Business

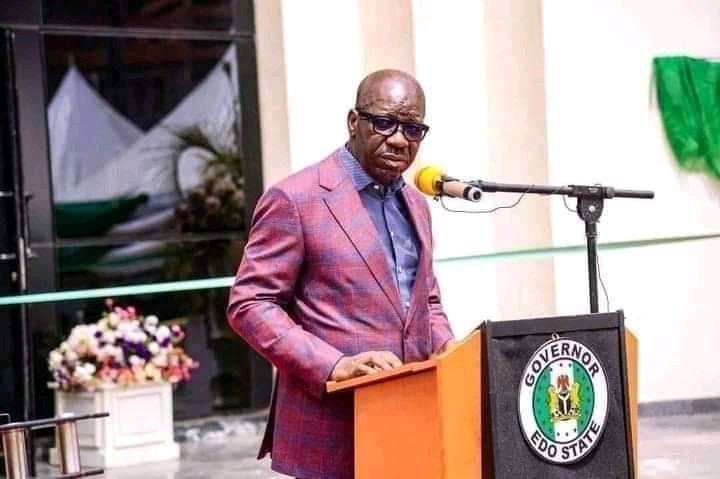

Obaseki Presents N214.2bn 2022 Budget Of ‘Renewal’ To Edo Assembly

Edo State governor, Godwin Obaseki on Wednesday presented a budget proposal of N214.2 billion for the 2022 fiscal year to the state House of Assembly for consideration and approval.

The budget christened ‘Budget of Renewal, Hope and Growth’ showed an increase of 32.9 percent over the 2021 approved budget of N161 billion.

Presenting the budget, Obaseki said that it was made up of N95.9 billion recurrent expenditure and N118 billion capital expenditure.

“Mr Speaker, the increase in capital expenditure over the previous year’s approved budget underscores my administration’s commitment to enhancing and stimulating the ease of doing business.

“Recurrent estimates of the budget are based on $57 per barrel bench mark for crude oil and an average daily production of 1.88 million barrels per day as well as increase of our IGR to N50.2 billion

“The proposed capital and recurrent expenditures ratios is put at 55 percent to 45 percent respectively.

“The total projected IGR for 2022 is N186 billion consisting of N65 billion statutory allocation.

“Value added tax of N23 billion, IGR of N50.3 billion and N11.6 billion from grants,” he said.

READ ALSO: EndSARS: No Peace Without Justice, Eedris Abdulkareem To Sanwo-Olu

During the presentation, the Governor proposed N24.6 billion for Education, Health N14.1 billion, Government buildings N21 billion, Road/Bridges N30 billion, Youth/Social Development N5 billion and Environment N8 billion.

Others are Agriculture, N4.6 billion; water, N1.2 billion; Electricity, N2.7 billion and public safety and security N9.2 billion.

The budget proposal also included Technology enhancement, N7.6 billion, enhancing working environment, N15 billion, Tourism and development of Benin cultural districts N2 billion and administration of justice N5 billion among others.

Business

14 Nigerian Banks Yet To Meet CBN’s Recapitalization Deadline [FULL LIST]

With barely eleven weeks to the Central Bank of Nigeria’s (CBN) recapitalisation deadline, fourteen banks are yet to meet the requirement.

This comes as DAILY POST reports that 19 Nigerian banks had met the apex bank’s recapitalisation requirements as of January 6, 2025.

The banks that have complied with the CBN’s minimum capital benchmark include Access Bank, Fidelity Bank, First Bank, GTBank (GTCO), UBA, Zenith Bank, and twelve others.

READ ALSO:CBN Revokes Licences Of Aso Savings, Union Homes As NDIC Begins Deposit Payments

However, as of the time of filing this report, fourteen Nigerian banks are yet to comply.

The banks that have not met the apex bank’s recapitalisation requirement include First City Monument Bank (FCMB), Unity Bank, Keystone Bank, Union Bank (Titan), Taj Bank, Standard Chartered Bank, Parallex Bank, and SunTrust Bank.

Others are FBH Merchant Bank, Rand Merchant Bank, Coronation Merchant Bank, Alternative Bank, and other non-interest banks.

Meanwhile, financial experts have predicted possible mergers and acquisitions ahead of the March 31 deadline.

Business

Naira Extends Appreciation Against US Dollar

The naira extended appreciation against the dollar at the official foreign exchange market on Wednesday.

The Central Bank of Nigeria’s data showed that the Naira further firmed up on Wednesday to N1,418.26 per dollar, up from N1,419.07 exchanged on Tuesday.

Wednesday’s uptrend represents a slight N0.80 gain against the dollar on a day-to-day basis.

READ ALSO:Naira Records Significant Appreciation Against US Dollar

Meanwhile, at the black market, the Naira remained unchanged against the dollar at N1,480 per dollar on Wednesday, the same rate recorded the previous day.

The development comes as Nigeria’s foreign reserves further rose to $45.62 billion as of January 6th, 2026.

Recall that on Tuesday, the Naira posted a N10.24 gain against the dollar.

Business

Naira Continues Gain Against US Dollar As Nigeria’s Foreign Reserves Climb To $45.57bn

The Naira appreciated further against the United States Dollar at the official foreign exchange market, beginning the week on a good note.

Central Bank of Nigeria data showed that the Naira strengthened on Monday to N1,429.31 per dollar, up from N1,430.85 exchanged on Friday, 2 January 2026.

This means that the Naira gained N1.56 against the dollar on Monday when compared to N1,430.85 last week Friday.

READ ALSO:Naira Records Significant Appreciation Against US Dollar

At the black market, the Naira dropped by N5 to N1480 per dollar on Monday, down from N1475 traded Friday.

The development comes as the country’s external reserves rose to $45.57 billion as of Friday last week.

News5 days ago

News5 days agoWhat I Saw After A Lady Undressed Herself — Pastor Adeboye

Headline5 days ago

Headline5 days agoPROPHECY: Primate Ayodele Reveals Trump’s Plot Against Tinubu

Metro5 days ago

Metro5 days agoArmed Robbers Shot PoS Operator To Death In Edo

Business3 days ago

Business3 days agoNNPCL Reduces Fuel Price Again

Metro4 days ago

Metro4 days agoAAU Disowns Students Over Protest

Metro5 days ago

Metro5 days agoJoint Task Force Kills 23 Bandits Fleeing Kano After Attacks

Metro4 days ago

Metro4 days agoEdo: Suspected Kidnappers Kill Victim, Hold On To Elder Brother

Politics5 days ago

Politics5 days ago2027: Rivers APC Pledges To Follow Wike’s Instructions

Headline2 days ago

Headline2 days agoRussia Deploys Navy To Guard Venezuelan Oil Tanker Chased By US In Atlantic

Metro4 days ago

Metro4 days agoNine Soldiers Feared Dead In Borno IED Explosion