Business

NLC Protests: CBN To Flood Banks With Old Naira Notes

Published

2 years agoon

By

Editor

The Central Bank of Nigeria has finally concluded plans to release all N1,000, N500 and N200 notes in its custody to Deposit Money Banks.

This decision is expected to end months of hardships and pains Nigerians have been going through following a controversial CBN naira redesign policy that has caused a severe shortage of old and new naira notes across the country.

The CBN’s latest decision came several weeks after the Supreme Court ordered that old N1,000, N500 and N200 notes should remain legal tender until December 31, 2023.

On Wednesday night, top officials of the CBN and commercial banks confirmed to The PUNCH that the CBN Governor, Godwin Emefiele, had directed DMBs to begin the disbursement of old N1,000, N500 and N200 notes to members of the public effective Thursday (today).

According to him, the CBN will also start releasing old notes to commercial banks from Thursday.

READ ALSO: NLC Gives FG 7-day-ultimatum Over Naira Scarcity

According to The PUNCH, Emefiele met with the chief executive officers of DMBs on Wednesday evening where he told them that the central bank would start releasing all old notes in its custody to commercial banks effective Thursday (today).

Sources at the meeting said the CBN would also be cancelling all the controversial cash withdrawal limits it put in place in recent months.

Also, it was learnt the CBN would start by releasing crisp old notes to DMBS after which the ones deposited by commercial banks will also be released.

Furthermore, the CBN stated at the meeting that bank customers would no longer be required to generate any code before depositing their old notes.

One of the bank CEOs at the meeting, who spoke on condition of anonymity, said, “The CBN governor met with bank CEOs this evening virtually. It was a short meeting that lasted for just about 15 minutes. The governor said all old N1,000, N500 and N200 notes will be released to commercial banks beginning from Thursday. The CBN will start with crisp old notes after which the ones deposited by DMBs will be returned. The plan is to flood the economy with cash and ameliorate the challenges Nigerians have been passing through.“

Top bank chief

The top bank chief added, “Also, the CBN will be cancelling cash withdrawal limits it put in place recently. This means that individuals can now withdraw up to N500,000 across the counter while corporate bodies can do N5m. The CBN is expected to release a circular to this effect later tonight or tomorrow morning (today). But effectively, things should be back to normal as far the cashless policy is concerned.”

Further findings by The PUNCH confirmed the CBN would begin to release the old notes into circulation by Thursday. It was also gathered that banks would begin to pay their customers the old notes immediately to ensure the cash circulate across the country.

According to reliable sources in the CBN, banks have been also been directed to report to the old offices to collect the old naira notes they deposited with the apex bank.

They noted that before the end of the week, the country would be awash with naira notes.

Meanwhile, a top source close to the CBN said the apex bank took the decision to avert the planned picketing of the CBN offices nationwide by supporters and leaders of the Nigeria Labour Congress.

READ ALSO: Ramadan: CBN Told To Release More New Naira Notes

NLC protests

Earlier, The PUCH had gathered that the NLC would on Wednesday picket the CBN headquarters and state offices in protest against the lingering naira crisis and fuel scarcity in the country.

The NLC President, Joe Ajaero, who disclosed this at a press conference on Wednesday, lamented that people’s hardships over the naira crisis had worsened.

The union had penultimate Monday issued a seven-day ultimatum to the Federal Government to address the scarcity of naira notes and fuel which had compounded the hardships being faced by Nigerians.

Though the CBN said then that it had complied with the Supreme Court judgment which directed that the old N200, N500 and N1000 notes should remain legal tender till December 31, banks have continued to ration the amount of cash issued to customers, indicating that they have not received cash supplies from the apex bank.

The three states of Kaduna, Kogi and Zamfara which sued the Federal Government over the naira redesign policy had threatened to file contempt charges against the Attorney-General of the Federation, Abubakar Malami, SAN and the CBN governor, Emefiele for not fully complying with the Supreme Court judgment.

Speaking at a press briefing in Abuja on Wednesday, Ajaero said the planned picketing of CBN offices became imperative following the apex bank’s failure to comply with the one-week ultimatum given to it to make cash available for Nigerians.

Ajaero explained that the union took the decision when it noticed that the situation appeared to be getting worse despite the Supreme Court order allowing the old N500 and N1000 notes to circulate with the new notes till December 31.

He directed all NLC’s affiliate unions and their state councils to begin mobilisation on Friday for the nationwide mass action, saying the Federal Government and the CBN have not shown any commitment to address the situation.

Giving an update about the ultimatum at the briefing which was held at Labour House, Ajaero said workers could no longer access cash to pay fares to their respective workplaces or buy food for their families.

He said, “Last week at the end of our CWC (Central Working Committee) meeting, we gave a one-week ultimatum for the Federal Government to address immediately, among other issues, the issue of cash crunch that was caused by the policy. As of this morning when the CWC met again to review the situation, we discovered that not much improvement has been made.

READ ALSO: Supreme Court Nullifies FG’s Cashless Policy, Naira Redesign

“The situation is still almost the same. People are still buying our currency with our currencies. People no longer have access to the currency and the government seems to be very adamant about this. No moves have been made to reduce the suffering of Nigerians.

One-week notice

“Consequently, the CWC-in-session resolved to go into the process of actualising the one-week notice. From Friday, there will be a mobilisation of all state councils through a NEC meeting. All unions have already been directed to mobilise all their organs and their branches.

“By Wednesday, next week, all Central Bank of Nigeria offices nationwide will be picketed. All central banks from the CBN headquarters will be shut till further notice. Workers are directed to stay at home and join in the picketing exercise.

“We call on Nigerians to understand the circumstances we are operating in. People will be telling you about the political situation. The political situation is self-inflicted and the economic situation is worse than the political situation because people cannot eat.”

The labour leader described the proposed demonstration as “total”, saying the workers have been pushed to the wall.

He added, “Workers can no longer go to the office and nothing is happening. So, we have been pushed to the wall having given one week (ultimatum) and we thought they could address the situation which is not addressed.

“We have decided to take our destiny into our hands. So, comrades, the mobilisation commences immediately and when we talk of action from Wednesday, it’s total; until further notice.’’

The labour leader explained that the lingering fuel scarcity and cash crunch were important issues for the NLC as they affected every Nigerian.

The Secretary-General of the National Union of Aviation Transport Employees, Ocheme Abah disclosed that the unions would comply with the NLC’s directive on the picketing action.

Responding to inquiries from The PUNCH, he said,” Yes, of course, we will comply as NLC directed. Yes, all the unions in all airports.

Meanwhile, the Acting Director of Corporate Communications at CBN, Mr Isa Abdulmumin, said he could not immediately comment on whether the CBN would be releasing the old notes to commercial banks.

He said the apex bank would communicate its position on the matter on Thursday.

PUNCH

You may like

753 Duplexes: Abuja Court Admits Emefiele To N2bn Bail

Reps To Quiz Edun, Cardoso Over Non-compliance With Fiscal Responsibility Act

JUST IN: CBN Retains 27.50% Interest Rate Again

Nigeria’s External Reserves Increase As CBN Releases 2024 Financial Results

CBN Opens Up On Introducing New ₦5,000, ₦10,000 Notes

Alleged $6.3m Fraud: Court Defers Trial Of 3 CBN Officials

The Naira experienced a slight depreciation on Friday at the official market, trading at N1,528.56 to the dollar.

Data obtained from the website of the Central Bank of Nigeria (CBN) showed that the Naira lost N2.73.

This represents a 0.17 percent loss compared to the N1,525.82 recorded on Thursday.

READ ALSO:Naira Appreciates At Official Market

The Naira, which opened the week on Monday with a gain of N9.52 against the dollar, held steady gains until Thursday.

On Wednesday, the local currency gained N3.42 against the dollar and received commendation from the International Monetary Fund (IMF).

The IMF, in its 2025 Article IV Consultation report on Nigeria, commended the CBN for its reforms to the foreign exchange market, which supported price discovery and liquidity.

Business

JUST IN: Dangote Refinery Hikes Petrol Ex-depot Price

Published

2 weeks agoon

June 20, 2025By

Editor

Nigerians may soon pay more for petrol as the Dangote Petroleum Refinery on Friday increased its ex-depot price for Premium Motor Spirit to N880 per litre, raising fresh concerns over fuel affordability and price volatility in the downstream sector.

Checks on petroleumprice.ng, a platform tracking daily product prices, and a Pro Forma Invoice seen by The PUNCH confirmed the hike, representing a N55 increase from the previous rate of N825 per litre.

The increment would ripple across the entire fuel distribution chain, likely pushing pump prices above N900/litre in some parts of the country, especially in areas far from the distribution hubs.

The hike comes despite global crude prices falling. Brent crude dipped by 3.02% to $76.47, WTI fell to $74.93, and Murban dropped to $76.97 on Friday. The decline in benchmarks offers little relief due to persistent fears of sudden supply disruptions.

READ ALSO: JUST IN: Dangote Refinery Sashes Petrol Gantry Price

The refinery has increased its reliance on imported U.S. crude and operational costs amid exchange rate instability, which adds to its pricing pressure.

On Thursday, the President of the Dangote Group, Aliko Dangote, said his 650,000-barrel capacity refinery is “increasingly” relying on the United States for crude oil.

This came as findings showed that the Dangote Petroleum Refinery is projected to import a total of 17.65 million barrels of crude oil between April and July 2025, beginning with about 3.65 million barrels already delivered in the past two months, amid ongoing allocations under the Federal Government’s naira-for-crude policy.

Dangote informed the Technical Committee of the One-Stop Shop for the sale of crude and refined products in naira initiative that the refinery was still battling crude shortages, which had led it to resort to imports from the United States.

READ ALSO:Dangote Stops Petrol Sale In Naira, Gives Condition For Resumption

On Monday, the president of the Petroleum and Natural Gas Senior Staff Association of Nigeria, Festus Osifo, accused oil marketers of exploiting Nigerians through inflated petrol prices, insisting that the current pump price of PMS should range between N700 and N750 per litre.

He criticised the disparity between falling global crude oil prices and the stagnant retail price of petrol in Nigeria.

“If you go online and check the PLAT cost per cubic metre of PMS, convert that to litres and then to our Naira, you will see that with crude at around $60 per barrel, petrol should be retailing between N700 and N750 per litre.”

He asserted that if Nigerians bear the brunt of higher fuel costs, they should be allowed to enjoy the benefit of low pricing.

His forecast of increased costs now appears spot on, considering the latest developments.

Marketers are already adjusting. Depot owners and fuel distributors in Lagos and other cities anticipate a domino effect, with new price bands expected to follow Dangote’s lead.

Many had held back pricing decisions since Tuesday, when the refinery halted sales and withheld fresh PFIs. The delay fueled speculation, allowing opportunistic price hikes across various depots.

The Naira, which has seen steady appreciation against the Dollar all week, closed stronger on Friday, trading at ₦1,580.44 in the official forex market.

Data from the Central Bank of Nigeria’s website show the Naira gained ₦4.51k against the Dollar on Friday alone.

This marks a 0.28 per cent appreciation from Thursday’s closing rate of ₦1,584.95 in the official foreign exchange window.

The local currency maintained consistent strength throughout the week, recording gains daily.

READ ALSO: Naira Appreciates Against Dollar At Foreign Exchange Market

On Monday, May 19, it traded at ₦1,598.68; on Tuesday, at ₦1,590.45; and on Wednesday, at ₦1,584.49.

These gains suggest increased investor confidence and improved forex supply, contributing to the naira’s performance.

Meanwhile, the CBN, at its 300th Monetary Policy Committee meeting held Monday and Tuesday, retained the Monetary Policy Rate at 27.5 per cent.

- Osun Monarchs Donate Air-conditioners, Computers To Support NUJ’s E-Library Project

- Man Seeks End Of 16 Years Wedlock For Lack Of Love

- Coalition: Why Tinubu Must Not Sleep —Primate Ayodele

- My Wife Goes Clubbing At Will, Cares Less That She’s Childless, Man Tells Court

- I Ran For My Dear Life After My Wife Threatened To Bathe Me With Acid — Husband

- My Husband Leaves Home Whenever We Have Misunderstanding, Woman Tells Court

- 2Face Controversy: Family, Friends Speak Out Amid Apology Backlash

- Burna Boy Turns 34, Reveals Plans To Start A Family

- Cultism: Edo Police Arrest Suspected Killer Of Three Vigilantes, 15 Others

- My Wife Abandoned Me, Deserted Home For Three Months —Husband

About Us

Trending

Metro5 days ago

Metro5 days agoPanic As Bees Invade Central Mosque In Edo

Sports2 days ago

Sports2 days agoBREAKING: Liverpool Star Diogo Jota Is Dead

News4 days ago

News4 days agoSenator Withdraws From Legislative Duties Over Health Challenge

Politics4 days ago

Politics4 days agoINEC Unveils 2025-2026 Election Timetable, Resumes Voter Registration

Headline4 days ago

Headline4 days agoUS-based Lawyer Becomes First Nigerian To Travel To Space

Politics3 days ago

Politics3 days agoEdo: S’Court Reserves Verdict On Ighodalo’s Case Against Okpebholo

Headline4 days ago

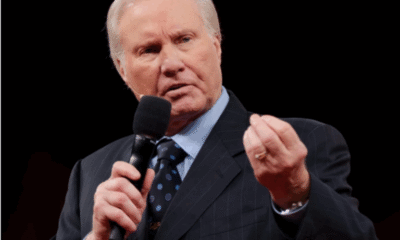

Headline4 days agoTelevangelist, Jimmy Swaggart, Is Dead

Metro4 days ago

Metro4 days agoCleric Jailed 53 years For Sexually Assaulting 14-year-old Daughter

Politics5 days ago

Politics5 days agoBREAKING: APC Fixes Date For NEC Meeting

Metro3 days ago

Metro3 days agoControversy Over Pregnant Woman Buried Alive In Edo