Business

Court Orders Seizure Of Emirates Airline’s Aircraft Over N8m Judgment Debt

Published

6 years agoon

By

Editor

A Federal High Court sitting in Lagos on Monday ordered the seizure of an aircraft belonging to Emirates Airline over an N8.1 million judgment debt.

The order was sequel to a motion filed by Dr. Charles Mekwunye seeking the enforcement of a Supreme Court judgment in a suit between Promise Mekwunye and the airline.

In a judgment delivered on November 15, 2010, the Federal High Court held that the refusal of Emirates Airline to carry Mekwunye amounted to a breach of contract of carriage.

Consequently, the court ordered a full refund of the ticket without any deduction or charge and further granted N2.5 million in general damages and N250,000 in legal costs against the airline.

Granting the reliefs sought by Mekwunye, Justice Mohammed Liman held that “it is accordingly ordered that an attachment is hereby issued on the judgment debtor’s aircraft registered as ‘A6 Aircraft Type 77W EK: 783/784’, or any other aircraft belonging to the judgment debtor which flies into Nigeria Territory, to be arrested and detained until the judgment debt is fully paid. If there is default after 30 days, the aircraft shall be auctioned to satisfy the judgment debt.”

The judge also ordered that Emirates Airline to bear the cost of maintenance and custody of the detained aircraft.

Miss Mekwunye, who was then a student of North Texas University, Denton, Texas, United States had in 2008 dragged the airline to court for refusal of her two-way flight ticket from Dallas to Nigeria and back for no reason and for also refusing to fully refund the cost of the American Airline ticket she bought for her return trip to Nigeria.

She claimed that the airline offered no reason for its action leaving her stranded for days at the airport until she was able to secure a more expensive flight ticket on a longer route to Lagos.

Vanguard

You may like

Business

JUST IN: Dangote Refinery Hikes Petrol Ex-depot Price

Published

2 weeks agoon

June 20, 2025By

Editor

Nigerians may soon pay more for petrol as the Dangote Petroleum Refinery on Friday increased its ex-depot price for Premium Motor Spirit to N880 per litre, raising fresh concerns over fuel affordability and price volatility in the downstream sector.

Checks on petroleumprice.ng, a platform tracking daily product prices, and a Pro Forma Invoice seen by The PUNCH confirmed the hike, representing a N55 increase from the previous rate of N825 per litre.

The increment would ripple across the entire fuel distribution chain, likely pushing pump prices above N900/litre in some parts of the country, especially in areas far from the distribution hubs.

The hike comes despite global crude prices falling. Brent crude dipped by 3.02% to $76.47, WTI fell to $74.93, and Murban dropped to $76.97 on Friday. The decline in benchmarks offers little relief due to persistent fears of sudden supply disruptions.

READ ALSO: JUST IN: Dangote Refinery Sashes Petrol Gantry Price

The refinery has increased its reliance on imported U.S. crude and operational costs amid exchange rate instability, which adds to its pricing pressure.

On Thursday, the President of the Dangote Group, Aliko Dangote, said his 650,000-barrel capacity refinery is “increasingly” relying on the United States for crude oil.

This came as findings showed that the Dangote Petroleum Refinery is projected to import a total of 17.65 million barrels of crude oil between April and July 2025, beginning with about 3.65 million barrels already delivered in the past two months, amid ongoing allocations under the Federal Government’s naira-for-crude policy.

Dangote informed the Technical Committee of the One-Stop Shop for the sale of crude and refined products in naira initiative that the refinery was still battling crude shortages, which had led it to resort to imports from the United States.

READ ALSO:Dangote Stops Petrol Sale In Naira, Gives Condition For Resumption

On Monday, the president of the Petroleum and Natural Gas Senior Staff Association of Nigeria, Festus Osifo, accused oil marketers of exploiting Nigerians through inflated petrol prices, insisting that the current pump price of PMS should range between N700 and N750 per litre.

He criticised the disparity between falling global crude oil prices and the stagnant retail price of petrol in Nigeria.

“If you go online and check the PLAT cost per cubic metre of PMS, convert that to litres and then to our Naira, you will see that with crude at around $60 per barrel, petrol should be retailing between N700 and N750 per litre.”

He asserted that if Nigerians bear the brunt of higher fuel costs, they should be allowed to enjoy the benefit of low pricing.

His forecast of increased costs now appears spot on, considering the latest developments.

Marketers are already adjusting. Depot owners and fuel distributors in Lagos and other cities anticipate a domino effect, with new price bands expected to follow Dangote’s lead.

Many had held back pricing decisions since Tuesday, when the refinery halted sales and withheld fresh PFIs. The delay fueled speculation, allowing opportunistic price hikes across various depots.

The Naira, which has seen steady appreciation against the Dollar all week, closed stronger on Friday, trading at ₦1,580.44 in the official forex market.

Data from the Central Bank of Nigeria’s website show the Naira gained ₦4.51k against the Dollar on Friday alone.

This marks a 0.28 per cent appreciation from Thursday’s closing rate of ₦1,584.95 in the official foreign exchange window.

The local currency maintained consistent strength throughout the week, recording gains daily.

READ ALSO: Naira Appreciates Against Dollar At Foreign Exchange Market

On Monday, May 19, it traded at ₦1,598.68; on Tuesday, at ₦1,590.45; and on Wednesday, at ₦1,584.49.

These gains suggest increased investor confidence and improved forex supply, contributing to the naira’s performance.

Meanwhile, the CBN, at its 300th Monetary Policy Committee meeting held Monday and Tuesday, retained the Monetary Policy Rate at 27.5 per cent.

Business

BREAKING: Again, Dangote Refinery Cuts Petrol Price

Published

1 month agoon

May 22, 2025By

Editor

The Dangote Petroleum Refinery has announced a nationwide reduction in the pump price of Premium Motor Spirit (PMS), commonly known as petrol, with new prices now ranging between ₦875 and ₦905 per litre, depending on location.

The ₦15 per litre cut applies across all regions and partner fuel stations, and was confirmed via an official announcement posted on Dangote Refinery’s social media channels on Thursday.

Major marketers participating in the new pricing regime include MRS, Ardova, Heyden, Optima Energy, Techno Oil, and Hyde Energy — partners in the distribution of Dangote-refined products.

READ ALSO: JUST IN: Dangote Refinery Sashes Petrol Gantry Price

Under the previous pricing structure, Lagos residents paid ₦890 per litre, while prices reached ₦920 in the North-East and South-South regions. With the latest adjustment, Lagos now pays ₦875 per litre, while the North-East and South-South will see prices drop to ₦905.

A regional breakdown of the revised prices is as follows: Lagos: ₦875, South-West: ₦885, North-West & Central: ₦895, North-East & South-South: ₦905 and South-East: ₦905.

In its announcement, Dangote Refinery encouraged consumers to purchase fuel only from authorised partner stations and urged the public to report any cases of non-compliance via its official hotlines: +234 707 470 2099 and +234 707 470 2100.

“Our quality petrol and diesel are refined for better engine performance and are environmentally friendly,” the company said.

- NYSC Commends Bauchi Govt On Infrastructural Development In Orientation Camp

- Gunmen Kill 10 In Anambra Community

- EFCC Arrests 31 Suspected Internet Fraudsters In Nasarawa

- 30-year-old Man Hacks Mother To Death

- FCT Police Arrest Three Wanted Kidnappers

- Ghana Deports Convicted Nigerian For Smuggling Fake $100,000

- Man Jailed Seven Years For N11.4m Enugu Land Fraud

- Tragedy As 23-year-old Dies By Self-stabbing In Delta

- Police Raid Criminal Hideouts In Delta, Arrest Suspects, Seize Weapons

- Sex Worker Dies After Dispute Over N15,000 Refund In Ondo

About Us

Trending

News5 days ago

News5 days agoArson: Man To Pay N150m For Burning FRSC Patrol Vehicle In Bauchi

Politics4 days ago

Politics4 days agoBREAKING: Confusion As APC Chair, Ganduje Resigns

News2 days ago

News2 days agoAuchi Poly Mass Comm Class of 2006 Holds Maiden Reunion in Benin

Politics5 days ago

Politics5 days ago‘Peace Has Returned To Rivers’ — Wike, Fubara Speak After Meeting Tinubu

Headline2 days ago

Headline2 days ago‘They Checked My Instagram’ – Nigerian Lady Breaks Down After Landing In U.S, Denied Entry

Metro2 days ago

Metro2 days agoBREAKING: Emir’s Palace, NDLEA Office Set Ablaze As Protest Rocks Kwara

Sports4 days ago

Sports4 days agoChelsea Set To Offload Jackson, Madueke, 8 Others [See list]

News2 days ago

News2 days agoNSCDC, Immigration, Others: FG Postpones Recruitment, Changes Portal

Metro4 days ago

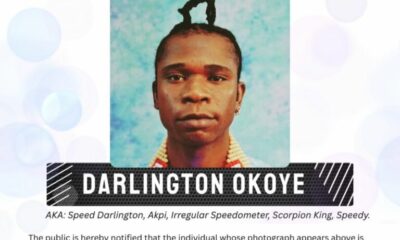

Metro4 days agoNAPTIP Declares Speed Darlington Wanted For Tape, Cyberbullying

Metro1 day ago

Metro1 day agoPanic As Bees Invade Central Mosque In Edo