News

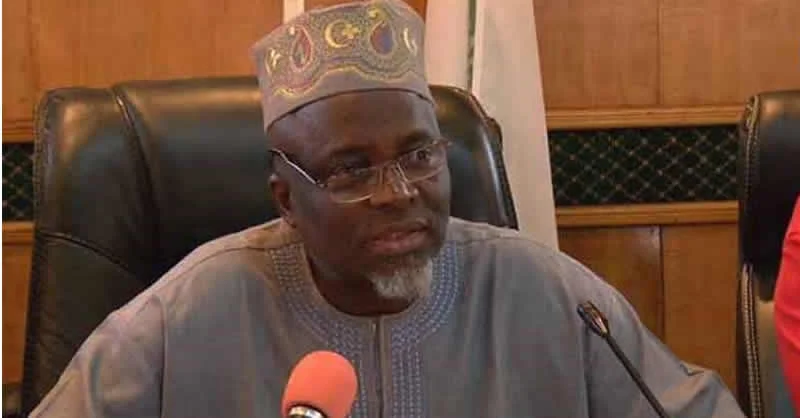

JAMB Sanctions Officials Over Harassment Of Hijab-wearing Candidate

The Joint Admissions and Matriculation Board on Sunday announced that it has sanctioned some officials over the harassment of a female Hijab-wearing candidate.

The female candidate who sat her Unified Tertiary Matriculation Examination at the Bafuto Institute, Ile-Iwe Bus Stop, Ejigbo, Lagos was said to have been asked to remove her headcover during the accreditation process before being allowed into the examination hall.

Addressing the issue in a statement signed by the Head of Public Affairs of the Board, Dr. Fabian Benjamin, the Board noted that it deeply regretted the incident.

READ ALSO: UTME: JAMB, Police Warn Candidates Against Fake Websites

It said on investigation, it discovered that the incident or others in the past were not linked to any of its examination guidelines but rather a product of the misplaced priority of some of the Board’s accredited partners or officials who claimed ignorance of the its guidelines on accreditation.

The statement read, “This situation was instantly addressed by a senior official of the Board at the center and the candidate in question was allowed in after the usual checks with her hijab.

“However, since ignorance of the law is not an excuse, the officials have been appropriately sanctioned to serve as a deterrent to others, who might wish to toe the same line going forward.

READ ALSO: Nigerian National Pleads Guilty To Defrauding US Citizens Of $12m

“It is worthy of note that the Board, as a national institution, has no policy barring candidates from sporting the religious paraphernalia peculiar to their religious persuasions as these are the facts of everyday life in Nigeria, which everyone should have been familiar with by now.”

Furthermore, the Board assured the general public that the issue would be properly investigated as to prevent a recurrence.

“The Board is committed to the discharge of its statutory role of ensuring that suitably qualified candidates are selected for admission into the nation’s tertiary institutions and would not allow anything or anyone to detract it from the pursuit of this noble goal,” it reiterated.

Meanwhile, the conduct of 2024 UTME, which commenced on Friday, 19th April 2024, has been marred with reports of technical glitches as over 1.2 million candidates would have successfully taken the examination by Monday, 22nd April 2024.

News

Otuaro Tasks Media On Objective Reportage

The Administrator, Presidential Amnesty Programme (PAP) Dr. Dennis Otuaro has charged media practitioners particularly members of the Ijaw Publishers’ Forum to promote ethical journalism through their reportage.

He gave the charge in Warri on Wednesday during the 2nd Annual Ijaw Media Conference organised by the Ijaw Publishers’ Forum (IPF).

Represented by Princewill Binebai, spokesman, Ijaw Youth Council (IYC) Worldwide, Otuaro while stating that the Niger Delta stories have been told in such a way that is quite different from what is obtainable in the real sense, said this, IPF must do everything possible to correct.

The administrator added: “I am happy that Ijaw journalists have boldly come out together to champion the Ijaw struggle in a very dynamic perspective”.

READ ALSO:IPF Hosts Media Conference, Seeks Protection For N’Delta Environment

“The Ijaw story was misrepresented over the years, but IPF’s emergence had corrected this error and the story is gradually changing for better.”

Otuaro, however, challenged Ijaw media practitioners to be objective, truthful, accurate and fearless in their reportage to correct many years anomalies of the Ijaw struggle.

He admonished members of IPF to see themselves as brothers and love one another in the discharge of their activities to achieve a common goal.

News

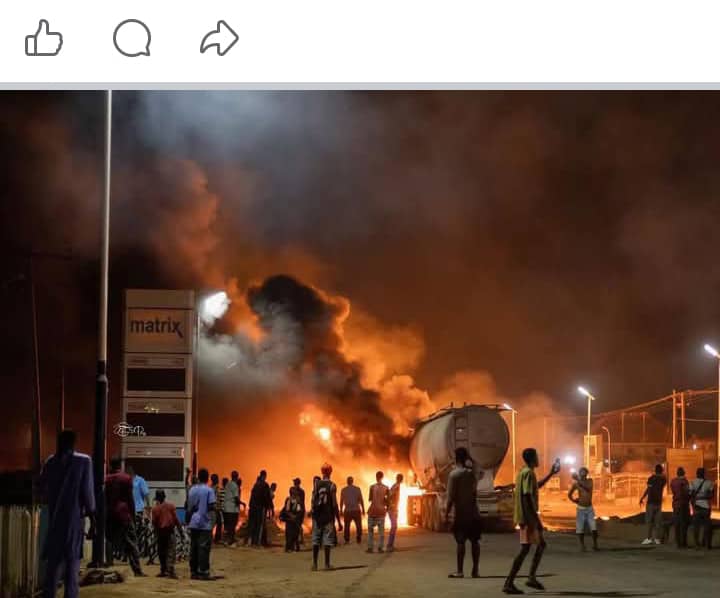

Police Confirm Edo Tanker Explosion, say No Casualty

The Edo State Police Command has confirmed tanker explosions that rocked Auchi, the administrative headquarters of Etsako West Local Government Area of the state.

The Command’s Police Publice Relations Officer, Eno Ikoedem, who confirmed the incident via the phone, said the explosion occurred at about 6:30 p.m. following the fall of a fuel tanker along the road.

Ikoedem said the incident occurred on Wednesday evening at about 6:30 p.m. following the fall of a fuel tanker along the road.

READ ALSO:Edo SSG Calls On Media To Support Govt Policies, Assures Better Welfare

She explained that spilled fuel seeped into underground tunnels, which later ignited and caused three explosions in different parts of the Auchi community.

According to her, officers from the Auchi Divisional Police Headquarters and the Area Command were mobilised to the affected areas and successfully cordoned them off to prevent loss of lives.

She added: “No casualty was recorded. Our men on ground were able to cordoned the affected areas.”

READ ALSO:Edo Assembly Declares Okpebholo’s Projects Unprecedented

It was gathered that three separate explosions rocked the town simultaneously in different parts, which led to properties worth millions of naira destroyed.

A resident who does not want his name in print said via the telephone that the blasts occurred along Igbei Road, Igbo Shade, and along the Auchi–Okene Road, close to Winners Junction.

The resident, who alleged the explosions appeared to have been coordinated, called for a thorough investigation into the incident to prevent future occurrences.

Calls put across to Mr. Monday Edogiawere, Chairman, Red Cross, Edo State, were not picked.

News

IPF Hosts Media Conference, Seeks Protection For N’Delta Environment

The Ijaw Publishers’ Forum (IPF) on Wednesday , December 17, 2025 held its annual media conference in Warri, Delta State, where the media practitioners sought protection of the Niger Delta’s natural resources and environment for future generations.

In his welcome address at the conference themed: ‘Safeguarding the Niger Delta Natural Resources for Future Generations,’ IPF President, Comrade Austin Ozobo, while emphasising the importance of protecting the Niger Delta’ environment and resources, highlighted the devastating impact of oil theft, environmental pollution, exploitation by oil companies, federal government and deforestation on the region.

He called on oil exploration companies to prioritize the well-being of the people and the environment.

Comrade Austin also provided a brief history of the IPF, which was formed in October 2023 to promote the Ijaw struggle and its identity.

READ ALSO:Otuaro: IPF Urges Reps To Take Caution Over Arrest Threat

He noted that the IPF has made significant strides in telling the Ijaw story and advocating for the rights of the Ijaw nation.

Ozobo, who noted that the conference was aimed at addressing the challenges facing the Niger Delta region and find solutions to safeguard its natural resources for future generations, said: “We must stop oil theft, environmental pollution which has destroyed fishing and farming activities or occupation in our region. We must equally stop deforestation and waste of other forest and aquatic resources. Our resources are our future. Our environment is our wealth. Pollution does not just affect our environment but it shortens our life span. Stealing our crude or sabotaging it, is as well as stealing our common wealth, invariably creating poverty, unemployment and lack of opportunities in our region. This message largely affects our oil exploration companies. The IOC and indigenous oil companies management should stop exploitation and deliberate environmental pollution if our well-being should be prioritized”.

“We have proactively told the Ijaw story in all dimensions, we have propagated and seamlessly advocated for the struggle of the Ijaw nation. We have actively defended the Ijaw nation from willful blackmails, people who are hellbent to hand twist, incite government, its military against Ijaw nation to jeopardise Ijaw identity. This is not to entertain you but well-meaning leaders, stakeholders and youths could attest to it”.

READ ALSO:IPF Holds Annual Ijaw Media Conference December

“There is no gainsaying that IPF has balanced the equilibrium, the Ijaw nation is now more significant in the media industry than ever, there is now a checks and balances between those who bastardise our collective image or identity in the name of telling our story. We have corrected many such narratives and we will continue to put a stop to it. I can assure you that the rate at which the foreign papers battered our identity have reduced to the barest minimum since we took charge and made Ijaw significant in the media industry”

“The Yoruba has their media houses, Hausa has its own, Igbo has, Itsekiri has, Urhobo has, so the commitments and efforts made by brilliant Ijaw sons and daughters to strengthen Ijaw presence in the media industry should be encouraged by all well-meaning Ijaw leaders and critical stakeholders. Our mission and visions are to defend, advocate, propagate Ijaw/Niger Delta self-determination struggle and build dependable media houses for the Ijaw nation in no distance time. So that when all papers and broadcasting stations will show patriotism to their origins, political Godfathers and hand twisted governments in the unforeseen dark days, Ijaw nation will not be left in the rain and sun to be battered”.

READ ALSO:Ex-Nigerian Amb., Igali, To Deliver Keynote Address As IPF Holds Ijaw Media Conference

The conference was attended by prominent guests, including High Chief Dennis Otuaro, Administrator of the Presidential Amnesty Programme, and RT. Hon. Emomotimi Guwor, Speaker of the Delta State House of Assembly, Chief Lawuru Promise, Amb. Godknows Igali, Pandef National leader, Chief Oyakemeagbegha Izinebi, INC publicity Secretary, Chief Wellington Bobo, Chief Emmanuel Amgbaduba former commissioner of oil and gas, Delta State, Chief Udens Eradiri, IYC spokesman Princewill Binebai, Ijaw women Rights’ Protection Forum IWRPF, Ijaw women in politics, for peace and Culture, Ayakoromo ladies, President Amnesty students leadership and others.

Metro3 days ago

Metro3 days agoSuspected Kidnappers Abduct 18 Passengers On Benin-Akure Road

News3 days ago

News3 days agoI’m Not Distracted By Anti-Niger Delta Elements, Says PAP Boss, Otuaro

News3 days ago

News3 days agoOPINION: Time For The Abachas To Rejoice

News4 days ago

News4 days agoEdo Assembly Charges Contractor Handling Ekekhuan Road To Accelerate Work

Sports2 days ago

Sports2 days agoJUST IN: Dembélé Named FIFA Best Men’s Player, Bonmatí Wins Women’s Award

News2 days ago

News2 days agoWage Dispute: Court Orders PSG To Pay Mbappe €61 Million

Metro3 days ago

Metro3 days agoNDLEA Seizes 457kg of Cannabis, Arrests Suspected Trafficker In Edo

News3 days ago

News3 days agoEx-Nigerian Amb., Igali, To Deliver Keynote Address As IPF Holds Ijaw Media Conference

Headline2 days ago

Headline2 days agoAircraft Crashes In Owerri With Four Persons Onboard

Business2 days ago

Business2 days agoCBN Revokes Licences Of Aso Savings, Union Homes As NDIC Begins Deposit Payments