Business

Nigerians Sent N2tn Via USSD Codes In Six Months – Report

The Central Bank of Nigeria’s electronic payment statistics have shown that, between January and June 2024, 252.06 million transactions, which amounted to N2.19tn, were carried out via Unstructured Supplementary Service Data codes.

This is a significant milestone compared to the full-year data for 2023, which showed that N4.84tn was transacted via USSD codes across 630.6 million transactions.

The N2.19tn recorded in the first half of 2024 represents 45.3 per cent of the total value of USSD transactions in 2023 and 40 per cent of the total transaction volume for the same year.

Initially developed by telecom companies for providing airtime and subscription services, the USSD service has been widely adopted in the banking sector because it does not require an Internet connection.

READ ALSO: CBN Plans To Raise Fines On Erring Banks

USSD codes continue to play a crucial role in Nigeria’s financial inclusion strategy, offering a platform for users with limited internet access to make quick and convenient transactions.

This is especially important in rural areas, where internet connectivity remains unreliable.

However, this form of transaction has been threatened by over N250bn debt, which has been a contentious issue for the past six years, prompting past interventions from the Central Bank of Nigeria under Godwin Emefiele’s leadership and the former Minister of Communications, Isa Pantami, but no lasting solution has been reached.

The Chairman of the Association of Licensed Telecommunications Operators of Nigeria, Gbenga Adebayo, earlier lamented that banks have been profiting from USSD services without fulfilling their payment obligations in the last six years.

READ ALSO: CBN Threatens Sanction Over Cash Scarcity At ATMs

Last month, it was reported that telecom operators in Nigeria were seeing some progress in the repayment of the N250bn debt tied to Unstructured Supplementary Service Data services, with smaller banks beginning to settle their obligations.

However, tier-one lenders responsible for the bulk of the debt are yet to make significant payments.

At the time, the ALTON chairman disclosed that while some repayments have been recorded, they fall short of expectations.

READ ALSO: CBN Plans To Raise Fines On Erring Banks

While USSD remains a dominant channel amidst existing challenges, other electronic payment methods have also seen substantial growth.

Automated Teller Machine transactions have experienced a remarkable volume, with N12.21tn transacted in the first half of 2024 for 496.44 million transactions.

Point-of-sale transactions are also significant, indicating the country’s ongoing shift towards cashless payments.

PUNCH

Business

Naira Records Second Consecutive Depreciation Against US Dollar

The Naira recorded its second consecutive depreciation against the United States dollar at the foreign exchange market on Tuesday to continue the bearish trend this week.

The Central Bank of Nigeria’s data showed that the Naira further weakened on Tuesday to N1,438.71 against the dollar, down from N1,437.2933 exchanged on Monday.

This means that the Naira again dropped by N1.42 against the dollar on Tuesday on a day-to-day basis.

At the black market, the Naira remained flat at N1465 per dollar on Tuesday, the same rate traded on Monday.

READ ALSO:Naira Records First Appreciation Against US Dollar At Official Market

This is the second consecutive decline of Nigerian currency at the official market since the commencement of this week.

Meanwhile, the country’s external reserves had continued to rise, standing at $43.37 billion as of Monday, 10th November 2025, up from $43.35 billion on November 7.

Business

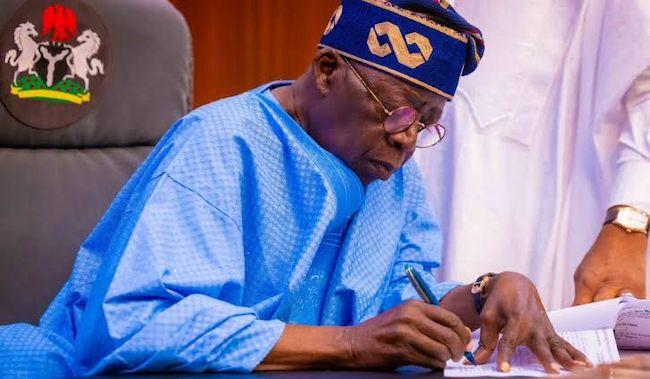

Tinubu Approves 15% Import Duty On Petrol, Diesel

President Bola Tinubu has approved a 15 percent ad-valorem import duty on diesel and premium motor spirit (PMS), also known as petrol.

This was announced in a letter dated October 21, 2025, where the private secretary to the president, Damilotun Aderemi, conveyed Tinubu’s approval to the Federal Inland Revenue Service (FIRS) and the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA).

Tinubu gave his approval, following a request by the FIRS to apply the 15 percent duty on the cost, insurance and freight (CIF) to align import costs to domestic realities.

READ ALSO:UPDATED: Tinubu Reverses Maryam Sanda’s Pardon, Convict To Spend Six Years In Jail

With the approval, the implementation of the import duty will increase a litre of petrol by an estimated N99.72 kobo.

The latest development has led to the Nigerian National Petroleum Company Limited (NNPCL) announcing that it has begun a detailed review of the country’s three petroleum refineries, with a view to bringing them back online.

NNPCL Group Chief Executive Officer (GCEO), Bayo Ojulari, made the announcement in a post on his official X handle on Wednesday night.

READ ALSO:JUST IN: Tinubu Bows To Pressure, Reviews Pardon For Kidnapping, Drug-related Offences

According to Ojulari, one of the options being explored by the NNPCL is to search for technical equity partners to ‘high-grade or repurpose’ the facilities.

Tagged: “Update on Our Refineries”, Ojulari said: “The NNPCL continues to remain optimistic that the refineries will operate efficiently, despite current setbacks.”

It can be recalled that despite spending about $3 billion on revamping the refineries, only the 60,000 barrels per day portion of the facility worked skeletally for just a few months before packing up.

The Warri refinery has remained ineffective weeks after it was gleefully announced to have returned to production, while the one situated in Kaduna State never took off at all.

Business

NNPCL Raises Fuel Price

The Nigerian National Petroleum Company Limited (NNPCL) has increased the pump price of petrol from ₦865 to ₦992 per litre, marking a fresh hike that has sparked widespread concern among motorists and consumers .

As of the time of filing this report, the company has not released any official statement explaining the reason for the sudden adjustment.

During visits to several NNPC retail outlets, The Nation observed fuel attendants recalibrating their pumps to reflect the new price.

READ ALSO:JUST IN: NNPC, NUPRC, NMDPRA Shut As PENGASSAN Begins Strike

At NNPC filling station on Ogunusi road, Ojodu Berger, petrol attendants at the station said they were instructed to change the price to reflect the new rate N992 per litre.

However, checks at Ibafo along the Lagos /Ibadan expressway showed that NNPC outlets still displayed the old price of N875 per litre, although they were not selling to commuters.

Most of the NNPC stations were not dispensing fuel.

News5 days ago

News5 days agoFG Begins Payment Of Three-year Salary Arrears to 1,700 College Teachers

Politics5 days ago

Politics5 days agoBREAKING: Nigerian Senate Approves Tinubu’s N1.15tn Loan Request

News5 days ago

News5 days agoBodies Of Terrorists Float In River As Boko Haram Murders 200 ISWAP Fighters [VIDEO]

News5 days ago

News5 days agoDefence Minister Reacts Yo Wike–Naval Officer Clash

Entertainment4 days ago

Entertainment4 days agoRegina Daniels Introduced Me To Drugs, She Sleeps With Girls – Co-wife, Charani Alleges

News5 days ago

News5 days agoPAP Begins Second Phase Distribution Of Laptops To Scholarship Beneficiaries

News4 days ago

News4 days agoJUST IN: Abuja Airport Shutdown Over Aircraft Incident

News5 days ago

News5 days agoNaval Officer In Face-off With Wike Breached The Law — SAN

News5 days ago

News5 days ago[JUST IN] Terrorism: Nnamdi Kanu Appeals For Stay Of Proceedings Ahead Of Nov 20 Judgment

Metro5 days ago

Metro5 days agoStudent Pastor Arrested In Umuahia For Allegedly Defiling Teenage Girl