Economy

CBN Compels Banks To Suspend Staff Lay-off

Published

4 years agoon

By

Editor

The proposed plan by some banks to downsize their workforce as a result of the Coronavirus pandemic has been suspended.

The Central Bank of Nigeria and the banks in the country, after a meeting agreed to suspend the planned sack of workers in the banking sector even as they plan to recommence operations.

This was contained in a statement on Sunday by the apex bank’s Director, Corporate Communications, Isaac Okorafor.

READ ALSO: Word Press Freedom Day: Ex-Legislator Commends Journalists, Says ‘You Deserve Reward’

The PUNCH reports that the Presidential Task Force Team on COVID-19 had said last week that banks would be allowed to re-open for commercial operations as the lockdown eases in parts of the country effective Monday, May 4.

Some banks had proposed the idea of downsizing their workforce as they plan to recommence operations, a decision that has met public outcry.

But the apex bank said it convened a meeting with the banks to review the economic impact the proposed action would have on workers and their families, especially at such a difficult time.

READ ALSO: Three Arrested For Insulting Buhari

It said, “A special meeting of the Bankers’ Committee was convened on May 2, 2020, to further review the implications of the COVID-19 pandemic on the Nigerian banking industry. The Committee particularly deliberated on the issue of the operating costs of banks in view of the disruptions emanating from the global economic difficulties and decided as follows:

“In order to help minimize and mitigate the negative impact of the COVID-19 pandemic on families and livelihoods, no bank in Nigeria shall retrench or lay-off any staff of any cadre (including full-time and part-time).

“To give effect to the above measure, the express approval of the Central Bank of Nigeria shall be required in the event that it becomes absolutely necessary to lay-off any such staff.

READ ALSO: Alleged Plot To Return Niger Delta Amnesty Boss, Youths Send Protest Letter To Buhari

“The Central Bank of Nigeria solicits the support of all in our collective effort to weather through the economic challenges occasioned by the COVID-19 pandemic.”

(PUNCH)

(PHOTO: File)

You may like

Economy

Israel Again Pounds Gaza; Army Chief Says War To Last ‘Many More Months

Published

4 months agoon

December 27, 2023By

Editor

Israel again pounded Gaza with air strikes and shelling on Wednesday after its armed forces chief warned the war raging with Hamas since the October 7 attacks will last “many more months”.

Explosion lit up the night sky over the southern Gaza city of Khan Yunis — a focus of heavy urban combat since the Israeli army said it had largely gained operational control over Gaza’s north.

Heavy firefights however also raged again around Gaza City in the north, while an air strike wounded 11 people near Rafah, a far-southern city crowded with internally displaced people, witnesses said.

The reported deaths of almost 21,000 Palestinians and Gaza’s spiralling humanitarian crisis have amplified calls for an end to the hostilities.

Israeli Prime Minister Benjamin Netanyahu has repeatedly vowed to keep up the campaign to destroy Hamas, an Islamist group blacklisted as a “terrorist” organisation by the United States and the European Union.

“This war’s objectives are essential and not simple to achieve,” armed forces chief Herzi Halevi said late Tuesday. “Therefore, the war will continue for many more months.”

READ ALSO: Gaza War Rages On Christmas Eve As Biden Urges Caution

The conflict erupted when Hamas gunmen attacked southern Israel on October 7 and killed about 1,140 people, mostly civilians, according to an AFP tally based on Israeli figures.

During the deadliest attack in Israel’s history, Palestinian militants also took around 250 hostages, 129 of whom remain in captivity, Israel says.

Israel retaliated with a relentless bombardment and a siege followed by a ground invasion from October 27.

The campaign has killed at least 20,915 people, mostly women and children, according to the latest toll issued by Gaza’s Hamas-run health ministry.

The number of Israel soldiers killed inside Gaza has risen to 164, the military said.

Israel on Tuesday returned the bodies of 80 Palestinians killed in Gaza, after checking there were no hostages among them, via the Red Cross, sources in the territory’s health ministry said.

READ ALSO: Israel Battles Hamas As UN Calls Gaza ‘Hell On Earth’

An AFP photographer witnessed a digger lowering the human remains in blue body bags into a mass grave in Rafah.

– ‘Beyond a catastrophe’ –

Gaza’s 2.4 million people have been suffering severe shortages of water, food, fuel and medicines, with only limited aid entering the territory.

An estimated 1.9 million Gazans have been displaced, according to the UN.

The Gaza war “goes beyond a catastrophe and a genocide,” Palestinian president Mahmud Abbas charged in an interview on Egyptian television.

The Palestinian Authority chief argued “what is happening now is much uglier than what happened” during the 1948 war that accompanied Israel’s creation when 760,000 Palestinians fled or were expelled from their homes.

“Netanyahu’s plan is to get rid of the Palestinians and the Palestinian Authority,” Abbas said.

The UN Security Council, in a resolution on Gaza last week, called for the “safe and unhindered delivery of humanitarian assistance at scale”.

READ ALSO: No Peace Until Hamas Is Destroyed, Israel PM Declares

It requested the appointment of a UN humanitarian coordinator to oversee and verify third-country aid to Gaza, and on Tuesday Sigrid Kaag, the outgoing Dutch finance minister, was named to the post.

The resolution, which did not call for an immediate end to the fighting, effectively leaves Israel with operational oversight of aid deliveries.

In Rafah, hundreds turned up at the Abdul Salam Yassin water company carrying baskets, pulling handcarts and even pushing a wheelchair stacked with bottles to queue for clean water.

“This was my father’s cart,” said Rafah resident Amir al-Zahhar. “He was martyred during the war. He used it to transport and sell fish, and now we are using it to transport fresh water.”

Elsewhere in the city, people split logs and stacked kindling as the lack of fuel forced them to burn wood for cooking and to keep warm.

One woman who was washing her family’s clothes by hand told AFP: “I’ve pleaded with people for water. I have absolutely nothing. I’ve borrowed everything, even the blankets, from others.”

READ ALSO: JUST IN: Ex-Speaker, Ghali Na’Abba, Is Dead

– Mideast tensions –

US National Security Advisor Jake Sullivan met Tuesday to discuss shifting “to a different phase” of the Israel-Hamas war with Israeli Strategic Affairs Minister Ron Dermer, a White House official said.

It was also meant as a chance to speak on “the transition to a different phase of the war to maximise focus on high-value Hamas targets,” the official said.

Amid the Gaza war, violence has also flared across the Israel-occupied West Bank, with more than 300 Palestinians killed by Israeli forces and settlers, according to the territory’s health ministry.

An Israeli operation in a refugee camp in the north of the West Bank left six people dead early Wednesday, it said.

The impacts of the war have reverberated across the Middle East, with armed groups backed by Israel’s arch-foe Iran escalating attacks.

An Israeli air strike on a Lebanon border town killed a Hezbollah fighter, the group said Wednesday, with state media reporting two of his relatives were also killed.

In Syria, an Israeli strike Monday killed Iranian general Razi Moussavi, a senior commander in the Quds Force, the foreign operations arm of the Islamic Revolutionary Guard Corps.

In Iraq, the US military launched strikes Tuesday on pro-Iran groups it has blamed for numerous attacks on US and allied forces. The strike claimed at least one life, Iraqi authorities said.

Yemen’s Huthi rebels have repeatedly fired at Israel and at passing cargo ships in the Red Sea in attacks they say are in solidarity with Hamas.

US military forces shot down more than a dozen Huthi attack drones and several missiles, the Pentagon said, reporting no casualties or damage.

Israel’s military said Tuesday a fighter jet had intercepted “in the Red Sea area a hostile aerial target that was on its way to Israeli territory”.

Economy

OPINION: NBC, The Dragon And Media’s Long Walk To Liberty

Published

1 year agoon

April 4, 2023By

Editor

By Suyi Ayodele

Alfred Thompson “Tom” Denning, Baron Denning, popularly called Lord Denning, the Master of the Rolls, was a British jurist who died on March 5, 1999, at the ripe age of 100. During his stints on the Bench and at the Bar, Denning was a defender of the principle of natural justice. In a 1968 matter he adjudicated between the Metropolitan Properties Co (FGC) Ltd vs Lannon, the man who answered the sobriquet ‘the people’s judge’ summarized natural justice thus: “Justice must be rooted in confidence and confidence is destroyed when right-minded people go away thinking: ‘The judge was biased’.” On another occasion, the late jurist said: “The law is to see that truth is observed and that justice is done between man, and man”. Together with another jurist, Lord Emerich Edward Dalberg Acton (Lord Acton), Denning popularized the twin fundamental principles of natural justice to wit: hear both side in a matter (Audi Alteram Partem) and no one should be a judge in his own case (Nemo Judex in Casua Sua).

These two principles are anchored on the need to avoid biases on the part of the judge. These are the principles the NBC flagrantly violated in its decision to slam a N5 million fine on Channels TV. The questions to ask are many. When was the station queried? What was its response? Did NBC actually watch the broadcast as it claimed? If it did, what did it make of Okinbaloye’s several cautions to Datti? How can an umpire such as NBC be working the sums from the answer? While one will agree that the NBC has the authority to regularize the broadcasting industry, can one agree with the fact that the NBC is the investigator, the prosecutor, the judge and the enforcer of the sanction? Could Lord Acton have had the NBC in mind when he postulated that “Authority that does not exist for Liberty is no authority but force”? Why is NBC moving toward becoming a dragon, a monster in the hands of despotic leaders? NBC cannot be the complainant, the investigator, the prosecutor, and the judge. That is against the principle of natural justice. If the Broadcast laws allow the Commission to impose fines, the simple explanation is that the drafters of the law never envisaged a day when a party which is intolerant of the truth like the APC would come to power.

On Friday, the Nigeria Broadcasting Commission (NBC) slammed a N5 million fine on the Channels Television for the March 22, 2023, interview the television house granted Datti Baba-Ahmed, the vice-presidential candidate of the Labour Party (LP) in the February 25 election. During the interview, Datti expressed misgivings about the conduct of the election and warned General Muhammadu Buhari not to swear in Tinubu as he did not score 25% of the vote in the FCT, being one of the prerequisites for being declared the winner. An emotional Datti, in the interview, and against the many restraints from the anchor, Seun Okinbaloye, insisted that his LP won the election and described the certificate of return issued to Tinubu by INEC as a “dud cheque”. Among other things, the LP vice presidential candidate said that should General Buhari hand over to Tinubu on May 29 in spite of the infractions, “that would be ending democracy”. He insisted that handing over to Tinubu, who he claimed did not fulfill the “constitutional requirements of the constitution” would amount to unconstitutionality and warned the CJN not to partake in the “unconstitutionality”.

FROM THE AUTHOR: OPINION: Iwuanyanwu And The Proverbial Eran Ìbíye

Shortly after the interview was aired, Bayo Onanuga, APC presidential campaign council’s Director of Media and Publicity, wrote a complaint to the NBC, accusing Datti of making comments that attacked the integrity of the presidential elections. Onanuga, in his petition claimed that the LP vice-presidential candidate, as the guest on the programme in question, asking General Buhari not to swear in the president-elect “is a subversive comment since the matter is among the issues submitted in their petition before the tribunal for adjudication. Therefore, until the court rules otherwise, the status quo is the INEC position as declared in the final results”. He cited Sections 3.8.1(b) nad14.0.1 of the Nigerian Broadcasting Code 6th edition to back up his complaints. Datti’s statements, the Tinubu media man insisted I “is not only divisive and subversive but also inciting and inflammatory. The comment by Mr. Datti later on the same programme that if ‘President Buhari should hand over to the President-elect by 29th May, that would be the end of democracy’ is another case of unguarded statement and breach of Section 5.3.3(b), which states that – ‘A Broadcaster shall avoid divisive and inflammatory matters in its provocative form in using political material’. Furthermore, Section 3.0.2.1 said that no Broadcaster shall encourage or incite crime, lead to public hate, disorder or repugnant to public feelings’ materials that cause disaffection. We, therefore, urge NBC to invoke the necessary sanctions on Channels Television for the breaches enumerated above”, Onanuga prayed the regulatory body.

Pronto, the NBC slammed a fine of N5 million on Channels Television for breaking the broadcasting law and ordered the station to pay the fine within two weeks. The letter dated March 27 and titled: “Broadcast of an Inciting Interview, A Sanction”, was signed by Balarabe Ilelah, the NBC’s Director-General. The letter reads in Part: The NBC claimed to have monitored the broadcast of the live interview with Datti and concluded that the broadcast was volatile and capable of inciting public disorder, violating some sections of the broadcasting code. “Consequently, on the following infractions, Channels Television is hereby sanctioned and shall pay a penalty of N5,000,000 (five million naira) only in the first instance. You are advised to pay within two weeks from the day of receipt of this letter or the penalty will be graduated,” the NBC Director-General threatened. This is where the problem begins.

FROM THE AUTHOR: OPINION: The Cults Of Lagos

In his reaction to my March 7, 2023, column titled, Tinubu And My Journey To ‘Exile’, the foremost lexicographer, Patrick Obahiagbon, popularly known as Igodomigodo, wrote to assure me of the character of the president-elect. Igodomigodo maintained: “…I don’t also think that Asiwaju holds that very myopic view of those like you, Adedayo and my very good friend, Olagunju who are critical of his politics. That’s not the Asiwaju I know Sir. Please don’t allow the views of some political hallelujah choristers to put you off…Give Asiwaju a chance, and like u rightly said, access him critically as usual in approbation or disapprovingly as d (the) day goes by”. Bola Ahmed Tinubu, the president-elect, will be sworn in as President and Commander-in-Chief of the Armed Forces on Monday, May 29, 2023, God willing. That is some 55 days away. Morning shows the night. Nigerians are definitely in for a long walk with the Tinubu presidency. My major concern is the liberty of the media in the Tinubu presidency. My fear is informed by the utterances of some of the aides of Tinubu, especially the pretentious ones among them. The fear is being given a life of its own while Tinubu is still the president-elect. Like I said before, I have never met the man, Tinubu. But I can sufficiently give a vivid description of his personality. A man is known by what he says, what he does and what people say about him. Elementary sociology teaches that a man can also be identified by the company he keeps. Tinubu has, in large numbers, some elements that are what my people call the typical Elegun Sango.

Sango, now known as the god of thunder, was once a human king of Oyo Kingdom. He was the fourth king of the kingdom after the reign of Ajaka. Reputed to be a fiery-tempered person, Sango has an aide, who holds his reins and is believed to be the caution to the fire-emitting king. That aide is known in history as Elegun Sango. Traditional worshippers of Sango as a deity know that it is not Sango that is temperamental. The one, who is supposed to exercise restraint on him is regarded as the real problem. Again, my people describe the relationship in a proverb thus: Sango is not as temperamental as his rein (Sango o gbona bi elegun re). It is Elegun Sango who points out those who offended the deity to him and he in anger would strike. This is why during Egungun festival, the elders caution the masquerade to be wary of the one holding the reins (Atokun Eegun). This in essence means that a principal may have a pleasant disposition but if he is surrounded by very bad aides, the principal will always be in the public space for the wrong reasons. This is the case with the president-elect.

FROM THE AUTHOR: OPINION: Why Is Emi L’okan Afraid Of Awa L’okan In Lagos?

Is it not unfortunate that the APC, which in 2015, as the opposition party threatened to form a parallel government should it fail to win the presidential election and the heaven did not fall, is the same party that would not want anyone to complain about its malfeasance? That threat was reported by the media, electronic and print and nobody was fined. What has Datti done and what has the Channels TV broadcast that the APC did not do when it was an opposition party? If the Goodluck Ebele Jonathan, whom the APC and its top echelons described as “clueless” and helped to amplify the “ineffectual buffoon” description The Economist gave the former president, and the man did not hunt them, why is APC the one to complain about an opposition calling a certificate of return a “dud cheque”? The same party, which against all protestations, fielded a Muslim-Muslim ticket, went ahead to rent ‘Bishops’ to legitimize its single-faith ticket and rolled out Oro cults to win Lagos gubernatorial election, is the one complaining about a Peter Obi and Bishop Oyedepo’s alleged telephone conversation! How do you describe hypocrisy? If indeed Obi called Oyedepo and declared the February 25 presidential election as “religious and ethnic war”, did the APC not do worse things during the election? Who started the “religious and ethnic war” in the first instance?

But the most unfortunate personality in the NBC fine is the writer of the petition, Onanuga, who many regard as a foremost journalist. This is a case of the fowl eating the entrails of another fowl. How would any journalist have believed that a day would come in the history of the noble profession when an Onanuga would be at the vanguard of gagging the media? That is class betrayal of the crudest form! The same Bayo Onanuga who used the defunct The News to hunt the expired dictator, Sani Abacha to his grave? How time changes people. Or is it that Onanuga has been the proverbial two-faced Janus all this while? This is how a fellow journalist described Onanuga’s conduct in this matter: “Bayo Onanuga is just behaving like a young man that was promised recruitment into the Police Force and he goes about arresting people”. I cannot agree less. Imagine an Onanuga as the Minister of Information in Tinubu’s cabinet! Is the media not in for a long walk in a dark alley?

FROM THE AUTHOR: OPINION: Tinubu And My Journey To ‘Exile’

This is why I think the media, especially the electronic platforms, should seek redress in the court of law. This arbitrariness of the NBC and his cahoots should not be allowed to pass unchallenged. The print media survived because some people paid the price. The electronic media should follow that path. NBC cannot continue to be the judge in its own matters. Before the dragons get to power, the furrow it is building in our collective backyard should be sealed up to suffocate it. Once the media loses its liberty, humanity will ultimately lose its freedom. Foremost journalist and lawyer, Richard Akinnola, who doubles as Onanuga’s bosom friend, did an open letter to the former ‘human rights activist’ over the matter. Akinnola warned Onanuga that “we would fight this your planned “insurrection” against the independent media the way we, including you, fought Abacha’s dictatorship against the media”. Can I be the number one recruit in the Army for the liberation of our media space? Nzogbu nzogbu, Enyinba Enyi!

Suyi Ayodele is a senior journalist, South-South/South-East Editor, Nigerian Tribune and a columnist in the same newspaper.

Economy

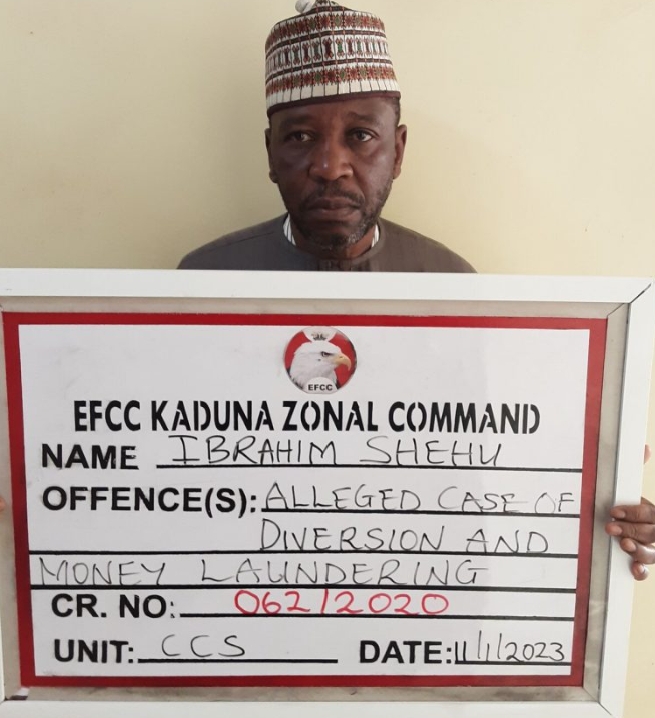

EFCC Arraigns Ex-ABU VC, Bursar For Money Laundering

Published

1 year agoon

March 30, 2023By

Editor

A former vice chancellor of Ahmadu Bello University, Zaria, Professor Ibrahim Garba, and Ibrahim Shehu Usman, a former bursar of the same university have been arraigned on a nine-count charge bothering on fraud.

They were arraigned before Justice R.M Aikawa of the Federal High Court sitting Kaduna, Kaduna State, for money laundering to the tune of over N1billion by the Kaduna Zonal Command of the Economic and Financial Crimes Commission.

READ ALSO: Pope Francis In Hospital, Events Cancelled

According to the post by the official handle of the EFCC, @officialEFCC, “They are alleged to have diverted the monies from different accounts of the institution meant for the renovation of the popular Kongo Conference Hotel, Zaria.”

Why Police Detained Yahaya Bello’s ADC, Security Details Revelead

Aiyedatiwa, 15 Others Jostle For Ondo APC Gov Ticket Today

Grammy Winner Found Dead In Her Apartment

Trending

Metro5 days ago

Metro5 days agoJunior Pope: Photos From Funeral Of Makeup Artiste, Abigail Frederick

Metro3 days ago

Metro3 days agoTwo Soldiers Arrested For Allegedly Stealing Armoured Cables At Dangote Refinery In Lagos

News5 days ago

News5 days agoBREAKING: APC Suspends National Chairman Ganduje

Headline5 days ago

Headline5 days agoUS-based Nigerian Bodybuilder Dies 18 Days After Being Shot By Wife

Headline3 days ago

Headline3 days agoB-I-Z-A-R-E: Woman Wheels Dead Uncle’s Corpse Into Bank To “Sign Off” Loan In Her Name [VIDEO]

News4 days ago

News4 days agoBREAKING: FG Begins Disbursement Of N200bn Palliative Loans

Headline4 days ago

Headline4 days agoBill: MP Punched In The Face As Georgian Politicians Fight Dirty In Parliament [VIDEO]

Metro4 days ago

Metro4 days agoTransformer Vandal Met Waterloo, Electrocuted In Benin

News1 day ago

News1 day agoAPC Debunks Viral Video, Says Presidency Not After Ganduje

Metro4 days ago

Metro4 days agoDouble Tragedy As Man Punches Relative To Death During Father’s Burial