News

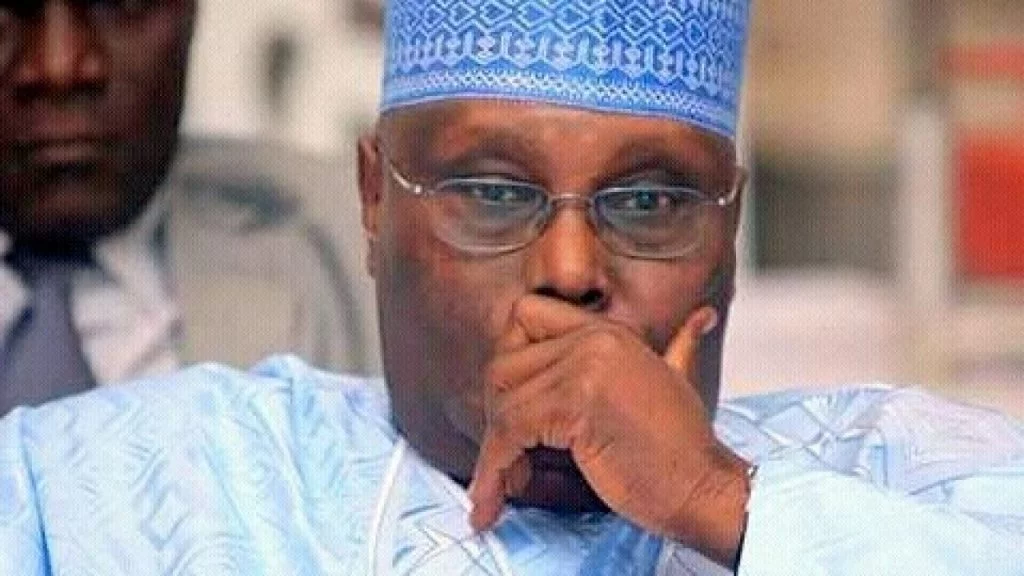

I’ve Paid Over N6m, Yet To Receive Exhibits From INEC — Atiku

The Peoples Democratic Party and its presidential candidate in the last election Abubakar Atiku on Tuesday complained to the Presidential Election Petition Court that the Independent National Electoral Commission refused to provide them with some documents which they requested.

This the party and Atiku told the court during the hearing of their petitions challenging the presidential election wherein Bola Tinubu of the ruling All Progressives Congress emerged as the winner.

The petitioners informed the court that though he has paid over N6 million for the certification of exhibits in evidence before the court, the Commission had yet to make the requested materials available to him.

READ ALSO: Tinubu’s Govt Is Temporary, Atiku Tells PDP NASS Members

The respondents in the petition marked CA/PEPC/05/2023 are Independent National Electoral Commission, Tinubu and the APC.

At Tuesday’s proceedings, counsel for Atiku, Eyitayo Jegede SAN sought to tender forms EC8A from 10 out of 21 Local Government Areas of Kogi State to establish the petition against Tinubu.

The exhibits, mainly documents used for the February 25 Presidential Election, were from Ankpa, Dekina, Idah, Ofu, Olamaboro, Yagba East, Yagba West, Kabba-Bunu and Igalamela Odolu.

Although the schedule of documents was filed along with the exhibits, the court declared that presenting such sensitive exhibits at piece meals would not be of any help, especially in the areas of marking and numbering them.

Jegede, however, blamed the electoral body for deliberate refusal to supply his client with the vital documents.

He lamented that the electoral body had not been forthcoming and cooperating as they are supposed to be.

Jegede further stated that to salvage the situation, Atiku’s legal team had to subpoena top officials of INEC to compel them to bring the required documents before the Court on their own.

As a result of the limitations caused by the situation, the senior advocate sought a 24-hour adjournment to enable him to approach the electoral body to do the needful.

Following no objections from counsel to the respondents, the presiding justice of the five-man panel, Justice Tsammani adjourned the matter to June 7.

News

Eating Takeout Food Often May Increase Heart Disease Risk — Study

Research suggests that higher takeout food consumption may increase a person’s risk of cardiovascular disease, like heart disease.

In a new study, published in Food Science & Nutrition, researchers said eating takeout food too often can influence systemic inflammation that underlies much cardiovascular disease.

The study of over eight thousand people in the 2009 to 2018 U.S. National Health and Nutrition Examination Survey (NHANES) found that those who eat greater amounts of takeout food are likely to have various elevated risk factors for heart disease.

They were interviewed in their homes and also visited a mobile examination centre, where they recalled their food intake, received cardiometabolic health assessments, and had blood collected.

READ ALSO:23 Ships With Fuel, Food Items To Arrive Lagos Ports – NPA

Mammograms may predict heart disease risk in women — Study

The researchers found a correlation between the amount of takeout food a person consumes and their likelihood of developing chronic low-level inflammation, a key driver of cardiovascular pathology.

Deaths from cardiovascular disease and the consumption of takeout foods are both on the rise, and while that does not prove a causal relationship, the study explores whether there is a connection between the two.

The study tracked degrees of systemic inflammation according to the Dietary Inflammatory Index (DII), a scale that quantifies the risk of inflammation related to the intake of specific dietary substances.

READ ALSO:Food Security: 14,000 Smallholder Farmers To Benefit From N4bn Smart Agriculture Training In Bauchi

The three major takeaways from the analysis included that a higher level of takeout food consumption corresponded to an unfavourable cardiometabolic profile consisting of lower HDL, as well as higher triglycerides, fasting glucose, serum insulin, and insulin resistance.

Jayne Morgan, MD, cardiologist and Vice President of Medical Affairs in a reaction, who was not involved in the study, explained that “Takeout food raises the cardiovascular risk not because of one ingredient, but because of a predictable combination of nutrients, additives, and preparation methods that adversely affect blood pressure, lipids, insulin sensitivity, inflammation, and endothelial function.”

“This includes excess sodium that increases blood volume and blood vessel stiffness, and unhealthy fats, usually saturated fats or trans fats, that increase cholesterol level and atherosclerosis, a condition that can lead to heart attack and stroke.”

Michelle Routhenstein, Preventive Cardiology Dietitian at Entirely Nourished, also not involved in this study, declared, “It is also important to recognise that frequent takeout use often reflects broader lifestyle pressures such as demanding schedules, limited access to cooking resources, irregular meals, and disrupted sleep, all of which can quietly compound cardiovascular risk.”

News

How To Identify Fake Kiss Condoms In Circulation

The National Agency for Food and Drug Administration and Control (NAFDAC) has recently warned Nigerians about the circulation of counterfeit Kiss brand condoms in major markets across the country.

Contents

Original DKT Kiss condoms

Fake Kiss condoms

In a public alert published on its website recently and referenced as Public Alert No. 042/2025, the agency said the warning followed information received from DKT International Nigeria, a non-governmental organisation involved in contraceptive social marketing and HIV/AIDS prevention.

NAFDAC stated, “The National Agency for Food and Drug Administration and Control is notifying the public about the sale and distribution of fake Kiss condoms in various Nigerian markets.

“The information was received from the MAH-DKT International Nigeria, a leading non-governmental organisation focused on contraceptive social marketing. Its mission is to provide Nigerians with affordable and safe options for family planning and HIV/AIDS prevention.

“The fake Kiss condoms have been reported to be found in Onitsha Market, Idumota Market, Trade Fair Market, and various markets in Kano, Abuja, Uyo, Gombe, Enugu, and others.”

READ ALSO:Married Man Denies Wife At Brazil Concert To Kiss Tems On Stage [VIDEO]

Kiss condom is a brand of male latex condoms designed to offer sexual protection, including the prevention of unwanted pregnancy and sexually transmitted infections such as HIV, gonorrhoea and syphilis.

To help consumers avoid counterfeit products, NAFDAC outlined key differences between original and fake Kiss condoms.

Original DKT Kiss condoms

The original product comes in a light red box pack with clear instructions printed on the lower part of the pack, including single-use warnings and storage and caution information. The box contains detailed medical device information, including MDSS GmbH, Germany, and a complete Nigerian address at Isolo Industrial Layout, Oshodi-Apapa Expressway.

The condom pack is light red, with the word “Kiss” closely written on six lines. The wallet outer pack is lighter red, carries the Oshodi-Apapa address, manufacturer details, and a clear product description beside the condom image. The hidden flap includes revision dates, medical device details, and caution information, while the wallet inner contains detailed instructions and eight bullet points under important notes.

READ ALSO:Lagos Names Mandy Kiss Anti-drug Abuse Ambassador

The original condom is large, oval-shaped, well-lubricated, and has a large teat end for semen collection.

Fake Kiss condoms

In contrast, fake Kiss condoms come in darker-coloured box packs with little or no additional information. Some boxes are plain white inside and lack condom images. The address is wrongly listed as 42, Montgomery Road, Yaba, Lagos, while the manufacturer’s address is incomplete or missing. Storage and caution information is absent.

The condom pack is darker, with “Kiss” loosely written on five lines and wide spacing. The condom strip is longer than the original. The wallet outer pack is also darker red, carries incorrect or missing addresses, lacks colour wave designs, and shows inconsistencies in barcode lines. Medical device and caution information are missing, and the hidden flap contains no details.

Inside the wallet, information is summarised with only six bullet points. The fake condom is thinner, round-shaped, less lubricated, and has a smaller teat end.

(TRIBUNE)

News

Lagos: Police Arrest 14 Suspected Traffic Robbers On Lekki-Epe Expressway

Fourteen persons suspected to be involved in traffic-related robbery have been arrested at various points along the Lekki-Epe Expressway in Lagos over the past two weeks.

The arrests were confirmed on Tuesday by the Lagos State Police Command spokesperson, SP Abimbola Adebisi, via a post on her official X handle, @AbimbolaShotayo.

According to her, operatives of the Command’s Tactical Squad based in Elemoro carried out the operations that led to the suspects’ apprehension.

READ ALSO:VIDEO: Chaos As Last-minute Shoppers Overwhelm Lagos Balogun Market

She explained that the arrests followed sustained patrols and intelligence-driven operations aimed at curbing criminal activities associated with traffic congestion and improving the safety of motorists and other road users along the busy corridor.

Adebisi noted that the development reflects the Command’s determination to strengthen security and uphold law and order on the Lekki-Epe axis, adding that the Tactical Squad has continued to proactively identify crime-prone areas and respond swiftly to threats posed by criminal elements.

She called on residents and commuters to support police efforts by providing timely and credible information that could assist in preventing and detecting crime.

READ ALSO:VIDEO: Chaos As Last-minute Shoppers Overwhelm Lagos Balogun Market

“Security is a shared responsibility. Members of the public are encouraged to stay alert and promptly report any suspicious movements or activities to the nearest police station,” she said.

The police spokesperson further reassured residents and road users of the Command’s commitment to maintaining aggressive patrols and security operations to protect lives and property in the area.

She reiterated the Command’s community policing message, “See Something, Say Something,” stressing the importance of cooperation between the police and the public in sustaining peace and security.

Metro5 days ago

Metro5 days agoJUST IN: Court Orders Remand Of Ex-AGF Malami, Son, Wife In Kuje Prison

Politics5 days ago

Politics5 days agoDino Melaye Reacts To Malami’s Arraignment For Money Laundering

News5 days ago

News5 days agoOPINION: Don Pedro And Beautiful Benin

Metro5 days ago

Metro5 days agoVIDEO: Chaos As Last-minute Shoppers Overwhelm Lagos Balogun Market

News5 days ago

News5 days agoLagos: Police Arrest 14 Suspected Traffic Robbers On Lekki-Epe Expressway

Metro5 days ago

Metro5 days agoSeven Journalists On Their Way To Colleague’s Marriage, FG Reacts

Business5 days ago

Business5 days agoDangote Unveils 10-day Credit Facility For Petrol Station Owners

News5 days ago

News5 days agoHow To Identify Fake Kiss Condoms In Circulation

Entertainment5 days ago

Entertainment5 days agoHow I Struggled With Masturbation, Started Smoking At 13 — Tonto Dikeh

Business5 days ago

Business5 days agoNNPCL Announces Restoration Of Escravos-Lagos Pipeline