News

FULL LIST: NELFUND Clears 22 More Institutions For Student Loan

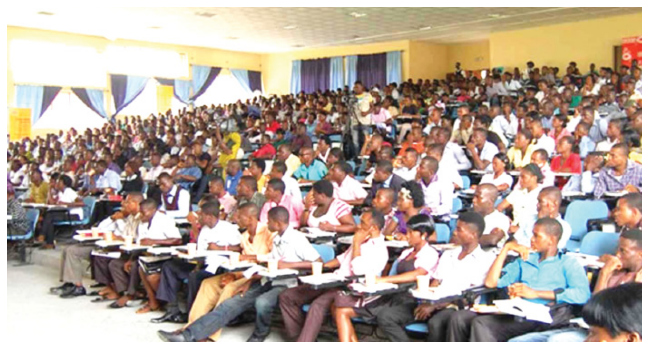

The Nigeria Education Loan Fund (NELFUND) said it has cleared an extra 22 state-owned tertiary institutions to apply for student loans.

The implementation of the student loan scheme is President Bola Tinubu’s flagship project in the education sector.

The statement posted via @NELFUND on X said, “The Nigeria Education Loan Fund has announced that students from the following 22 state-owned tertiary institutions can now apply for loans on its portal: nelf.gov.ng

“This followed a review by the committee responsible for the Student Verification System. Prior to this, 86 state-owned institutions were cleared, bringing a total of 108 institutions whose students are now able to apply,” the statement posted via @NELFUND on X said.

The onboarding of the 22 state-owned institutions brings total number of approved state institutions to 108.

The development comes barely one month after the fund was set up by President, Tinubu. The president introduced the fund when he signed the Access to Higher Education Act, which creates a legal framework for granting loans to indigent or low-income Nigerians to facilitate the payment of their fees in Nigerian tertiary institutions.

READ ALSO: Ogun To Give N500,000, N10m Grants, Others To Business-oriented Youths

The law, reenacted earlier this year, created the Nigerian Education Loan Fund.

NELFUND is saddled with the responsibility of handling all loan requests, grants, disbursement, and recovery.

The fund, according to the act, is to be funded from multiple streams and will engage in other productive activities.

The Newly Cleared Institutions Are As Follows:

1. Abia State University, Uturu

2. College of Education, Nsugbe

3. Chukwuemeka Odumegwu Ojukwu University

4. Delta State University, Abraka.

5. Delta State Polytechnic, Otefe-Oghara, Delta State

READ ALSO: Women Protest Half-Naked Over Incessant Killings In Ondo Community

6. Ekiti State Polytechnic, Isan-Ekiti

7. Kogi State University, Kabba, Kogi State

8. Prince Abubakar Audu University

9. Kwara State University

10. Kwara State College of Health Technology

11. Abdulkadir Kure University Minna

12. Ogun State College of Health Technology, Ilese-Ijebu

13. Moshod Abiola Polytechnic

14. Emmanuel Alayande University of Education, Oyo

15. The Polytechnic, Ibadan

16. The Oke Ogun Polytechnic, Saki

17. Rivers State University, Port Harcourt

18. Kenule Beeson Saro-Wiwa Polytechnic

19. Shehu Sule College of Nursing and Midwifery, Damaturu

20. College of Administration, Management andTechnology Potiskum, Yobe State 21. College of Agriculture, Science & Technology, Gujba

22. College of Education Legal Studies, Nguru

Previously Cleared Institutions Are As Follows:

1. Abia State Polytechnic

2. Adamawa State University Mubi

3. Adamawa State Polytechnic Yola

4. College of Education Afaha Nsit

5. Akwa Ibom State University

6. Akwa Ibom State Polytechnic

7. Aminu Saleh College of Education, Azare

8. Niger Delta University

9. Benue State University, Makurdi

10. Borno State University

READ ALSO: National Anthem Recitation: Fresh Protest Looms Over Controversial Bill

11. College of Education, Waka-Biu

12. Mohammed Lawan College Of Agriculture

13. Ramat Polytechnic, Maiduguri

14. Cross River State University

15. Delta State Polytechnic, Ogwashi-uku

16. Delta State University of Science and Technology

17. Dennis Osadebay University, Asaba 18.

University of Delta Agbor

19. Ebonyi State University, AbakalikI

20. Edo State University Uzairue.

21. Ekiti State University, Ado Ekiti

22. Bamidele Olumilua University of Edu., Sc., and Tech

23. University of Medical and Applied Sciences Enugu State

24. Gombe State University

25. Imo State University of Agriculture and Environmental Sciences Umuagwo

26. Kingsley Ozumba Mbadiwe University

27. Benjamin Uwajumogu State College of Education IhitteUboma

28. Imo State Polytechnic Omuma

29. Sule Lamido University Kafin Hausa, Jigawa State

30. Nuhu Bamalli Polytechnic, Zaria

31. Kaduna State College of Education Gidan Waya

32. Kaduna State University

33. Aliko Dangote University of science and Technology wudil

34. Yusuf Maitama Sule University

35. Katsina State Institute of Technology and Management

36. Umar Musa Yaradua University Katsina

37. Kebbi State University of Science and Technology, Aliero

38. Confluence University of Science and Technology

39. Prince Abubakar Audu University Anyigba

40. Kwara Polytechnic

41. Kwara State College of Education Oro

42. Lagos state university of education

43. Lagos State University of Science and Technology

44. Lagos State University

45. Isa Mustapha Agwai Polytechnic, Lafia

46. Nasarawa State University Keffi

47. Ibrahim Badamasi Babangida Uniersity Lapai

READ ALSO: Seminarian Arrested For Defiling 10-year-old Girl In Anambra

48. Niger State Polytechnic Zungeru

49. Abraham Adesanya Polytechnic

50. Olabisi Onabanjo University

51. Tai Solarin University of Education

52. Ogun State Institute of Technology, Igbesa

53. D.S Adegbenro ICT Polytechnic Itori-Ewekoro.

54. Gateway ICT Polytechnic Saapade

55. University of Medical Sciences, Ondo

56. Adekunle Ajasin University Akungba-Akoko, Ondo State

57. Government Technical College Ile-Ife 58. GTC, ARA Osun State

59. GTC, GBONGAN Osun State

60. GTC, IJEBU-JESA Osun State

News

Grassroots To Global Podium: Edo Sports Commission Marks Enabulele’s First Year In Office

The Indoor Sports Hall in Benin City came alive on Wednesday as the Edo State Sports Commission rolled out the drums to celebrate the first anniversary in office of its Executive Chairman, Hon. Amadin Desmond Enabulele. Management, staff, coaches and athletes gathered in an atmosphere charged with pride, reflection and optimism.

The colourful ceremony drew executives and members of various sports associations, officials of the Sports Writers Association of Nigeria (SWAN), coaches, athletes and other key stakeholders in Edo sports.

In her welcome address, the Acting Permanent Secretary of the Commission, Mrs. A. P. Amenze, praised Hon. Enabulele for what she described as focused and purposeful leadership. She said the past year had seen renewed confidence, discipline and energy return to the state’s sports ecosystem.

Adding excitement to the event were exhibition bouts and demonstrations by the Kung Fu, Karate, Taekwondo and Judo associations, staged in honour of the Executive Chairman.

READ ALSO:2025 NYG: Enabulele Charges Edo Coaches On Performance

Speaking for SWAN Edo State, Chairman Comrade Kehinde Osagiede commended Hon. Enabulele’s open-door leadership style and consistent support for sports development. He noted that the Commission had effectively driven Governor Monday Okpebholo’s “Catch Them Young” policy through practical grassroots programmes that identify and groom young talents across the state.

In recognition of his contributions to sports development and media relations, Comrade Osagiede conferred the Patronship of SWAN Edo State on Hon. Enabulele and presented him with a special anniversary card.

Goodwill messages followed from Executive Directors of the Commission, including Hon. Frank Ilaboya (Edo North), Coach Baldwin Bazuaye, MON (Edo South), Barr. Anthony Ikuenobe (Edo Central), and Mrs. Sabrina Chikere, Executive Director, Sports Development and Operations. Representatives of coaches, athletes and sports associations also took turns to acknowledge the progress recorded under the current leadership.

In his stewardship address, Hon. Enabulele expressed gratitude to Governor Monday Okpebholo and Deputy Governor Rt. Hon. Dennis Idahosa for the trust placed in him, noting that their backing and shared vision had driven the Commission’s achievements.

READ ALSO:Enabulele Lauds Okpehbolo For Creating Enabling Environment For Football To Thrive

He highlighted Team Edo’s third-place finish at the 9th National Youth Games in Asaba, where the state recorded its best-ever outing with 79 medals—33 gold, 18 silver and 28 bronze—reinforcing Edo’s reputation as a national sports powerhouse.

The Chairman also pointed to the impact of inclusive and grassroots sports programmes, citing Favour Ojeabu, a visually impaired para-cyclist who won three gold medals to emerge Africa’s champion at the African Track Para-Cycling Championship in Egypt.

Other milestones listed included outstanding performances by Edo para powerlifters on the international stage, historic achievements in cricket, weightlifting, cycling, judo and deaf athletics, as well as structural reforms such as the repositioning of Bendel Insurance FC and deeper investment in grassroots sports development.

Cultural performances added colour and tradition to the celebration, as stakeholders closed the event united in their assessment of the past year as a truly transformative period for sports development in Edo State.

News

Otuaro Tasks Media On Objective Reportage

The Administrator, Presidential Amnesty Programme (PAP) Dr. Dennis Otuaro has charged media practitioners particularly members of the Ijaw Publishers’ Forum to promote ethical journalism through their reportage.

He gave the charge in Warri on Wednesday during the 2nd Annual Ijaw Media Conference organised by the Ijaw Publishers’ Forum (IPF).

Represented by Princewill Binebai, spokesman, Ijaw Youth Council (IYC) Worldwide, Otuaro while stating that the Niger Delta stories have been told in such a way that is quite different from what is obtainable in the real sense, said this, IPF must do everything possible to correct.

The administrator added: “I am happy that Ijaw journalists have boldly come out together to champion the Ijaw struggle in a very dynamic perspective”.

READ ALSO:IPF Hosts Media Conference, Seeks Protection For N’Delta Environment

“The Ijaw story was misrepresented over the years, but IPF’s emergence had corrected this error and the story is gradually changing for better.”

Otuaro, however, challenged Ijaw media practitioners to be objective, truthful, accurate and fearless in their reportage to correct many years anomalies of the Ijaw struggle.

He admonished members of IPF to see themselves as brothers and love one another in the discharge of their activities to achieve a common goal.

News

Police Confirm Edo Tanker Explosion, say No Casualty

The Edo State Police Command has confirmed tanker explosions that rocked Auchi, the administrative headquarters of Etsako West Local Government Area of the state.

The Command’s Police Publice Relations Officer, Eno Ikoedem, who confirmed the incident via the phone, said the explosion occurred at about 6:30 p.m. following the fall of a fuel tanker along the road.

Ikoedem said the incident occurred on Wednesday evening at about 6:30 p.m. following the fall of a fuel tanker along the road.

READ ALSO:Edo SSG Calls On Media To Support Govt Policies, Assures Better Welfare

She explained that spilled fuel seeped into underground tunnels, which later ignited and caused three explosions in different parts of the Auchi community.

According to her, officers from the Auchi Divisional Police Headquarters and the Area Command were mobilised to the affected areas and successfully cordoned them off to prevent loss of lives.

She added: “No casualty was recorded. Our men on ground were able to cordoned the affected areas.”

READ ALSO:Edo Assembly Declares Okpebholo’s Projects Unprecedented

It was gathered that three separate explosions rocked the town simultaneously in different parts, which led to properties worth millions of naira destroyed.

A resident who does not want his name in print said via the telephone that the blasts occurred along Igbei Road, Igbo Shade, and along the Auchi–Okene Road, close to Winners Junction.

The resident, who alleged the explosions appeared to have been coordinated, called for a thorough investigation into the incident to prevent future occurrences.

Calls put across to Mr. Monday Edogiawere, Chairman, Red Cross, Edo State, were not picked.

-

Metro3 days ago

Suspected Kidnappers Abduct 18 Passengers On Benin-Akure Road

-

News4 days ago

I’m Not Distracted By Anti-Niger Delta Elements, Says PAP Boss, Otuaro

-

News3 days ago

OPINION: Time For The Abachas To Rejoice

-

Sports3 days ago

JUST IN: Dembélé Named FIFA Best Men’s Player, Bonmatí Wins Women’s Award

-

News3 days ago

Wage Dispute: Court Orders PSG To Pay Mbappe €61 Million

-

News4 days ago

Edo Assembly Charges Contractor Handling Ekekhuan Road To Accelerate Work

-

Metro3 days ago

NDLEA Seizes 457kg of Cannabis, Arrests Suspected Trafficker In Edo

-

Headline2 days ago

Aircraft Crashes In Owerri With Four Persons Onboard

-

Business3 days ago

CBN Revokes Licences Of Aso Savings, Union Homes As NDIC Begins Deposit Payments

-

News3 days ago

Ex-Nigerian Amb., Igali, To Deliver Keynote Address As IPF Holds Ijaw Media Conference