News

Why I Adopted Mmesoma – Anambra Commissioner

Published

8 months agoon

By

Editor

The Anambra State Commissioner for Education, Prof. Ngozi Chuma-Udeh, says she has adopted Mmesoma Ejikeme, a student of Anglican Girls Secondary School, Nnewi, who reportedly forged her 2023 Unified Tertiary Matriculation Examination result.

Chuma-Udeh said she adopted Mmesoma as a daughter to help her actualise her dreams in life.

She disclosed this to journalists in Awka, on Saturday, shortly after receiving an award presented to her by FreeNews Magazine.

READ ALSO: Mmesoma: Anambra Commissioner Adopts Embattled UTME Candidate

She said, “She is not the first I am adopting. Even as a lecturer, I have been adopting children and training them through schools.

“Mmesoma is doing very, very well. She is still undergoing a psycho-therapy class with the state appointed psycho-therapist.

“I decided to adopt Mmesoma to help her actualise her dreams. She is a human being, so we cannot throw her away like that. We are not going to let her down. We are still pleading with JAMB to reconsider her.

“Governor Chukwuma Soludo is very passionate about every citizen in Anambra State. So we will train her through her education.”

READ ALSO: FG Raises Concern Over Ozone Layer Depletion

The commissioner, however, thanked the organisers of the award for recognising her, saying the honour will ginger her to do more for the state.

Earlier, the Chairman of FreeNews Magazine Editorial Board, Obinna Mbonu, said the award was in recognition of the commissioner’s ability to drive the vision and mission of the governor in the education sector.

You may like

Anambra Teaching Hospital To Commence Mass Burial Of Abandoned Corpses

Anambra: Man Arrested For Giving Underage Daughter’s Hand In Marriage

75-year Old Man Arrested For Defiling 8-year-old Girl In Anambra

Cultists Arrested For Invading Anambra Hotel With Charms

Outrage As Kingsmen Flogged Anambra Man To Death [VIDEO]

Commuters Stranded As Petrol Stations Shut In Anambra

News

Tinubu Bows To Pressure, Orders CBN To Suspend Implementation Of Cybersecurity Levy

Published

56 mins agoon

May 12, 2024By

Editor

President Bola Tinubu has asked the Central Bank of Nigeria to suspend the implementation of the controversial cybersecurity levy policy and ordered a review.

This followed the decision of the House of Representatives, which, last Thursday, asked the CBN to withdraw its circular directing all banks to commence charging a 0.5 per cent cybersecurity levy on all electronic transactions in the country.

The CBN on May 6, 2024, issued a circular mandating all banks, mobile money operators, and payment service providers to implement a new cybersecurity levy, following the provisions laid out in the Cybercrime (Prohibition, Prevention, etc) (Amendment) Act 2024.

According to the Act, a levy amounting to 0.5 per cent of the value of all electronic transactions will be collected and remitted to the National Cybersecurity Fund, overseen by the Office of the National Security Adviser.

Financial institutions are required to apply the levy at the point of electronic transfer origination.

READ ALSO: ICYMI: CBN Orders Banks To Charge 0.5% Cybersecurity Levy

The deducted amount is to be explicitly noted in customer accounts under the descriptor “Cybersecurity Levy” and remitted by the financial institution. All financial institutions are required to start implementing the levy within two weeks from the issuance of the circular.

By implication, the deduction of the levy by financial institutions should commence on May 20, 2024.

However, financial institutions are to make their remittances in bulk to the NCF account domiciled at the CBN by the fifth business day of every subsequent month.

The circular also stipulates a timeframe for financial institutions to reconfigure their systems to ensure complete and timely submission of remittance files to the Nigeria Interbank Settlement Systems Plc as follows: “Commercial, Merchant, Non-Interest, and Payment Service Banks – Within four weeks of the issuance of the Circular.

READ ALSO: SERAP Gives FG 48-hr Ultimatum To Reverse CBN’s 0.5% Cybersecurity Levy

“All other Financial Institutions (Microfinance Banks, Primary Mortgage Banks, Development Financial Institutions) – Within eight weeks of the issuance of the Circular,” the circular noted.

The CBN has emphasised strict adherence to this mandate, warning that any financial institution that fails to comply with the provisions will face severe penalties. As outlined in the Act, non-compliant entities are subject to a minimum fine of two per cent of their annual turnover upon conviction.

The circular provides a list of transactions currently deemed eligible for exemption, to avoid multiple applications of the levy.

These are loan disbursements and repayments, salary payments, intra-account transfers within the same bank or between different banks for the same customer, and intra-bank transfers between customers of the same bank.

READ ALSO: Banditry: Niger Speaker To Marry Off 100 Female Orphans

Exemptions include other financial institutions’ transfers to their correspondent banks, interbank placements, banks’ transfers to CBN and vice versa, inter-branch transfers within a bank, cheque clearing and settlements, letters of credit, and banks’ recapitalisation-related funding.

Others are bulk funds movement from collection accounts, savings, and deposits including transactions involving long-term investments such as treasury bills, bonds, and commercial papers, and government social welfare programmes transactions.

These may include pension payments, non-profit and charitable transactions including donations to registered non-profit organisations or charities, educational institutions transactions, including tuition payments and other transactions involving schools, universities, or other educational institutions, and transactions involving the bank’s internal accounts, inter-branch accounts, reserve accounts, nostro and vostro accounts, and escrow accounts.

The introduction of the new levy sparked varied reactions among stakeholders as it is expected to raise the cost of conducting business in Nigeria and could potentially hinder the growth of digital transaction adoption.

PUNCH

News

Moment Chief Defense Staff Hosts Prince Harry, Meghan Markle In Reception [VIDEO/PHOTOS]

Published

11 hours agoon

May 11, 2024By

Editor

Prince Harry and Meghan Markle attended a reception hosted by the Chief of Defense Staff.

This was after they attended a volleyball game earlier in the day.

During the reception, which held at the Armed Forces Officers Mess & Suites in Abuja, the Duke and Duchess of Sussex received asho oke gifts from Abike Dabiri-Erewa, Chairman/CEO of the Nigerians in Diaspora Commission (NiDCOM).

READ ALSO: VIDEO: See Winner Of Best Content Creator At AMVCA

The couple also danced with Dabiri-Erewa.

The purpose of the visit was to introduce the royal couple to Nigeria’s rich socio-cultural heritage and provide an opportunity for the Duchess of Sussex to explore her Nigerian lineage.

News

JUST IN: Again, Aircraft Skids Off Runway At Lagos Airport

Published

18 hours agoon

May 11, 2024By

Editor

Barely 16 days after Dana Air was shut down by the Nigeria Civil Aviation Authorities, another aircraft belonging to XEJET Airlines also skidded off the runway and landed in the grass at the Murtala Muhammed Airport, Lagos on Saturday.

Following this development, the Federal Airports Authority of Nigeria has shut the 18/Left runway of the airport

The Airbus with registration 5N-BZZ with 52 passengers on board departed Abuja and landed in Lagos at 11.29 am.

READ ALSO: JUST IN: Aircraft Belonging To Dana Air Skids Off Lagos Airport Runway

Just last month, Dana MD-82 aircraft was involved in a skidding off of the runway, necessitating the Minister of Aviation and Aerospace Development, Festus Keyamo, to order the suspension of the carrier for a comprehensive auditing.

Last year, in November, two aircraft from two different airlines skidded off the runway, in one week.

Aero Contractors, flight NG 119 with a registered Boeing 737 aircraft 5N-BYQ from Lagos to Abuja had a total of 133 passengers on board.

All passengers were safely evacuated through a controlled disembarkation.

READ ALSO: Tragedy Adverted As ValueJet’s Aircraft Skids Off Runway

The temporary closure of the runway by FAAN limits the airport to one single runway which is expected to lead to aircraft delays and landing.

The spokesperson of the Nigerian Safety Investigation Bureau, Bimbo Olajide, confirmed that an aircraft belonging to Xejet Airlines skidded off the runway of the domestic wing of the Murtala Muhammed Airport on Saturday.

She stated that a team had been deployed to the site of the incident.

“Our teams are there and on top of the matter. But whether or not the runway will be reopened today, i cannot immediately answer questions on that.” NSIB spokesperson told PUNCH Online.

Customs Intercepts N10m Worth Petrol En Route Cameroon Illegally

Failure To Prosecute Deborah’s Killers Two Years After, Reinforcement Of Impunity – Amnesty International

Why Tinubu Didn’t Intervene In Ganduje’s Troubles – APC Leaders

Trending

Headline5 days ago

Headline5 days agoMother Throws Disabled 6-year-old Son Into Crocodile Infested River [PHOTOS]

News5 days ago

News5 days ago‘I’m Considering Having 4th Child’ – Mother Of Three Who Breastfeeds Husband , 3 Kids [PHOTOS]

News4 days ago

News4 days agoThe New Masquerade’ Actress, Ovularia Is Dead

Politics5 days ago

Politics5 days agoEdo Poll: PDP Gubernatorial Aspirant Resigns From Party

Headline5 days ago

Headline5 days ago‘Shame On You’- Ugandan Senator Knocked For Showing Off Wooden Bridge He Constructed

News4 days ago

News4 days agoBREAKING: Rivers State House Of Assembly Gets New Speaker

Politics5 days ago

Politics5 days agoEdo Poll: Akoko-Edo PDP Leaders Meet Deputy Gov, Pledge Massive Votes For Ighodalo

Business4 days ago

Business4 days agoFULL LIST: CBN Publishes List Of Licensed Deposit Money Banks

News4 days ago

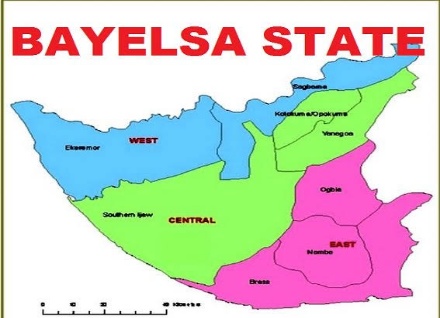

News4 days agoFather Of 12 Found Dead Inside Brothel In Bayelsa

Metro4 days ago

Metro4 days agoEdo: Police Patrol Van Pursuing ‘Yahoo Boys’ Rams Into Motorcycle Convening Passenger