Business

Stock Market Review: FBN Holdings Leads 41 Others As Investors Gain N811bn

FBN Holdings Plc has topped 41 other advanced equities to pull the Nigerian Exchange Ltd.(NGX) market indices up by 1.46 per cent, week-on-week, making investors gain N811 billion.

The market, having opened for four days in the week, following the May Day holiday, had FBN Holdings leading the gainers’ table by 32.68 per cent to close at N27 per share.

Sterling Financial Holdings followed by 27.75 per cent to close at N4.88, while UACN gained 24.60 per cent to close at N15.45 per share.

Julius Berger added 23.76 to close at N72.40, while Flour Mills rose by 20.66 per cent to close at N36.80 per share.

READ ALSO: Teenager Jailed For Life For Murder Of 16-year-old Boy At House Party

Conversely, Nascon Allied Industries Plc led the losers’ table by 17.03 per cent to close at N43.60, University Press trailed by 16.67 per cent to close N2.05 per share.

Neimeth International Pharmaceuticals shed 14.14 per cent to close at N1.70, Berger Paints Plc declined by 9.87 per cent to close at N13.70 and Vitafoam Nigeria lost 9.81 per cent to close at N17 per share.

Meanwhile, 42 equities appreciated in price during the week, higher than 27 equities in the previous week.

Thirty-six equities depreciated in price, lower than 43 in the previous week, while 76 equities remained unchanged, lower than 84 recorded in the previous week.

READ ALSO: Shell Set To Build Gas Pipelines In Oyo

Consequently, the All-Share Index and Market Capitalisation appreciated by 1.46 per cent to close the week at 99,587.25 and N56.323 trillion, respectively, in contrast to 98,152.91 and N55.512 trillion posted last week.

Similarly, all other indices finished higher with the exception of NGX Consumer Goods, NGX Oil and Gas and NGX Industrial Goods which depreciated by 0.26, 0.68 and 0.36 per cent, respectively, while NGX ASeM and NGX Sovereign Bond indices closed flat.

Meanwhile, a total turnover of 1.941 billion shares worth N32.644 billion in 35,807 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 1.839 billion shares, valued at N34.258 billion, that exchanged hands last week in 37,528 deals.

READ ALSO: Officer Who Shot Man Dead During Fuel Queue Tumult Identified — Lagos Police

The financial services industry measured by volume led the activity chart with 1.496 billion shares valued at N22.453 billion traded in 19,225 deals, thus contributing 77.08 and 68.78 per cent to the total equity turnover volume and value, respectively.

The consumer goods industry followed with 144.722 million shares worth N5.063 billion in 4,966 deals.

In the third place was the conglomerates industry, with a turnover of 109.978 million shares worth N1.539 billion in 2,064 deals.

Trading in the top three equities, namely Abbey Mortgage Bank Plc, Guaranty Trust Holdings Company Plc and Access Holdings Plc, measured by volume, accounted for 898.940 million shares worth N14.314 billion in 5,518 deals.

These contributed 46.31 and 43.85 per cent to the total equity turnover volume and value, respectively.

(NAN)

Business

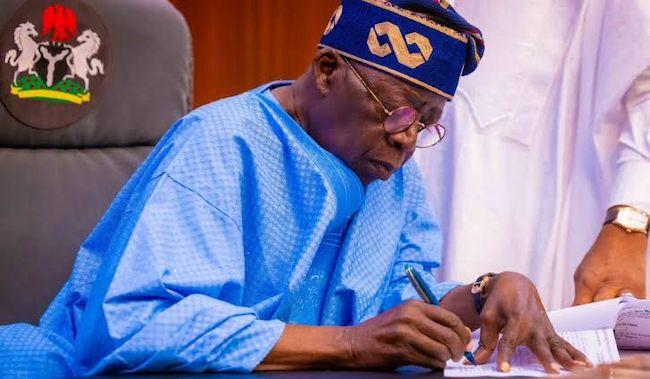

Tinubu Approves 15% Import Duty On Petrol, Diesel

President Bola Tinubu has approved a 15 percent ad-valorem import duty on diesel and premium motor spirit (PMS), also known as petrol.

This was announced in a letter dated October 21, 2025, where the private secretary to the president, Damilotun Aderemi, conveyed Tinubu’s approval to the Federal Inland Revenue Service (FIRS) and the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA).

Tinubu gave his approval, following a request by the FIRS to apply the 15 percent duty on the cost, insurance and freight (CIF) to align import costs to domestic realities.

READ ALSO:UPDATED: Tinubu Reverses Maryam Sanda’s Pardon, Convict To Spend Six Years In Jail

With the approval, the implementation of the import duty will increase a litre of petrol by an estimated N99.72 kobo.

The latest development has led to the Nigerian National Petroleum Company Limited (NNPCL) announcing that it has begun a detailed review of the country’s three petroleum refineries, with a view to bringing them back online.

NNPCL Group Chief Executive Officer (GCEO), Bayo Ojulari, made the announcement in a post on his official X handle on Wednesday night.

READ ALSO:JUST IN: Tinubu Bows To Pressure, Reviews Pardon For Kidnapping, Drug-related Offences

According to Ojulari, one of the options being explored by the NNPCL is to search for technical equity partners to ‘high-grade or repurpose’ the facilities.

Tagged: “Update on Our Refineries”, Ojulari said: “The NNPCL continues to remain optimistic that the refineries will operate efficiently, despite current setbacks.”

It can be recalled that despite spending about $3 billion on revamping the refineries, only the 60,000 barrels per day portion of the facility worked skeletally for just a few months before packing up.

The Warri refinery has remained ineffective weeks after it was gleefully announced to have returned to production, while the one situated in Kaduna State never took off at all.

Business

NNPCL Raises Fuel Price

The Nigerian National Petroleum Company Limited (NNPCL) has increased the pump price of petrol from ₦865 to ₦992 per litre, marking a fresh hike that has sparked widespread concern among motorists and consumers .

As of the time of filing this report, the company has not released any official statement explaining the reason for the sudden adjustment.

During visits to several NNPC retail outlets, The Nation observed fuel attendants recalibrating their pumps to reflect the new price.

READ ALSO:JUST IN: NNPC, NUPRC, NMDPRA Shut As PENGASSAN Begins Strike

At NNPC filling station on Ogunusi road, Ojodu Berger, petrol attendants at the station said they were instructed to change the price to reflect the new rate N992 per litre.

However, checks at Ibafo along the Lagos /Ibadan expressway showed that NNPC outlets still displayed the old price of N875 per litre, although they were not selling to commuters.

Most of the NNPC stations were not dispensing fuel.

Business

CBN Directs Banks To Refund Failed ATM Transactions Within 48hrs

The Central Bank of Nigeria has directed Deposit Money Banks and other financial institutions to refund customers for failed Automated Teller Machine transactions within 48 hours, in a sweeping reform aimed at protecting consumers and restoring confidence in the banking system.

The directive is contained in a draft guideline released by the apex bank on Saturday, titled “Exposure of the Draft Guidelines on the Operations of Automated Teller Machines in Nigeria.”

The document, signed by Musa I. Jimoh, Director of Payments System Policy Department, was circulated to banks, payment service providers, card schemes, and independent ATM deployers, with a call for stakeholder feedback by October 31, 2025.

Under the draft, failed “on-us” transactions, where customers use their own bank’s ATM, must be reversed instantly. If technical glitches prevent immediate reversal, the bank is required to manually refund the customer within 24 hours.

READ ALSO:CBN Sets POS Maximum Transactions In Fresh Guidelines

For “not-on-us” transactions, involving other banks’ ATMs, refunds must be processed within 48 hours.

“Customers must not be made to suffer for failed transactions caused by system errors or network failures,” the circular stressed.

In a significant shift, the CBN mandated banks and ATM acquirers to deploy technology that automatically reverses failed or partial transactions, removing the need for customers to lodge complaints.

Institutions holding customer funds due to failed disbursements must reconcile and return balances immediately.

READ ALSO:FG Records N7.34tn Fiscal Deficit In 11 Months – Report

According to the apex bank, these measures respond to widespread frustration over delayed refunds and poor customer service and form part of a broader effort to enhance consumer protection, improve reliability, and modernise Nigeria’s payment infrastructure in line with global standards.

The guidelines will also overhaul ATM operations nationwide. Banks and card issuers are now required to deploy at least one ATM for every 5,000 active cards, with phased targets of 30% compliance in 2026, 60% in 2027, and full compliance by 2028. Any future deployment, relocation, or decommissioning of ATMs must receive prior approval from the CBN.

To ensure safety, ATMs must be fitted with anti-skimming devices, CCTV cameras, and placed in enclosed or well-lit areas.

Machines are expected to comply with Payment Card Industry Data Security Standards, maintain audit logs, and display functional helpdesk contacts. At least 2% of all ATMs must feature tactile symbols for visually impaired customers.

READ ALSO:CBN, UBA, Others In Benin Given Ultimatum To Remove Their Buildings Or Be Demolished

ATMs are also required to dispense cash before returning cards, allow free PIN changes, issue receipts for all transactions except balance inquiries, display clear transaction fees, dispense only clean banknotes, and provide backup power to reduce downtime.

Downtime must not exceed 72 consecutive hours, after which operators must inform the public of the cause and expected restoration time.

The CBN will enforce compliance through regular audits, on-site inspections, and monthly reports from ATM operators detailing deployments and locations. Defaulting institutions risk sanctions, though fines were not specified.

READ ALSO:Nigeria’s External Reserves Increase As CBN Releases 2024 Financial Results

The apex bank explained that the overhaul was necessary due to rising complaints about failed transactions, cyber fraud, and declining service quality, noting that “the goal is to build a payments system that works seamlessly for everyone, urban and rural users alike.”

Nigeria’s electronic payments landscape has grown rapidly in recent years, with 200 million cardholders and rising reliance on digital banking, but network failures, poor infrastructure, and delayed reversals have continued to undermine confidence.

The fresh guidelines, coming eight months after a revision of ATM fees, are expected to streamline service delivery, enhance transaction security, and hold banks accountable. Stakeholders are invited to submit feedback ahead of the final policy adoption, which could take effect before the end of the year.

News5 days ago

News5 days agoJUST IN: Reps Make U-turn, Reconvene For Plenary Wednesday

Metro5 days ago

Metro5 days agoFamily Declares 45-year-old Hairdresser Missing In Ibeju-Lekki

News3 days ago

News3 days agoEdo Sets Up Special Court To Prosecute Govt-owned Land Encroachers

Metro5 days ago

Metro5 days agoPolice Arrest Suspected Militant, Hunt Fleeing Monarch In A’Ibom

News5 days ago

News5 days agoTinubu Directs Education Minister To End ASUU Strike

News5 days ago

News5 days agoOPINION: US And FFK’s Drum Of War

News5 days ago

News5 days agoDSS Dismisses 115 Personnel, Warns Against Impostors

Headline3 days ago

Headline3 days agoMexican President Pledges Tougher Sexual‑harassment Laws After Being Groped

News5 days ago

News5 days agoImmigration, Natasha Trade Words Over Passport Drama

Metro4 days ago

Metro4 days agoAmotekun Arrests 16 Illegal Immigrants, 22 Others In Ondo