Business

PENGASSAN Fingers Military In 600,000-barrel Daily Stolen

Published

2 years agoon

By

Editor

The Petroleum and Natural Gas Senior Staff Association of Nigeria has said that the military should be held responsible for the high rate of crude oil theft in the country.

This was made known at the Senate’s investigation into oil lifting and theft on Wednesday, which was chaired by Senator Akpan Bassey.

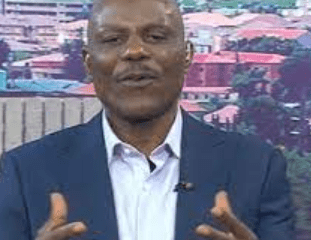

The National President of PENGASSAN, Festus Osifo, said oil theft was a collaborative crime between military personnel assigned to protect oil installations and the locals running illegal refineries.

He alleged that the military and other security agencies were aiding and abetting criminals to steal the crude with the active connivance of the regulatory agencies in charge of the nation’s petroleum industry.

Osifo, therefore, challenged the regulatory agencies and various security outfits to be alive to their responsibilities in order to solve the problems.

READ ALSO: PENGASSAN Blames Fuel Scarcity On Lack Of Forex

He specifically alleged that men of the Amphibious Brigade in Port Harcourt and their counterparts in the Navy, in connivance with superior officers at different times, joined the locals in the theft.

Osifo alleged, “One of the greatest problems we have, which nobody has highlighted, is that there is strong connivance of our security forces in the crime. There is no doubt about this. From our Army to our Navy officers, we have information that they pay their superiors to post them to some areas in the Niger Delta.

“I can authoritatively inform this committee that men of the Nigerian Army and the Navy pay their superiors to be posted to Niger Delta. Even when the former Commander of the Amphibious Brigade in Port Harcourt was removed, many of the men in the command resisted being posted out due to the ‘lucrativeness’ of their operational areas.

“I think the people who have a solution to this problem are not even the ones sitting here. They are the ones you will invite behind the camera”.

Also, the Executive Commissioner, Corporate Services and Administration in Nigerian Upstream Petroleum Regulatory Commission, Mr Jide Adeola, said about 600,000 barrels of crude oil were stolen per day.

He said, “As of today, Nigeria produces 1.23million barrels of crude oil per day as against 1.8million barrels targeted, leading to total revenue loss, as of today, of $2.1billion or N877billion.”

Worried by the submissions, the Chairman of the Committee, Akpan Bassey, said he had never seen “economic sabotage of this magnitude and it must be stopped.”

“The required political will through the instrumentality of legislative intervention shall surely be done after meeting other critical stakeholders like the Nigerian National Petroleum Corporation Limited, the Military, etc,” he noted.

The Senate also lamented that the country was losing over 900,000 barrels per day to oil thieves, stressing that the massive oil theft would crumble the economy.

Bassey said if the ongoing theft was not immediately stopped, it would also frustrate the implementation of the Petroleum Industry Act passed into law last year by the National Assembly.

Speaking at the investigative hearing on the experience of the committee during its oversight visit to major platforms in the Niger Delta, the senator expressed shock over the humongous loss of national oil revenues due to oil theft and sabotage.

Bassey stated that the committee discovered that pipelines carrying crude oil could not be identified because they were covered with no right of way, making it difficult to monitor these pipelines.

He told the stakeholders that the shortfall in the country’s oil revenues was not caused by oil theft alone but also by the inability to have evacuation access, effective metering and monitoring by operators as well as the unwillingness of security agencies to checkmate the incidents.

He lamented that the Bonny Terminal, which hitherto produces 60,000 barrels per day, had not produced a single barrel for the past seven months.

Also speaking at the occasion, the Senate President, Senator Ahmad Lawan, who had declared the investigative hearing open, said it was the view of the Senate that oil theft impacted negatively on the country’s oil production and revenues, hence its decision to set up the committee to come up with a workable template to arrest the situation.

READ ALSO: Fresh Fuel Scarcity Looms As PENGASSAN Threatens To Shut Down Installations Over Oil Theft

Lawan, who was represented at the occasion, also charged stakeholders to come up with a plan to end this national challenge.

He said, “It is regrettable that the criminals are perpetrating the unfortunate crime with the active connivance of stakeholders, including security personnel.

“The Senate will stop at nothing to unveil the criminals behind the crime and that is why we set an ad hoc committee to unravel the thieves and come up with workable solutions to end the menace, before December this year.”

A member of the committee, the senator representing Kano South senatorial district, Senator Kabir Kaya, noted that while Nigeria’s OPEC quota was 1.8 million BPD, the country currently produces 1,2 million BPD, showing a shortfall of 600,000 BPD. He challenged the stakeholders and the operators to find a solution to this problem.

PUNCH

You may like

BREAKING: Military Releases Slain Terrorist Commanders’ Names

JUST IN: Military Yields To Pressure, Frees Abducted Lagos Editor

How Soldiers Were Ambushed, Killed In Delta Community, Ex-General Speaks

Military Airstrikes Kill Kidnap Kingpin, Others In Kaduna, Niger

Military Destroys 68 Illegal Refining Sites In Niger Delta

Military Killed Four Notorious Terrorist Commanders – DHQ

The Central Bank of Nigeria (CBN) started fresh and direct sales of US dollars at N1,021 per dollar to Bureau De Change operators.

Nigeria’s apex bank disclosed this in a circular signed by its Director of Trade and Exchange Department Hassan Mahmud.

“We write to inform you of the sale of $10,000 by the Central Bank of Nigeria (CBN) to BDCs at the rate of N1,021/$1. The BDCs are in turn to sell to eligible end users at a spread of NOT MORE THAN 1.5 percent above the purchase price,” the circular posted on its website read.

READ ALSO: Tinubu Unveils African Counter-Terrorism Summit

“ALL eligible BDCs are therefore directed to commence payment of the Naira deposit to the underlisted CBN Naira Deposit Account Numbers from today, Monday, April 22, 2024, and submit confirmation of payment, with other necessary documentations, for disbursement of FX at the respective CBN Branches.”

CBN’s move is coming as the naira is recording a slight depreciation against the dollar after weeks of gains.

In late March, the bank also sold $10,000 to each of the eligible Bureau De Change (BDC) operators in the country at the rate of N1,251/$1.

READ ALSO: Mixed Reactions Trail Video Of Couple’s Customised N200 Notes

Like in the most recent sales, it warned BDCs against breaching terms of the dollar sales, vowing to sanction defaulters “including outright suspension from further participation in the sale”.

The fortunes of the naira have fallen sharply since President Bola Tinubu took over in May. Inflation figures have reached new highs and the cost of living hitting the rooftops.

Nigeria’s currency slid to about N1,900/$ some months ago at the parallel market. But in recent weeks, it has gained against the dollar.

The Nigerian authorities have also doubled down on their crackdown against cryptocurrency platform Binance and illegal BDCs.

On March 1, the CBN revoked the licences of 4,173 BDCs over compliance failures.

Olusegun Alebiosu has been appointed as the Acting Managing Director/Chief Executive Officer of First Bank of Nigeria Limited (FirstBank Group), effective April 2024.

Alebiosu steps into this pivotal role from his previous position as the Executive Director, Chief Risk Officer, and Executive Compliance Officer, a position he held since January 2022.

Alebiosu brings to the helm of FirstBank over 28 years of extensive experience in the banking and financial services industry. His expertise spans various domains including credit risk management, financial planning and control, corporate and commercial banking, agriculture financing, oil and gas, transportation, and project financing.

READ ALSO: JUST IN: Access Holdings Names New Acting CEO

Having embarked on his professional journey in 1991 with Oceanic Bank Plc. (now EcoBank Plc.), Alebiosu has held several notable positions in esteemed financial institutions.

Prior to joining FirstBank in 2016, he served as Chief Risk Officer at Coronation Merchant Bank Limited, Chief Credit Risk Officer at the African Development Bank Group, and Group Head of Credit Policy & Deputy Chief Credit Risk Officer at United Bank for Africa Plc.

Alebiosu’s academic credentials further enrich his professional profile. He is an alumnus of the Harvard School of Government and holds a Bachelor’s degree in Industrial Relations and Personnel Management. Additionally, he obtained a Master’s degree in International Law and Diplomacy from the University of Lagos, as well as a Master’s degree in Development Studies from the London School of Economics and Political Science.

READ ALSO: Meet Newly Appointed Union Bank CEO

A distinguished member of various professional bodies, including the Institute of Chartered Accountants (FCA), Nigeria Institute of Management (ANIM), and Chartered Institute of Bankers of Nigeria (CIBN), Alebiosu is renowned for his commitment to excellence and ethical practices in the banking sector.

Beyond his professional endeavors, Alebiosu is known for his passion for golf and adventure. He is happily married and a proud parent.

With Alebiosu’s appointment, FirstBank of Nigeria Limited anticipates continued growth and innovation under his leadership, reinforcing its position as a leading financial institution in Nigeria and beyond.

Business

CBN Gives New Directive On Lending In Real Estate

Published

1 week agoon

April 17, 2024By

Editor

The Central Bank of Nigeria, CBN, has released a new regulatory directive to enhance lending to the real sector of the Nigerian economy.

The directive, issued on April 17, 2024, with reference number BSD/DIR/PUB/LAB/017/005 and signed by the Acting Director of Banking Supervision, Adetona Adedeji, signifies a notable shift in the bank’s policy towards a more contractionary approach.

In line with the new measures, the CBN has reduced the loan-to-deposit ratio by 15 percentage points, down to 50 per cent.

This move aligns with the CBN’s current monetary tightening policies and reflects the increase in the Cash Reserve ratio rate for banks.

READ ALSO: JUST IN: CBN Gov Sacks Eight Directors, 32 Others

The LDR is a metric used to evaluate a bank’s liquidity by comparing its total loans to its total deposits over the same period, expressed as a percentage.

An excessively high ratio may indicate insufficient liquidity to meet unexpected fund requirements.

All Deposit Money Banks are now mandated to adhere to this revised LDR.

The CBN has stated that average daily figures will be utilised to gauge compliance with this directive.

Furthermore, while DMBs are encouraged to maintain robust risk management practices in their lending activities, the CBN has committed to continuous monitoring of adherence and will adjust the LDR as necessary based on market developments.

READ ALSO: JUST IN: CBN Increases Interest Rate To 24.75%

Adedeji has called on all banks to acknowledge these modifications and adjust their operations accordingly. He emphasised that this regulatory adjustment is anticipated to significantly influence the banking sector and the wider Nigerian economy.

The circular read in part, “Following a shift in the Bank’s policy stance towards a more contractionary approach, it is crucial to revise the loan-to-deposit ratio policy to conform with the CBN’s ongoing monetary tightening.

“Consequently, the CBN has decided to decrease the LDR by 15 percentage points to 50 per cent, proportionate to the rise in the CRR rate for banks.

“All DMBs must maintain this level, and it is advised that average daily figures will still be applied for compliance assessment.

“While DMBs are urged to sustain strong risk management practices concerning their lending operations, the CBN will persist in monitoring compliance, reviewing market developments, and making necessary adjustments to the LDR. Please be guided accordingly.”

Three Suspected Pipeline Vandals Caught In Edo

Cultists Arrested For Invading Anambra Hotel With Charms

LASTMA, Viju Officials Clash Leaves 10 Injured

Trending

Entertainment4 days ago

Entertainment4 days agoBridesmaids’ Dance At Wedding Causes Stir On Social Media [VIDEO/PHOTOS]

Metro4 days ago

Metro4 days agoVIDEO: ‘UNN Lecturer’ Caught Pants Down With Married Student

News2 days ago

News2 days agoDrama! Supporters Of Yahaya Bello Perform Rituals to Prevent His Arrest By EFCC [Video]

Headline3 days ago

Headline3 days agoDrama As Women Fight Dirty, Breasts Fall Out During Spring Break Outing In US [PHOTOS/VIDEO]

News3 days ago

News3 days agoVIDEO: Force PRO Orders Arrest Officers Caught On Video Bashing Driver’s Car

Entertainment3 days ago

Entertainment3 days agoNollywood Actor, Zulu Adigwe Is Dead

Headline3 days ago

Headline3 days agoMeet 17-year-old Nigerian Who Won $3.5m Worth Of Scholarships From Harvard, 13 Other Foreign Universities

Metro3 days ago

Metro3 days agoEdo Cultists Kill Rival In Daughter’s Presence, Abandon Getaway Car

News4 days ago

News4 days agoIGP, Jonathan Disagree Over State Police

Headline3 days ago

Headline3 days agoVideo Of Girl Being Bullied, Slapped At Lead British School Sparks Outrage Online [PHOTOS/VIDEO]