Business

Aircraft Maintenance: Nigeria Lost N1.25 Trillion In 2021 To Other African Countries

Published

2 years agoon

By

Editor

The Federal Airport Authority of Nigeria (FAAN) has revealed that Nigeria lost at least $2.5 billion (about N1.25 trillion) in the maintenance of its aircraft to foreign Maintenance, Repair and Overhaul (MRO) facilities in 2021.

Speaking on Tuesday in Abuja at the inaugural National Aviation Conferences (FNAC) organised by FAAN with the theme: ‘Advancing the Frontiers of Possibilities for Safe, Secure and Profitable Air Transport,’ the Managing Director of FAAN, Capt Rabiu Yadudu, said that such capital flight would have been saved if the country had MRO facilities that could adequately cater for all types of aircraft.

To typically carry out C-check on Boeing 737 aircraft or its category, airlines spend at least $1.8 million and C-check is carried out on aircraft every 18 months.

Yadudu said that Nigeria’s potential in the global air transport industry is underutilised as Nigeria has the largest fleet of aircraft within the subregion.

”It was reported that Nigeria lost $2.5 billion (about N1.25 trillion) in MRO investments to neighbouring countries. Having such investments here would have created more employment opportunities for Nigerians, revenue generation and training of technical personnel for maintenance of aircraft,” he said.

”The interlink and value chain between the air transport, tourism and hospitality industry for economic growth cannot be over-emphasised. Today, the Eiffel Tower in Paris, London bridge, Dubai Mall, Burj Khalifa, the British Museum in the United Kingdom, etc, have all been consciously developed into major tourist attractions that drive passenger traffic to those destinations and by implication attract businesses and generate employments for the locals and foreigners alike,” he said.

Yadudu lauded the Minister of Aviation, Hadi Sirika, the Permanent Secretary, Directors of the Federal Ministry of Aviation, the Senate and House Committee Chairmen and other stakeholders for supporting the industry at all times.

Earlier, Sirika in his goodwill message, disclosed that President Muhammadu Buhari would at any moment from now sign into law the passed Civil Aviation Bill by the National Assembly.

He assured that with the president’s assent to the bill, the Nigerian aviation industry would grow rapidly, while more opportunities would also be created for all stakeholders and investors.

He pointed out that the Aviation Industry Roadmap as approved by the Federal Government was intentionally fashioned after the Public-Private Participation (PPP) model with the plan to grow the entire sector.

READ ALSO: Aviation Crisis: We Are Yet To Feel Impacts Of FG’s Intervention – Airline Operators

He challenged investors to tap into the myriads of opportunities in the sector, especially with the recently approved 12, hectares of land for implementation of the aviation roadmap by the Federal Capital Territory (FCT).

Some of the aviation roadmaps include MRO, Aviation Leasing Company, National Carrier, Aerospace University, Airport Concession and Aerorropolis amongst others.

“We are ready to pursue all the components of the roadmap. Every part of the roadmap has reached advanced stages and all would be delivered before the end of this administration. The aviation industry in Nigeria is a goldmine, but it is still a virgin.

”Globally, the core variables that sustain the aviation industry are safety and security. We must continue to sustain these in the country,” he stated.

SUN

You may like

Why Aviation Workers Are On Strike

Passengers Stranded As Aviation Unions Begin Strike

Foreign Creditors May Seize Presidential Jets Over Accumulated Debts

Protesting Aviation Workers Shut Down Lagos Airport

Disappointments As Nigerian Air Refuses To Fly Amid Aviation Crisis

Planned Shutdown Of Airline Operations: Aviation Ministry Working To Engage Stakeholders – Minister

The Central Bank of Nigeria (CBN) started fresh and direct sales of US dollars at N1,021 per dollar to Bureau De Change operators.

Nigeria’s apex bank disclosed this in a circular signed by its Director of Trade and Exchange Department Hassan Mahmud.

“We write to inform you of the sale of $10,000 by the Central Bank of Nigeria (CBN) to BDCs at the rate of N1,021/$1. The BDCs are in turn to sell to eligible end users at a spread of NOT MORE THAN 1.5 percent above the purchase price,” the circular posted on its website read.

READ ALSO: Tinubu Unveils African Counter-Terrorism Summit

“ALL eligible BDCs are therefore directed to commence payment of the Naira deposit to the underlisted CBN Naira Deposit Account Numbers from today, Monday, April 22, 2024, and submit confirmation of payment, with other necessary documentations, for disbursement of FX at the respective CBN Branches.”

CBN’s move is coming as the naira is recording a slight depreciation against the dollar after weeks of gains.

In late March, the bank also sold $10,000 to each of the eligible Bureau De Change (BDC) operators in the country at the rate of N1,251/$1.

READ ALSO: Mixed Reactions Trail Video Of Couple’s Customised N200 Notes

Like in the most recent sales, it warned BDCs against breaching terms of the dollar sales, vowing to sanction defaulters “including outright suspension from further participation in the sale”.

The fortunes of the naira have fallen sharply since President Bola Tinubu took over in May. Inflation figures have reached new highs and the cost of living hitting the rooftops.

Nigeria’s currency slid to about N1,900/$ some months ago at the parallel market. But in recent weeks, it has gained against the dollar.

The Nigerian authorities have also doubled down on their crackdown against cryptocurrency platform Binance and illegal BDCs.

On March 1, the CBN revoked the licences of 4,173 BDCs over compliance failures.

Olusegun Alebiosu has been appointed as the Acting Managing Director/Chief Executive Officer of First Bank of Nigeria Limited (FirstBank Group), effective April 2024.

Alebiosu steps into this pivotal role from his previous position as the Executive Director, Chief Risk Officer, and Executive Compliance Officer, a position he held since January 2022.

Alebiosu brings to the helm of FirstBank over 28 years of extensive experience in the banking and financial services industry. His expertise spans various domains including credit risk management, financial planning and control, corporate and commercial banking, agriculture financing, oil and gas, transportation, and project financing.

READ ALSO: JUST IN: Access Holdings Names New Acting CEO

Having embarked on his professional journey in 1991 with Oceanic Bank Plc. (now EcoBank Plc.), Alebiosu has held several notable positions in esteemed financial institutions.

Prior to joining FirstBank in 2016, he served as Chief Risk Officer at Coronation Merchant Bank Limited, Chief Credit Risk Officer at the African Development Bank Group, and Group Head of Credit Policy & Deputy Chief Credit Risk Officer at United Bank for Africa Plc.

Alebiosu’s academic credentials further enrich his professional profile. He is an alumnus of the Harvard School of Government and holds a Bachelor’s degree in Industrial Relations and Personnel Management. Additionally, he obtained a Master’s degree in International Law and Diplomacy from the University of Lagos, as well as a Master’s degree in Development Studies from the London School of Economics and Political Science.

READ ALSO: Meet Newly Appointed Union Bank CEO

A distinguished member of various professional bodies, including the Institute of Chartered Accountants (FCA), Nigeria Institute of Management (ANIM), and Chartered Institute of Bankers of Nigeria (CIBN), Alebiosu is renowned for his commitment to excellence and ethical practices in the banking sector.

Beyond his professional endeavors, Alebiosu is known for his passion for golf and adventure. He is happily married and a proud parent.

With Alebiosu’s appointment, FirstBank of Nigeria Limited anticipates continued growth and innovation under his leadership, reinforcing its position as a leading financial institution in Nigeria and beyond.

Business

CBN Gives New Directive On Lending In Real Estate

Published

1 week agoon

April 17, 2024By

Editor

The Central Bank of Nigeria, CBN, has released a new regulatory directive to enhance lending to the real sector of the Nigerian economy.

The directive, issued on April 17, 2024, with reference number BSD/DIR/PUB/LAB/017/005 and signed by the Acting Director of Banking Supervision, Adetona Adedeji, signifies a notable shift in the bank’s policy towards a more contractionary approach.

In line with the new measures, the CBN has reduced the loan-to-deposit ratio by 15 percentage points, down to 50 per cent.

This move aligns with the CBN’s current monetary tightening policies and reflects the increase in the Cash Reserve ratio rate for banks.

READ ALSO: JUST IN: CBN Gov Sacks Eight Directors, 32 Others

The LDR is a metric used to evaluate a bank’s liquidity by comparing its total loans to its total deposits over the same period, expressed as a percentage.

An excessively high ratio may indicate insufficient liquidity to meet unexpected fund requirements.

All Deposit Money Banks are now mandated to adhere to this revised LDR.

The CBN has stated that average daily figures will be utilised to gauge compliance with this directive.

Furthermore, while DMBs are encouraged to maintain robust risk management practices in their lending activities, the CBN has committed to continuous monitoring of adherence and will adjust the LDR as necessary based on market developments.

READ ALSO: JUST IN: CBN Increases Interest Rate To 24.75%

Adedeji has called on all banks to acknowledge these modifications and adjust their operations accordingly. He emphasised that this regulatory adjustment is anticipated to significantly influence the banking sector and the wider Nigerian economy.

The circular read in part, “Following a shift in the Bank’s policy stance towards a more contractionary approach, it is crucial to revise the loan-to-deposit ratio policy to conform with the CBN’s ongoing monetary tightening.

“Consequently, the CBN has decided to decrease the LDR by 15 percentage points to 50 per cent, proportionate to the rise in the CRR rate for banks.

“All DMBs must maintain this level, and it is advised that average daily figures will still be applied for compliance assessment.

“While DMBs are urged to sustain strong risk management practices concerning their lending operations, the CBN will persist in monitoring compliance, reviewing market developments, and making necessary adjustments to the LDR. Please be guided accordingly.”

‘Dey Play,’ Nigerians Mock Prophet Who Claims World Ends Today

VIDEO: Meet Nigerian Pastor Who Predicted World Will End April 25

Again, FG Talks Tough, Threatens To Revoke Lokoja-Benin Road Contract

Trending

Entertainment3 days ago

Entertainment3 days agoBridesmaids’ Dance At Wedding Causes Stir On Social Media [VIDEO/PHOTOS]

Politics4 days ago

Politics4 days agoEdo Guber: Akoko-Edo PDP Leaders Meet In Igara, Describe Ighodalo, Ogie As ‘Perfect Match’

Metro3 days ago

Metro3 days agoVIDEO: ‘UNN Lecturer’ Caught Pants Down With Married Student

News4 days ago

News4 days agoOutrage As Chinese Supermarket In Abuja Denies Nigerians Entry

News3 days ago

News3 days agoIGP, Jonathan Disagree Over State Police

News1 day ago

News1 day agoVIDEO: Force PRO Orders Arrest Officers Caught On Video Bashing Driver’s Car

Headline2 days ago

Headline2 days agoDrama As Women Fight Dirty, Breasts Fall Out During Spring Break Outing In US [PHOTOS/VIDEO]

News1 day ago

News1 day agoDrama! Supporters Of Yahaya Bello Perform Rituals to Prevent His Arrest By EFCC [Video]

Entertainment2 days ago

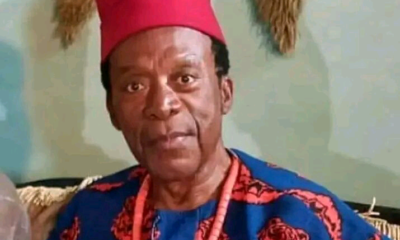

Entertainment2 days agoNollywood Actor, Zulu Adigwe Is Dead

Headline2 days ago

Headline2 days agoMeet 17-year-old Nigerian Who Won $3.5m Worth Of Scholarships From Harvard, 13 Other Foreign Universities