Business

Ossiomo Power Project: Delayed Agreement Signing Due To Non-Agreement Of Oprational Processes-BEDC

Published

4 years agoon

By

Editor

The Management of Benin Electricty Distribution Company (BEDC) PLC, yesterday, January 31, explained that the its delay in signing the bilateral agreement on Edo State owned Ossiomo Power project was due to Ossiomo’s non agreement to process of operations, maintenance and management of the line being constructed in line with licensing and safety standard in order to ensure safety of lives and property.

The Management, however, affirmed it ready to partner Edo State government on the project, stressing that this is evidenced in its constant efforts at ensuring that the Nigerian Electricity Regulatory Commission (NERC) clearance letter is properly and safely implemented.

BEDC Chief Head, Edo State, Mr. Abel Enechaziam, while disclosing the company’s position to newsmen in Benin, said procurement process for the proposed new line, expected to be based on open & competitive procurement that is in line with prudency requirement by the regulators has not been agreed to by Ossiomo.

READ ALSO: Huawei Donates Lab. Equipment To Tafawa Varsity

Enechaziam, who addressed the press on behalf of the Managing Director of BEDC, Funke Osibodu, noted that when combined with proposal by Ossiomo, the valuation methodology for pricing of purchase in 10years time should be agreed to in future, stressing that these can lead to tariff costs that may not conform with regulatory approval.

“As you are aware, we operate in a regulated sector andsector and would require the sign off of the relevant sector regulators such as NERC and NEMSA before executing the proposed agreement, in order to ensure that we remain within the permitted regulatory parameters”, he stressed further.

According to him, two grey areas that were in contention in the bilateral agreement on Ossiomo bordered on the need for valuation of the line being used for power evacuation through open, competitive and transparency tendering process to ensure that only prudent cost are passed to the customers.

READ ALSO: Idahagbon’s Assassination Attempt: Ize-Iyamu Condemns Act, Berates Edo Govt Silence

The other area of dispute he said was the company’s insistence that joint operation and maintenance of the Ossiomo line was not allowed and that a sub contactor could be appointed by Ossiomo to work under BEDC supervision for accountability and safety sake in its network.

He stated, “The recent electrocution of two persons occasioned by Ossiomo’s ongoing construction which interfaced with our distribution line thereby causing supply interruption to the community in the area as well as alleged death of one of the parties involved, indeed emphasizes the need for the project to be undertaken in line with applicable regulatory and safety standards.”

He further noted that in addition, there were also other unresolved matters such as valuation methodology for line construction, as well as the issue of procurement of 33KV line, and the operation and maintenance of the constructed distribution line.

READ ALSO: Man Bags 5years Jail For Land-Grabbing, Resale In Benin

The Management therefore requested for the release of the draft agreement for its review and clearance by the regulator; considerations for safety of the lives of people and public costs so that there is need for proper alignment of key stakeholders and regulatory sign off on the agreement before execution.

You may like

Chairman of Dangote Industries Limited, Aliko Dangote has said that the devaluation of Naira created the biggest mess for the company in 2023.

Speaking at the annual general meeting of Dangote Sugar Refinery, Dangote said this affected lots of companies in the country.

He said: “We are doing whatever it takes to make sure that at the end of the day, we will be paying dividends because if you look at our dividends last year, it was almost 50 percent more so we will try and get out of the mess.

READ ALSO: Ex-policeman Who filmed Wife Having Wex With Her Superior Found Guilty Of Stalking

“The biggest mess created was actually the devaluation of the naira from N460 to N1,400. You can see almost 97 percent of the companies, especially in food and beverages businesses, none of them will pay dividends this year for sure but, we will try and get out of it as soon as possible.

“We want to see that at the end of the day, no matter how small, we will be able to pay some dividends, especially if there is a rebound of the naira.”

Business

Customers Panic As CBN Bans Opay, Palmpay, Others’ New Accounts

Published

2 days agoon

April 30, 2024By

Editor

Some bank customers have expressed panic as the Central Bank of Nigeria bans mobile money operators including fintech firms from onboarding new customers.

However, the Bank Customers Association of Nigeria backed the CBN directive.

The new directive will affect fintech companies such as OPay, Palmpay, Kuda Bank, and Moniepoint, from opening new accounts until further notice.

Reliable sources from three major fintechs who requested not to be mentioned as they were not permitted to speak, confirmed the development to The PUNCH on Monday.

The CBN’s move was linked to an ongoing audit of the Know-Your-Customer process of the fintechs, which have been under scrutiny in recent months over concerns around money laundering and terrorism financing.

It was gathered that the CBN had summoned some of the heads of fintechs to Abuja to discuss issues around KYC last week.

The CBN has not yet publicly commented on the directive to the fintech firms. The PUNCH’s attempts to reach the apex bank for comment were unsuccessful.

Several calls made to the telephone line of the CBN spokesperson, Hakama Ali Sidi, were not responded to as of the time of filing this report.

READ ALSO: CBN Sells Fresh Dollars To BDCs At N1,021/$

Also, the directive coincided with the court order that the Economic and Financial Crimes Commission (EFCC) obtained to freeze at least 1,146 bank accounts owned by various individuals and companies allegedly involved in illegal foreign exchange transactions.

The 85-page court order (document), which listed the bank account details suspected to be involved in illicit activities, was obtained by The PUNCH on Monday.

Justice Emeka Nwite, in a ruling on the ex-parte motion, moved by counsel for the anti-graft agency, Ekele Iheanacho, also granted the commission’s application to conclude the investigation within 90 days.

Part of the court document read, “That the applicant’s (EFCC) application is hereby granted as prayed.

“That an order of this honorable court is hereby made freezing the bank accounts stated in the schedule below, which accounts are owned by various individuals who are currently being investigated in a case involving the offenses of unauthorised dealing in foreign exchange, money laundering, and terrorism financing, to the extent that the investigation will be for a period of 90 (ninety) days.”

The EFCC, in the motion marked FHC/ABJ/CS/543/2024 dated and filed April 24 by Iheanacho, was heard by the judge the same day in the interest of national interest.

“The motion was brought pursuant to Section 44(2) and (K) of the 1999 Constitution; Section 34 of the EFCC Establishment Act 2004; Section 7(8) of the Money Laundering Prevention and Prohibition Act, 2022; and under the inherent jurisdiction of the court.”

The President of the Bank Customers Association of Nigeria, Uju Ogubunka, backed the CBN’s move to suspend new account opening on the affected platforms.

He told The PUNCH that the strict regulations that govern deposit money banks must apply to fintechs, and microfinance banks in order to ensure the integrity of the financial institutions.

READ ALSO: CBN Gives New Directive On Lending In Real Estate

He said, “Anything that can disrupt the system should not be permitted. If the platforms are being used for things that are against the regulations, I think the CBN decision is OK. I don’t see anything wrong with that. It behoves on the companies now to get their KYC right.

“Let them do what they are supposed to do. KYC applies to banks and other financial institutions that deposit money. It should also apply to them so that the regulators can understand what is going on and hold them accountable.”

On the other hand, Emmanuel Odunsi on X (formerly Twitter) welcomed the move, citing the need for better KYC processes to prevent scams and fraudulent activities.

“Their KYC isn’t that great. Lots of scammers are using their apps to defraud people.

“Most of the accounts were created by mining phone numbers, with subscribers’ permission. Almost every phone number has been linked to an account,” Odunsi said.

In October 2023, Fidelity Bank blocked transfers to OPay, Palmpay, Kuda, and Moniepoint due to concerns around KYC processes.

In response, the CBN introduced new KYC rules for all financial institutions in November 2023, which appeared to target fintech startups.

READ ALSO:JUST IN: CBN Gov Sacks Eight Directors, 32 Others

A source from Moniepoint said the company had complied with the directive, effectively halting new account creation on their platform. However, the source denied having anything to do with KYC.

“It’s just a regulation from the CBN, and we’ve complied. The real question is, why are fintechs always targeted,” he source argued.

“It has nothing to do with KYC; I am aware that the CBN communicated, but this particular issue dwells on accounts related to cryptocurrency transactions,” the source revealed.

The CBN has an ambitious target to increase overall financial inclusion to 95 per cent of the adult population by 2024.

With the new order, the target may be affected, as the company processes about 100 new accounts every day.

The source argued that fintechs had played significant roles in deepening financial inclusion in the country.

The company had deployed robust and reliable digital payment infrastructure that has facilitated an average monthly transaction value of $12bn for about 1.6 million businesses, it said last year.

READ ALSO: FULL LIST: 31 States Owe CBN N340bn Bailout Funds

A senior employee of PalmPay confirmed to The PUNCH that there was a CBN directive for fintechs to reassess their KYC processes.

This is causing a temporary pause in onboarding new customers, the source stated.

She clarified that the KYC review was a collaborative effort with the CBN, and fintechs were awaiting further instructions without a specified timeline for resolution.

Another source at OPay, who also declined to be named, said they were following the CBN’s directive and could not comment further.

“We don’t really have anything to say. It’s just a directive that we are following. The CBN has issued their directive.“

Fintech companies have faced increased regulatory scrutiny over their account opening processes.

Customers worry

However, some customers have also used social media, both on X (formerly Twitter) and Facebook, to express their worries and opinions on the matter.

Some customers are anxious about the safety of their funds, with Warisenibo Jumbo suggesting it’s best to transfer their money out of Opay.

Oye Niran wondered if their Moniepoint account was safe, stating, “Hope my Moniepoint account is safe.”

Larry Leanz questioned the rationale for keeping money on these platforms.

“But is it still safe to keep money there?, Leanz questioned.

The Central Bank of Nigeria (CBN) started fresh and direct sales of US dollars at N1,021 per dollar to Bureau De Change operators.

Nigeria’s apex bank disclosed this in a circular signed by its Director of Trade and Exchange Department Hassan Mahmud.

“We write to inform you of the sale of $10,000 by the Central Bank of Nigeria (CBN) to BDCs at the rate of N1,021/$1. The BDCs are in turn to sell to eligible end users at a spread of NOT MORE THAN 1.5 percent above the purchase price,” the circular posted on its website read.

READ ALSO: Tinubu Unveils African Counter-Terrorism Summit

“ALL eligible BDCs are therefore directed to commence payment of the Naira deposit to the underlisted CBN Naira Deposit Account Numbers from today, Monday, April 22, 2024, and submit confirmation of payment, with other necessary documentations, for disbursement of FX at the respective CBN Branches.”

CBN’s move is coming as the naira is recording a slight depreciation against the dollar after weeks of gains.

In late March, the bank also sold $10,000 to each of the eligible Bureau De Change (BDC) operators in the country at the rate of N1,251/$1.

READ ALSO: Mixed Reactions Trail Video Of Couple’s Customised N200 Notes

Like in the most recent sales, it warned BDCs against breaching terms of the dollar sales, vowing to sanction defaulters “including outright suspension from further participation in the sale”.

The fortunes of the naira have fallen sharply since President Bola Tinubu took over in May. Inflation figures have reached new highs and the cost of living hitting the rooftops.

Nigeria’s currency slid to about N1,900/$ some months ago at the parallel market. But in recent weeks, it has gained against the dollar.

The Nigerian authorities have also doubled down on their crackdown against cryptocurrency platform Binance and illegal BDCs.

On March 1, the CBN revoked the licences of 4,173 BDCs over compliance failures.

Edo Poll: LP Group Hails Tinubu For Adhering To Zoning, Says Party Has Murdered Sleep In The State

19-year-old Convicted For Dating, Impregnating 14-year-old Sister

75-year Old Man Arrested For Defiling 8-year-old Girl In Anambra

Trending

News5 days ago

News5 days ago‘I Can’t Breathe’ – Black Man Cries As US Police Handcuffed, Pinned Him Down Till He Dies [VIDEO]

Metro4 days ago

Metro4 days agoEdo Police Arrest Suspected Cultists Who Allegedly Killed Rival In His Daughter’s Presence

News5 days ago

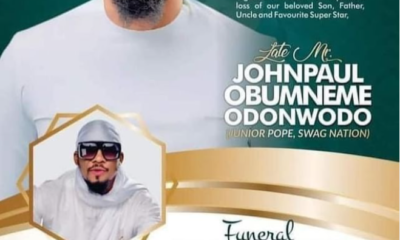

News5 days agoLate Actor, Junior Pope’s Funeral Arrangement Released

News4 days ago

News4 days agoJUST IN: Popular Gospel Singer Is Dead

News5 days ago

News5 days agoOba Of Benin Suspends Six Officials For Posing As Palace Emissaries To Ooni Of Ife

News4 days ago

News4 days agoUNIBEN Ex-deputy VC Is Dead

Politics21 hours ago

Politics21 hours agoWhy Candidate Who Needs Interpreter Can’t Be Edo Gov – Shaibu

Business2 days ago

Business2 days agoCustomers Panic As CBN Bans Opay, Palmpay, Others’ New Accounts

News5 days ago

News5 days agoCurrency Manipulation: EFCC Arrests 34 Currency Speculators In Abuja

News5 days ago

News5 days agoEdo Guber: ‘Which Campaign Council’, Orbih Fumes, Rejects Inclusion