News

NECO Unveils E-platform For Verification, Confirmation Of Results

Published

10 months agoon

By

Editor

The National Examinations Council, NECO,on Thursday, launched a result verification and confirmation portal, otherwise known as NECO e-Verify.

The NECO e-Verify is an online result verification solution that guarantees instant authentication of academic and basic information about prospective candidates for admission and employment into academic institutions and work

Speaking at the launch of the portal in Abuja,NECO Registrar, Prof. Dantani Wushishi, explained that the introduction of the NECO e-Verify,was due to the growing need for verification and confirmation of results by institutions both home and abroad.

He noted that before now, all requests for verification and confirmation of results were routed through the Council’s headquarters in Minna, “which took a longer time to process.”

READ ALSO: BREAKING: NECO Reschedules Entrance Examination To School For Gifted

According to him,result verification is an important process that helps to ensure the accuracy of academic credentials.

“Due to the growing need for verification and confirmation of results by institutions both home and abroad, the Council decided that now was the best time to introduce the e-Verify platform.

“From available records at our disposal, we have observed that there were requests for verification and confirmation of results from 64 institutions across 37 countries over a two-year period (2020-2022).

“Similarly, we have such requests from 72 institutions in Nigeria within the same period-this is besides requests from individuals which are numerous,” he said.

READ ALSO: NECO Releases 2022 SSCE Results

The NECO boss, who said it was an irrefutable fact that academic institutions and employers of labour, among other agencies, rely on verification of results to help them select the best prospective students for admission and employment purposes,said: “Result verification is an important process that helps to ensure the accuracy of academic credentials.”

“By verifying the authenticity of candidates’ results, academic institutions and employers will be more confident that they are admitting and hiring persons who have the required qualification for further studies and specific job schedules,” he said.

He listed reasons why verifying candidates result is important.

According to him,the benefits include increased confidence;risk reduction and improved efficiency.

The portal, he said, will give institutions and employers more confidence of admitting and hiring the most qualified candidates “especially in today’s world of technology where result forgery is easiestis important to verify students and employees credentials for some studies and positions to ensure that the institutions/establishments successfully meet their goals.”

READ ALSO: NECO Withholds Result Of Over 80,000 Kano Students

He spoke further: “Admitting/hiring unqualified persons can lead to a number of risk such as poor academic performance, decreased productivity, low morale and wen fraudulent behaviors that can retard the progress of the institution and businesses Result verification helps to reduce these risks by ensuring that only qualified candidates are admitted and hired.

“With proper verification of candidates results, institutions and businesses will run more efficiently as they will be able to recruit the best applicants that are capable of learning faster and employees that can carry out their duties without of with minimal supervision. This also places universities and other tertiary institutions on a good pedestal as candidates with questionable results would not dare to apply for admission

“It is against this backdrop that the National Examinations Council, as part of its efforts in meeting with global standards, has found it necessary to deploy cutting-edge technology to improve candidates’ experiences as they seek to advance their educational pursuit. With a delightful heart and deep sense of responsibility therefore, we are pleased to present to you, our esteemed stakeholders, the NECO e-Verify Result Verification/Confirmation System.

“This enviable feat, no doubt, will bring a great deal of relief to millions of our candidates, educational institutions and other stakeholders. Please join me as I take you through the workings of the NECO e-Verify platform.”

You may like

NECO 2023: 50,066 Students Score Five Credits In Maths, English

NECO Postpones 2024 Staff Promotion Examination Indefinitely

Bauchi Govt To Sponsor 20,000 Students For 2024 WAEC, NECO – Commissioner

NECO Awards Scholarships To Best Performing Candidates In 2022, 2023 Exams

NECO Unveils App, 70 New Vehicles To Improve Logistics For Exams

Over 74,000 Candidates Register For 2023 NECO SSCE External Examination – Registrar GCE

News

SERAP, BudgIT, Others Drag CBN To Court Over Cybersecurity Levy

Published

7 mins agoon

May 12, 2024By

Editor

The Socio-Economic Rights and Accountability Project; a not-for-profit organisation, BudgIT, and 136 concerned Nigerians have filed a lawsuit against the Central Bank of Nigeria “over its failure” to withdraw the cybersecurity levy.

In what was described as an “unlawful circular,” the plaintiffs in the suit number FHC/L/CS/822/2024 filed last Friday at the Federal High Court, Lagos State, asked the court to determine “whether the CBN circular dated 6th May 2024, directing financial institutions to deduct from customers’ accounts a cybersecurity levy is unlawful and therefore ultra vires the CBN.”

This is contained in a statement issued by SERAP’s Deputy Director, Kolawole Oluwadare, made available to newsmen on Sunday.

Last Monday, through a circular, the apex bank ordered all commercial, merchant, non-interest, and payment service banks, among others. operating in the country to start charging a cybersecurity levy on transactions.

READ ALSO: Tinubu Bows To Pressure, Orders CBN To Suspend Implementation Of Cybersecurity Levy

The CBN noted that, in compliance with the enactment of the Cybercrime (Prohibition, Prevention, etc.) (Amendment) Act 2024 and under the provision of Section 44 (2)(a) of the Act, a levy of 0.5 per cent (0.005) equivalent to a half per cent of all electronic transactions value by the business specified in the Second Schedule of the Act, is to be remitted to the National Cybersecurity Fund which shall be administered by the Office of the National Security Adviser.

“The levy shall be applied at the point of electronic transfer origination, then deducted and remitted by the financial institution. The deducted amount shall be reflected in the customer’s account with the narration, ‘Cybersecurity Levy.” the circular stated.

Although, President Bola Tinubu had directed the CBN to suspend the implementation of the controversial cybersecurity levy policy and ordered a review, the plaintiffs asked the court to determine whether the apex bank’s directive “are not in breach of sections 14(2), 44(1) and 162(1) of the Nigerian Constitution 1999 [as amended], and therefore unconstitutional, null, and void.”

They also demanded that the “CBN, its office, agents, privies, assigns, or any other persons acting on its instructions from enforcing the circular dated 6th May 2024, pending the hearing and determination of the motion on notice filed contemporaneously in this suit,” be restrained.

READ ALSO: SERAP Gives FG 48-hr Ultimatum To Reverse CBN’s 0.5% Cybersecurity Levy

The suit filed on behalf of the plaintiffs by their lawyer, Ebun-Olu Adegboruwa, SAN, read in part, “The CBN circular is unlawful and an outright violation of the provisions of the Nigerian Constitution and the country’s international obligations.

“Unless the reliefs sought are granted, the CBN will enforce its circular directing banks to deduct from customers’ accounts a cybersecurity levy. Millions of Nigerians with active bank accounts would suffer irreparable damage from the unlawful deduction of cybersecurity levies from their accounts.

“The provisions of the Cybercrimes Act on payment of cybersecurity levy strictly apply only to businesses listed in the Second Schedule to the Act. These provisions make no reference to bank customers, contrary to the CBN circular to all banks and other financial institutions.”

The statement noted that while the CBN’s circular “a blatant violation of Nigerians’ human rights including the right to property guaranteed under section 44 of the Nigerian Constitution and article 14 of the African Charter on Human and Peoples’ Rights to which Nigeria is a state party,” the Federal Government “has a legal responsibility to ensure the security and welfare of the people, as provided for under section 14(2)(b) of the Nigerian Constitution and human rights treaties to which Nigeria is a state party.”

READ ALSO: ICYMI: Five Things To Know About The New Cybersecurity Levy To Be Paid By Nigerians

The plaintiffs, therefore, urged the court to “grant the reliefs sought in the public interest and the interest of justice as well as to prevent arbitrariness and ensure the rule of law in the country.”

The cybersecurity levy, as ordered by the apex bank, is to be be remitted to the National Cybersecurity Fund which shall be administered by the Office of the National Security Adviser.

While disagreeing with this, the plaintiffs noted that according to Section 162 (1) of the Nigerian Constitution, the payment of “revenues collected by or on behalf of the Government of the Federation are mandatorily required to be paid into the Federation Account save the revenue excepted by the provisions of the section.”

“The National Cybersecurity Fund established by section 44(1) of the Cybercrimes Act 2015 [as amended] into which it is required to be paid the levy of 0.5% chargeable on all electronic transactions instead of the Federation Account is unconstitutional, null, and void.

“As of 30 April 2024, commercial banks in Nigeria already charge exorbitant fees for electronic transactions, including electronic transfer charges at N53.75 on any amount above N10,000; stamp duty of N50 on every transaction and account maintenance charge deducted per month,” the statement partly read.

No date has been fixed for the hearing of the suit.

News

Tinubu Bows To Pressure, Orders CBN To Suspend Implementation Of Cybersecurity Levy

Published

1 hour agoon

May 12, 2024By

Editor

President Bola Tinubu has asked the Central Bank of Nigeria to suspend the implementation of the controversial cybersecurity levy policy and ordered a review.

This followed the decision of the House of Representatives, which, last Thursday, asked the CBN to withdraw its circular directing all banks to commence charging a 0.5 per cent cybersecurity levy on all electronic transactions in the country.

The CBN on May 6, 2024, issued a circular mandating all banks, mobile money operators, and payment service providers to implement a new cybersecurity levy, following the provisions laid out in the Cybercrime (Prohibition, Prevention, etc) (Amendment) Act 2024.

According to the Act, a levy amounting to 0.5 per cent of the value of all electronic transactions will be collected and remitted to the National Cybersecurity Fund, overseen by the Office of the National Security Adviser.

Financial institutions are required to apply the levy at the point of electronic transfer origination.

READ ALSO: ICYMI: CBN Orders Banks To Charge 0.5% Cybersecurity Levy

The deducted amount is to be explicitly noted in customer accounts under the descriptor “Cybersecurity Levy” and remitted by the financial institution. All financial institutions are required to start implementing the levy within two weeks from the issuance of the circular.

By implication, the deduction of the levy by financial institutions should commence on May 20, 2024.

However, financial institutions are to make their remittances in bulk to the NCF account domiciled at the CBN by the fifth business day of every subsequent month.

The circular also stipulates a timeframe for financial institutions to reconfigure their systems to ensure complete and timely submission of remittance files to the Nigeria Interbank Settlement Systems Plc as follows: “Commercial, Merchant, Non-Interest, and Payment Service Banks – Within four weeks of the issuance of the Circular.

READ ALSO: SERAP Gives FG 48-hr Ultimatum To Reverse CBN’s 0.5% Cybersecurity Levy

“All other Financial Institutions (Microfinance Banks, Primary Mortgage Banks, Development Financial Institutions) – Within eight weeks of the issuance of the Circular,” the circular noted.

The CBN has emphasised strict adherence to this mandate, warning that any financial institution that fails to comply with the provisions will face severe penalties. As outlined in the Act, non-compliant entities are subject to a minimum fine of two per cent of their annual turnover upon conviction.

The circular provides a list of transactions currently deemed eligible for exemption, to avoid multiple applications of the levy.

These are loan disbursements and repayments, salary payments, intra-account transfers within the same bank or between different banks for the same customer, and intra-bank transfers between customers of the same bank.

READ ALSO: Banditry: Niger Speaker To Marry Off 100 Female Orphans

Exemptions include other financial institutions’ transfers to their correspondent banks, interbank placements, banks’ transfers to CBN and vice versa, inter-branch transfers within a bank, cheque clearing and settlements, letters of credit, and banks’ recapitalisation-related funding.

Others are bulk funds movement from collection accounts, savings, and deposits including transactions involving long-term investments such as treasury bills, bonds, and commercial papers, and government social welfare programmes transactions.

These may include pension payments, non-profit and charitable transactions including donations to registered non-profit organisations or charities, educational institutions transactions, including tuition payments and other transactions involving schools, universities, or other educational institutions, and transactions involving the bank’s internal accounts, inter-branch accounts, reserve accounts, nostro and vostro accounts, and escrow accounts.

The introduction of the new levy sparked varied reactions among stakeholders as it is expected to raise the cost of conducting business in Nigeria and could potentially hinder the growth of digital transaction adoption.

PUNCH

News

Moment Chief Defense Staff Hosts Prince Harry, Meghan Markle In Reception [VIDEO/PHOTOS]

Published

12 hours agoon

May 11, 2024By

Editor

Prince Harry and Meghan Markle attended a reception hosted by the Chief of Defense Staff.

This was after they attended a volleyball game earlier in the day.

During the reception, which held at the Armed Forces Officers Mess & Suites in Abuja, the Duke and Duchess of Sussex received asho oke gifts from Abike Dabiri-Erewa, Chairman/CEO of the Nigerians in Diaspora Commission (NiDCOM).

READ ALSO: VIDEO: See Winner Of Best Content Creator At AMVCA

The couple also danced with Dabiri-Erewa.

The purpose of the visit was to introduce the royal couple to Nigeria’s rich socio-cultural heritage and provide an opportunity for the Duchess of Sussex to explore her Nigerian lineage.

SERAP, BudgIT, Others Drag CBN To Court Over Cybersecurity Levy

Customs Intercepts N10m Worth Petrol En Route Cameroon Illegally

Failure To Prosecute Deborah’s Killers Two Years After, Reinforcement Of Impunity – Amnesty International

Trending

Headline5 days ago

Headline5 days agoMother Throws Disabled 6-year-old Son Into Crocodile Infested River [PHOTOS]

News5 days ago

News5 days ago‘I’m Considering Having 4th Child’ – Mother Of Three Who Breastfeeds Husband , 3 Kids [PHOTOS]

News4 days ago

News4 days agoThe New Masquerade’ Actress, Ovularia Is Dead

Politics5 days ago

Politics5 days agoEdo Poll: PDP Gubernatorial Aspirant Resigns From Party

Headline5 days ago

Headline5 days ago‘Shame On You’- Ugandan Senator Knocked For Showing Off Wooden Bridge He Constructed

News4 days ago

News4 days agoBREAKING: Rivers State House Of Assembly Gets New Speaker

Politics5 days ago

Politics5 days agoEdo Poll: Akoko-Edo PDP Leaders Meet Deputy Gov, Pledge Massive Votes For Ighodalo

Business4 days ago

Business4 days agoFULL LIST: CBN Publishes List Of Licensed Deposit Money Banks

News4 days ago

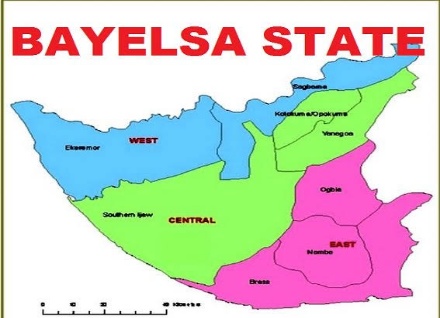

News4 days agoFather Of 12 Found Dead Inside Brothel In Bayelsa

Metro4 days ago

Metro4 days agoEdo: Police Patrol Van Pursuing ‘Yahoo Boys’ Rams Into Motorcycle Convening Passenger