Business

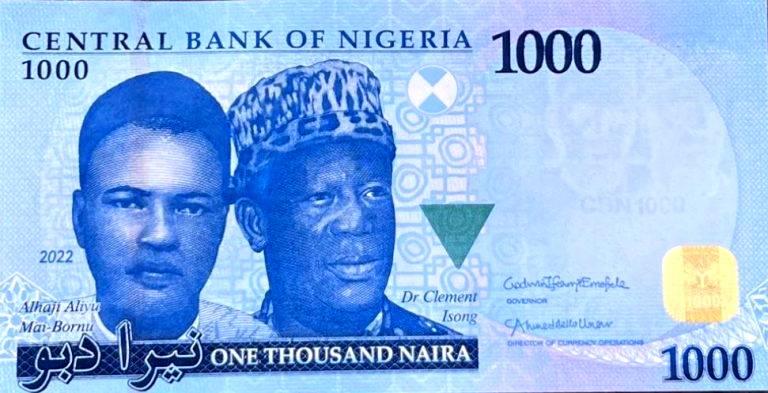

[UPDATED] Cash Withdrawal: CBN Revises Individuals Limits To N500,000 Weekly

The Central Bank of Nigeria, CBN had revised the cash withdrawal limits for individuals to N500,000 weekly from N100,000 weekly across all payment channels.

The apex bank also revised the cash withdrawal limit for corporates to N5 million weekly from N500,000 weekly.

CBN disclosed this today in a letter to all Deposits Money Banks and other financial institutions, Payment Service Banks, Primary Mortgage Banks, Microfinance Banks, and Mobile Money Operators and agents signed by Director of Banking Supervision, CBN, Haruna Mustapha.

According to the regulator, the directive supersede that of December 6, 2022 and would take effect nationwide from January 9, 2023.

READ ALSO: CBN Bows To Pressure, Raises Weekly Withdrawal Limits

The Circular stated: ”Following our circular BSD/DIR/PUB/LAB/015/069 dated December 6, 2022 on the above subject and based on feedback received from stakeholders, the CBN hereby makes the following reviews: The maximum weekly limit for cash withdrawal across all channels by Individuals and corporate organizations shall be N500,000and N5 000,000 respectively.

” In competing circumstances where cash withdrawal above the limits in (1) above is required for legitimate purposes, such requests shall be subject to a processing fee of 3 percent and 5 percent for individuals and corporate organizations,

respectively.

“Further to (2) above, the financial institution shall obtain the following information from the customer, at the minimum, and upload same on the CBN portal created for the purpose:

“Valid means of identification of the payee (National ID, International Passport, or Driver’s License) Bank Verification Number (BVN) of the payee Tax identification Number (TIN) of both the payee and the payer.

” Approval in waiting by the MD/CEO of the financial institution authorizing the withdrawal.

“Third party cheques above N100, 000 shall not be eligible for payment over the counter, while the extant limit of N10 million on clearing cheques still subsist.

” Kindly further note the following:

Monthly returns on cash withdrawal transactions above the specified limits should be rendered to the Banking Supervision, Other Financial Institutions Supervision and Payments System Management Departments as applicable.

“Compliance with extant AML/CFT regulations relating to KYC, on-going customer due diligence, currency and suspicious transaction reporting etc. |g mandatory in all circumstances.

“Customers should be encouraged to use alternative channels (internet banking, mobile banking apps, USSD, cards/POS, eNaira, etc ) to conduct their banking transactions.

READ ALSO: Withdrawal Limit: CBN Writes Reps, Says Emefiele Having Health Challenges

“Bank and Mobile Money Agents are important participants in the financial system, enabling access to financial services in underserved and rural communities They will continue to perform these strategic functions, in line with existing regulations governing their actvities.

“The CBN recognizes the vital role that cash plays in supporting underserved and rural communities and will ensure an inclusive approach as it implements the transition to a more cash-less society.

“All banks and OFIs are to note that aiding and abetting the circumvention of this policy will attract severe sanctions.

“The above directives supersede that of December 6, 2022 and take effect nationwide from January 9, 2023.

Business

Report Any MRS Filling Stations Selling Fuel Above N739 Per Liter — Dangote Refinery To Nigerians

Dangote Refinery has urged Nigerians to report any MRS filling station outlets nationwide selling fuel above the N739 per liter announced price.

The company disclosed this in a statement on Sunday.

The refinery insisted that its petrol being at retail outlets remain N739 per liter while the gantry price is N699.

It further called on other filling station owners to patronize its refined petroleum products at the N699 rate.

“We also call on other petrol station operators to patronize our products so that the benefits of this price reduction can be passed on to Nigerians across all outlets, ensuring broad-based relief and a more stable downstream market.”

READ ALSO:Dangote Sugar Announces South New CEO

Recall that Aliko Dangote, the president of Dangote Refinery, had pegged the retail price of his petrol at a maximum of N740.

DAILY POST reports that MRS filling and other filling stations had reduced fuel prices to between N739 and N912 per liter in Abuja.

However, reports emerged that some MRS filling stations were selling above the N739 per liter announced price benchmark.

Business

Naira Records Significant Appreciation Against US Dollar

The Naira recorded significant appreciation against the United States dollar on Monday at the official foreign exchange market to begin the week ahead of Yuletide on a good note.

The Central Bank of Nigeria’s data showed that the Naira strengthened to N1,456.56 per dollar on Monday, up from N1,464.49 traded on Friday last week, 19th December 2025.

This means that the Naira gained N7.93 against the dollar when compared with the N1,464.49 was exchanged as of Friday, December 19, 2025. DAILY POST reports that Monday’s gain at the official FX market is the first since December 15th.

READ ALSO:

Meanwhile, at the black market, the Naira remained stable at N1500 per dollar on Monday, according to multiple Bureau De Change operators in Wuse Zone 4, Abuja.

The development comes as the country’s external reserves stood at $44.66 billion as of last week Friday.

Business

CBN Revokes Licences Of Aso Savings, Union Homes As NDIC Begins Deposit Payments

The Central Bank of Nigeria (CBN) has revoked the operating licences of Aso Savings and Loans Plc and Union Homes Savings and Loans Plc, citing persistent regulatory infractions and deepening financial distress in the two primary mortgage banks.

The revocation, which took effect on December 15, 2025, was carried out under Section 12 of the Banks and Other Financial Institutions Act (BOFIA) 2020 and Section 7.3 of the Revised Guidelines for Mortgage Banks in Nigeria, the CBN said in a statement issued on Tuesday.

According to the apex bank, the affected institutions failed to meet minimum paid-up share capital requirements, had insufficient assets to cover their liabilities, recorded capital adequacy ratios below prudential thresholds, and consistently breached regulatory directives.

“The CBN remains committed to its core mandate of ensuring financial system stability,” a statement, signed by the apex bank’s Acting Director, Corporate Communications, Mrs Hakama Sidi Ali said.

READ ALSO:CBN Directs Nigerian Banks To Withdraw Misleading Advertisement

Following the licence revocation, the Nigeria Deposit Insurance Corporation (NDIC) was appointed liquidator of the defunct banks in line with the law.

The Corporation said it has commenced the liquidation process and begun verification and payment of insured deposits to customers.

Under the deposit insurance framework, depositors are entitled to receive up to two million naira per depositor, with payments made through BVN-linked alternate bank accounts.

Depositors with balances above the insured limit will receive the initial two million naira while the remaining sums will be paid as liquidation dividends after the realisation of the banks’ assets and recovery of outstanding loans.

READ ALSO:CBN Issues Directive Clarifying Holding Companies’ Minimum Capital

The NDIC said depositors may submit claims either online or physically at designated branches of the closed banks, while creditors will be paid after all depositors have been fully settled, in accordance with statutory provisions.

The two mortgage banks have faced prolonged operational challenges, including depositor complaints, governance concerns, and delisting from the Nigerian Exchange (NGX) in 2024 for failure to submit audited financial statements for more than six years.

The CBN assured the public that the action was taken to strengthen the mortgage banking sub-sector and protect depositors, adding that banks whose licences have not been revoked remain safe and sound.

This means the two financial institutions can no longer operate as licensed financial institutions.

News2 days ago

News2 days agoPHOTOS: New Era In Furupagha-Ebijaw As Okpururu 1 Receives Staff Of Office

Metro4 days ago

Metro4 days agoJUST IN: Former Edo Information Commissioner Is Dead

News1 day ago

News1 day agoUBTH CMD Marks 120 Days In Office, Expresses Commitment To Providing Conducive Working Environment

News2 days ago

News2 days agoFG Declares Public Holidays For Christmas, New Year Celebrations

News5 days ago

News5 days agoCoordinator, Edo First Lady Office, Majority Leader, Rights Lawyer, Others Bag 2025 Leadership Award

News5 days ago

News5 days ago[OPINION] Tinubu: Ade Ori Okin Befits KWAM 1, Not Awujale Crown

Metro4 days ago

Metro4 days agoShe Grabs, Pulls My Manhood Anytime We Fight — Husband

News2 days ago

News2 days agoOPINION: Gumi And His Terrorists

News4 days ago

News4 days agoMy Wife Dented My Image, Took Our Marital Crises To Radio Stations — Husband

News2 days ago

News2 days agoOPINION: My Man Of The Season