFUND) said it has cleared an extra 22 state-owned tertiary institutions to apply for student loans.

The implementation of the student loan scheme is President Bola Tinubu’s flagship project in the education sector.

The statement posted via @NELFUND on X said, “The Nigeria Education Loan Fund has announced that students from the following 22 state-owned tertiary institutions can now apply for loans on its portal: nelf.gov.ng

“This followed a review by the committee responsible for the Student Verification System. Prior to this, 86 state-owned institutions were cleared, bringing a total of 108 institutions whose students are now able to apply,” the statement posted via @NELFUND on X said.

The onboarding of the 22 state-owned institutions brings total number of approved state institutions to 108.

The development comes barely one month after the fund was set up by President, Tinubu. The president introduced the fund when he signed the Access to Higher Education Act, which creates a legal framework for granting loans to indigent or low-income Nigerians to facilitate the payment of their fees in Nigerian tertiary institutions.

READ ALSO: Ogun To Give N500,000, N10m Grants, Others To Business-oriented Youths

The law, reenacted earlier this year, created the Nigerian Education Loan Fund.

NELFUND is saddled with the responsibility of handling all loan requests, grants, disbursement, and recovery.

The fund, according to the act, is to be funded from multiple streams and will engage in other productive activities.

The Newly Cleared Institutions Are As Follows:

1. Abia State University, Uturu

2. College of Education, Nsugbe

3. Chukwuemeka Odumegwu Ojukwu University

4. Delta State University, Abraka.

5. Delta State Polytechnic, Otefe-Oghara, Delta State

READ ALSO: Women Protest Half-Naked Over Incessant Killings In Ondo Community

6. Ekiti State Polytechnic, Isan-Ekiti

7. Kogi State University, Kabba, Kogi State

8. Prince Abubakar Audu University

9. Kwara State University

10. Kwara State College of Health Technology

11. Abdulkadir Kure University Minna

12. Ogun State College of Health Technology, Ilese-Ijebu

13. Moshod Abiola Polytechnic

14. Emmanuel Alayande University of Education, Oyo

15. The Polytechnic, Ibadan

16. The Oke Ogun Polytechnic, Saki

17. Rivers State University, Port Harcourt

18. Kenule Beeson Saro-Wiwa Polytechnic

19. Shehu Sule College of Nursing and Midwifery, Damaturu

20. College of Administration, Management andTechnology Potiskum, Yobe State 21. College of Agriculture, Science & Technology, Gujba

22. College of Education Legal Studies, Nguru

Previously Cleared Institutions Are As Follows:

1. Abia State Polytechnic

2. Adamawa State University Mubi

3. Adamawa State Polytechnic Yola

4. College of Education Afaha Nsit

5. Akwa Ibom State University

6. Akwa Ibom State Polytechnic

7. Aminu Saleh College of Education, Azare

8. Niger Delta University

9. Benue State University, Makurdi

10. Borno State University

READ ALSO: National Anthem Recitation: Fresh Protest Looms Over Controversial Bill

11. College of Education, Waka-Biu

12. Mohammed Lawan College Of Agriculture

13. Ramat Polytechnic, Maiduguri

14. Cross River State University

15. Delta State Polytechnic, Ogwashi-uku

16. Delta State University of Science and Technology

17. Dennis Osadebay University, Asaba 18.

University of Delta Agbor

19. Ebonyi State University, AbakalikI

20. Edo State University Uzairue.

21. Ekiti State University, Ado Ekiti

22. Bamidele Olumilua University of Edu., Sc., and Tech

23. University of Medical and Applied Sciences Enugu State

24. Gombe State University

25. Imo State University of Agriculture and Environmental Sciences Umuagwo

26. Kingsley Ozumba Mbadiwe University

27. Benjamin Uwajumogu State College of Education IhitteUboma

28. Imo State Polytechnic Omuma

29. Sule Lamido University Kafin Hausa, Jigawa State

30. Nuhu Bamalli Polytechnic, Zaria

31. Kaduna State College of Education Gidan Waya

32. Kaduna State University

33. Aliko Dangote University of science and Technology wudil

34. Yusuf Maitama Sule University

35. Katsina State Institute of Technology and Management

36. Umar Musa Yaradua University Katsina

37. Kebbi State University of Science and Technology, Aliero

38. Confluence University of Science and Technology

39. Prince Abubakar Audu University Anyigba

40. Kwara Polytechnic

41. Kwara State College of Education Oro

42. Lagos state university of education

43. Lagos State University of Science and Technology

44. Lagos State University

45. Isa Mustapha Agwai Polytechnic, Lafia

46. Nasarawa State University Keffi

47. Ibrahim Badamasi Babangida Uniersity Lapai

READ ALSO: Seminarian Arrested For Defiling 10-year-old Girl In Anambra

48. Niger State Polytechnic Zungeru

49. Abraham Adesanya Polytechnic

50. Olabisi Onabanjo University

51. Tai Solarin University of Education

52. Ogun State Institute of Technology, Igbesa

53. D.S Adegbenro ICT Polytechnic Itori-Ewekoro.

54. Gateway ICT Polytechnic Saapade

55. University of Medical Sciences, Ondo

56. Adekunle Ajasin University Akungba-Akoko, Ondo State

57. Government Technical College Ile-Ife 58. GTC, ARA Osun State

59. GTC, GBONGAN Osun State

60. GTC, IJEBU-JESA Osun State

News

Edo SWAN Distances Self From Online Publication Against Enabulele

…demands retraction, warns member against unverified publication

The Sports Writers Association of Nigeria (SWAN), Edo State Chapter, has distanced itself from an online publication titled: ‘Samuel Ogbemudia Stadium Shut Against Stephen Keshi.’

A statement signed by the Secretary of the association, Comrade Idahosa Moses, Edo SWAN said neither was it consulted nor involved in the “framing of the narrative presented by the online publication.”

Edo SWAN described the publication as misleading, sensational and grossly lacking in factual balance.

The statement partly reads: “SWAN finds the report inconsistent with the ethical standards and core values of the journalism profession.

READ ALSO:SWAN Orders Nationwide Boycott Of NFF Activities

“While Edo SWAN recognises and respects the sentiments expressed by Mr. Austin Popo, Secretary of the Board of Trustees of the Stephen Keshi Football and Vocational Training Centre (SKFTVC), concerning the challenges encountered in securing the use of the Samuel Ogbemudia Stadium for this year’s Stephen Keshi Memorial National Under-17 Soccer Tournament, it is imperative to state that such concerns should not be reported in a manner that imputes motives, assigns blame without verification, or portrays public officials as acting in bad faith.”

On allegations against the Executive Chairman of the Edo State Sports Commission, Hon. Amadin Desmond Enabulele, in the publication, SWAN described Enabulele as a “seasoned professional with a proven track record of integrity and dedicated service to sports development in Edo State.”

“Any insinuation that he or the Commission deliberately acted to undermine the memory and legacy of the late Stephen Okechukwu Keshi is not only unfair but also unsupported by verifiable facts.”

Edo SWAN, therefore, “strongly cautions the publisher of Popular News to desist from publishing unverified and inflammatory reports capable of misleading the public and damaging reputations.”

READ ALSO:Botswana’s New President Sworn In As Voters Kick Out Ruling Party Of Nearly Six Decades

“The Association formally demands that the controversial publication be withdrawn immediately and that an unreserved apology be tendered to Hon. Amadin Desmond Enabulele.”

SWAN further “extends its sincere apologies to the Chairman of the Edo State Sports Commission, who is also a Patron of the Edo SWAN Chapter, for any embarrassment or misrepresentation arising from the said publication, and assures him of its continued respect, support and cooperation.”

Edo SWAN, while stating that it “shares in the collective responsibility of preserving and honouring the legacy of the late Stephen Keshi—a national icon whose contributions to Nigerian football remain indelible—the Association, maintained that “this noble course must be pursued through constructive engagement, professionalism and mutual respect among all stakeholders.”

Edo SWAN, thereafter, warned “all sports writers in the state to avoid unverifiable reports and sensationalism, stressing that any member found culpable of professional misconduct will be decisively sanctioned in line with the Association’s statutes.”

News

Court Dissolves Petitioner’s Marriage Over Lack Of Love, Care

An Area Court sitting at Centre-Igboro, Ilorin in Kwara State, on Thursday, dissolved the four-year-old marriage between Aminat Mustapha and Wahab Adeshina, following the petitioner’s insistence.

The petitioner told the court that she was no longer interested in her marriage to her husband following claims of lack of love and care.

According to the News Agency of Nigeria (NAN), while delivering ruling, the presiding judge, Mr Toyin Aluko, held that the respondent had written to the court, accepting the divorce application made by his wife.

READ ALSO:Why I Charged My Husband Money For Sex —Woman

Aluko, consequently, dissolved the marriage between the parties, and ordered the woman to observe one month iddah (waiting period) before she could remarry.

Meanwhile, the court granted custody of the two children in the marriage, ages one and three, to their mother.

He ordered the father to pay a monthly sum of N20,000 for the children’s feeding and maintenance.

The court also held that the respondent will be responsible for their education and healthcare.

Again, the court held that the father has unrestricted access to his children, but at reasonable time adding that he should be notified before any decision is taken on his children.

The judge ordered the petitioner to get a copy of the judgment and send same to the respondent.

News

Tinubu Embarks On Three-state Visit

President Bola Ahmed Tinubu will depart Abuja on Saturday on a working visit to Borno, Bauchi and Lagos.

This is contained in a statement issued by Presidential Spokesperson, Mr Bayo Onanuga, on Friday in Abuja.

While in Borno, the President will commission projects executed by the Borno State Government under Gov. Babagana Zulum, in collaboration with the Federal Government.

He will also attend the wedding ceremony of Sadeeq Sheriff, son of former Borno Governor, Sen. Ali Modu Sheriff, and his bride, Hadiza Kam Salem.

READ ALSO:Ambassadorial Nominees: Ndume Asks Tinubu To Withdraw List

From Maiduguri, Tinubu will proceed to Bauchi State to condole with the state government and the family of Sheikh Dahiru Bauchi, the renowned Islamic cleric and leader of the Tijjaniyya Muslim Brotherhood.

Sheikh Dahiru Bauchi died on Nov. 27.

After the condolence visit, the President will travel to Lagos, where he will spend the end-of-year holidays.

During his stay in Lagos, Tinubu is expected to attend several engagements, including the Eyo Festival scheduled for Dec. 27.

The festival, to be held at Tafawa Balewa Square, will honour notable personalities, including the President’s late mother, Alhaja Abibatu Mogaji, former Lagos State governors Alhaji Lateef Jakande and Chief Michael Otedola.

Metro4 days ago

Metro4 days agoAlleged Organ Harvesting: Bereaved Families Rush To Check Corpses

News5 days ago

News5 days agoForest Reserve: Okpebholo Broker Peace Between Host Communities, Investors

News4 days ago

News4 days agoPolice Confirm Edo Tanker Explosion, say No Casualty

News3 days ago

News3 days agoFormer Delta North senator Peter Nwaoboshi Dies

News4 days ago

News4 days agoEdo SSG Calls On Media To Support Govt Policies, Assures Better Welfare

Metro2 days ago

Metro2 days agoJUST IN: Former Edo Information Commissioner Is Dead

News3 days ago

News3 days agoGrassroots To Global Podium: Edo Sports Commission Marks Enabulele’s First Year In Office

News4 days ago

News4 days agoOtuaro Tasks Media On Objective Reportage

News4 days ago

News4 days agoIPF Hosts Media Conference, Seeks Protection For N’Delta Environment

News4 days ago

News4 days agoOkpebholo Sympathises With Otaru, People of Auchi Over Tragic Tanker Fire Incident