Business

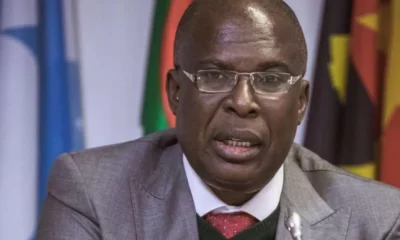

Why FG Can’t Intervene In Rising Kerosene Price – Sylva

Published

1 year agoon

By

Editor

The Minister of State Petroleum Resources, Chief Timipre Sylva, said on Monday, that the federal government has no powers to intervene in the rising price of household kerosene, a major cooking energy for low-income earners and rural dwellers in Nigeria.

The minister, who made the claim at a media briefing in Abuja to unfold the achievements of the Buhari administration in the petroleum industry since the assumption of office in 2015, pointed out that the price of kerosene had already been deregulated and could no longer be controlled by the government.

The minister said: “Kerosene, which is the fuel for the average household, is already a deregulated product. It is not necessarily within the purview of the government but a now a commercial decision. Companies will import and sell kerosene at a commercial rate. It is a deregulated product”.

READ ALSO: Nigeria Requires $410bn By 2060 To Address Energy Constraints, Policy Flexibility – Sylva

The latest data from the National Bureau of Statistics shows that kerosene price has risen by 145.86 per cent from N441 per litre in November 2021 to N1,083 per litre in November 2022.

Chief Sylva expressed the hope that Nigerians would see the need for petrol to be similarly deregulated to free up funds for the government to execute other development projects.

The minister explained that it was important for Nigerians to understand that petroleum products prices are market-driven and based on the prevailing exchange rate, adding that petroleum products were still being sold at the cheapest rates in Nigeria compared to its neighbours.

While insisting that the best way to make petrol readily available for all Nigerians was through the removal of subsidies, which is not sustainable, the minister however pointed out that the government is to ensure that the price is market-driven.

“If petroleum product prices are market-driven it would drive a lot of investments. A lot of private investors want to come in and invest in the Nigerian petroleum industry but who would want to invest under a subsidy regime?

“If you build a refinery, how is your refinery going to make a profit under a subsidy regime? But if you have a market-driven situation, a lot of investors will come and the problem of access to petroleum products will be a thing of the past,” Sylva stated.

He disclosed that the rehabilitation of the Port Harcourt Refinery was on track, saying the 60,000 barrels per day component of the refinery would come on stream before the end of the first quarter of 2023.

Chief Sylva also expressed optimism that oil production would continue to improve as security in the Niger Delta region is beefed up, insisting that the Federal Government’s target of three million per day production was realisable.

He said the government was committed to the expansion of gas development, adding that the $250 million funding from the Central Bank of Nigeria would facilitate investments into domestic gas usage in Nigeria.

The minister dismissed the notion that the new Nigerian National Petroleum Company Limited, NNPCL, which was created under the Petroleum Industry Act, PIA, was an independent company, pointing out that it remains under the Petroleum Resources Ministry.

READ ALSO: Call Not To Reapoint NCDMD Executive Secretary: Creek Dragons Tells Sylva To Disregard Such

“NNPC is not a private company; it is still 100 per cent government-owned. What has happened is that NNPC is now a commercial company and we allow it to operate commercially but it is still NNPC Limited, 100 per cent owned by the Federal Government of Nigeria and still under the purview of the Ministry of Petroleum,” Sylva pointed out.

Earlier, the Minister of Information, Alhaji Lai Mohamed, who coordinated the press briefing, berated those who accuse the Buhari administration of doing nothing tangible since coming into power, pointing out that the administration has left a legacy of achievements in all sectors of the economy.

Mohammed said, “Distinguished ladies and gentlemen, between the last edition of the PMB Administration Scorecard Series on Dec. 22nd, 2022, and today’s opening edition for 2023, a lot of things have happened in the polity.

“But the most significant has been naysayers and the opposition trying to distort the achievements of President Muhammadu Buhari for their own selfish ends.

“While some of the Administration’s fiercest critics said we have achieved nothing, others have admitted, though seemingly tongue in cheek, that it’s only in the area of infrastructure that the Administration has performed.

“Well, I want to say that both groups are wrong, very wrong. Yes, infrastructure development under the Buhari Administration is unprecedented since the nation’s return to democratic rule in 1999, and it has set the country on the path of development. But no, our legacy is more than infrastructure.

“The Buhari Administration is leaving a legacy of a revamped security sector, in the face of unprecedented security challenges in the country. Today, the Nigerian military is being restored to its glorious past, thanks to Mr. President’s foresight and doggedness in re-equipping the various services. And this has made it possible for the military to tackle insurgency and all other security challenges facing the country.

“As you can now see, this military has been recording success after success. Compare this with those who literally passed a vote of no confidence in our military by bringing in mercenaries to fight insurgency. Not only that, they looted dry all the funds earmarked to buy arms and ammunition for the military.

“Some of the alleged looters said they spent billions just praying against Boko Haram! The Nigerian military, which has excelled in global peacekeeping operations since 1960 and has sacrificed a lot to keep our country united, has regained its respect and influence.

“Ditto the Nigeria Police, which is steadily being repositioned to be efficient and well-motivated, and to improve its capacity to face modern-day security challenges. As the Honourable Minister of Police Affairs told us here last month, the Nigeria Police now has a state-of-the-art National Command and Control Centre.

“This is unprecedented. Other security agencies have not been left behind in the area of capacity enhancement through training and modernization of equipment.

READ ALSO: PIA To Unlock Investments In Nigeria’s Oil And Gas Sector – Sylva

“The Buhari Administration is leaving a legacy of inclusiveness, especially in the areas of infrastructure and social development. There is no state in Nigeria that is not witnessing at least a road, a bridge or a housing project. None!

“The Honourable Minister of Finance, Budget and National Planning has also told us here how Mr President approved tranches upon tranches of funds to states, irrespective of their party affiliation, to enable them to meet their obligations to the people.

“We dare any part of this country to say that it has not benefitted from the programmes of the Buhari Administration in one way or another and we will happily counter that with verifiable evidence,” Mohammed boasted.

VANGUARD

You may like

Bayelsa: Voting Commences In Sylva’s Ward After 3 Hours Delay

Again, Appeal Court Dismisses Suit Seeking Timipre Sylva’s Exclusion From Bayelsa Guber Poll

Bayelsa Poll: INEC Excludes Sylva’s Name From Candidates List, APC Kicks

JUST IN: Court Sacks Bayelsa APC Governorship Candidate, Sylva

Sylva Has No Capacity To Win Election In Bayelsa – APC Chieftain

Bayelsa Poll: APC Chieftain Prays Court To Stop Sylva From Contesting

Business

CBN Gives New Directive On Lending In Real Estate

Published

12 hours agoon

April 17, 2024By

Editor

The Central Bank of Nigeria, CBN, has released a new regulatory directive to enhance lending to the real sector of the Nigerian economy.

The directive, issued on April 17, 2024, with reference number BSD/DIR/PUB/LAB/017/005 and signed by the Acting Director of Banking Supervision, Adetona Adedeji, signifies a notable shift in the bank’s policy towards a more contractionary approach.

In line with the new measures, the CBN has reduced the loan-to-deposit ratio by 15 percentage points, down to 50 per cent.

This move aligns with the CBN’s current monetary tightening policies and reflects the increase in the Cash Reserve ratio rate for banks.

READ ALSO: JUST IN: CBN Gov Sacks Eight Directors, 32 Others

The LDR is a metric used to evaluate a bank’s liquidity by comparing its total loans to its total deposits over the same period, expressed as a percentage.

An excessively high ratio may indicate insufficient liquidity to meet unexpected fund requirements.

All Deposit Money Banks are now mandated to adhere to this revised LDR.

The CBN has stated that average daily figures will be utilised to gauge compliance with this directive.

Furthermore, while DMBs are encouraged to maintain robust risk management practices in their lending activities, the CBN has committed to continuous monitoring of adherence and will adjust the LDR as necessary based on market developments.

READ ALSO: JUST IN: CBN Increases Interest Rate To 24.75%

Adedeji has called on all banks to acknowledge these modifications and adjust their operations accordingly. He emphasised that this regulatory adjustment is anticipated to significantly influence the banking sector and the wider Nigerian economy.

The circular read in part, “Following a shift in the Bank’s policy stance towards a more contractionary approach, it is crucial to revise the loan-to-deposit ratio policy to conform with the CBN’s ongoing monetary tightening.

“Consequently, the CBN has decided to decrease the LDR by 15 percentage points to 50 per cent, proportionate to the rise in the CRR rate for banks.

“All DMBs must maintain this level, and it is advised that average daily figures will still be applied for compliance assessment.

“While DMBs are urged to sustain strong risk management practices concerning their lending operations, the CBN will persist in monitoring compliance, reviewing market developments, and making necessary adjustments to the LDR. Please be guided accordingly.”

The Dangote Petroleum Refinery has announced a reduction in the price of Automotive Gas Oil, popularly called diesel, from N1,200/litre to N1,000/litre.

It announced this in a statement issued on Tuesday by its spokesperson, Nduka Chiejina.

The statement read in part, “In an unprecedented move, Dangote Petroleum Refinery has announced a further reduction of the price of diesel from N1,200 to N1,000/litre.

READ ALSO: NNPP Faction Suspends Kano Governor For Six Months

“While rolling out the products, the refinery supplied at a substantially reduced price of N1,200/litre three weeks ago, representing over 30 per cent reduction from the previous market price of about N1,600/litre.

“This significant reduction in the price of diesel at Dangote Petroleum Refinery is expected to positively affect all the spheres of the economy and ultimately reduce the high inflation rate in the country.”

According to The PUNCH report, last week, oil marketers called on the refinery to reduce its diesel price, as they urged managers of the facility to sell at N850/litre.

Details later…

Business

Nigeria’s Oil Production Drops Again, Now 1.23mbpd – OPEC

Published

6 days agoon

April 12, 2024By

Editor

Nigeria’s crude oil production witnessed the second consecutive monthly decline since the beginning of this year, as it dropped to 1.231 million barrels per day in March, the Organisation of Petroleum Exporting Countries stated on Thursday.

OPEC disclosed this in its latest Monthly Oil Market Report for April 2024, stating that crude oil production details which it got through direct communication from Nigeria showed that the country pumped less oil in March when compared to what was produced in February.

Data from the report indicated that Nigeria produced 1.322 million barrels per day of crude in February this year, but this dropped to 1.231mbpd in March, representing a plunge of 91mbpd.

The report further stated that the country had produced 1.427mbpd of crude in January, but this was not sustained in February as it dropped in that month, while the southward oil production continued in March.

OPEC data, however, showed that the country’s average crude oil production in the first quarter of 2024 was 1.327mbpd, higher than the 1.313mbpd average oil production in the fourth quarter of 2023.

Nigeria’s first quarter oil output in 2024 was also higher than the 1.201mbpd average production in the third quarter of last year.

READ ALSO: Oil Production Rises 26.57m Bpd In February — OPEC

Oil theft and pipeline vandalism have dealt severe blows on Nigeria’s oil production, limiting the country’s output and making it fall below the volume approved for Nigeria by OPEC.

The PUNCH reported on Wednesday that the Nigerian National Petroleum Company Limited recorded 155 oil theft incidents in one week.

The report that stated the company revealed that during the review period, 53 illegal pipeline connections and 36 illegal refineries were uncovered in the Niger Delta.

“Between March 30 and April 5, 2024, a total of 155 incidents were recorded across several locations in the Niger Delta region from various incident sources,” the firm stated.

In a summary of the incidents, NNPCL stated that it recorded 53 illegal connections, discovered 36 illegal refineries and 32 wooden fibre boats, identified 14 pipeline vandalism cases, eight vessel infractions and four oil spills, as well as made seven vehicle and one vessel arrests.

Some of the incident sources include the Nigeria Agip Oil Company, Tantita Security Services Ltd, NNPCL Command and Control Centre, Shell Petroleum Development Company, NNPCL 18 Operating Ltd, among others.

READ ALSO: Oil Drops Further After OPEC Delay With Asian Stocks Mixed

Providing additional details, the company said, “In the past week, 32 wooden boats conveying stolen crude and illegally refined products were seized and confiscated in Rivers and Delta states.

“On land, seven vehicles loaded with stolen crude were arrested in Imo, Delta and Rivers states. 53 illegal connections were uncovered between March 30 and April 5, 2024 in Bayelsa, Rivers and Delta states.

“14 cases of vandalism were also recorded in Rivers, Bayelsa and Delta states, while illegal storage sites where stolen crude and illegally refined products are kept were uncovered in Akwa Ibom, Bayelsa, Rivers and Delta states.”

The national oil company also stated there were clusters of illegal refineries in Abia State, as activities of oil thieves had devastated the effected environments in the state.

It said 36 clusters of the illegal refineries were discovered in the past week across several locations in Rivers and Abia states.

“Four cases of oil spills due to activities of vandals were recorded in the past week,” NNPCL stated, adding that in Rivers State, oil leaks from a wellhead is destroying aquatic lives.

NNPCL stated that 38 suspects were arrested during the week under review, stressing that the national oil company would not back down on the war against crude oil theft until the menace is eradicated.

READ ALSO: OPEC Cuts Nigeria’s Oil Output By 20.7% To 1.38 mb/d

Nigeria has been losing trillions of naira to crude oil theft, a development that has made some international oil companies to divest from onshore to deep offshore oil fields, while others have exited the country.

In November 2023, for instance, The PUNCH reported that the Federal Government revealed that more than N4.3tn worth of crude oil was stolen in 7,143 pipeline vandalism cases within a period of five years.

The report stated that the government disclosed this at the Nigeria International Pipeline Technology and Security Conference in Abuja, with the theme, ‘Bolstering Regulations, Technology and Security for Growth.’ The conference was organised by the Pipeline Professionals Association of Nigeria.

In a presentation at the conference by the Nigeria Extractive Industries Transparency Initiative, a Federal Government agency, the organisation revealed that oil theft and losses in Nigeria had become a national emergency.

The Executive Secretary, NEITI, Ogbonnaya Orji, said oil theft was an emergency that posed serious threat to oil exploration and exploitation with huge negative consequences on economic growth, business prospects and profit earnings by oil companies.

Providing data from the agency’s reports to back his claims, he said, “NEITI disclosed that in the last five years, 2017 to 2021, Nigeria recorded 7,143 cases of pipeline breakages and deliberate vandalism resulting in crude theft and product losses of 208.639 million barrels valued at $12.74m or N4.325tn.

“NEITI reports also disclosed that during the same period Nigeria spent N471.493bn to either repair or maintain pipelines.”

PUNCH

EFCC Obtains Arrest Warrant For Yahaya Bello

Hiccups: What You Need To Know

Tinubu Directs Inclusion Of NOUN Graduates In NYSC Scheme, Law School

Woman S*xually Abuses Child, Films It In Viral Video

Junior Pope: ‘Our Boat Captain Hit Fisherman’s Canoe’ – Survived Actor Narrates How It Happened [VIDEO]

Jnr Pope: ‘That Guy No Suppose Knack Bell’ – Boat Captain Narrates His Own Side Of Story [VIDEO]

Trending

Metro5 days ago

Metro5 days agoWoman S*xually Abuses Child, Films It In Viral Video

Entertainment5 days ago

Entertainment5 days agoJnr Pope: ‘That Guy No Suppose Knack Bell’ – Boat Captain Narrates His Own Side Of Story [VIDEO]

News5 days ago

News5 days agoDeadly Flog: Girl Caught In Camera Beating Up Baby With Rod [VIDEO]

News3 days ago

News3 days agoVideo: Moment Pastor Enenche Sent Lady Away For Giving False Testimony On The Altar

Metro3 days ago

Metro3 days agoJunior Pope: Photos From Funeral Of Makeup Artiste, Abigail Frederick

Entertainment5 days ago

Entertainment5 days agoBoat Mishap: ‘This Is My Story’ – Movie Producer, Adanma Luke, Breaks Silence [VIDEO]

News3 days ago

News3 days agoBREAKING: APC Suspends National Chairman Ganduje

Headline2 days ago

Headline2 days agoUS-based Nigerian Bodybuilder Dies 18 Days After Being Shot By Wife

News5 days ago

News5 days agoViral Video: Edo CP Orders Investigation, Mental Test For Police Constable

Metro1 day ago

Metro1 day agoTwo Soldiers Arrested For Allegedly Stealing Armoured Cables At Dangote Refinery In Lagos