Business

FG Offers 17 New Oil Blocks For Bidding

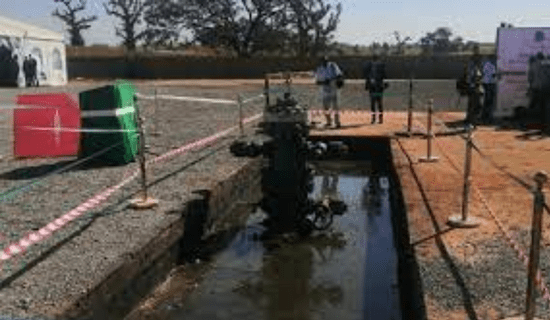

The Federal Government, on Tuesday, announced the addition of 17 deep offshore oil blocks to the 2024 Licensing Round for oil fields in Nigeria.

Recall that some deep offshore blocks were recently put on offer for the 2022/23 mini-bid round and other blocks which cut across onshore, continental shelf and deep offshore terrains were also put on offer for the Nigeria 2024 Licencing Round.

Precisely on May 8, the government invited investors to bid for 12 oil blocks and seven deep offshore assets in the 2024 marginal fields bid round.

Also on June 12, 2024, it was reported that the Federal government had increased the number of oil blocks on offer in the 2024 marginal bid round.

The Chief Executive Officer, Nigerian Upstream Petroleum Regulatory Commission, Gbenga Komolafe, disclosed this at the pre-bid conference for the 2024 licencing round in Lagos.

READ ALSO: JUST IN: Nigeria To Send First Civilian To Space

Providing updates on the 2022/2023 and 2024 licencing rounds, Komolafe, in a statement he signed and issued in Abuja on Tuesday, said 17 deep offshore blocks have been added to the 2024 Licensing Round.

He said, “In pursuit of the commission’s commitment to derive value from the country’s abundant oil and gas reserves and increase production, the commission has been working assiduously with multi-client companies to undertake more exploratory activities to acquire more data to foster and encourage further investment in the Nigerian upstream sector.

“As a result of additional data acquired in respect of deep offshore blocks, the commission has added 17 deep offshore blocks to the 2024 Licensing Round. Further details on the blocks can be found on the bid portal.”

Komolafe further stated that “by the published guidelines, we had earlier indicated that some of the assets on REoffer should be applied for as clusters, namely: PPL 300-CS & PPL 301-CS, PPL 2000 and PPL 2001. Bidders are hereby advised that they may, at their option, bid for those blocks as clusters or as single units.”

READ ALSO: Woman Wrongly Convicted Of Murder Freed After 43 Years In Prison

For clarification, he said bidders should refer to the Frequently Asked Questions Sections of the 2022/23 and 2024 Licensing Round portals, or contact the upstream regulatory agency.

The NUPRC boss also stated that to allow interested investors to take advantage of the expanded opportunities, the 2024 Licencing Round schedule had been amended.

He said, “Registration/submission of pre-qualification documents which was initially scheduled to close on June 25, 2024, has been extended by 10 days and will now close on July 5, 2024.

“Data access/data purchase/evaluation/bid preparation and submission which was initially scheduled to open on July 4, 2024, and close on 29/11/24 will now start on July 8, 2024, and close on 29/11/24 as previously scheduled.

READ ALSO: 22-year-old UNIBEN Graduate Beaten, Raped To Death, Family Seeks Justice

“All other dates in the published 2024 licencing round schedule remain the same unless otherwise communicated.”

He stated that to vacate entry barriers, the commission had sought and obtained the approval of President Bola Tinubu, who, as petroleum minister, approved attractive fiscal regimes and also minimised entry fees for both licencing rounds by putting a cap on the signature bonus payable for the award of the acreages.

“Consequently, it is necessary to ensure that the same bid criteria (in addition to the uniform signature bonus criteria) are applicable for both licencing rounds, to promote transparency and provide a level playing ground for all bidders.

“Since the criteria for the award of the oil blocks are now much more attractive than they initially were during the 2022/23 Mini Bid Round, it is in the interest of equity and fair play to give all investors the same opportunity to bid for the assets,” Komolafe stated.

READ ALSO: Homes Are Bleeding, Methodist Archbishop Tells Tinubu

Based on this, he declared that all blocks in the 2022/23 and 2024 Licencing Rounds were now available to all interested investors the websites developed for the exercise by the NUPRC, adding that the 2022/23 Mini Bid Round registration phase had been reopened to new applicants.

“The public is therefore invited to take advantage of this development and attractive entry terms and conditions and participate in the exercise.

“However, all the pre-qualified applicants published on the 2022/23 Mini Bid Round portal will not be required to go through a new pre-qualification process, as their technical submissions remain valid and eligible even for the 2024 Licencing Round.

“They may, however, wish to re-submit new commercial bids to take advantage of the more attractive criteria applicable to both licencing rounds and revise their bid bonds to adapt to the new bid criteria. They are also free to bid for blocks on offer in the 2024 Licencing Round,” Komolafe stated.

Business

Naira Records Highest Depreciation Against US Dollar

The Naira recorded the highest depreciation against the United States dollar at the official foreign exchange on Friday to end the week on a negative note.

Central Bank of Nigeria data showed that the Naira extended its dip on Friday to N1,423.17 against the dollar, down from N1,419.72 traded on Thursday.

This represents a N3.45 depreciation against the dollar on a day-to-day basis, the highest in the week under review and in 2026 so far.

READ ALSO:Naira Records Massive Appreciation Against US Dollar Into Christmas Holidays

Meanwhile, at the black market, the naira remained at N1,490 per dollar on Friday, the same rate recorded on Thursday.

In the other week, the Naira recorded three gains and two losses against the US dollar and other currencies.

The development comes amid the continued rise in the country’s external reserves, which hit $45.67 billion as of January 8, 2026.

Business

KPMG Flags Five Major ‘Errors’ In Nigerian Tax Laws

Fresh apprehension has surfaced over Nigeria’s newly implemented tax framework after KPMG Nigeria highlighted what it described as “errors, inconsistencies, gaps, and omissions” in the new tax laws that took effect on January 1, 2026. The professional services firm in a recent statement cautioned that failure to address these issues could weaken the overall objectives of the tax reforms.

Nigeria’s tax overhaul is built around four major legislations: the Nigeinpieces of legislation:ria Tax Act (NTA), the Nigeria Tax Administration Act (NTAA), the Nigeria Revenue Service (NRS) Establishment Act, and the Joint Revenue Board (JRB) Establishment Act. The laws were signed by President Bola Ahmed Tinubu in June 2025 and formally commenced in 2026. However, the reforms have continued to attract controversy since they were first introduced in October 2024.

Despite the concerns, government officials have consistently described the reforms as essential to improving Nigeria’s low tax-to-GDP ratio and modernisingpieces of legislation:modernizing the country’s tax system in line with evolving economic conditions.

In a detailed review, KPMG outlined several areas of concern.

Capital gains, inflation modernizing inflation and market response

KPMG flagged Sections 39 and 40 of the Nigeria Tax Act, which require capital gains to be calculated as the difference between sale proceeds and the tax-written-down value of assets, without adjusting for inflation. According to the firm, this approach is problematic given Nigeria’s prolonged high-inflation environment.

Data from the National Bureau of Statistics shows that headline inflation has remained in double digits for eight consecutive years, averaging over 18 percent between 2022 and 2025. Over the same period, asset prices have been significantly influenced by currency depreciation and general price increases.

READ ALSO:How To Calculate Your Taxable Income

Market data also reflects investor sensitivity to tax policy changes. Although the NGX All-Share Index gained more than 50 percent over the year and market capitalisation inflation,capitalization approached N99.4 trillion, equities experienced sharp sell-offs in late 2025. In November alone, market value reportedly declined by about N6.5 trillion amid uncertainty surrounding the new capital gains tax regime.

KPMG warned that taxing nominal gains in such an environment could result in investors paying tax on inflation-driven increases rather than real economic gains. The firm recommended introducing a cost indexation mechanism to adjust asset values for inflation, noting that this would reduce distortions while still enabling the government to earn revenue from genuine capital appreciation.

Indirect transfers and foreign investment concerns

Attention was also drawn to Section 47 of the Nigeria Tax Act, which subjects gains from indirect transfers by non-residents to Nigerian tax where the transactions affect ownership of Nigerian companies or assets.

This provision comes at a time of subdued foreign investment. Figures from the United Nations Conference on Trade and Development indicate that foreign direct investment inflows into Nigeria remain below pre-2019 levels, reflecting ongoing investor caution.

READ ALSO:UK Supported US Mission To Seize Russian-flagged Oil Tanker – Defense Ministry

While similar rules exist in other countries, KPMG noted that they are often supported by detailed guidance and clear thresholds. The firm advised Nigerian tax authorities to issue comprehensive administrative guidelines to clarify scope, thresholds,capitalizationthresholds, and reporting obligations inorder to reduce disputes and limit potential negative effects on foreign investment.

Foreign exchange deductions and business impact

Another issue identified relates to Section 24 of the Act, which restricts businesses from deducting foreign-currencyforeign currency expenses beyond their naira equivalent at the official Central Bank of Nigeria exchange rate.

In reality, limited access to official foreign exchange forces many companies to source FX at higher parallel market rates. Under the current rule, the additional cost becomes non-deductible, effectively increasing taxable profits and overall tax liabilities.

KPMG observed that although the provision aims to discourage FX speculation, it does not adequately reflect supply constraints. The firm recommended allowing deductions based on actual costs incurred, provided transactions are properly documented, to avoid penalisingforeign currencypenalizing businesses for factors outside their control.

READ ALSO:UK Supported US Mission To Seize Russian-flagged Oil Tanker – Defense Ministry

VAT-related expense disallowances

Section 21(p) of the Nigeria Tax Act also came under scrutiny for disallowing deductions on expenses where VAT was not charged, even if the costs were entirely business-related.

Given Nigeria’s large informal sector and persistent VAT compliance gaps, analysts argue that the rule unfairly shifts part of the VAT enforcement burden onto compliant taxpayers. KPMG advised that the provision be removed or significantly amended, stressing that expense deductibility should be based on whether costs were wholly and necessarily incurred for business, while VAT compliance should be enforced directly on defaulting suppliers.

Non-resident taxation uncertainties

KPMG further highlighted ambiguities around the compliance obligations of non-resident companies. While the Nigeria Tax Act recognizespenalizingrecognizes withholding tax as the finalthe final tax for certain nonresident payments in the absence of a permanent establishment or significant economic presence, the Nigeria Tax Administration Act does not clearly exempt such entities from registration and filing requirements.

Nigeria’s network of double taxation treaties, including agreements with the UK, South Africa, Canada, and France, generally supports the principle that final withholding tax extinguishes further obligations. Experts warn that inconsistencies between the laws could create uncertainty and discourage foreign participation.

READ ALSO:Tax Reform Law: Reps Minority Caucus Seeks Suspension Of Implementation

KPMG recommended harmonizing the relevant provisions of the NTA and NTAA, with explicit exemptions for non-resident companies whose tax obligations have been fully settled through withholding tax. The firm noted that such alignment would ease compliance and enhance Nigeria’s appeal for cross-border transactions.

As Nigeria undertakes its most extensive tax reform in decades, KPMG concluded that the success of the overhaul will depend on clarity, consistency, and alignment with international best practices. Without timely amendments, businesses may face higher costs, foreign investors could remain cautious, and capital markets may continue to experience volatility.

Recall that KPMG concerns come after a lawmaker, Abdulsamman Dasuki, raised alarm over alleged alterations to the gazetted tax laws.

(DAILY POST)

Business

Naira Records First Depreciation Against US Dollar In 2026

The Naira recorded its first depreciation against the United States dollar in the official foreign exchange market on Thursday, the first time in 2026 so far.

The Central Bank of Nigeria’s data showed that it weakened on Thursday after days of gains to N 1,419.72 per dollar, down from N 1,418.26 on Wednesday.

This means that for the first time this year, the Naira dipped by N1.46 against the dollar on a day-to-day basis.

READ ALSO:Naira Continues Gain Against US Dollar As Nigeria’s Foreign Reserves Climb To $45.57bn

Similarly, the Naira also depreciated by N10 at the black market to N1,490 on Thursday, down from the N1,480 recorded the previous day.

This comes despite the continued rise in the country’s foreign reserves to $45.64 billion as of Wednesday, 7th January 2026.

DAILY POST reports that the Naira recorded a seven-day bullish run at the official foreign exchange before Thursday’s decline.

News4 days ago

News4 days agoHow To Calculate Your Taxable Income

Metro4 days ago

Metro4 days agoEdo widow-lawyer Diabolically Blinded Over Contract Seeks Okpebholo’s Intervention

Headline4 days ago

Headline4 days agoRussia Deploys Navy To Guard Venezuelan Oil Tanker Chased By US In Atlantic

News3 days ago

News3 days agoExpert Identify Foods That Increase Hypertension Medication’s Effectiveness

Entertainment4 days ago

Entertainment4 days agoVIDEO: ‘Baba Oko Bournvita,’ Portable Drags His Father, Alleges Bad Parenting, Extortion

Politics3 days ago

Politics3 days agoAPC Leaders, Tinubu/Shettima Group Call For Wike’s Removal As FCT Minister

Politics4 days ago

Politics4 days ago2027: Details Of PDP Leaders, Jonathan’s Meeting Emerge

Metro4 days ago

Metro4 days agoJUST IN: Court Grants Malami, Wife, Son N500m Bail Each

Headline2 days ago

Headline2 days agoScience Discovers Why Hungry, Broke Men Prefer Bigger Breasts

Politics2 days ago

Politics2 days agoWike A ‘Pestilence’ On Rivers, I Resigned Because Of It – Ex-Commissioner