News

Hajj: Five States With $383m Debt Budget N9bn For Pilgrims

Five states; Kogi, Kebbi, Jigawa, Bauchi and Kano states, have subsidised Hajj fares for 10,260 intending pilgrims for the 2024 exercise, with a combined sum of N9,120,997,990 billion.

The subsidy payments by the various states’ governments follow the announcement of the National Hajj Commission of Nigeria, asking already registered pilgrims to pay an additional sum of N1.9m to balance up fares for the 2024 exercise, in accordance with current foreign exchange rates.

With the deadline for the payment given as March 28, the 48,414 pilgrims had only about 72 hours between the time of the announcement of the increase to either come up with the funds to secure their seats or apply for a refund of their money.

In the days that followed the expiration of the deadline, Kogi State Government under Governor Ahmed Ododo was the first to announce full payments of the sum for its 460 pilgrims.

READ ALSO: Nigerians React As FG Subsidises Hajj Fare With N90bn

The Kano State Governor, Abba Yusuf, also announced a N500,000 subsidy for each of its 2,906 pilgrims, followed by Governor Bala Mohammed of Bauchi State, who announced a subsidy of N959,000 for the 2,290 pilgrims in the state, while Jigawa and Kebbi state governments also subsidised fares with N1m each for its 1,260 and 3,344 pilgrims respectively.

There are also reports that the Rivers State Government paid the total fare for the intending pilgrims, while the Osun State Government subsidised the fares with an undisclosed amount.

The subsidies given by the states are beside the N90bn subsidy allegedly given by the Federal Government to reduce the burden of the fares on the intending pilgrims.

Meanwhile, the states have a combined debt profile of $382.9m, with Kogi indebted to the tune of $54.3m, Kebbi $40.8m, Jigawa $26.2m, Bauchi $170.4m, and Kano $101.3m, as of June 2023, according to the official website of the Debt Management Office.

READ ALSO: Tinubu Approves 3 Airlines For 2024 Hajj Pilgrimage

This, however, will not be the first time governors have sponsored citizens on pilgrimage.

Between 2022 and 2023, 13 state governors spent N14.84bn to sponsor about 4,771 persons on both Muslim and Christian pilgrimages.

A resident of the FCT told our correspondent on the condition of anonymity that “all in all, N5bn set aside for thousands of students and N90bn earmarked for pilgrim subsidy. This can only happen in a country where leaders have no regard for quality education but believe in presenting fake certificates”.

Another respondent, who simply identified himself as Michael, expressed annoyance with the development, stating, “It’s annoying to see government on this path. Why subsidise for the rich who can afford to go on pilgrimage, either Christian or Muslim? Instead subsidise the price of food and transportation, which is what mostly affect the masses”.

READ ALSO: Why Many Nigerian Pilgrims Fell Ill During Hajj — Official

Meanwhile, the National Hajj Commission of Nigeria has disclosed that over 50,000 pilgrims have completed payments for the 2024 Hajj exercise under the government quota.

NAHCON made the disclosure in a statement by the Assistant Director, Public Affairs, Fatima Usara, on Saturday.

According to the statement, the official number of pilgrims now stood at 51,477 after the close of registration for the year’s exercise.

A breakdown of the numbers revealed the sub-total from Borno, Adamawa, Yola, Taraba and Yobe states as 5,492 pilgrims; northern sub-total, 36,261 pilgrims; Southern sub-total, 6,310 pilgrims, while the remaining 3,384 pilgrims were from the Hajj Savings Scheme and others, making the total 51,447.

Usara thanked the Federal Government for its “leading role” and “numerous sacrifices”, towards easing the burdens of the intending pilgrims, while also appreciating State governors and other stakeholders for providing support.

PUNCH

News

Accept Free Flights, $3,000 Cash To Leave Or Risk Arrest – US Tells Illegal Immigrants

The United States government has announced a Christmas self-deportation incentive, offering undocumented immigrants free flight tickets and a $3,000 cash bonus to voluntarily leave the country before the end of the year.

The announcement was made in a statement released on Monday, December 22, by the Department of Homeland Security (DHS), which warned that undocumented immigrants who ignore the offer risk arrest, forced deportation, and a lifetime ban from re-entering the United States.

According to the DHS, undocumented immigrants who enrol in the programme before December 31 will receive fully funded travel arrangements to their home countries, along with a $3,000 stipend.

“Illegal aliens who sign up to self-deport through the CBP Home app by the end of the year will receive a $3,000 stipend in addition to a free flight home,” the department said.

READ ALSO:

The initiative is being implemented through the CBP Home mobile application, which allows undocumented immigrants to register for voluntary departure. Participants will also benefit from waived civil fines and penalties related to overstaying or previous failure to leave the country.

DHS said the policy has already yielded significant results, with a marked increase in voluntary departures.

“Since January 2025, approximately 1.9 million illegal aliens have voluntarily self-deported, with tens of thousands using the CBP Home programme,” the statement said.

Homeland Security Secretary Kristi Noem described the initiative as a temporary goodwill gesture tied to the Christmas season, noting that the incentive had been tripled for the holidays.

READ ALSO:

“During the Christmas season, the US taxpayer is generously tripling the incentive to leave voluntarily, offering a $3,000 exit bonus, but only until the end of the year,” Noem said.

She warned that those who fail to take advantage of the offer would face strict enforcement measures.

“Illegal aliens should take advantage of this gift and self-deport. If they don’t, we will find them, arrest them, and they will never return,” she said.

The DHS assured interested migrants that the process is straightforward and fully handled by the government.

“Self-deportation through the CBP Home app is fast, free, and easy. DHS will take care of everything, including travel arrangements,” the department said.

The agency reiterated that undocumented immigrants who ignore the programme would be subject to arrest, forced removal, and permanent restrictions on future entry into the United States.

News

Benue: Five Killed As Suspected Herdsmen Attack Ortese, Block Major Road

No fewer than five youths have reportedly lost their lives in a deadly attack attributed to suspected Fulani herdsmen in Ortese, Guma Local Government Area of Benue State.

According to local accounts, the assailants barricaded the Ortese–Yogbo road during the attack, ambushing and killing the victims at the scene.

Several other residents were said to have been forcibly taken to undisclosed locations.

The assault has sparked widespread fear in the community, with residents expressing concern over their safety as tensions continue to rise.

READ ALSO:Forest Reserve: Okpebholo Broker Peace Between Host Communities, Investors

Community sources revealed that additional bodies are being found in nearby areas, further worsening the situation.

As of the time of filing this report, security agencies have not released an official statement on the incident, although investigations are ongoing and efforts are underway to restore calm in Ortese and surrounding communities.

News

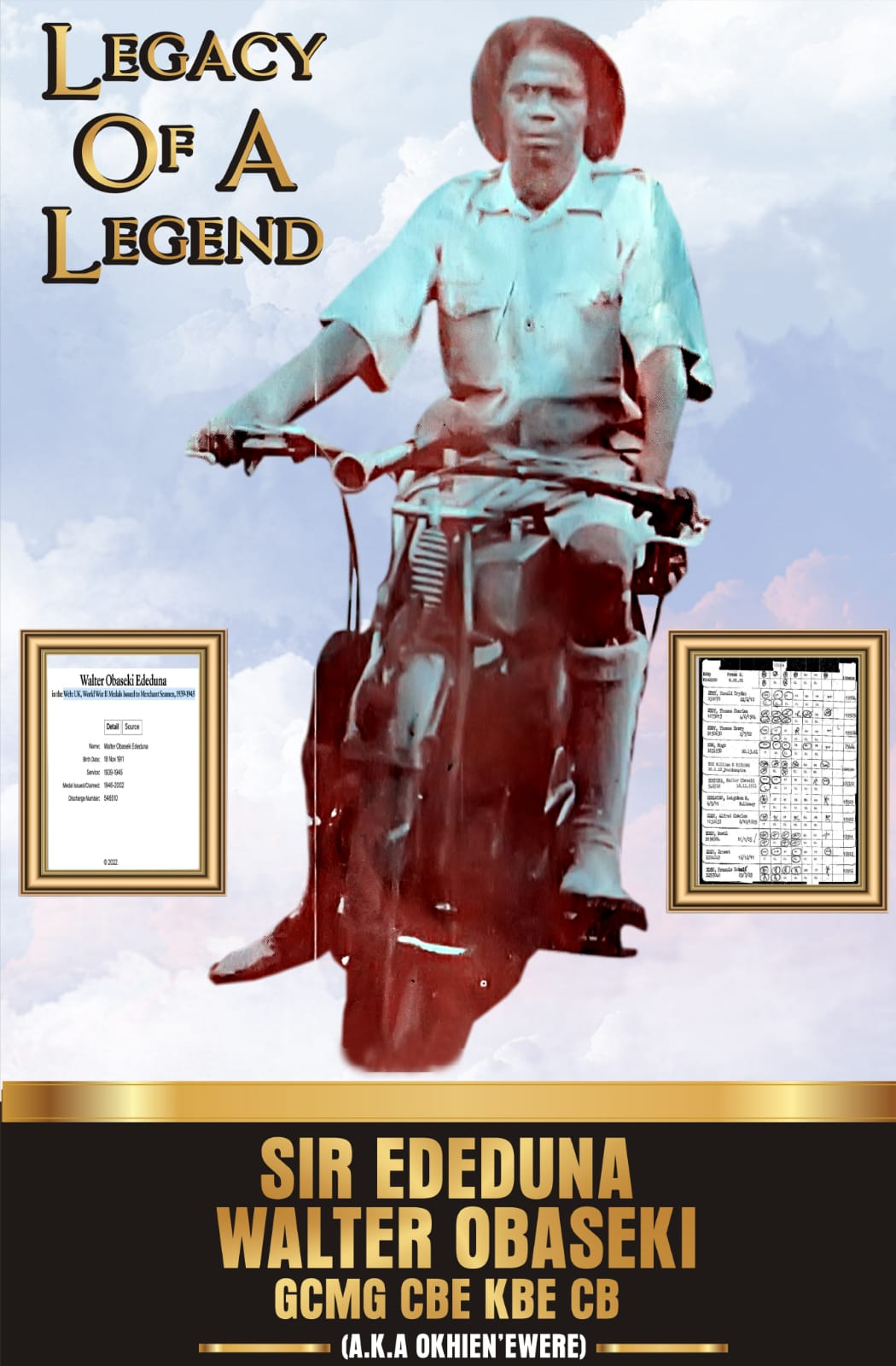

86 Years Memorial Of Capt. Sir Walter Ededuna Obaseki

In loving, ever green and very precious 86 years memorial of our grand patriarch,

His Excellency,

The right honourable,

the most distinguished ambassador

Capt. Sir Walter Ededuna Obaseki (A.K.A Okhien’Ewere)

GBE GCB GCMG KCB KBE CBE OM CH PC DSO

Head of Hovernment

British Administrator

and

Prime Minister in the British Nigerian Government.

Governor of the British Board of Trade.

Captain of the British Merchant navy.

World war II veteran

and a recipient of the world war II campaigns and gallantry medals of honour;

I. The 1939-1945 Star

II. Atlantic Medal

III. British War Medal

IV. Italy Star

Awarded to officers and seamen of the British merchant navy by HRM King George VI

Daddy, your good life is worthy of emulation

Your public works and legacy open great doors for us your descendants

You plotted the skies, mapped the land and chatted the oceans and high seas to threshold development in our great nation Nigeria. as a pioneer industrialist you successfully brought your people to understand and become part of the modern world governnent.

Ededuna Walter Obaseki together with the British established government agencies, built public facilities, institutions and parastatals of government and also brought law and order to the way things are done according to the standards of international best practice as we have it even in The international community.

Those who tried to steal your glory and change the true position of things failed woefully, their evil craftsmanship have since been exposed to everyone because the truth cannot be hidden completely forever.

May your memory never ever go to oblivion!

Just as it is written in The Holy Book

Proverbs 10: 7.

The memory of the just is blessed: but the name of the wicked shall rot.

Psalm 112: 6.

The Righteous Shall be remembered forever!

Signed:

The Scion of Sir Walter Ededuna Obaseki;

Mercy Ededuna Obaseki

for

The entire direct descendants of Capt. Sir Walter Ededuna Obaseki GCMG CBE DSO OM CH PC

Metro3 days ago

Metro3 days agoJUST IN: Former Edo Information Commissioner Is Dead

News1 day ago

News1 day agoPHOTOS: New Era In Furupagha-Ebijaw As Okpururu 1 Receives Staff Of Office

News4 days ago

News4 days agoFormer Delta North senator Peter Nwaoboshi Dies

News5 days ago

News5 days agoGrassroots To Global Podium: Edo Sports Commission Marks Enabulele’s First Year In Office

News4 days ago

News4 days ago[OPINION] Tinubu: Ade Ori Okin Befits KWAM 1, Not Awujale Crown

News4 days ago

News4 days agoCoordinator, Edo First Lady Office, Majority Leader, Rights Lawyer, Others Bag 2025 Leadership Award

Metro3 days ago

Metro3 days agoShe Grabs, Pulls My Manhood Anytime We Fight — Husband

News1 day ago

News1 day agoFG Declares Public Holidays For Christmas, New Year Celebrations

News4 days ago

News4 days agoDelta Speaker Advocates Strict Legislative Protection Of N’Delta Environment

Metro3 days ago

Metro3 days agoWhy I Charged My Husband Money For Sex —Woman