Business

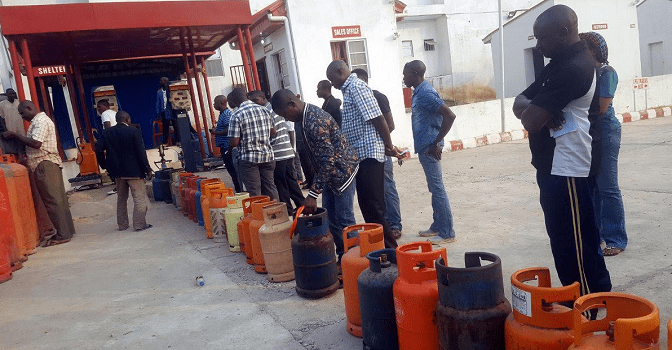

Why Cooking Gas Prices Are Rising – Marketers

Nigerians have expressed concern over another hike in the price of cooking gas, with a kilogram now selling for as high as ₦2,000 in some parts of the country.

According to gas marketers, the increase has little to do with any official price adjustment.

The Nigerian Association of Liquefied Petroleum Gas Marketers has attributed the surge in cooking gas price to temporary supply disruptions and market exploitation by some operators.

The association’s National President, Oladapo Olatunbosun, stated this on Wednesday while speaking on Channels Television’s The Morning Brief.

He said there had been no official increment in the price of Liquefied Petroleum Gas, blaming the hike on opportunistic marketers taking advantage of supply gaps caused by the recent strike by the Petroleum and Natural Gas Senior Staff Association of Nigeria against the Dangote Refinery.

READ ALSO:Dangote Refinery Dispute: PENGASSAN Suspends Strike After FG Intervention

He said, “I sympathise with Nigerians as the President of NALPGAM because we never intended to have a situation like this.

“I must say it categorically that prices of cooking gas have not gone up. No increment has been done officially.

“What is happening is that some marketers are taking advantage of the shortage in supply and the market forces that have increased demand. They are cashing up to make good money, which is wrong.

“We frown at this as an Association, and I’m happy that by the grace of God, normalcy will return in the next few days.”

Channels TV reports that prices of LPG, which previously averaged between ₦1,200 and ₦1,300 per kilogram, have in recent days risen to between ₦1,700 and ₦2,000, and as high as ₦3,000 in some areas.

READ ALSO:Dangote Hits Out At PENGASSAN, Says Union ‘Serial Saboteurs, Serving Oligarchs’

Olatunbosun explained that the current situation was artificial and temporary, noting that normal supply and pricing were expected to stabilise in the coming days.

He said the problem began when Dangote Refinery, which had previously improved domestic supply by eliminating middlemen, embarked on maintenance and renovation that slowed truck loading.

He stated, “Before the strike, when you load from Dangote, he sends out about 50 trucks per day, which is good because it served the South West and some part of the North well, and if you add it to what you get from Apapa, and other depots in Lagos, because they also source their products from IOCs and other producers.

“Dangote came in with his own strategy, selling directly to offtakers. That made importation not to be attractive. You won’t be able to compete if you import because you are likely to incur losses.

“But at a time, Dangote also commenced renovation/maintenance, which affected loading. Trucks started spending like 14 days at Dangote yard before they could get products.

“So, marketers switched to Apapa, and nobody felt the impact.”

READ ALSO:Fuel Scarcity Looms As PENGASSAN Stops Gas, Crude Supply To Dangote Refinery

According to him, while the refinery was undergoing maintenance, marketers turned to Apapa depots for supply, but the subsequent PENGASSAN strike disrupted vessel discharges and inspections, drying up stocks.

“When Dangote finished renovation, and we were about to commence full loading, the strike came in. Although Dangote didn’t stop production, everybody had rushed to Apapa, and it was now out of product, and all the depots there were dry.

“The only vessel that came in from NOJ axes was meant to supply three depots could not berth because of the strike. And even when it berthed, the officers to inspect it weren’t on the ground because of the strike, and that caused about five days’ loss, and the real impact of the backlog became obvious.

“Now that the strike is off, the product has been discharged, and they are trucking out. But because everywhere is dry and the South West is the only place that consumes the largest amount of LPG in Nigeria,” he added.

He said the backlog from the delay worsened the scarcity, particularly in the South-West, which he said consumes the largest share of LPG in Nigeria.

Olatunbosun added that the country’s national LPG consumption had increased from about 1.2 million metric tonnes three years ago to nearly two million metric tonnes, further straining supply whenever there were disruptions.

READ ALSO:Over 600 Pilgrims Hospitalised After Chlorine Gas Leaked In Iraq

He advised consumers to buy directly from registered gas plants, noting that those buying through middlemen or third parties were likely to pay inflated prices.

Olatunbosun said, “If you buy a product from a third party, fourth party, the chain has been extended, then the price is going up, which is quite illegal. Just like you buy petrol on the road for people who carry kegs, they will sell it at exorbitant prices. So if you go to gas plants, the price you can buy today is 1,300 maximum.

“People who are claiming to buy gas at 1700 did not disclose the source of their purchase. If you are buying from a third or fourth party, then catch on, and the prices increase.

“But if you buy from gas bottling plants, my members, you will not buy as high as that. Average price within my members in Southwest today is between N1000 to maximum of N1300, depending on the location and the kind of overhead they incur to get the gas into the plant. Before this artificial scarcity, the prices were being sold at 1,050 in some places, N950. So the highest you could get from a gas plant today is N1300, depending on if it’s a very remote area.”

The NALPGAM president assured Nigerians that the association was working with relevant authorities to stabilise supply.

Business

Naira Continues Gain Against US Dollar As Nigeria’s Foreign Reserves Climb To $45.57bn

The Naira appreciated further against the United States Dollar at the official foreign exchange market, beginning the week on a good note.

Central Bank of Nigeria data showed that the Naira strengthened on Monday to N1,429.31 per dollar, up from N1,430.85 exchanged on Friday, 2 January 2026.

This means that the Naira gained N1.56 against the dollar on Monday when compared to N1,430.85 last week Friday.

READ ALSO:Naira Records Significant Appreciation Against US Dollar

At the black market, the Naira dropped by N5 to N1480 per dollar on Monday, down from N1475 traded Friday.

The development comes as the country’s external reserves rose to $45.57 billion as of Friday last week.

Business

NNPCL Reduces Fuel Price Again

The Nigerian National Petroleum Company Limited, NNPCL, has again reduced its premium motor spirit price.

In Abuja, on Monday morning, it was gathered that NNPCL retail outlets have reduced their fuel price to N815 per liter, down from N835.

This means that the NNPCL filling stations cut their price by N20.

The fresh price has been implemented at NNPCL filling stations in Wuse Zone 6 and 4 Abuja, Keffi-Abuja Road, and Kubwa Expressway.

READ ALSO:Fuel Price Cut: NNPCL GCEO Ojulari Reveals Biggest Beneficiaries

An NNPCL filling station attendant, who preferred anonymity, told DAILY POST that the new price was implemented on Sunday evening.

However, the N815 per liter is N79 higher than the N739 per liter sold at Dangote Refinery’s backed MRS filling stations nationwide.

DAILY POST recalls that NNPCL on December 19, 2025, cut its price of petrol by N80 to N835 amid a price war among players in the country’s oil downstream sector triggered by Dangote Refinery’s gantry price reduction to N699 per liter.

Business

NNPCL Announces Restoration Of Escravos-Lagos Pipeline

The Nigerian National Petroleum Company Limited (NNPCL) has announced the complete restoration of the Escravos-Lagos Pipeline System (ELPS) in Warri, Delta State, following the recent explosion on the asset.

The chief corporate communications officer (CCCO) of the nation’s oil company, Andy Odeh, in a statement, said that the pipeline is fully operational, reiterating the company’s resilience and commitment to energy security.

“NNPC Limited is pleased to announce the successful restoration of the Escravos-Lagos Pipeline System (ELPS) in Warri, Delta State.

READ ALSO:Fuel Price Cut: NNPCL GCEO Ojulari Reveals Biggest Beneficiaries

“Following the unexpected explosion on December 10, 2025, we immediately activated our emergency response, deployed coordinated containment measures, and worked tirelessly with multidisciplinary teams to ensure the damaged section was repaired, pressure-tested, and safely recommissioned.

“Today, the pipeline is fully operational, reaffirming our resilience and commitment to energy security. This achievement was made possible through the unwavering support of our host communities, the guidance of regulators, the vigilance of security agencies, and the dedication of our partners and staff.

“Together, we turned a challenging moment into a success story, restoring operations in record time while upholding the highest standards of safety and environmental stewardship.

“As we move forward, NNPC Limited remains steadfast in its pledge to protect our environment, safeguard our communities, and maintain the integrity and reliability of our assets. Thank you for your trust as we continue to power progress for Nigeria and beyond,” the statement read.

Headline3 days ago

Headline3 days agoPROPHECY: Primate Ayodele Reveals Trump’s Plot Against Tinubu

News3 days ago

News3 days agoWhat I Saw After A Lady Undressed Herself — Pastor Adeboye

Metro3 days ago

Metro3 days agoArmed Robbers Shot PoS Operator To Death In Edo

Metro3 days ago

Metro3 days agoGunmen Demand N200m Ransom For Kidnapped Brothers In Edo

Metro3 days ago

Metro3 days agoJoint Task Force Kills 23 Bandits Fleeing Kano After Attacks

Politics3 days ago

Politics3 days agoWhy Kano Governor Postponed Formal Defection To APC

Politics3 days ago

Politics3 days ago2027: Rivers APC Pledges To Follow Wike’s Instructions

Metro2 days ago

Metro2 days agoAAU Disowns Students Over Protest

Entertainment3 days ago

Entertainment3 days agoPHOTOS: Anthony Joshua Makes First Social Media Post After Surviving Deadly Car Crash

Entertainment3 days ago

Entertainment3 days agoAnthony Joshua Returns To UK In Private Jet