Business

Why Nigeria Is Yet To Be Food Secured – Varsity Don

Published

1 year agoon

By

Editor

A University Lecturer with Agronomy Department, Faculty of Agriculture in Bayero University, Kano, BUK, Sani Miko has listed factors responsible for why Nigeria is yet to be food secured.

Miko who categorized the factors into Internal and external policy challenges undermining the nation’s food security, said they include inadequate funding for the agricultural sector, threat of climate change for sustainable agriculture, insecurity of agricultural land and investments, insufficient value addition and agro-industrial processing facilities and low agricultural export among others.

The Varsity Don stated this while delivering a paper titled, “Policy Challenges To Food Security in Nigeria” during an annual Ramadan lecture organized by the Islamic Forum of Nigeria National Headquarters in Kano.

According to him, “Indeed, there are numerous challenges that prevented the Nigerian agricultural sector from attaining its full potential. They can be categorized into Internal and external policy challenges undermining food security in the country. The chief among them are as follows:

READ ALSO:

“Inadequate funding for the agricultural sector. Funding is inadequate to drive agricultural development in Nigeria.

“Achieving agricultural transformation would require funding beyond what the current budgetary allocation would provide.

“Over the years, Agriculture receives low investment from both State and Federal Governments. Example, Federal Government made budgetary allocation of between 1.3% and 3.4% to Agriculture in annual budget from the year, 2000 to 2007.

“In the year 2017, combined expenditure of the federal and state governments showed they spent only 1 .8 percent of their total annual budget to agriculture.

“Threat of Climate Change for Sustainable agriculture. This is negatively affecting the Nigerian agricultural sector while the policy response and the needed interventions to mitigate the impact has remained largely ad-hoc.

“Another factor is insecurity of Agricultural land and investments which is currently posing greater risk to agricultural production, processing, marketing and delivery of essential services.

“The menace of Boko Haram, Banditry and communal, farmers and pastoralists conflicts have devastated livelihoods and investments of hundreds of farming and pastoral communities.

“Low level of agricultural mechanization. The availability and accessibility of macro and micro mechanization equipment such as tractors, power tillers, planters, combine harvesters and others needed for land preparation and other agricultural activities is very low in the country.

“Another factor is inadequate rural Infrastructure. The capacity of the rural communities for massive agricultural production and on-farm processing has been constrained by inadequate road networks, power supply, irrigation infrastructure, storage and processing facilities.

“Poor extension services delivery: With an average of 1:10,000 extensions to farmer ratio across the country, farmers receive limited guidance and training in technology adoption. Also, limited access to affordable credit is another factor where farmers grapple with limited access to finance and high interest rates even with the interventions by the CBN.

“Similarly, issue of ineffectual synergy which relates to ineffective policy formulation and implementation structures at intra and inter-federal Ministries, Department and Agencies (MDAs) and weak synergy between federal and states MDAs. This has led to persistent inter and intra-agency rivalry in the sector.

“However, given the interdependent nature of international economic relations, it is unlikely that a country like Nigeria would be able to achieve its food security goal using its internal dynamics alone. For any country to be able to achieve its food security goal, it would need to think and act both locally and globally.

“This would need an adjustment of its relations with international, regional, and sub-regional institutions like the FAO, the European Union (EU), and Economic Community of West African States (ECOWAS).

“It would also require seeking the understanding and support of some countries, which may be negatively affected by some agricultural, food, and fiscal policies of Nigeria.

“Thus, the ban placed on the import of some agricultural products – like Rice and Wheat, frozen chicken, and meat – in order to encourage local production, hurts the exporting countries of these food items to Nigeria.

“This can provoke retaliation against Nigeria’s export of cash crops.

“These countries need to be reassured that Nigeria’s import prohibition of food items was not aimed to rubbish their ingenuity to produce so much food for local consumption and export the surplus; while greater collaboration is also needed with FAO in order to keep technical and financial aids that regularly come from the organization flowing.

“In addition, it would be helpful for the Nigerian government to take a hard and more discerning look at the usual irritating and self-serving suggestion from the World Bank, IMF, and the developed countries against subsidies in agriculture in developing countries.

“This is because it is now evident that the suggestion is at variance with the practice in the developed countries.

“The developed countries do subsidize agricultural products. It is the support and subsidies that have enabled greater agricultural production and cheaper food without depressing the income of the farmers, but generating surpluses that the developed countries dole out as food aid to the developing countries, where the food aid sometimes serves as a disincentive to local food production.

“The Nigerian government has made food security a top priority in its economic reform agenda. It has also formulated agricultural policies and adopted some strategies it believes will make the agricultural sector of the economy more viable to ensure food security but the goal of food security seems increasingly elusive because the formulation and implementation of agricultural policies alone are not yielding the desired results and even if it is conceded that they are yielding some results, such results are incredibly marginal to be noticed by the people.

“This is so and likely to remain like that because of the lacuna in the whole agricultural development program, typified by the absence of a food policy, ineffective linkage between the local food system, international food production, and supply system; inadequate funding of science and technology, universally acknowledged as one of the pillars on which food security rests; and the inability of the government to tackle decisively the increasing level of poverty and insecurity, which reduces access of many Nigerians to food production, supply and consumption,” Miko stated.

You may like

Business

Customers Panic As CBN Bans Opay, Palmpay, Others’ New Accounts

Published

1 day agoon

April 30, 2024By

Editor

Some bank customers have expressed panic as the Central Bank of Nigeria bans mobile money operators including fintech firms from onboarding new customers.

However, the Bank Customers Association of Nigeria backed the CBN directive.

The new directive will affect fintech companies such as OPay, Palmpay, Kuda Bank, and Moniepoint, from opening new accounts until further notice.

Reliable sources from three major fintechs who requested not to be mentioned as they were not permitted to speak, confirmed the development to The PUNCH on Monday.

The CBN’s move was linked to an ongoing audit of the Know-Your-Customer process of the fintechs, which have been under scrutiny in recent months over concerns around money laundering and terrorism financing.

It was gathered that the CBN had summoned some of the heads of fintechs to Abuja to discuss issues around KYC last week.

The CBN has not yet publicly commented on the directive to the fintech firms. The PUNCH’s attempts to reach the apex bank for comment were unsuccessful.

Several calls made to the telephone line of the CBN spokesperson, Hakama Ali Sidi, were not responded to as of the time of filing this report.

READ ALSO: CBN Sells Fresh Dollars To BDCs At N1,021/$

Also, the directive coincided with the court order that the Economic and Financial Crimes Commission (EFCC) obtained to freeze at least 1,146 bank accounts owned by various individuals and companies allegedly involved in illegal foreign exchange transactions.

The 85-page court order (document), which listed the bank account details suspected to be involved in illicit activities, was obtained by The PUNCH on Monday.

Justice Emeka Nwite, in a ruling on the ex-parte motion, moved by counsel for the anti-graft agency, Ekele Iheanacho, also granted the commission’s application to conclude the investigation within 90 days.

Part of the court document read, “That the applicant’s (EFCC) application is hereby granted as prayed.

“That an order of this honorable court is hereby made freezing the bank accounts stated in the schedule below, which accounts are owned by various individuals who are currently being investigated in a case involving the offenses of unauthorised dealing in foreign exchange, money laundering, and terrorism financing, to the extent that the investigation will be for a period of 90 (ninety) days.”

The EFCC, in the motion marked FHC/ABJ/CS/543/2024 dated and filed April 24 by Iheanacho, was heard by the judge the same day in the interest of national interest.

“The motion was brought pursuant to Section 44(2) and (K) of the 1999 Constitution; Section 34 of the EFCC Establishment Act 2004; Section 7(8) of the Money Laundering Prevention and Prohibition Act, 2022; and under the inherent jurisdiction of the court.”

The President of the Bank Customers Association of Nigeria, Uju Ogubunka, backed the CBN’s move to suspend new account opening on the affected platforms.

He told The PUNCH that the strict regulations that govern deposit money banks must apply to fintechs, and microfinance banks in order to ensure the integrity of the financial institutions.

READ ALSO: CBN Gives New Directive On Lending In Real Estate

He said, “Anything that can disrupt the system should not be permitted. If the platforms are being used for things that are against the regulations, I think the CBN decision is OK. I don’t see anything wrong with that. It behoves on the companies now to get their KYC right.

“Let them do what they are supposed to do. KYC applies to banks and other financial institutions that deposit money. It should also apply to them so that the regulators can understand what is going on and hold them accountable.”

On the other hand, Emmanuel Odunsi on X (formerly Twitter) welcomed the move, citing the need for better KYC processes to prevent scams and fraudulent activities.

“Their KYC isn’t that great. Lots of scammers are using their apps to defraud people.

“Most of the accounts were created by mining phone numbers, with subscribers’ permission. Almost every phone number has been linked to an account,” Odunsi said.

In October 2023, Fidelity Bank blocked transfers to OPay, Palmpay, Kuda, and Moniepoint due to concerns around KYC processes.

In response, the CBN introduced new KYC rules for all financial institutions in November 2023, which appeared to target fintech startups.

READ ALSO:JUST IN: CBN Gov Sacks Eight Directors, 32 Others

A source from Moniepoint said the company had complied with the directive, effectively halting new account creation on their platform. However, the source denied having anything to do with KYC.

“It’s just a regulation from the CBN, and we’ve complied. The real question is, why are fintechs always targeted,” he source argued.

“It has nothing to do with KYC; I am aware that the CBN communicated, but this particular issue dwells on accounts related to cryptocurrency transactions,” the source revealed.

The CBN has an ambitious target to increase overall financial inclusion to 95 per cent of the adult population by 2024.

With the new order, the target may be affected, as the company processes about 100 new accounts every day.

The source argued that fintechs had played significant roles in deepening financial inclusion in the country.

The company had deployed robust and reliable digital payment infrastructure that has facilitated an average monthly transaction value of $12bn for about 1.6 million businesses, it said last year.

READ ALSO: FULL LIST: 31 States Owe CBN N340bn Bailout Funds

A senior employee of PalmPay confirmed to The PUNCH that there was a CBN directive for fintechs to reassess their KYC processes.

This is causing a temporary pause in onboarding new customers, the source stated.

She clarified that the KYC review was a collaborative effort with the CBN, and fintechs were awaiting further instructions without a specified timeline for resolution.

Another source at OPay, who also declined to be named, said they were following the CBN’s directive and could not comment further.

“We don’t really have anything to say. It’s just a directive that we are following. The CBN has issued their directive.“

Fintech companies have faced increased regulatory scrutiny over their account opening processes.

Customers worry

However, some customers have also used social media, both on X (formerly Twitter) and Facebook, to express their worries and opinions on the matter.

Some customers are anxious about the safety of their funds, with Warisenibo Jumbo suggesting it’s best to transfer their money out of Opay.

Oye Niran wondered if their Moniepoint account was safe, stating, “Hope my Moniepoint account is safe.”

Larry Leanz questioned the rationale for keeping money on these platforms.

“But is it still safe to keep money there?, Leanz questioned.

The Central Bank of Nigeria (CBN) started fresh and direct sales of US dollars at N1,021 per dollar to Bureau De Change operators.

Nigeria’s apex bank disclosed this in a circular signed by its Director of Trade and Exchange Department Hassan Mahmud.

“We write to inform you of the sale of $10,000 by the Central Bank of Nigeria (CBN) to BDCs at the rate of N1,021/$1. The BDCs are in turn to sell to eligible end users at a spread of NOT MORE THAN 1.5 percent above the purchase price,” the circular posted on its website read.

READ ALSO: Tinubu Unveils African Counter-Terrorism Summit

“ALL eligible BDCs are therefore directed to commence payment of the Naira deposit to the underlisted CBN Naira Deposit Account Numbers from today, Monday, April 22, 2024, and submit confirmation of payment, with other necessary documentations, for disbursement of FX at the respective CBN Branches.”

CBN’s move is coming as the naira is recording a slight depreciation against the dollar after weeks of gains.

In late March, the bank also sold $10,000 to each of the eligible Bureau De Change (BDC) operators in the country at the rate of N1,251/$1.

READ ALSO: Mixed Reactions Trail Video Of Couple’s Customised N200 Notes

Like in the most recent sales, it warned BDCs against breaching terms of the dollar sales, vowing to sanction defaulters “including outright suspension from further participation in the sale”.

The fortunes of the naira have fallen sharply since President Bola Tinubu took over in May. Inflation figures have reached new highs and the cost of living hitting the rooftops.

Nigeria’s currency slid to about N1,900/$ some months ago at the parallel market. But in recent weeks, it has gained against the dollar.

The Nigerian authorities have also doubled down on their crackdown against cryptocurrency platform Binance and illegal BDCs.

On March 1, the CBN revoked the licences of 4,173 BDCs over compliance failures.

Olusegun Alebiosu has been appointed as the Acting Managing Director/Chief Executive Officer of First Bank of Nigeria Limited (FirstBank Group), effective April 2024.

Alebiosu steps into this pivotal role from his previous position as the Executive Director, Chief Risk Officer, and Executive Compliance Officer, a position he held since January 2022.

Alebiosu brings to the helm of FirstBank over 28 years of extensive experience in the banking and financial services industry. His expertise spans various domains including credit risk management, financial planning and control, corporate and commercial banking, agriculture financing, oil and gas, transportation, and project financing.

READ ALSO: JUST IN: Access Holdings Names New Acting CEO

Having embarked on his professional journey in 1991 with Oceanic Bank Plc. (now EcoBank Plc.), Alebiosu has held several notable positions in esteemed financial institutions.

Prior to joining FirstBank in 2016, he served as Chief Risk Officer at Coronation Merchant Bank Limited, Chief Credit Risk Officer at the African Development Bank Group, and Group Head of Credit Policy & Deputy Chief Credit Risk Officer at United Bank for Africa Plc.

Alebiosu’s academic credentials further enrich his professional profile. He is an alumnus of the Harvard School of Government and holds a Bachelor’s degree in Industrial Relations and Personnel Management. Additionally, he obtained a Master’s degree in International Law and Diplomacy from the University of Lagos, as well as a Master’s degree in Development Studies from the London School of Economics and Political Science.

READ ALSO: Meet Newly Appointed Union Bank CEO

A distinguished member of various professional bodies, including the Institute of Chartered Accountants (FCA), Nigeria Institute of Management (ANIM), and Chartered Institute of Bankers of Nigeria (CIBN), Alebiosu is renowned for his commitment to excellence and ethical practices in the banking sector.

Beyond his professional endeavors, Alebiosu is known for his passion for golf and adventure. He is happily married and a proud parent.

With Alebiosu’s appointment, FirstBank of Nigeria Limited anticipates continued growth and innovation under his leadership, reinforcing its position as a leading financial institution in Nigeria and beyond.

LIST: Nigerian Passport Ranked Among Worst Globally

[BREAKING] Coastal Highway: FG To Pay N2.75bn Compensation Today

Edo Poll: Youth Leader Tackles Orbih, Shaibu Over Anti-Ighodalo Stance, Wants Them Suspended

Trending

News5 days ago

News5 days agoDSTV Price Hike: Five Alternatives Nigerians Are Opting For

News4 days ago

News4 days ago‘I Can’t Breathe’ – Black Man Cries As US Police Handcuffed, Pinned Him Down Till He Dies [VIDEO]

News4 days ago

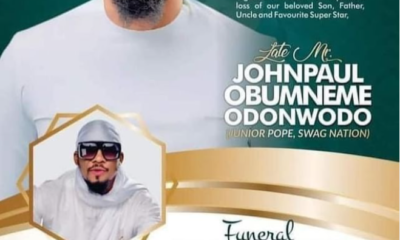

News4 days agoLate Actor, Junior Pope’s Funeral Arrangement Released

Metro5 days ago

Metro5 days agoTwo Fake Police Inspectors Arrested In Edo

Metro3 days ago

Metro3 days agoEdo Police Arrest Suspected Cultists Who Allegedly Killed Rival In His Daughter’s Presence

Entertainment5 days ago

Entertainment5 days agoJUST IN: Nollywood Veteran Actor, Ogunjimi Is Dead

News3 days ago

News3 days agoJUST IN: Popular Gospel Singer Is Dead

News4 days ago

News4 days agoUNIBEN Ex-deputy VC Is Dead

News4 days ago

News4 days agoOba Of Benin Suspends Six Officials For Posing As Palace Emissaries To Ooni Of Ife

News4 days ago

News4 days agoCurrency Manipulation: EFCC Arrests 34 Currency Speculators In Abuja