Business

Debt Servicing To Hit N10.43tn, Economists Slam FG

Published

3 years agoon

By

Editor

The Federal Government has projected that debt servicing will cost N10.43tn by 2025, according to the 2023-2035 Medium Term Expenditure Framework & Fiscal Strategy Paper.

This is a 182.66 per cent increase from the N3.69tn budgeted for debt service in 2022.

Multilateral agencies and economists have constantly warned the Federal Government about the rising cost of debt service, which can trigger a crisis for the country.

However, the Minister of Finance, Budget and National Planning, Dr Zainab Ahmed, and the Director General of the Debt Management Office, Patience Oniha, have insisted that the country does not have a debt problem but a revenue challenge.

In a document by the DMO DG recently obtained by our correspondent, the DMO stated that high debt levels would often lead to high debt services and affect investments in infrastructure.

According to the DMO DG, “High debt levels lead to heavy debt service which reduces resources available for investment in infrastructure and key sectors of the economy.”

In the document, she stressed the need for debt sustainability, which she defined as the ability to service all current and future obligations, while maintaining the capacity to finance policy objectives without resort to unduly large adjustments or exceptional financing such as arrears accumulation, debt restructuring, which could otherwise compromise the economy’s stability.

READ ALSO: Amid Rising Debt, Subsidy Cost Jumps By 370%

Speaking at the launch of the World Bank’s Nigeria Development Update titled, ‘The urgency for business unusual,’ held recently in Abuja, the finance minister had admitted that Nigeria was struggling to service its debt.

She said, “Already, we are struggling with being able to service debt because even though revenue is increasing, the expenditure has been increasing at a much higher rate, so it is a very difficult situation.”

The International Monetary Fund had earlier warned that debt servicing might gulp 100 per cent of the Federal Government’s revenue by 2026 if the government failed to implement adequate measures to improve revenue generation.

According to the IMF’s Resident Representative for Nigeria, Ari Aisen, based on a macro-fiscal stress test that was conducted on Nigeria, interest payments on debts might wipe up the country’s entire earnings in the next four years.

Aisen said, “The biggest critical aspect for Nigeria is that we have done a macro-fiscal stress test, and what you observe is the interest payments as a share of revenue, and as you see us in terms of the baseline from the federal government of Nigeria, the revenue of almost 100 per cent is projected by 2026 to be taken by debt service.

“So, the fiscal space or the amount of revenues that will be needed and this, without considering any shock, is that most of the revenues of the Federal Government are now, in fact, 89 per cent and it will continue if nothing is done to be taken by debt service.”

Less than two months after Aisen’s warning, the finance minister disclosed that Nigeria’s debt service cost surpassed its revenue in the first four months of this year.

Debt service gulped N1.94tn between January and April 2022, as against a retained revenue of N1.63tn.

According to a recent PUNCH report, the Federal Government exceeded its debt service allocation by N1.15tn for the period between January and November 2021.

A copy of the public presentation of the 2022 approved budget by the finance minister showed that the Federal Government allocated N3.32tn for debt servicing in 2021.

READ ALSO: Debt Servicing May Take All Of Nigeria’s Revenue By 2026, IMF Warns

However, the minister’s presentation document showed that a total of N4.2tn was spent on debt servicing in 11 months, indicating a difference of N1.15tn or 37.9 per cent of the money allocated for debt servicing for the period.

The PUNCH also reports that Nigeria’s debt servicing bill increased by 109 per cent, from N429bn in December 2021 to N896bn in March 2022.

A report by the Nigerian Economic Summit Group and the Open Society Initiative for West Africa has disclosed that Nigeria and 10 other Economic Community of West African States countries are currently in debt distress based on debt sustainability analysis.

The 10 other countries are: Benin, Burkina Faso, Cabo Verde, the Gambia, Ghana, Guinea Bissau, Liberia, Niger, Senegal, and Togo.

It was further disclosed in the report that public debt accumulation for these countries was becoming unsustainable and needed to be addressed to avert the looming debt crisis.

The report warned that the possibility of a debt crisis in Nigeria would adversely affect public and private investments, as well as other sectors of the country.

The World Bank recently said that Nigeria’s debt, which might be considered sustainable for now, was vulnerable and costly.

According to the Washington-based global financial institution, the country’s debt was also at risk of becoming unsustainable in the event of macro-fiscal shocks.

Experts have kicked against the Federal Government’s proclivity for debt, which they have described as unsustainable.

Economists slam FG’s debt proclivity

The Chief Executive Officer of Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, said that the Nigerian economy had been characterised by diverse economic vulnerabilities, which included rising public debt and debt service burden.

He said, “Debt service to revenue ratio for the first four months of the current year is over 100 per cent. The implication of this is that the actual revenue of the government over the period is not sufficient to service debt. Therefore, financing of the operations of government – personnel cost, overhead cost, capital expenditure, and even part of the servicing of the debt – will have to come from additional borrowing. These portend severe vulnerabilities for the Nigerian economy.”

A Professor of Development Macroeconomics at the University of Lagos, Prof Olufemi Saibu, criticised the government for over-borrowing.

He said, “I think we are over-borrowing. We continue to rely on international benchmarks, which make us lazy in terms of revenue generation.”

Prof Saibu urged the government to lessen its huge expenditure costs and channel money into more productive sectors of the economy.

“With our current heavy infrastructure debt financing and the low productivity in the local economy, the government needs to find a way of reducing its expenditures. We need to redirect the government’s finances to areas that are productive and borrow less for consumption,” he said.

In addition, Prof Saibu said that the government needed to look inwardly and borrow domestically rather than externally, which would lessen the burden of debt service.

He said the government should stop saying the country had the capacity to borrow more, and refrain from ballooning already outsized debts.

READ ALSO: Debt, Inflation Affecting Global Growth – World Bank

Prof Saibu advised that the government should engage the private sector in the area of infrastructure development to reduce the weight on the public sector.

A Professor of Development Economics at Babcock University, Prof Adegbemi Onakoya, said that borrowing was not an issue but the value obtained from it.

He also said that Nigeria had a revenue problem, which had made the country rely more on debt financing.

Prof Onakoya also said that there was a problem when money borrowed was not judiciously applied for productive purposes or programmes that would help production.

PUNCH

You may like

Nigeria’s Public Debt Rises To N149trn

13 States To Borrow Fresh N380bn In 2025 [SEE LIST]

20 Governors Borrow Fresh N446bn As Revenues Tumble

JUST IN: Nigeria’s Public Debt Rose By N24.33tn In Three Months – DMO

Hajj: Five States With $383m Debt Budget N9bn For Pilgrims

Full List: 13 New Governors Borrowed N226.8bn In Six Months – DMO

Business

JUST IN: Dangote Refinery Hikes Petrol Ex-depot Price

Published

2 weeks agoon

June 20, 2025By

Editor

Nigerians may soon pay more for petrol as the Dangote Petroleum Refinery on Friday increased its ex-depot price for Premium Motor Spirit to N880 per litre, raising fresh concerns over fuel affordability and price volatility in the downstream sector.

Checks on petroleumprice.ng, a platform tracking daily product prices, and a Pro Forma Invoice seen by The PUNCH confirmed the hike, representing a N55 increase from the previous rate of N825 per litre.

The increment would ripple across the entire fuel distribution chain, likely pushing pump prices above N900/litre in some parts of the country, especially in areas far from the distribution hubs.

The hike comes despite global crude prices falling. Brent crude dipped by 3.02% to $76.47, WTI fell to $74.93, and Murban dropped to $76.97 on Friday. The decline in benchmarks offers little relief due to persistent fears of sudden supply disruptions.

READ ALSO: JUST IN: Dangote Refinery Sashes Petrol Gantry Price

The refinery has increased its reliance on imported U.S. crude and operational costs amid exchange rate instability, which adds to its pricing pressure.

On Thursday, the President of the Dangote Group, Aliko Dangote, said his 650,000-barrel capacity refinery is “increasingly” relying on the United States for crude oil.

This came as findings showed that the Dangote Petroleum Refinery is projected to import a total of 17.65 million barrels of crude oil between April and July 2025, beginning with about 3.65 million barrels already delivered in the past two months, amid ongoing allocations under the Federal Government’s naira-for-crude policy.

Dangote informed the Technical Committee of the One-Stop Shop for the sale of crude and refined products in naira initiative that the refinery was still battling crude shortages, which had led it to resort to imports from the United States.

READ ALSO:Dangote Stops Petrol Sale In Naira, Gives Condition For Resumption

On Monday, the president of the Petroleum and Natural Gas Senior Staff Association of Nigeria, Festus Osifo, accused oil marketers of exploiting Nigerians through inflated petrol prices, insisting that the current pump price of PMS should range between N700 and N750 per litre.

He criticised the disparity between falling global crude oil prices and the stagnant retail price of petrol in Nigeria.

“If you go online and check the PLAT cost per cubic metre of PMS, convert that to litres and then to our Naira, you will see that with crude at around $60 per barrel, petrol should be retailing between N700 and N750 per litre.”

He asserted that if Nigerians bear the brunt of higher fuel costs, they should be allowed to enjoy the benefit of low pricing.

His forecast of increased costs now appears spot on, considering the latest developments.

Marketers are already adjusting. Depot owners and fuel distributors in Lagos and other cities anticipate a domino effect, with new price bands expected to follow Dangote’s lead.

Many had held back pricing decisions since Tuesday, when the refinery halted sales and withheld fresh PFIs. The delay fueled speculation, allowing opportunistic price hikes across various depots.

The Naira, which has seen steady appreciation against the Dollar all week, closed stronger on Friday, trading at ₦1,580.44 in the official forex market.

Data from the Central Bank of Nigeria’s website show the Naira gained ₦4.51k against the Dollar on Friday alone.

This marks a 0.28 per cent appreciation from Thursday’s closing rate of ₦1,584.95 in the official foreign exchange window.

The local currency maintained consistent strength throughout the week, recording gains daily.

READ ALSO: Naira Appreciates Against Dollar At Foreign Exchange Market

On Monday, May 19, it traded at ₦1,598.68; on Tuesday, at ₦1,590.45; and on Wednesday, at ₦1,584.49.

These gains suggest increased investor confidence and improved forex supply, contributing to the naira’s performance.

Meanwhile, the CBN, at its 300th Monetary Policy Committee meeting held Monday and Tuesday, retained the Monetary Policy Rate at 27.5 per cent.

Business

BREAKING: Again, Dangote Refinery Cuts Petrol Price

Published

1 month agoon

May 22, 2025By

Editor

The Dangote Petroleum Refinery has announced a nationwide reduction in the pump price of Premium Motor Spirit (PMS), commonly known as petrol, with new prices now ranging between ₦875 and ₦905 per litre, depending on location.

The ₦15 per litre cut applies across all regions and partner fuel stations, and was confirmed via an official announcement posted on Dangote Refinery’s social media channels on Thursday.

Major marketers participating in the new pricing regime include MRS, Ardova, Heyden, Optima Energy, Techno Oil, and Hyde Energy — partners in the distribution of Dangote-refined products.

READ ALSO: JUST IN: Dangote Refinery Sashes Petrol Gantry Price

Under the previous pricing structure, Lagos residents paid ₦890 per litre, while prices reached ₦920 in the North-East and South-South regions. With the latest adjustment, Lagos now pays ₦875 per litre, while the North-East and South-South will see prices drop to ₦905.

A regional breakdown of the revised prices is as follows: Lagos: ₦875, South-West: ₦885, North-West & Central: ₦895, North-East & South-South: ₦905 and South-East: ₦905.

In its announcement, Dangote Refinery encouraged consumers to purchase fuel only from authorised partner stations and urged the public to report any cases of non-compliance via its official hotlines: +234 707 470 2099 and +234 707 470 2100.

“Our quality petrol and diesel are refined for better engine performance and are environmentally friendly,” the company said.

- NYSC Commends Bauchi Govt On Infrastructural Development In Orientation Camp

- Gunmen Kill 10 In Anambra Community

- EFCC Arrests 31 Suspected Internet Fraudsters In Nasarawa

- 30-year-old Man Hacks Mother To Death

- FCT Police Arrest Three Wanted Kidnappers

- Ghana Deports Convicted Nigerian For Smuggling Fake $100,000

- Man Jailed Seven Years For N11.4m Enugu Land Fraud

- Tragedy As 23-year-old Dies By Self-stabbing In Delta

- Police Raid Criminal Hideouts In Delta, Arrest Suspects, Seize Weapons

- Sex Worker Dies After Dispute Over N15,000 Refund In Ondo

About Us

Trending

News5 days ago

News5 days agoArson: Man To Pay N150m For Burning FRSC Patrol Vehicle In Bauchi

Politics4 days ago

Politics4 days agoBREAKING: Confusion As APC Chair, Ganduje Resigns

News2 days ago

News2 days agoAuchi Poly Mass Comm Class of 2006 Holds Maiden Reunion in Benin

Politics5 days ago

Politics5 days ago‘Peace Has Returned To Rivers’ — Wike, Fubara Speak After Meeting Tinubu

Headline2 days ago

Headline2 days ago‘They Checked My Instagram’ – Nigerian Lady Breaks Down After Landing In U.S, Denied Entry

Metro2 days ago

Metro2 days agoBREAKING: Emir’s Palace, NDLEA Office Set Ablaze As Protest Rocks Kwara

News2 days ago

News2 days agoNSCDC, Immigration, Others: FG Postpones Recruitment, Changes Portal

Sports4 days ago

Sports4 days agoChelsea Set To Offload Jackson, Madueke, 8 Others [See list]

Metro4 days ago

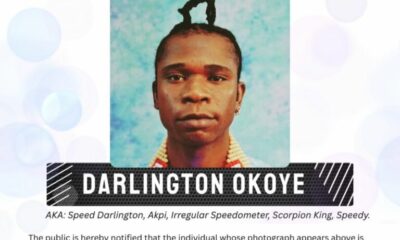

Metro4 days agoNAPTIP Declares Speed Darlington Wanted For Tape, Cyberbullying

Metro1 day ago

Metro1 day agoPanic As Bees Invade Central Mosque In Edo