Business

List Of Indian-owned Businesses Which Pumped $19 Billion Into Nigeria In Four Decades

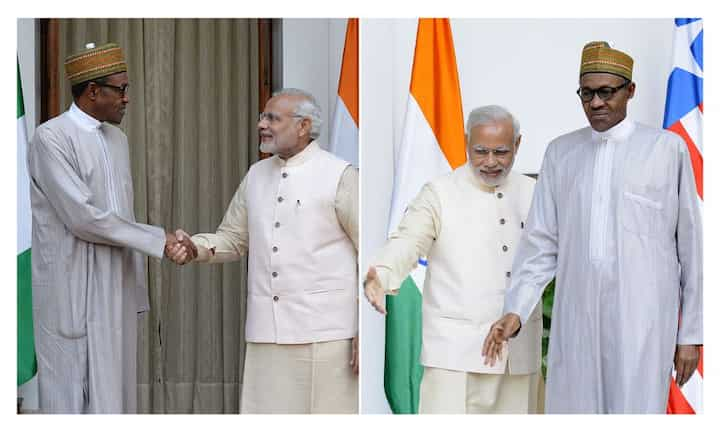

The Indian government has revealed that Indian firms operating in Nigeria have pumped about $19 billion into the economy over the past 40 years.

The Indian High Commissioner to Nigeria Shri G. Balasubramanian stated this during an interview with the News Agency of Nigeria on Wednesday, January 11, 2023, in Abuja.

He noted that the relationship between the two countries has been excellent and India plans to deepen the cultural exchange program with Nigeria.

He said the countries could corporate via information-sharing and news networks, among others.

READ ALSO: VIDEO: Moment Peter Obi Was Saved From Mob In Southeast State, Nigerians React

The bilateral trade volume between Nigeria and India crossed the $19 billion mark for the financial period of 2021 to 2022, representing an increase of 69.80 per cent.

According to reports, the ex-Prime Minister of India visited Nigeria in 2007 to raise the bilateral relationship between the two countries.

Indian-owned businesses in Nigeria range from automobiles to retail stores and others.

TATA Africa Services Founded in 1868 by Indian businessman, Jamsetji Nasserwanji Tata, the conglomerate has its products in over 150 countries across six continents.

The company was established in Nigeria in 2006 with investments in excess of $10 million, offering products such as passenger vehicles, and light commercial vehicles, amongst others.

Dana Group

Dana Group is a conglomerate with businesses across major industries, founded by Jacky Hathiramani.

The company produces plastic, surgical instruments, steel, allied products, shipping and real estate.

It began its business in Nigeria with medical products and manufacturing before diversifying into the importation of industrial chemical products, among others.

Artee Group

The retail company began as a wholesale business in Nigeria in 1998.

The company also owns Spar Market, a retail store spread across Nigeria, and Park n Shop which operates in cities such as Lagos, Abuja and Port Harcourt.

Antee Group began work on three shopping mall projects in Nigeria after the success of the Port Harcourt Mall.

Me Cure Healthcare

Me Cure Healthcare was founded in 2009 and is a diagnostic service provider identifying the gap in medical diagnostics and providing dependable medical examinations.

The health facility has become a household name for imaging, pathology and cardiac-care services.

About 400 Nigerians work in Me Cure and the facility has expanded into eye care, dental care, cancer management and preventive healthcare.

Dufil Prima Foods

Dufil Prima Foods is the company behind Nigeria’s noodles staple, Indomie Instant Noodles.

The company was founded by Deepak Singhal in Nigeria in 2001 as a private limited liability company, then restructured to become a holding company in 2008.

READ ALSO: Emefiele ‘Secretly’ Returns To Nigeria Amidst Fear Of Arrest

It has six subsidiaries including Northern Noodles Limited, and Pure Flour Mills Limited.

Chi Limited

Chi Limited was registered in 1980 and became wholly owned by the Coca-Cola Company after its acquisition in 2019.

It provides direct employment to over 2,000 people in Nigeria and 50,000 throughout its value chain.

It produces various fruit juices and yoghurt variants and snacks.

Business

CBN Revokes Licences Of Aso Savings, Union Homes As NDIC Begins Deposit Payments

The Central Bank of Nigeria (CBN) has revoked the operating licences of Aso Savings and Loans Plc and Union Homes Savings and Loans Plc, citing persistent regulatory infractions and deepening financial distress in the two primary mortgage banks.

The revocation, which took effect on December 15, 2025, was carried out under Section 12 of the Banks and Other Financial Institutions Act (BOFIA) 2020 and Section 7.3 of the Revised Guidelines for Mortgage Banks in Nigeria, the CBN said in a statement issued on Tuesday.

According to the apex bank, the affected institutions failed to meet minimum paid-up share capital requirements, had insufficient assets to cover their liabilities, recorded capital adequacy ratios below prudential thresholds, and consistently breached regulatory directives.

“The CBN remains committed to its core mandate of ensuring financial system stability,” a statement, signed by the apex bank’s Acting Director, Corporate Communications, Mrs Hakama Sidi Ali said.

READ ALSO:CBN Directs Nigerian Banks To Withdraw Misleading Advertisement

Following the licence revocation, the Nigeria Deposit Insurance Corporation (NDIC) was appointed liquidator of the defunct banks in line with the law.

The Corporation said it has commenced the liquidation process and begun verification and payment of insured deposits to customers.

Under the deposit insurance framework, depositors are entitled to receive up to two million naira per depositor, with payments made through BVN-linked alternate bank accounts.

Depositors with balances above the insured limit will receive the initial two million naira while the remaining sums will be paid as liquidation dividends after the realisation of the banks’ assets and recovery of outstanding loans.

READ ALSO:CBN Issues Directive Clarifying Holding Companies’ Minimum Capital

The NDIC said depositors may submit claims either online or physically at designated branches of the closed banks, while creditors will be paid after all depositors have been fully settled, in accordance with statutory provisions.

The two mortgage banks have faced prolonged operational challenges, including depositor complaints, governance concerns, and delisting from the Nigerian Exchange (NGX) in 2024 for failure to submit audited financial statements for more than six years.

The CBN assured the public that the action was taken to strengthen the mortgage banking sub-sector and protect depositors, adding that banks whose licences have not been revoked remain safe and sound.

This means the two financial institutions can no longer operate as licensed financial institutions.

Business

9th FirstBank Digital Xperience Centre Launched In UNIBEN

First Bank Nigeria Plc on Tuesday launched its Digital Xperience Centre (DXC) at the University of Benin Branch, Benin City.

In his remarks at the launching, Chief Executive Officer, First Bank Plc, Olusegun Alebiosu, described the digital xperience centre as “an exceptional feat in our shared commitment toward innovation,” adding that

“this is our 9th Centre, and it operates round-the-clock.”

Alebiosu, while stating that the “FirstBank’s DXC is more than a banking facility,” added that “it is a step toward redefining how banking connects with education, technology, and the whole community.”

He said: “In partnership with the University, we’ve created a hub where students, faculty and community members can access FirstBank’s digital world.

READ ALSO:Full List: FG Releases Names Of 68 ambassadorial Nominees Sent To Senate For Confirmation

“Our DXCs are more than just banking hubs – they are gateways to a smarter, faster, and more personalised financial journey. Equipped with cutting-edge technology, customers have access to state-of-the-art self-service terminals designed to simplify transactions while ensuring top-tier security and efficiency.

“Whether you need to deposit cash, request for debit card, or update your account details, the DXC’s provides an elevated banking experience with speed and ease, designed to put you in control.

“Our DXCs operate round-the-clock, including weekends, providing the convenience you need to bank anytime in just a few minutes.

READ ALSO: First Bank Releases Statement On Foiled Abuja Robbery Attack

“The DXC embodies our commitment to Environmental Social and Governance (ESG) principles as it promotes financial inclusion, fosters digital literacy, and uses sustainable technology to empower underserved communities.”

The CEO, while thanking the leadership of UNIBEN for “partnering with us to bring this vision to life, aligning academic excellence with cutting-edge technology,” urged the public to “embrace this DXC as a catalyst for learning, innovation, and development.”

In his remarks at the launching, the Vice-Chancellor, UNIBEN, Prof. Edoba Omoregie said: “We are very happy that First Bank is doing this in our institution,” describing UNIBEN as a “first generation university.”

Earlier, while playing host to the First Bank CEO and his team in his office, Prof. Edoba had sought support from the company in the revamp of the university Information Technology Centre (ICT).

Business

Full List: 82 Newly Approved, Fully Licensed BDC Operators

The Central Bank of Nigeria (CBN) has granted final operating licences to 82 Bureaux De Change (BDC) operators under its revised regulatory framework, reinforcing warnings against transactions with unlicensed foreign exchange dealers.

In a statement on Monday, the Acting Director of Corporate Communications, Hakama Sidi-Ali, confirmed that the licences took effect on November 27, 2025, in accordance with the 2024 Regulatory and Supervisory Guidelines for BDC Operations. The guidelines require all operators to meet specified capital thresholds and regulatory conditions to qualify for licensing.

“The Central Bank of Nigeria, in exercise of its powers under the Banks and Other Financial Institutions Act (BOFIA) 2020 and the 2024 Guidelines, has granted final licences to 82 Bureaux De Change to operate with effect from November 27, 2025,” the statement read.

The apex bank emphasised that only BDCs listed on its official website are considered fully licensed, urging the public to verify the status of any operator before engaging in foreign exchange transactions.

“While the CBN will continue to update the list of Bureaux De Change with valid operating licences for public verification on our website, the Bank advises the general public to avoid dealing with unlicensed Foreign Exchange Operators,” the statement warned.

READ ALSO:CBN Issues 82 New BDC Licences, Moves To Curb Unregistered FX Operators

The CBN noted that operating a BDC without a valid licence constitutes an offence under Section 57(1) of the BOFIA 2020, and confirmed that legal action would be taken against non-compliant operators.

TIER 1

1 DULA GLOBAL BDC LTD

2 TRURATE GLOBAL BDC LTD

TIER 2

1 ABBUFX BDC LTD

2 ACHA GLOBAL BDC LTD

3 ARCTANGENT SWIFT BDC LTD

4 ASCENDANT BDC LTD

5 BARACAI BDC LTD

6 BERGPOINT BDC LTD

7 BRAVO MODEL BDC LTD

8 BRIMESTONE BDC LTD

9 BROWNSTON BDC LTD

10 BUZZWALLET BDC LTD

11 CASHCODE BDC LTD

12 CHATTERED BDC LTD

13 CHRONICLES BDC LTD

14 COOL FOREX BDC LTD

15 CORPORATE EXCHANGE BDC LTD

16 COURTESY CURRENCY BDC LTD

17 DANYARO BDC LTD

18 DASHAD BDC LTD

READ ALSO:JUST IN: CBN Removes Cash Deposit Limits, Raises Weekly Withdrawal To N500,000

19 DEVAL BDC LTD

20 DFS BDC LTD

21 EASY CASH BDC LTD

22 ELELEM BDC LTD

23 E-LIOYDS BDC LTD

24 ELOGOZ BDC LTD

25 ENOUF BDC LTD

26 EVER JOJ GOLD BDC LTD

27 EXCEL RIJIYA FOREX BDC LTD

28 FABFOREX BDC LTD

29 FELLOM BDC LTD

30 FINE BDC LTD

31 FOMAT BDC LTD

32 GENELO BDC LTD

33 GENTLE BREEZE BDC LTD

34 GRACEFUL GLORY AND HUMILITY BDC LTD

35 GREENGATE BDC LTD

36 GREENVAULT BDC LTD

37 HAZON CAPITAL BDC LTD

38 HIGH-POINT BDC LTD

39 I & I EXCHANGE BDC LTD

40 IBN MARYAM BDC LTD

41 JOURNEY WELL BDC LTD

42 KEEPERS BDC LTD

43 KHADHOUSE SOLUTIONS BDC LTD

READ ALSO:CBN Directs Nigerian Banks To Withdraw Misleading Advertisement

44 KIMMELFX BDC LTD

45 KINGSOFT ATLANTIC BDC LTD

46 M.S. ALHERI BDC LTD

47 MASTERS BDC LTD

48 MCMENA BDC LTD

49 MKOO BDC LTD

50 MKS BDC LTD

51 MR J GOLF BDC LTD

52 MUSDIQ BDC LTD

53 MZ FOREX BDC LTD

54 NEJJ BDC LTD LTD

55 NETVALUE BDC LTD

56 NEW WAVE BDC LTD

57 NOTABLE AND KINGSTON BDC LTD

58 PILCROW BDC LTD

59 RAPID BDC LTD

60 RIGHTWAY BDC LTD

61 RWANDA BDC LTD

62 SABLES BDC LTD

63 SAFETRANZ BDC LTD

64 SAMFIK BDC LTD

65 SEVENLOCKS BDC LTD

66 SHAPEARL BDC LTD

67 SIMTEX BDC LTD

68 SOLID WHITE BDC LTD

69 ST. NICHOLAS GLOBAL BDC LTD

70 TOPFIRST UNIQUE MULTICHOICE BDC LTD

71 TOPGATE BDC LTD

72 TRAVELLER’S CHOICE BDC LTD

73 TUCA GLOBAL BDC LTD

74 TURBOVA BDC LTD

75 TURN-UP BDC LTD

76 UNIGO BDC LTD

77 VICTORY AHEAD BDC LTD

78 WHITEWAY WWW BDC LTD

79 YUND GLOBAL LINK BDC LTD

80 ZAMAD FOREX BDC LTD

News4 days ago

News4 days agoFormer Delta North senator Peter Nwaoboshi Dies

Metro3 days ago

Metro3 days agoJUST IN: Former Edo Information Commissioner Is Dead

News5 days ago

News5 days agoPolice Confirm Edo Tanker Explosion, say No Casualty

News4 days ago

News4 days agoGrassroots To Global Podium: Edo Sports Commission Marks Enabulele’s First Year In Office

News5 days ago

News5 days agoOtuaro Tasks Media On Objective Reportage

News5 days ago

News5 days agoOkpebholo Sympathises With Otaru, People of Auchi Over Tragic Tanker Fire Incident

News3 days ago

News3 days ago[OPINION] Tinubu: Ade Ori Okin Befits KWAM 1, Not Awujale Crown

News5 days ago

News5 days agoIPF Hosts Media Conference, Seeks Protection For N’Delta Environment

News16 hours ago

News16 hours agoPHOTOS: New Era In Furupagha-Ebijaw As Okpururu 1 Receives Staff Of Office

News3 days ago

News3 days agoCoordinator, Edo First Lady Office, Majority Leader, Rights Lawyer, Others Bag 2025 Leadership Award