Business

Full List Of Forbes’ 25 World Billionaires In 2023

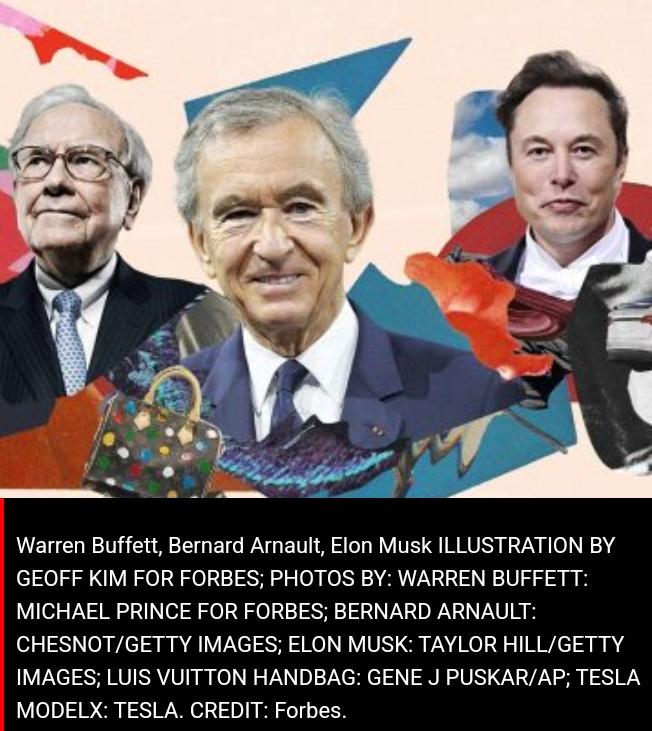

American business magazine, Forbes, in its 2023 list of 25 richest people in the world, featured Bernard Arnault on the No. 1 spot, followed by Twitter Chief Executive Officer, Elon Musk.

In its previous list in 2022, Musk was on the No. 1 spot.

Forbes described the drop of Musk from the top spot as ” this year’s second-biggest loser”, adding that “Elon Musk, had it worse.”

So This Happened (202) Reviews Lagos…

Musk lost his title of the world’s richest person after his pricey purchase of Twitter, which he funded in part by the sale of Tesla shares, helping to spook investors. Musk, who is worth $39 billion less than a year ago, is now No. 2.

For Jeff Bezos, fortune knocked him from number. 2 in the world in 2022 to No. 3 this year as Amazon shares crashed by 38 per cent.

Also, among the top 25, two billionaires — Zhang Yiming, Changpeng Zhao lost their spots and were unable to make it on the list for this year.

Yiming, the founder of Tik Tok-parent Bytedance, dropped one place, from No. 25 to No. 26, as his embattled company has taken a haircut from investors while Zhao, Binance founder, known as CZ, fell from No. 19 last year all the way to No. 167 amid the crypto winter.

READ ALSO: Elon Musk Puts Twitter’s Value At $20bn

Below are the list of Forbes 25 richest people in the world in 2023 with their net worth

1. Bernard Arnault & family

(Net worth: $211 Billion | Source of Wealth: LVMH | Age: 74 | Citizenship: France)

2. Elon Musk

(Net worth: $180 Billion | Source of Wealth: Tesla, SpaceX | Age: 51 | Citizenship: U.S.)

3. Jeff Bezos

(Net worth: $114 Billion | Source of Wealth: Amazon | Age: 59 | Citizenship: U.S.)

4. Larry Ellison

(Net worth: $107 Billion | Source of Wealth: Oracle | Age: 78 | Citizenship: U.S.)

5. Warren Buffett

(Net worth: $106 Billion | Source of Wealth: Berkshire Hathaway | Age: 92 | Citizenship: U.S.)

6. Bill Gates

(Net worth: $104 Billion | Source of Wealth: Microsoft | Age: 67 | Citizenship: U.S.)

7. Michael Bloomberg

(Net worth: $94.5 Billion | Source of Wealth: Bloomberg LP | Age: 81 | Citizenship: U.S.)

8. Carlos Slim Helú & family

(Net worth: $93 Billion | Source of Wealth: Telecom | Age: 83 | Citizenship: Mexico)

9. Mukesh Ambani

(Net worth: $83.4 Billion | Source of Wealth: Diversified| Age: 65 | Citizenship: India)

10. Steve Ballmer

(Net worth: $80.7 Billion | Source of Wealth: Microsoft | Age: 67 | Citizenship: U.S.)

11. Françoise Bettencourt Meyers & family

(Net worth: $80.5 Billion | Source of Wealth: L’Oréal | Age: 69 | Citizenship: France)

READ ALSO: Messi Tops Forbes’ Highest-paid Athlete List For 2022 [Full List]

12. Larry Page

(Net worth: $79.2 Billion | Source of Wealth: Google | Age: 50 | Citizenship: U.S.)

13. Amancio Ortega

(Net worth: $77.3 Billion | Source of Wealth: Zara | Age: 87 | Citizenship: Spain)

14. Sergey Brin

(Net worth: $76 Billion | Source of Wealth: Google | Age: 49 | Citizenship: U.S.)

15. Zhong Shanshan

(Net worth: $68 Billion | Source of Wealth: Beverages, pharmaceuticals | Age: 68 | Citizenship: China)

16. Mark Zuckerberg

(Net worth: $64.4 Billion | Source of Wealth: Facebook | Age: 38 | Citizenship: U.S.)

17. Charles Koch

(Net worth: $59 Billion | Source of Wealth: Koch Industries | Age: 87 | Citizenship: U.S.)

18. Julia Koch & family

(Net worth: $59 Billion | Source of Wealth: Koch Industries | Age: 60 | Citizenship: U.S.)

19. Jim Walton

(Net worth: $58.8 Billion | Source of Wealth: Walmart | Age: 74 | Citizenship: U.S.)

20. Rob Walton

(Net worth: $57.6 Billion | Source of Wealth: Walmart | Age: 78 | Citizenship: U.S.)

READ ALSO: 44 Newcomers Boost Forbes’ 400 List Of America’s Richest People, Trump Still Out

21. Alice Walton

(Net worth: $56.7 Billion | Source of Wealth: Walmart | Age: 73 | Citizenship: U.S.)

22. David Thomson & family

(Net worth: $54.4 Billion | Source of Wealth: Media | Age: 65 | Citizenship: Canada)

23. Michael Dell

(Net worth: $50.1 Billion | Source of Wealth: Dell Technologies | Age: 58 | Citizenship: U.S.)

24. Gautam Adani

(Net worth: $47.2 Billion | Source of Wealth: Infrastructure, commodities | Age: 60 | Citizenship: India)

25. Phil Knight & family

(Net worth: $45.1 Billion | Source of Wealth: Nike | Age: 85 | Citizenship: U.S.)

Business

NNPCL Announces Restoration Of Escravos-Lagos Pipeline

The Nigerian National Petroleum Company Limited (NNPCL) has announced the complete restoration of the Escravos-Lagos Pipeline System (ELPS) in Warri, Delta State, following the recent explosion on the asset.

The chief corporate communications officer (CCCO) of the nation’s oil company, Andy Odeh, in a statement, said that the pipeline is fully operational, reiterating the company’s resilience and commitment to energy security.

“NNPC Limited is pleased to announce the successful restoration of the Escravos-Lagos Pipeline System (ELPS) in Warri, Delta State.

READ ALSO:Fuel Price Cut: NNPCL GCEO Ojulari Reveals Biggest Beneficiaries

“Following the unexpected explosion on December 10, 2025, we immediately activated our emergency response, deployed coordinated containment measures, and worked tirelessly with multidisciplinary teams to ensure the damaged section was repaired, pressure-tested, and safely recommissioned.

“Today, the pipeline is fully operational, reaffirming our resilience and commitment to energy security. This achievement was made possible through the unwavering support of our host communities, the guidance of regulators, the vigilance of security agencies, and the dedication of our partners and staff.

“Together, we turned a challenging moment into a success story, restoring operations in record time while upholding the highest standards of safety and environmental stewardship.

“As we move forward, NNPC Limited remains steadfast in its pledge to protect our environment, safeguard our communities, and maintain the integrity and reliability of our assets. Thank you for your trust as we continue to power progress for Nigeria and beyond,” the statement read.

Business

Dangote Unveils 10-day Credit Facility For Petrol Station Owners

The Dangote Group has announced a 10-day credit facility backed by a bank guarantee for petrol station owners and dealers, alongside free direct delivery and other incentives, as part of a new supply arrangement.

The company disclosed this in a statement posted on its official X handle on Tuesday, inviting petrol station operators across the country to register to benefit from the offer.

According to the statement, participating dealers will enjoy “a 10-day credit facility backed by a bank guarantee,” with a minimum order requirement of 5,000 litres.

“Our free direct delivery service will commence soon,” the group said, adding that the offer is open to “all petrol station owners and dealers.”

READ ALSO:Dangote Sugar Announces South New CEO

The Dangote Group further called on operators to register their stations to access the supply arrangement.

“Register your petrol stations today to benefit from our competitive gantry price,” the statement read.

The company also disclosed that petrol supplied under the arrangement will be sold at a gantry price of ₦699 per litre.

For enquiries, the group provided the following contact numbers: 0802-347-0470, 0809-324-7070, 0809-324-7071 and 0203.

READ ALSO:Dangote Refinery Dispute: PENGASSAN Suspends Strike After FG Intervention

The announcement follows a recent petrol price adjustment by the Dangote Petroleum Refinery.

The PUNCH earlier reported that the refinery reduced its ex-depot petrol price from ₦828 to ₦699 per litre, representing a ₦129 cut or a 15.58 per cent reduction.

An official of the refinery, who spoke to PUNCH Online on condition of anonymity, confirmed the adjustment, saying, “The refinery has reduced petrol gantry price to ₦699 per litre.”

The new price reportedly took effect on December 11, 2025, marking the 20th petrol price adjustment announced by the refinery this year.

Business

JUST IN: Otedola Sells Shares In Geregu Power For N1trn

Billionaire businessman, Femi Otedola, has sold his majority stake in Geregu Power Plc for N1.088 trillion in a deal financed by a consortium of banks led by Zenith Bank Plc.

The Nigerian Exchange, NGX, made this announcement on Monday.

Otedola’s Amperion Power Distribution Company Ltd reportedly held nearly 80 percent of the power generating company.

READ ALSO:N200b Agric Credit Dispute: Appeal Court Slams NAIC, Upholds First Bank Victory

With this new development, Otedola, Chairman of First Holdco Ltd, parent company of First Bank of Nigeria Plc, will reportedly now concentrate on expanding his interest in the Nigerian banking sector, although he still retains some shares in Geregu.

Otedola is said to currently own 17.01 percent of First Bank — its single largest shareholder since the bank was established in 1894.

News5 days ago

News5 days agoBREAKING: Anthony Joshua Involved In Road Accident

Politics4 days ago

Politics4 days agoYou’re Not 001 – Wike Rubbishes Claims Of Fubara Being APC Leader In Rivers

Politics4 days ago

Politics4 days agoWike Speaks On Defecting To APC

Politics4 days ago

Politics4 days agoJUST IN: INEC Excludes PDP From Ekiti Governorship Election

News5 days ago

News5 days agoDoris Ogala: How Pastor Chris Knelt Before Church, Begged For Forgiveness [Video]

News4 days ago

News4 days agoNAF Neutralizes Bandits At Turba Hill, Kachalla Dogo Sule Camps

Politics4 days ago

Politics4 days agoGo To Hell, You Didn’t Pay My School Fees – Wike Hits Seyi Makinde

News4 days ago

News4 days agoNigerian Army Finally Reveals Details Of US Military-led Airstrikes In Sokoto

News4 days ago

News4 days agoOPINION: Trump Must Finish What He Started

Metro4 days ago

Metro4 days agoJUST IN: Court Orders Remand Of Ex-AGF Malami, Son, Wife In Kuje Prison