Business

Naira Redesign: CBN Deadline Insensitive, Spells Doom For Country’s Economy – Experts

Published

2 years agoon

By

Editor

As the 31 January 2023 deadline given by the Central Bank of Nigeria, CBN, to phase out the old naira notes inches closer, economic experts have said that refusing to extend the deadline is insensitive and would spell doom for the country’s economy.

The call is an addition to several ones made by stakeholders, including the National Assembly, on extending the deadline for old naira notes to remain legal tender.

In December, the Senate beckoned on the CBN to shift the deadline from 31 January to June. The upper chamber made this call in a motion raised by Senator Ali Ndume and supported by his colleagues during a plenary.

The speed with which the apex implements the naira redesign policy in less than three months leaves more to wonder as fear of a real crisis heightens.

READ ALSO: Locals Reject Old Naira, As Scarcity Of New Notes Hits Kaduna

When contacted CBN’s director of Corporate Communications, Mr Osita Nwanisobi, he said he was indisposed to reply to our correspondents’ enquiry on the naira redesign deadline because he was attending the bank’s Monetary Policy Meeting.

Speaking with DAILY POST on the development, the CEO of Centre for the Promotion of Private Enterprise, CPPE, Dr Muda Yusuf, said it would be insensitive if CBN insists on the 31 January, 2023, deadline.

According to him, the apex bank needs to be more realistic about the deadline based on the apparent adequacies and logistics gaps.

He said if CBN insists on implementing the 31 January deadline, it will infringe on citizens’ fundamental human rights.

“The CBN needs to be realistic about this deadline; there is still a lot of gap in the implementation of the naira redesign.

“Concerning the adequacy of the new naira notes, the quantity available is insufficient.

“The other gap regarding logistics, CBN never imagined the logistics implication.

“The logistical thing to do is to extend the deadline. It is going to dispose of citizens’ hard-earned money.

“It is most insensitive for CBN to insist on a deadline that would inflict another pain on Nigerians.

“It will create a whole lot of confusion in the system. CBN, an agency of government, should not toe this line.

“In other climes, they do current redesign policy implementation in two years. CBN wants to do it in less than two months here in Nigeria.

“The National Assembly and other stakeholders have called on the CBN to extend the 31 January deadline. President Muhammadu Buhari must add his voice, else the economy would be deeply affected.

READ ALSO: Naira Redesign Policy: Kidnappers Will Demand Dollars For Ransom – Gumi

“If CBN insists, it will be infringing on the fundamental human rights of Nigeria citizens,” he said.

A financial expert, Mr Idakolo Gbolade, said the CBN 31 January deadline is not feasible.

He stated that the CBN deadline extension would accelerate the policy implementation nationwide.

He said, “If the CBN does not flood the country with the new notes and even use other means of exchanging it for Nigerians apart from the commercial banks, I do not foresee a successful policy implementation in a week to the deadline.

“The CBN just came up with the cash swap policy for rural areas last week to exchange the old notes for the new ones. The cash swap policy will only succeed if the deadline is extended.

“I am now concluding that the deadline is punitive and could cause some uninformed Nigerians significant loss if the dynamics remain the same.”

Also, an Accounting and Financial Development don at Lead City University, Ibadan, Prof Godwin Oyedokun, said the deadline extension is inevitable.

According to him, Nigerians should not suffer the inefficiency of CBN and those responsible for governance.

“I have said it long before that extension of this date is inevitable.

“It is common knowledge that these notes are not out in commercial quantities.

“It is not our fault as citizens, and we cannot be made to suffer the inefficiency of those charged with governance.

“Now that the notes are not in circulation or in sufficient quantities, it is expected that the CBN should do the needful by extending this by some reasonable days”, he stated.

READ ALSO: Naira Redesign: Governors Summon Emefiele Over Policy

The CBN announced late last year, precisely October 26, the naira redesign policy, and barely a month after, 23 November, President Muhammadu Buhari unveiled the new naira notes, followed by its circulation on 15 December.

The apex bank issued a directive to commercial banks to ensure that their ATMs dispense only the banknotes. But many banks continued to defy the order.

In less than seven days to the 31 January deadline, the old naira notes are the majority currency in circulation nationwide.

Although the CBN has carried out several initiatives, including its latest cash-swap programme, the calls for extending the deadline have become too loud to ignore.

DAILY POST

You may like

Naira Redesign: Farmers Ask FG For Compensation Over Losses

Edo: Traders Reject Old Notes, Residents Groan Over Buhari’s Stance On S’Court Judgement

Naira Redesign: Four Days After, Commercial Banks In Benin Yet To Comply With Supreme Court Ruling

Supreme Court Nullifies FG’s Cashless Policy, Naira Redesign

Banks Resume Receiving Old N500, N1000 Notes

Buhari Apologises Over Naira Redesign Policy

Business

JUST IN: Dangote Refinery Hikes Petrol Ex-depot Price

Published

2 weeks agoon

June 20, 2025By

Editor

Nigerians may soon pay more for petrol as the Dangote Petroleum Refinery on Friday increased its ex-depot price for Premium Motor Spirit to N880 per litre, raising fresh concerns over fuel affordability and price volatility in the downstream sector.

Checks on petroleumprice.ng, a platform tracking daily product prices, and a Pro Forma Invoice seen by The PUNCH confirmed the hike, representing a N55 increase from the previous rate of N825 per litre.

The increment would ripple across the entire fuel distribution chain, likely pushing pump prices above N900/litre in some parts of the country, especially in areas far from the distribution hubs.

The hike comes despite global crude prices falling. Brent crude dipped by 3.02% to $76.47, WTI fell to $74.93, and Murban dropped to $76.97 on Friday. The decline in benchmarks offers little relief due to persistent fears of sudden supply disruptions.

READ ALSO: JUST IN: Dangote Refinery Sashes Petrol Gantry Price

The refinery has increased its reliance on imported U.S. crude and operational costs amid exchange rate instability, which adds to its pricing pressure.

On Thursday, the President of the Dangote Group, Aliko Dangote, said his 650,000-barrel capacity refinery is “increasingly” relying on the United States for crude oil.

This came as findings showed that the Dangote Petroleum Refinery is projected to import a total of 17.65 million barrels of crude oil between April and July 2025, beginning with about 3.65 million barrels already delivered in the past two months, amid ongoing allocations under the Federal Government’s naira-for-crude policy.

Dangote informed the Technical Committee of the One-Stop Shop for the sale of crude and refined products in naira initiative that the refinery was still battling crude shortages, which had led it to resort to imports from the United States.

READ ALSO:Dangote Stops Petrol Sale In Naira, Gives Condition For Resumption

On Monday, the president of the Petroleum and Natural Gas Senior Staff Association of Nigeria, Festus Osifo, accused oil marketers of exploiting Nigerians through inflated petrol prices, insisting that the current pump price of PMS should range between N700 and N750 per litre.

He criticised the disparity between falling global crude oil prices and the stagnant retail price of petrol in Nigeria.

“If you go online and check the PLAT cost per cubic metre of PMS, convert that to litres and then to our Naira, you will see that with crude at around $60 per barrel, petrol should be retailing between N700 and N750 per litre.”

He asserted that if Nigerians bear the brunt of higher fuel costs, they should be allowed to enjoy the benefit of low pricing.

His forecast of increased costs now appears spot on, considering the latest developments.

Marketers are already adjusting. Depot owners and fuel distributors in Lagos and other cities anticipate a domino effect, with new price bands expected to follow Dangote’s lead.

Many had held back pricing decisions since Tuesday, when the refinery halted sales and withheld fresh PFIs. The delay fueled speculation, allowing opportunistic price hikes across various depots.

The Naira, which has seen steady appreciation against the Dollar all week, closed stronger on Friday, trading at ₦1,580.44 in the official forex market.

Data from the Central Bank of Nigeria’s website show the Naira gained ₦4.51k against the Dollar on Friday alone.

This marks a 0.28 per cent appreciation from Thursday’s closing rate of ₦1,584.95 in the official foreign exchange window.

The local currency maintained consistent strength throughout the week, recording gains daily.

READ ALSO: Naira Appreciates Against Dollar At Foreign Exchange Market

On Monday, May 19, it traded at ₦1,598.68; on Tuesday, at ₦1,590.45; and on Wednesday, at ₦1,584.49.

These gains suggest increased investor confidence and improved forex supply, contributing to the naira’s performance.

Meanwhile, the CBN, at its 300th Monetary Policy Committee meeting held Monday and Tuesday, retained the Monetary Policy Rate at 27.5 per cent.

Business

BREAKING: Again, Dangote Refinery Cuts Petrol Price

Published

1 month agoon

May 22, 2025By

Editor

The Dangote Petroleum Refinery has announced a nationwide reduction in the pump price of Premium Motor Spirit (PMS), commonly known as petrol, with new prices now ranging between ₦875 and ₦905 per litre, depending on location.

The ₦15 per litre cut applies across all regions and partner fuel stations, and was confirmed via an official announcement posted on Dangote Refinery’s social media channels on Thursday.

Major marketers participating in the new pricing regime include MRS, Ardova, Heyden, Optima Energy, Techno Oil, and Hyde Energy — partners in the distribution of Dangote-refined products.

READ ALSO: JUST IN: Dangote Refinery Sashes Petrol Gantry Price

Under the previous pricing structure, Lagos residents paid ₦890 per litre, while prices reached ₦920 in the North-East and South-South regions. With the latest adjustment, Lagos now pays ₦875 per litre, while the North-East and South-South will see prices drop to ₦905.

A regional breakdown of the revised prices is as follows: Lagos: ₦875, South-West: ₦885, North-West & Central: ₦895, North-East & South-South: ₦905 and South-East: ₦905.

In its announcement, Dangote Refinery encouraged consumers to purchase fuel only from authorised partner stations and urged the public to report any cases of non-compliance via its official hotlines: +234 707 470 2099 and +234 707 470 2100.

“Our quality petrol and diesel are refined for better engine performance and are environmentally friendly,” the company said.

- NYSC Commends Bauchi Govt On Infrastructural Development In Orientation Camp

- Gunmen Kill 10 In Anambra Community

- EFCC Arrests 31 Suspected Internet Fraudsters In Nasarawa

- 30-year-old Man Hacks Mother To Death

- FCT Police Arrest Three Wanted Kidnappers

- Ghana Deports Convicted Nigerian For Smuggling Fake $100,000

- Man Jailed Seven Years For N11.4m Enugu Land Fraud

- Tragedy As 23-year-old Dies By Self-stabbing In Delta

- Police Raid Criminal Hideouts In Delta, Arrest Suspects, Seize Weapons

- Sex Worker Dies After Dispute Over N15,000 Refund In Ondo

About Us

Trending

News5 days ago

News5 days agoArson: Man To Pay N150m For Burning FRSC Patrol Vehicle In Bauchi

Politics4 days ago

Politics4 days agoBREAKING: Confusion As APC Chair, Ganduje Resigns

News2 days ago

News2 days agoAuchi Poly Mass Comm Class of 2006 Holds Maiden Reunion in Benin

Politics5 days ago

Politics5 days ago‘Peace Has Returned To Rivers’ — Wike, Fubara Speak After Meeting Tinubu

Headline2 days ago

Headline2 days ago‘They Checked My Instagram’ – Nigerian Lady Breaks Down After Landing In U.S, Denied Entry

Metro2 days ago

Metro2 days agoBREAKING: Emir’s Palace, NDLEA Office Set Ablaze As Protest Rocks Kwara

Sports4 days ago

Sports4 days agoChelsea Set To Offload Jackson, Madueke, 8 Others [See list]

News3 days ago

News3 days agoNSCDC, Immigration, Others: FG Postpones Recruitment, Changes Portal

Metro4 days ago

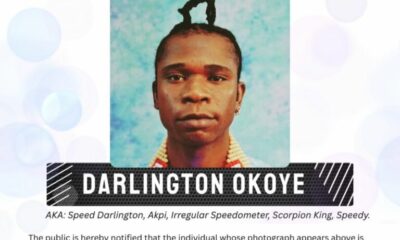

Metro4 days agoNAPTIP Declares Speed Darlington Wanted For Tape, Cyberbullying

News2 days ago

News2 days agoIndecent Dressing Punishable Offence, Attracts N50,000 Fine In Delta — Police Warns