Metro

GTBank Loses Bid To Reclaim MKO Son’s Lagos Mansion

The Court of Appeal, Lagos Division, has overturned a 2013 judgment of the Federal High Court, which allowed Guaranty Trust Bank Plc to foreclose on a N30bn 44-room mansion in Ikoyi, Lagos, belonging to Alhaji Agboola Abiola, son of the late business mogul and politician, Chief M.K.O. Abiola.

A Certified True Copy of the ruling in Appeal No. CA/L/888/2014, obtained by The PUNCH showed that the appellate court found significant discrepancies in the execution of the tripartite legal mortgage that GTBank relied on to secure the loan.

The unanimous judgment, delivered by Justice Paul Aimee Bassi, with Justices Polycarp Kwahar and Abdulaziz Anka concurring, held that the trial court erred in failing to properly evaluate serious allegations of forgery and fraud raised by the appellants.

The appeal stemmed from a June 20, 2014, decision by the Federal High Court in Lagos, which granted reliefs sought by GTBank in a motion filed on April 8, 2014.

READ ALSO: Nigeria Has Food But No Food Security – Don

Dissatisfied with the ruling, the appellants, represented by Dr Charles Adeogun-Phillips (SAN), filed a four-ground notice of appeal.

The main issues before the court included whether GTBank had the right to regularise its affidavit after the matter had been adjourned for judgment, whether the trial court rightly granted the bank’s reliefs, and whether a valid legal mortgage existed to justify the bank’s appointment of a receiver over the Ikoyi property.

In his lead judgment, Justice Bassi ruled that the mortgage instrument relied on by the bank was fundamentally flawed and incapable of conferring any right of foreclosure.

While the first appellant, RCN Networks Ltd, acknowledged executing the deed, the second appellant, Agboola Abiola, denied signing it.

He claimed that the execution page bearing his signature had been fraudulently lifted from a different document and inserted into the mortgage deed.

READ ALSO: US court Jails Five Nigerians 159 Years For $17m Fraud

The appellants also accused GTBank of consolidating two separate loans one of N508m and another of N1bn without their consent.

They alleged that after liquidating the shares pledged as collateral under the N508m loan, the bank improperly attempted to use the same execution page to enforce the N1 bn loan.

Meanwhile, police investigations that were conducted yielded inconclusive results.

In one of the reports, arbitration was recommended between the parties, while another dismissed the forgery allegations.

Nevertheless, the appellate court held that such reports could not resolve the lingering doubts surrounding the authenticity of the document in question.

READ ALSO: Kanu’s Radio Transmitter Import Was Unauthorised, DSS Tells Court

Justice Bassi noted several irregularities in the pagination of the deed.

The main pages were numbered from “2 of 9” to “9 of 9,” while the execution page carried the notation “11 of 17,” indicating that it was likely sourced from an entirely different document.

He criticised the trial court for overlooking these anomalies and focusing solely on the interpretation of Clause 6 of the mortgage deed.

According to the appellate court, a document whose authenticity is in dispute cannot form the basis for adjudicating parties’ rights and obligations.

Justice Bassi held: “The lower court erred by ruling on a document whose authenticity was seriously in question. This appeal succeeds.

“The judgment of the lower court dated June 20, 2014, is hereby set aside. Parties shall bear their respective costs.”

(PUNCH)

Metro

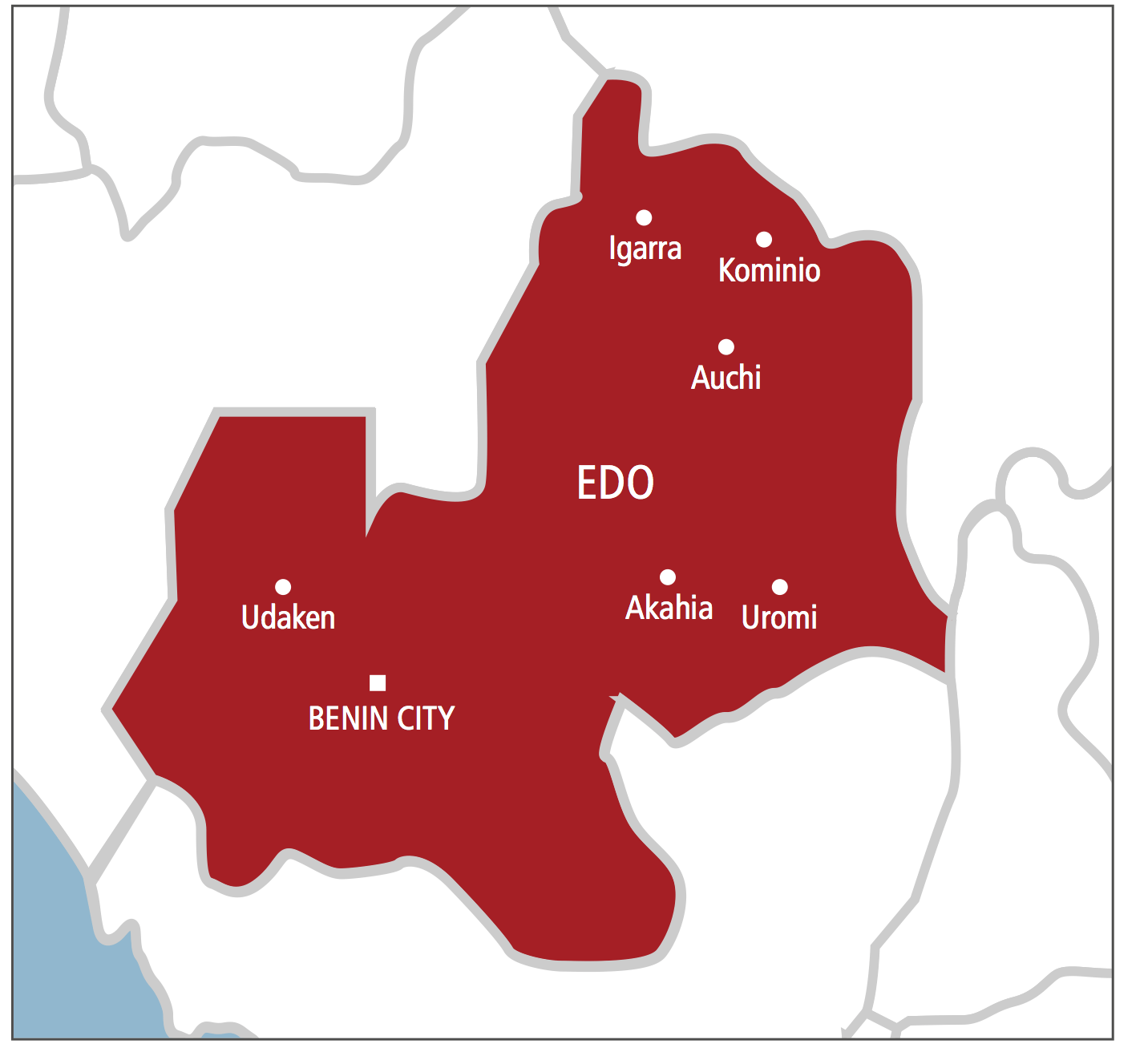

Two Brothers Miraculously Escape From Kidnappers’ Den In Edo

Two brothers, identified as Isaac and Victor Olayere, who were kidnapped on November 8 along Adughe and Imoga Road have miraculously escaped from kidnappers’ den.

The two brothers were taken into the bush as soon as they were kidnapped, throwing Uma/Imoga community into confusion, as the kidnappers demanded N22 million ransom.

While the community was still at a loss over how to raise the ransom, the victims called their father with an unknown number, telling him they had escaped from the kidnappers den.

The Okpahi of Imoga Kingdom, Oba Patrick Obajoye revealed this during a telephone interview.

He called on the authorities to come to the rescue of Imoga, a town he said, shares border with Ondo and Kogi, thereby making it prone to kidnapping activities.

READ ALSO:Court Sentences 11 to 79 Years Improvement In Edo

He said, “The two brothers were kidnapped on November 8 along Adughe and Imoga Road and were taken into the bush.

“Later, the kidnappers reached out to the family and demanded a ransom of N22 million, throwing the ancient community of Uma/Imoga in Akoko Edo Local Government Area, Edo State.

“I swiftly reported the incident to the Ibillo Police Station with the hope that the rescue effort will lead to the release of the brothers.

“It was said that somehow, the kidnappers suddenly went into a deep slumber in the forest, enabling their victims to escape. They were found by the vigilante of Adughe, a neighbouring community in Kogi that speaks the same Okpameri language with Uma/Imoga in Akoko Edo.

READ ALSO:Edo Twin Babies Died Of Natural Causes — Autopsy Report

“The vigilantes called Imoga people and the youth mobilised and entered the forest, but they could not see the kidnappers who had woken up after their captives had escaped and fled.

He noted that the activities of kidnappers and armed herders have become a major problem in the community, urging the authorities to create a police post in the area.

He added, “We need police presence in Imoga. If a police post is created here, the officers will patrol the community which will give the resident rest of mind.

“Imoga is the largest village in Akoko Edo, particularly in terms of land mass, into which many herders have entered en masse. It is the link between Edo State and the northern part of the country.”

Metro

NDLEA Arrests 39 Suspects With 2,477.59kg In Edo

Operatives of the National Drug Law Enforcement Agency (NDLEA), Edo State Command, have arrested thirty-nine (39) suspected drug traffickers with 2,477.59 Kg of narcotic drugs.

Mitchell Ofoyeju, state commander of the NDLEA made this known in a statement titled: operational scorecard for October 2025, which he made available to newsmen in Benin on Monday.

According to the statement, the suspects consist of twenty-seven (27) males and twelve (12) females.

READ ALSO:NDLEA Arrests 3 Suspects With 1,779kg Of Cannabis In Ogun

The statement added that, within the period under review, three cannabis sativa farms measuring 6.711192 hectares with an estimated yield of 16,777.98 kg were also destroyed.

A breakdown of the total 2,477.59 kg of seized drugs indicates that Cannabis Sativa 2,476.87 kg; Tramadol 0.3575 kg; Nitrazepam 0.068 kg; Bromazepam 0.8141 kg; Diazepam 0.084 kg; Swinol 0.0036 kg; Danabol (Molly) 0.013 kg; Methamphetamine (abandoned) 0.0465 kg and Codeine Syrup 0.1 litre.

According to the statement, three cannabis farms located in the Ugbodo Forest of Ovia North East Local Government Area, covering an area of 6.71 hectares, with an estimated yield of 16,777.98 kg of illegal crops, were eliminated.

READ ALSO:NDLEA Files Forfeiture Case Against Lagos Socialite’s Club Over Drug Party

The command’s prosecution unit also made significant strides in the ongoing fight against drug trafficking.

“October saw the conviction of eleven individuals involved in drug-related offences and eleven new cases charged in the courts. Currently, there are 121 pending cases at the Federal High Court in Benin City.

“Our commitment remains steadfast as we continue to enforce the law, educate members of the public, and rehabilitate affected individuals who have problems using drugs.

“The fight against drug trafficking is relentless, and those who continue to engage in this illegal trade will face not only heightened enforcement but also stiffer penalties,” the statement reads.

Metro

Police Rescue Stolen Boy, Arrest Six Over Child Trafficking In Anambra

The Anambra State Police Command has rescued a three-year-old boy who was stolen in the state and arrested six members of a child-stealing and trafficking syndicate operating across Anambra, Enugu, and Lagos states.

A statement by the Command’s spokesperson, Tochukwu Ikenga, said that on September 4, following a petition from the victim, operatives attached to the Gender Unit of the State Criminal Investigation Department (SCID), Awka, began an investigation into the case.

Ikenga explained that the petition detailed how the complainant’s daughter had left her three-year-old son in the care of one Samuel Ibe of Umusiome, Nkpor Uno, while she briefly went to her shop.

READ ALSO:Anambra Decides: CDD Advocates Neutrality, Seamless Process; Says Litmus Test For Amupitan

“On her return, both the child and the said Samuel were missing. Swift investigative actions by the operatives led to the arrest of the said Samuel Ibe. His confessional statement subsequently led to the arrest of his mother, Agatha Ejeweh, 35, and his younger brother, Ejeweh Chigozie Chidera, 15,” he said.

He further disclosed that operatives extended their investigation to Enugu State, where one Angela Eze, 30, was apprehended for collaborating with Juliet Onah to facilitate the transfer of the stolen child to Lagos.

READ ALSO:Newborn Rescued As Police Bust Anambra Child Trafficking Syndicate

“Acting on credible intelligence, the operatives proceeded to Lagos State, where a suspect, China Cosmas, was arrested and the stolen child was successfully rescued. The child has since been reunited with his family in good health,” Ikenga added.

He confirmed that the suspects involved in the crime are currently in custody and will be charged in court upon completion of investigations.

Ikenga reiterated the Command’s commitment to protecting lives and property, warning that criminal elements should not consider Anambra State a safe haven for any form of criminal enterprise.

Headline4 days ago

Headline4 days agoMexican President Pledges Tougher Sexual‑harassment Laws After Being Groped

News5 days ago

News5 days agoEdo Sets Up Special Court To Prosecute Govt-owned Land Encroachers

News4 days ago

News4 days agoTinubu Swears In Two New Ministers, Holds First FEC Meeting Since July

Metro4 days ago

Metro4 days agoCourt Sentences 11 to 79 Years Improvement In Edo

Metro4 days ago

Metro4 days agoPolice Arrest Two Suspects With Human Parts

News2 days ago

News2 days agoAnambraDecides: Let Every Vote Counts, Situation Room Tasks INEC

Metro4 days ago

Metro4 days agoLagos To Divert Traffic For 10th Women Run Saturday

Metro4 days ago

Metro4 days agoPolice Arrest Suspect For Raping Woman To Death In Rivers

News4 days ago

News4 days agoAnambra: EU Deploys 687 Observers Ahead Of Saturday Gov Election

News4 days ago

News4 days agoVIDEO: It’s Pure Genocide, APC’s Adamu Garba Backs Trump On Killings In Nigeria