Business

Tinubu Okays Payment Of N3.3tn Power Sector Debts, Gencos, Gas Producers To Get N1.3tn, $1.3bn

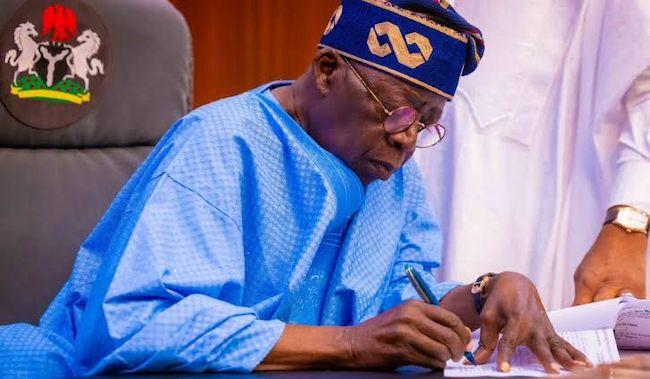

As part of the measures to tackle incessant power outages in the country, President Bola Tinubu has approved the gradual payments of power sector debts estimated at over N3.3tn.

Consequently, about N1.3tn owed power generating companies by the Federal Government will be paid via cash injections and promissory notes, while about $1.3bn (N1.994tn using the current official closing rate) owed to gas companies will be paid via cash and future royalties.

Already, the Federal Government has commenced payment of the cash part of the N1.3tn debt owed Gencos and concluded plans to settle the second part via promissory notes within a timeframe ranging from two to five years.

The Minister of Power, Chief Adebayo Adelabu, disclosed this at the 8th Africa Energy Marketplace held on Thursday in Abuja.

The event was themed, “Towards Nigeria ‘s Sustainable Energy Future: Policy, Regulation and Investment – A Policy Dialogue for the National Integrated Electricity Policy and Strategic Implementation Plan.”

The government is subsidising electricity by shouldering the gas payment component for power generation.

But over the years this payment has not been steady, leading to humongous gas debts as well as indebtedness to power generation companies.

Disclosing the solution to the issue, Adelabu stated that Tinubu had directed the Minister of Finance to make immediate payment of N130bn from the Gas Stabilisation Fund, being part of the N1.3tn owed Gencos. The rest will be spread over some time.

The power minister further explained that the payment of $1.3bn legacy debts owed gas producers would be sourced from future royalties and income streams in the gas sub-sector, a solution deemed satisfactory by the gas-supplying companies.

He said, “It is true that I mentioned that Mr President has approved the submission of the Hon. Minister of State Petroleum (Gas) to defray the outstanding debts owed to the gas supplying companies to the power sector operators.

“The payments will be in parts. We have the legacy debt and we have the current debt. For the current debt, approval has been given for a cash payment of about N130bn from the Gas Stabilisation Fund, which the Federal Ministry of Finance will pay, if not already paid.

“The payment for the legacy debts is going to be made from future royalties and streams of income in the gas sub-sector which is quite satisfactory to the gas supply companies. The last amount that was being quoted was $1.3bn, which we believe will go a long way to encourage these gas companies to enter into firm supplying contracts with the power generating companies.”

He further explained, “The situation we are in now is on a best endeavour model, which means there is no firm contract between the gas companies and the majority of the power generating companies. The day they can supply gas, they will, the day they cannot supply gas, there is no penalty. But once there is a firm contract they will be under contractual obligations to supply gas to these power-generating companies so that we can have a consistent power generation.

READ ALSO: B-I-Z-A-R-R-E! Man Missing For 26 Years Found Alive In Neighbour’s House

“So, that is the situation and the model we want to adopt for the gas segment of the power sector value chain.”

Continuing, the minister voiced concerns about the lack of policy coordination in the power sector, assuring the sector however that the current administration was committed to eliminating all bottlenecks in the industry.

Adelabu also justified the Band A tariff hike, saying that only 15 per cent of Nigerians were affected.

He disclosed that without proper billing, the power reform agenda of the present administration might not be achieved.

The minister also revealed that with the generation of 700MW from the Zungeru hydroelectric power plant, the Nigerian Electricity Supply Industry has recorded a new feat of 5,000MW.

Regarding the power-generating companies, he noted that the president had approved cash injections and promissory notes, providing significant encouragement to the companies and incentivising them to further invest in generation capacity.

The minister explained, “For the power generating companies, the debt is put at N1.3tn. I can also tell you that we have the consent of Mr. President to pay on the condition of settling the reconciliation of these debts between the government and the power-generating companies.

“And this, we have successfully done, and it is being signed off by both parties now. The majority have signed off, and we are engaging others to ensure we have a 100 per cent sign-off from the power-generating companies. And the modalities for paying this will be in two ways. Of course, there will be a cash injection, immediate cash injection.”

He added, “Government is not buoyant enough to pay down N1.3tn once and for all in terms of cash. But there is a fraction of it that will be paid in cash while the remaining fraction will be settled through a guaranteed debt instrument, preferably a promissory note. That is more like a comfort to these companies that in the next two, three to five years, the government is ready to defray this debt finally. This will go a long way to encourage the power generating companies to incentivise them to even invest more in generation so that you can know our generating output from the level it is now to a higher level because as I mentioned, there is an opportunity for demand locally and across the border. And that is a source of foreign exchange earnings for the country.”

Adelabu, who said the supply of electricity had increased due to the implementation of the Electricity Act 2023 and the Band A tariff, added that the Discos were requesting more load for onward distribution to their customers.

The power minister had stated in February that Nigeria must begin to move towards a cost-effective tariff model, as he revealed that the country was indebted to the tune of N1.3tn to electricity generating companies, while the debt to gas companies was $1.3bn at the time.

READ ALSO: JUST IN: NCC Suspends Issuance Of Virtual Operators Licence, Two Others

On March 1, 2024, The PUNCH reported that the Federal Government had paid $120m out of the $1.3bn indebtedness to gas companies for the supply of gas to run gas-fired power plants across the country.

Nigeria is currently suffering from low power supply because gas supply has been reduced after some operators stopped supplying the commodity to power-generating companies due to the indebtedness of the Gencos to gas-producing firms.

Adelabu recently revealed that the crash in power generation and attendant poor supply in January was because gas suppliers stopped supplying gas for the generation of electricity due to the indebtedness of the sector to gas producers.

Nigeria gets more than 70 per cent of its electricity from thermal power plants that run on gas. The remaining amount of electricity comes from hydropower-generating plants.

Speaking at the 7th Nigeria International Energy Summit in Abuja in March, the Director, Decade of Gas Secretariat, Ed Ubong, expressed excitement that the Federal Government had cleared $120m out of the $1.3bn gas debts.

The Decade of Gas Secretariat is under the Federal Ministry of Petroleum Resources (Gas). The Federal Government is subsidising electricity by paying for the gas used in generating power, as Nigerian power users are currently not paying the exact amount for electricity.

“As of last year, that (gas debts) was about $1.3bn, depending on how you add up the numbers. But I am pleased that between October and the end of January, the government has paid over $120m to offset some of that money,” Ubong stated.

Meanwhile, the African Development Bank is set to seek board approval for a $1bn policy-based operation with a significant energy component to support the reforms initiated by the new Electricity Act, of 2023. This funding aims to actualise the outcomes expected from the NIEP-SIP and attract sustainable investments.

The Vice President, Power, Energy, Climate and Green Growth Complex at the AfDB, Dr. Kevin K. Kariuki, disclosed this at the African Energy Market Place held in Abuja on Thursday.

The AEMP special edition focuses on the “National Integrated Electricity Policy and Strategic Implementation Plan,” reflecting the Federal Government of Nigeria’s ongoing reforms to enhance the power sector’s effectiveness, efficiency, and productivity.

Kariuki emphasised the alignment of the event with the bank’s “Light Up and Power Africa” initiative, which is part of its High 5 development strategy for the continent.

With Nigeria holding the highest electricity access deficit globally, the success of the reforms, including tariff adjustments and regulatory improvements, is crucial.

Kariuki highlighted the need to utilise over 13,000,000MW of installed capacity, improve transmission, reduce supply interruptions, and achieve financial viability across the power sector.

READ ALSO: Harry & Meghan: Outrage As UK Journalist Says Nigerians Are Nazis

The VP noted that the success of the Electricity Act would hinge on its ability to rapidly provide quality electricity access to all Nigerians, thereby addressing the country’s status as having the world’s highest electricity access deficit.

“With 90m Nigerians lacking electricity, the reforms are poised to utilize over 13 Gigawatt of installed capacity, improve transmission, reduce supply interruptions, and enhance the financial viability of the power sector.

“No economy can grow in the dark,” the VP stated, emphasising the critical role of reliable power in economic growth, industrialisation, and competitiveness.

The AfDB’s investments include the $256.2m Nigeria Transmission Expansion Project and the $200m Nigeria Electrification Project, which will construct transmission lines, substations, and mini-grids.

Furthermore, the AfDB is financing a study to explore the deployment of Battery Energy Storage Systems to stabilise the grid and promote renewable energy.

Nigeria’s participation in the $20bn Desert to Power initiative to generate 10,000MW of solar power in the Sahel region, was also mentioned as a key step toward increasing renewable energy in the country.

The AfDB boss expressed confidence that the AfDB’s multi-faceted approach, including policy support, infrastructure financing, and capacity building, would ensure a viable and sustainable power sector in Nigeria.

He called for a collaborative spirit among governments, the private sector, and partners to craft policy recommendations that would lead Nigeria to universal access by 2030 and zero carbon emissions by 2060.

Obi, Nnaji speak

Meanwhile, a former Minister of Power, Barth Nnaji, and the presidential candidate of the Labour Party in the 2023 general election, Peter Obi, have advised the Federal Government to declare an emergency in the power sector.

The duo spoke at the inaugural Dele Momodu Leadership Lecture held Thursday at the Nigerian Institute of International Affairs, Lagos.

Nnaji also called a super grid to end the incessant collapse of the national power grid.

Nnaji, who was the Guest Speaker at the event, said the current national grid kept collapsing because it was not well structured.

Recall that the national grid collapsed more than two times in the first quarter of 2024, plunging Nigerians into darkness.

READ ALSO: NDIC Obtains Order To Wind Down 96 Microfinance, Mortgage Banks

Touching on the theme, ‘Politics of Energy: The Way Forward’, Nnaji stated that the power ministry under his watch had years ago sought the approval of the Federal Executive Council to build what he called a super grid, a 765KV network that would rise above the existing 330 KV.

According to him, the 765KV is large enough to take power from high-capacity plants like the Manbilla Power Plant.

He revealed that the country has yet to have a transmission network that could wheel power from Manbilla when completed.

Nnaji explained, “Another critical area in Nigeria’s power sector is the transmission network. I believe that having the national grid the way we have it still going to be a problem. First, it is not robust, and it is not well structured. My advocacy is for multiple grids, autonomous but connected to the national grid. So that the national grid still operates, and will be more robust. It will begin to cure the regular incident of the failure of the national grid.

“When I was in government, we asked the Federal Executive Council to approve what we called a super grid, a 765KV network that will kind of rise above the existing 330KV network. Right now, Nigeria has 330KV and 132KV, but none of them is robust. But the 765KV network will be very important to take power from power plants such as the Manbilla that has been on for a while. Over 10,000 megawatts of power will come from Manbilla. So, the question is, which transmission infrastructure will take that power suppose that we finish it now? We need a super grid to take that power so that Nigeria can take power from various plants and transmit it to wherever we want it.”

The Chairman of Geometric Power commended Adelabu for reviving the super grid project.

“I am happy that the current Minister of Power, Adebayo Adelabu is reviving this super grid, and I think we have to spot him on that because it is a very important project. Our conception was that it would be done in sections by various companies so that it would not be one of these white elephant projects,” he said.

Nnaji expressed concern that still suffers gas shortages in the power sector despite its abundant natural gas reserves.

He wondered why the nation keeps exporting gas that is not yet enough for domestic use, calling for a state of emergency in the gas sector.

“A state of emergency needs to be declared in the gas sector. The declaration will save the power sector and allow the government and other stakeholders to address fundamental issues in the gas sector in a robust manner. The issue will include how to strike a healthy balance between producing gas for export and gas for domestic consumption,” he noted.

The former minister regretted that the Federal Government has not executed a power project since almost nine years ago, adding that some ongoing ones were abandoned by successive administrations.

READ ALSO: JUST IN: Convicted Kidnap Kingpin Evans Re-arraigned, Opts For Plea Bargain

“The development of the power sector has also been stalled for years because of the suspension of what we developed that time called partial risk guarantee to support power purchase agreement. A government that is buying power has to issue a power purchase agreement to the producer of power, and the agreement must be guaranteed.

“We were able to do this but only one project was completed, that is the Azura-Edo project, a 461MW power plant; and then it was stopped nine years ago. The outcome is that for this period, Nigeria has not commissioned a government-sponsored power project. And the former President of Ghana said you need to be adding over 12 per cent of energy to your country yearly. If you want to grow the economy, that’s what you need. If in nine years, we have not added anything, you can imagine. I want to tell you that because of that partial risk guarantee, four or five major projects had been fully developed but stopped. I encourage the government to reawaken those projects. They are very critical,” Nnaji added.

Earlier in his speech, former Ghanaian President, John Mahama, disclosed that Ghana had been able to power generation capacity to 5454MW, saying the country had been exporting electricity to other neighbouring countries in the West of Africa like Togo, Benin Republic and others.

Mahama remarked that Nigeria could achieve energy security for itself and other African countries, adding that a nation must plan because the energy demand will keep rising by 10 per cent yearly.

On energy transition, Mahama urged African leaders to decide their modalities with Nigeria showing leadership.

Speaking, the presidential candidate of the Labour Party, Peter Obi, posited, “When the former president of Ghana said they are generating and distributing 5,000MW, I was wondering; Ghana with one-seventh of our population generates and distributes more than us. We must declare an emergency in power. The way to go is very simple, we need embedded power, with gas supply. We have gas all over the place. Yes, we need the dollars, but I think making Nigeria more productive and pulling our people out of poverty, especially in the north, will give us far more value and dollars than focusing on exports. I think it is time to declare an emergency. We should encourage an embedded power”.

The organiser of the lecture and publisher of Ovation Magazine, Dele Momodu, maintained that Nigerians pay for electricity without getting the same being delivered to their homes.

In his welcome address, the veteran journalist wondered why the electricity challenges in Nigeria have defied all solutions.

“Why can’t we stop this endless energy crisis in Nigeria? We pay for electricity, but it can’t be delivered. The more we pay, the less we get,” he said.

Momodu lamented that the humongous money invested in the power sector over the years has not yielded any result.

This, he stated, informed his decision to organise the public lecture in commemoration of his 64th birthday.

Others at the lecture were Governor Ademola Adeleke of Osun State; former Governor Rabiu Kwankwanso of Kano State; former Governor Donald Duke of Cross River; the Ooni of Ife, Oba Adeyeye Ogunwusi and others.

PUNCH

Business

14 Nigerian Banks Yet To Meet CBN’s Recapitalization Deadline [FULL LIST]

With barely eleven weeks to the Central Bank of Nigeria’s (CBN) recapitalisation deadline, fourteen banks are yet to meet the requirement.

This comes as DAILY POST reports that 19 Nigerian banks had met the apex bank’s recapitalisation requirements as of January 6, 2025.

The banks that have complied with the CBN’s minimum capital benchmark include Access Bank, Fidelity Bank, First Bank, GTBank (GTCO), UBA, Zenith Bank, and twelve others.

READ ALSO:CBN Revokes Licences Of Aso Savings, Union Homes As NDIC Begins Deposit Payments

However, as of the time of filing this report, fourteen Nigerian banks are yet to comply.

The banks that have not met the apex bank’s recapitalisation requirement include First City Monument Bank (FCMB), Unity Bank, Keystone Bank, Union Bank (Titan), Taj Bank, Standard Chartered Bank, Parallex Bank, and SunTrust Bank.

Others are FBH Merchant Bank, Rand Merchant Bank, Coronation Merchant Bank, Alternative Bank, and other non-interest banks.

Meanwhile, financial experts have predicted possible mergers and acquisitions ahead of the March 31 deadline.

Business

Naira Extends Appreciation Against US Dollar

The naira extended appreciation against the dollar at the official foreign exchange market on Wednesday.

The Central Bank of Nigeria’s data showed that the Naira further firmed up on Wednesday to N1,418.26 per dollar, up from N1,419.07 exchanged on Tuesday.

Wednesday’s uptrend represents a slight N0.80 gain against the dollar on a day-to-day basis.

READ ALSO:Naira Records Significant Appreciation Against US Dollar

Meanwhile, at the black market, the Naira remained unchanged against the dollar at N1,480 per dollar on Wednesday, the same rate recorded the previous day.

The development comes as Nigeria’s foreign reserves further rose to $45.62 billion as of January 6th, 2026.

Recall that on Tuesday, the Naira posted a N10.24 gain against the dollar.

Business

Naira Continues Gain Against US Dollar As Nigeria’s Foreign Reserves Climb To $45.57bn

The Naira appreciated further against the United States Dollar at the official foreign exchange market, beginning the week on a good note.

Central Bank of Nigeria data showed that the Naira strengthened on Monday to N1,429.31 per dollar, up from N1,430.85 exchanged on Friday, 2 January 2026.

This means that the Naira gained N1.56 against the dollar on Monday when compared to N1,430.85 last week Friday.

READ ALSO:Naira Records Significant Appreciation Against US Dollar

At the black market, the Naira dropped by N5 to N1480 per dollar on Monday, down from N1475 traded Friday.

The development comes as the country’s external reserves rose to $45.57 billion as of Friday last week.

News5 days ago

News5 days agoWhat I Saw After A Lady Undressed Herself — Pastor Adeboye

Headline5 days ago

Headline5 days agoPROPHECY: Primate Ayodele Reveals Trump’s Plot Against Tinubu

Metro5 days ago

Metro5 days agoArmed Robbers Shot PoS Operator To Death In Edo

Business3 days ago

Business3 days agoNNPCL Reduces Fuel Price Again

Metro4 days ago

Metro4 days agoAAU Disowns Students Over Protest

Metro5 days ago

Metro5 days agoJoint Task Force Kills 23 Bandits Fleeing Kano After Attacks

Politics5 days ago

Politics5 days ago2027: Rivers APC Pledges To Follow Wike’s Instructions

Metro4 days ago

Metro4 days agoEdo: Suspected Kidnappers Kill Victim, Hold On To Elder Brother

Headline2 days ago

Headline2 days agoRussia Deploys Navy To Guard Venezuelan Oil Tanker Chased By US In Atlantic

Metro4 days ago

Metro4 days agoNine Soldiers Feared Dead In Borno IED Explosion