News

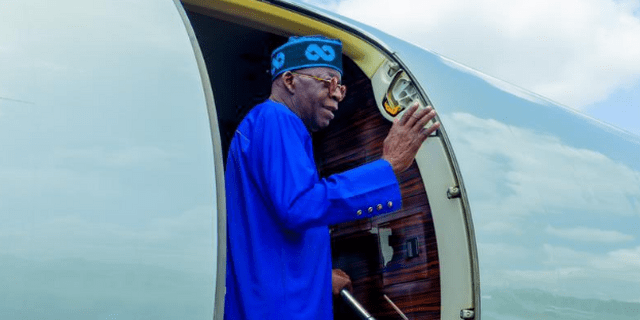

JUST IN: Tinubu Embarks On Working Visit To France

President Bola Tinubu will depart for Paris, France, today, Wednesday, on a short working visit.

Bayo Onanuga, Presidential Spokesman, said the President, will during the visit, appraise his administration’s mid-term performance and assess key milestones.

He will also use the retreat to review the progress of ongoing reforms and engage in strategic planning ahead of his administration’s second anniversary.

This period of reflection will inform plans to deepen ongoing reforms and accelerate national development priorities in the coming year.

READ ALSO: Don’t Kill Democracy In Nigeria, Dele Momodu Tells Tinubu

Recent economic strides reinforce the President’s commitment to these efforts, as evidenced by the Central Bank of Nigeria reporting a significant increase in net foreign exchange reserves to $23.11 billion—a testament to the administration’s fiscal reforms since 2023 when net reserves were $3.99 billion.

While away, President Tinubu will remain fully engaged with his team and continue to oversee governance activities.

Onanuga said the President will return to Nigeria in about a fortnight.

News

[OPINION] Tinubu: Ade Ori Okin Befits KWAM 1, Not Awujale Crown

Tunde Odesola

Blood is thicker than water, so the saying goes. But not in every case. Sometimes, workplace fluidity possesses the same viscosity as blood. The seed of my relationship with a longstanding friend and colleague, Hammed Shittu of ThisDay newspapers, was watered in the field of journalism before blossoming beyond the boundaries of deadline.

A relative of the Ẹ̀léjìgbò of Ẹ̀jìgbò, Ọba Ọmọ́wonúọlá Oyèyodé Oyèsosìn, Hammed was raised in the palace; therefore, his upbringing instilled in him the Yoruba social etiquette of respect, humility, integrity, and wisdom. Hammed, whom the Ògìyán of Ẹ̀jìgbò nicknamed Ẹ̀lẹ̀mdí Ìkòkò Ẹ̀wà because of his love for beans, is very funny. He takes as many jokes as he throws. Ẹ̀lẹ̀mdí’s jokes are raw, unrehearsed and far more cracking than the jokes from some unfunny folks who call themselves stand-up comedians.

I nearly got Hammed one day when his laptop went blurry. I kept a straight face as I faked computer expertise, pressing all the letters on his keypad: ‘Control–Shift–Cap Lock–Escape–Enter!’ But the problem persisted. Then, I pressed Escape–Shift–Control–Enter. Still no luck.

With a frown on my face, I broke the sad news: “Ha, Alhaji, there is no more ink in your laptop! You need a refill.” Ẹ̀lẹ̀mdí looked at me suspiciously, processing what I had said, and searching for mischief in my eyes for mischief. But I held my nerve. I didn’t put a price on the ink, that would give me away. For a few seconds, Ìkòkò Ẹ̀wà chewed on my advice. Then, he said in his bright white smile, “Ọ̀dà ni o ba mi ra, mo ra inki. Ara ò fu ọ́,” meaning: “Buy me paint, not ink, unserious fellow.” That was the wicked wit of Hammed. That was in 2003 when both of us were the only ones using laptops in the whole of the Osun State Correspondents’ Chapel in Osogbo.

But literally speaking, I need some ink in my laptop right now because its lettering is blurry from mourning and writing elegies. I’m not one to parrot the scaremongering belief that death doubles its hustle in the last four months of the year Nigerians christened EMBER Months, because each of the months ends in ‘ember’. I don’t believe that during ember months, death casts its net deeper into the world-wide-web called Ayé Àkámarà, to harvest souls and skulls. So far, in this year’s ember months, death has reaped where it never sowed, taking away my in-law and infotech guru, Tayo Adewusi; Owa of Igbajo, Oba Adegboyega Famodun; Pro-Chancellor and Chairman of Council, Obafemi Awolowo University, Prof Siyan Oyeweso; Oluomo of Ife, Honourable Gbenga Owolabi; Chairman, MicCom Golf and Country Club, Chief Tunde Ponnle; and my buddy and top table tennis player, Emmanuel Bamidele aka ‘Baba Alaye’, among others. May the souls of the departed find repose in their Maker, and may the Lord give families, relatives and friends the fortitude to bear the painful losses, amen.

As death was busy causing pain and chaos, some members of the Nigerian elite left many mouths gaping, gasping and saying, ‘Ehn-ehn?, Mba! O ti o, kai’, as they unfolded dramatic spectacles. Or, what do you make of Yoruba’s foremost traditional ruler, the Ooni of Ife, Oba Adeyeye Enitan Ogunwusi, installing the First Lady, Chief Remi Tinubu, as Yeye Asiwaju Gbogbo Ile Oodua, without the symbolic akòko leaves? Has the Ooni abolished the use of akòko leaves for traditional installation? I think if Yeye Asiwaju Remi Tinubu feels the akòko leaves are too dirty or pagan for her beautiful head, then she doesn’t know the responsibilities that her new title carries. She needs to know that titles walk with obligations hand in hand.

MORE FROM THE AUTHOR:OPINION: The ‘Fool’ Who Stopped Wike

As Yeye Asiwaju, Madam Tinubu’s primary assignment is the protection of Yoruba culture and tradition. It is absurd that the ultimate custodian of Yoruba culture, the Ooni of Ife, flouted ancestral protocol by failing to perform installation rites on Yeye Tinubu. When rites are flouted, history and meaning collapse, thereby negating the Yoruba cosmic order that enables birds to chirp as birds and rats to squeak as rats. Sadly, the Ooni failed to ‘se bi won ti i se, ko ba le ri bi o ti n ri.’ Gradually, the Ooni is eroding Yoruba culture and tradition by shivering before celebrities and politicians. When will King Ogunwusi shed the toga of Mister Enitan Adeyeye? Yoruba culture and tradition will not survive the brutal hammer of cash and carry; the Ooni must beware.

And Nigerians aahed and ohed when Aisha Buhari, the widow of the most greatest President in the history of Nigeria, General Muhammadu Buhari, spoke in a 600-page biography, “From Soldier to Statesman: The Legacy of Muhammadu Buhari.” Like American poet and civil rights activist Maya Angelou, who discovered why the caged bird sings, more Nigerians now know why the caged crocodile gaped.

On the home front, the Buhari presidency was far from peaceful, Aisha stated in the biography, revealing that Buhari was locking his bedroom door because he feared she (Aisha) might kill him. Aisha also said Buhari did not support the presidential ambition of former Vice President Yemi Osinbajo because the Daura general felt it was inappropriate for Osinbajo to contest against his political benefactor, Asiwaju Bola Tinubu.

In the midst of the elite confusion ravaging Nigeria, a primate, whose cap looks like the calabash used in drinking palm wine, ministered to a minister that he, hElijah, possesses God’s hotlines, urging the ministered to exchange tithe for ticket. When I saw this elite confusion, I made a quick dash for my dictionary and discovered that another meaning of primate is gorilla.

Do you know what would happen if you whisper this sentence into the ears of a cow, “Prophet Mohammed is dead?” The cow would immediately go mad and gore the speaker because the cow, until the speaker spoke those words, did not know Prophet Mohammed had died. Please, do not laugh; one Islamic cleric told his congregation this crazy tale while his listeners shouted, “Allahu Akbar!” Nothing kills faster than ignorance, not the bullet. To affirm the vacuity in the Islamic cleric’s statement, many Nigerians have since stormed ranches and abattoirs, dragging cows by the ears, announcing the death of Prophet Mohammed. “Ojise nla Mohamodu ti ku,” they chorused. What did the cows do? They looked blankly at the announcers and continued to chew the curd, wondering if Man did not manipulate his way to the top of the order of creation.

I won’t dwell on Alhaji Aliko Dangote’s takedown of the Chief Executive, Nigerian Midstream and Downstream Petroleum Regulatory Authority, Farouk Ahmed, because President Bola Tinubu acted like a dentist exasperated by the odour from a bad tooth, pulling it out swiftly. But surgeon Tinubu should look at all the other teeth in the buccal cavity, including his own.

MORE FROM THE AUTHOR:OPINION: Fayose-Obasanjo: Two Eboras Dragging Same Pair Of Trousers (1)

Now, here comes the weirdest of the Nigerian elite spectacles – the kingship ambition of the Olori Omoba Akile Ijebu, King Dr Wasiu Omogbolahan Olasunkanmi Adewale Ayinde Anifowose Marshall! Popularly called KWAM 1, Ayinde has staked his claim to the throne of the Awujale of Ijebuland via the Fusengbuwa royal family. However, his kingship bid suffered a huge setback when the Fusengbuwa royal family disowned the 68-year-old Fuji musician in response to his expression of intent. The Fusengbuwa royal family is set to produce the next Awujale of Ijebu-Ode.

In the response dated December 11, 2025, and signed by the Chairman of the ruling house, Otunba Abdulateef Owoyemi; Deputy Chairman, Otunba Adedokun Ajidagba, and Vice Chairman, Prof Fassy Yusuf, among others, the family told Ayinde that his form was curiously ‘certified by a purported family unit head, one Omooba Adetayo Abayomi Oduneye Eruobodo, on 8 December 2025, two days before your good self (Wasiu Ayinde) signed it’, describing the form as ‘presigned’.

The family said Wasiu’s expression of intent form was not signed by the authorised representative of his purported family unit. “Omooba Adetayo Abayomi Oduneye Eruobodo is not a registered member of the Jadiara Royal House, and therefore, has no locus standi to sign any linkage form on behalf of the family,” the Fusengbuwa family declared, adding that, “ Our extensive investigation has not revealed any proof of your (Wasiu Ayinde’s) membership of the Jadiara Royal House or indeed that of the Fusengbuwa Ruling House.”

Crowns and titles wrestle for space in Wasiu’s cabinet. As far back as 1993, he was crowned the Oluaye Fuji. Two years before the late Alaafin of Oyo, Oba Lamidi Adeyemi, joined his ancestors in 2022, Adeyemi crowned KWAM 1 as the first Mayegun of Yorubaland. Much earlier, Wasiu had bagged the titles of Golden Mercury of Africa (1986), Badabarawu of Ogijo (1985) and Ekrin Amuludun of Ibadan (1986). He’s also the Balogun of Ilupeju-Ekiti (2025), the Oluomo of Lagos (1999), among countless other titles such as Capo De Tutti.

Wasiu Ayinde’s longest-reigning hit, Ade Ori Okin, is contained in his Extended Play album, The Fuji Sound, released on August 20, 2020. In various versions of Ade Ori Okin, Wasiu tells the world that he possesses a crown similar to that of a peacock. He calls his possession a Fuji crown. He says it was given to him by the pioneer of Fuji music, the late Dr Sikiru Ayinde Ololade Agbejelola Barrister. Wasiu croons that another title was given to him by another Sikiru, the late Awujale of Ijebulan, Oba Sikiru Kayode Adetona, the Ogbagba Agbotewole II. He sings that the late Awujale installed him as the Olori Omoba Akile Ijebu, thanking both Barrister and the late Awujale as his great benefactors.

MORE FROM THE AUTHOR:[OPINION] Siyan Oyeweso: Lessons In Virtue And Vanity

I’ve been a fan of Wasiu since the release of his monster hit, Talazo ’84, in 1984. For his industry and creativity, I admire Wasiu, but I detest his attitude. If Wasiu must know, opinions are divided over the assertion of the peacock as the king of birds. The eagle is generally more acceptable as the king of birds than the peacock, which is incapable of flying long distances. Unlike the eagle and even the hawk, the peacock cannot fly long distances, reason why it accepted the fate of living on the ground.

The kingship of the eagle over the peacock manifests in various countries using the eagle as a symbol of courage in their coats of arms. Examples are Nigeria and the US. Nigeria’s national male football teams are named after the eagle. Yes, the peacock is colourful, but what is the use of shoes to a legless man? What does a toothless man use a toothpick to pick? What is the use of the hundreds of eyes on the peacock’s tail when it can’t fly to see the world?

The peacock, Wasiu’s symbol of kingship, is an interloper, a fàwọ̀rajà, a misfit, who pumps itself up in a pompous spread of plumage to deceive and win the crown. The peacock is an alágbe, a beggar, who having gathered enough alms, wants to mount the throne of great birds. If the peacock is sure of itself, it should fly up to the sky and show the world which schools of flying it went to, and who were its teachers? The throne of the king of birds demands schooling. The peacock should not hide behind any power because the hawk soars in broad daylight, “gbaangba lasa n ta.” Because the rainbow fades off thereafter, I’ll choose character over colour.

Our forebears say morning shows the day. It is not uncharitable to assert that Wasiu is a controversial figure. More than any of the other top Fuji artists, Ayinde has been in the news for the wrong reasons. Bonsue Fuji originator, Adewale Ayuba, is the poster boy for humility and gentleness. The post of the Awujale demands a personality with patience and humility. An Awujale should not be seen slapping people on the street. An Awujale must not be friends with people of questionable character. An Awujale must treat people, especially women, fairly. An Awujale must be decorous – he must not disdainfully address the elderly. The Awujale must not refer to the President of the country as if he was referrimng to his mate or a younger fellow. He must be courteous to the young and old. He must not look down on clerics and call them ‘Ganusiers’. The Awujale must be able to take to correction whenever he errs; he mustn’t refuse to apologise to ‘Ganusiers’when told to do so.

The late Oba Sikiru Adetona would never stand before a plane and attempt to stop it from flying. Nobody in their right senses would. Wasiu Ayinde has done so much for himself and Fuji music; the crown of the Awujale is not befitting for him because he lacks the temperament for the office. As a music superstar, Wasiu belongs to the stage, the limelight, the loud noise, the paparazzi; the palace is a centre of cultivation, good breeding and discernment.

The Yoruba have been beset with all manner of traditional rulers in the past decade. There is one king in Osun whose estranged wife caught him on camera smoking marijuana. An Osun king, the Oluwo of Iwo, Oba Abdulrasheed Adewale Akanbi, was jailed in the US for fraudulent crimes. Most of the traditional rulers misbehaving today were installed by the All Progressives Congress administrations. Ijebu-Ode kingmakers and the Ogun State Governor, Mr Dapo Abiodun, should save the Yoruba nation from the horror of seeing the Awujale singing the praises of people at parties. President Akanbi Ahmed Bola Tinubu, omo Olodo Ide, you know what is good for the people of Ijebuland. Please, do it. Don’t allow màgòmágó to prevail.

Email: tundeodes2003@yahoo.com

Facebook: @Tunde Odesola

X: @Tunde_Odesola

News

Former Delta North senator Peter Nwaoboshi Dies

Peter Nwaoboshi, the former senator representing Delta north, is dead.

Details of the circumstances surrounding his death were unclear at the time of this report, but according to reports, the former senator died in Abuja on Friday, aged 68.

In a statement, Sheriff Oborevwori, governor of Delta, expressed “profound grief” over the demise of the former lawmaker.

The governor described his demise as a monumental loss to the state, the Anioma nation, and Nigeria.

READ ALSO:Woman Taken For Dead Wakes Up Inside Coffin Few Minutes To Her Cremation

In a condolence message signed by Festus Ahon, his chief press secretary (CPS), Oborevwori hailed the late Nwaoboshi as a dedicated son of Delta and a bold champion of Anioma interests, whose legacy in nation-building will endure.

The governor said the late senator’s distinguished tenure in the national assembly, particularly as chairman of the senate committee on Niger Delta affairs.

“Nwaoboshi lived a life of service to his people, his party, and the country, bequeathing a heritage of bravery, loyalty, and commitment to public duty,” Oborevwori said.

READ ALSO:Fourteen Nigerian Banks Yet To Meet CBN’s Recapitalisation Ahead Of Deadline

“On behalf of the Delta State government and people, I mourn my dear friend, Senator Peter Onyelukachukwu Nwaoboshi.

“I extend deepest condolences to his family, the Anioma people, members of the All Progressives Congress, and everyone touched by his life.

“May God grant his soul peaceful rest and comfort to all who grieve this irreplaceable loss.”

News

Grassroots To Global Podium: Edo Sports Commission Marks Enabulele’s First Year In Office

The Indoor Sports Hall in Benin City came alive on Wednesday as the Edo State Sports Commission rolled out the drums to celebrate the first anniversary in office of its Executive Chairman, Hon. Amadin Desmond Enabulele. Management, staff, coaches and athletes gathered in an atmosphere charged with pride, reflection and optimism.

The colourful ceremony drew executives and members of various sports associations, officials of the Sports Writers Association of Nigeria (SWAN), coaches, athletes and other key stakeholders in Edo sports.

In her welcome address, the Acting Permanent Secretary of the Commission, Mrs. A. P. Amenze, praised Hon. Enabulele for what she described as focused and purposeful leadership. She said the past year had seen renewed confidence, discipline and energy return to the state’s sports ecosystem.

Adding excitement to the event were exhibition bouts and demonstrations by the Kung Fu, Karate, Taekwondo and Judo associations, staged in honour of the Executive Chairman.

READ ALSO:2025 NYG: Enabulele Charges Edo Coaches On Performance

Speaking for SWAN Edo State, Chairman Comrade Kehinde Osagiede commended Hon. Enabulele’s open-door leadership style and consistent support for sports development. He noted that the Commission had effectively driven Governor Monday Okpebholo’s “Catch Them Young” policy through practical grassroots programmes that identify and groom young talents across the state.

In recognition of his contributions to sports development and media relations, Comrade Osagiede conferred the Patronship of SWAN Edo State on Hon. Enabulele and presented him with a special anniversary card.

Goodwill messages followed from Executive Directors of the Commission, including Hon. Frank Ilaboya (Edo North), Coach Baldwin Bazuaye, MON (Edo South), Barr. Anthony Ikuenobe (Edo Central), and Mrs. Sabrina Chikere, Executive Director, Sports Development and Operations. Representatives of coaches, athletes and sports associations also took turns to acknowledge the progress recorded under the current leadership.

In his stewardship address, Hon. Enabulele expressed gratitude to Governor Monday Okpebholo and Deputy Governor Rt. Hon. Dennis Idahosa for the trust placed in him, noting that their backing and shared vision had driven the Commission’s achievements.

READ ALSO:Enabulele Lauds Okpehbolo For Creating Enabling Environment For Football To Thrive

He highlighted Team Edo’s third-place finish at the 9th National Youth Games in Asaba, where the state recorded its best-ever outing with 79 medals—33 gold, 18 silver and 28 bronze—reinforcing Edo’s reputation as a national sports powerhouse.

The Chairman also pointed to the impact of inclusive and grassroots sports programmes, citing Favour Ojeabu, a visually impaired para-cyclist who won three gold medals to emerge Africa’s champion at the African Track Para-Cycling Championship in Egypt.

Other milestones listed included outstanding performances by Edo para powerlifters on the international stage, historic achievements in cricket, weightlifting, cycling, judo and deaf athletics, as well as structural reforms such as the repositioning of Bendel Insurance FC and deeper investment in grassroots sports development.

Cultural performances added colour and tradition to the celebration, as stakeholders closed the event united in their assessment of the past year as a truly transformative period for sports development in Edo State.

Metro4 days ago

Metro4 days agoSuspected Kidnappers Abduct 18 Passengers On Benin-Akure Road

News4 days ago

News4 days agoI’m Not Distracted By Anti-Niger Delta Elements, Says PAP Boss, Otuaro

News4 days ago

News4 days agoOPINION: Time For The Abachas To Rejoice

News4 days ago

News4 days agoWage Dispute: Court Orders PSG To Pay Mbappe €61 Million

News5 days ago

News5 days agoEdo Assembly Charges Contractor Handling Ekekhuan Road To Accelerate Work

Sports4 days ago

Sports4 days agoJUST IN: Dembélé Named FIFA Best Men’s Player, Bonmatí Wins Women’s Award

Metro4 days ago

Metro4 days agoNDLEA Seizes 457kg of Cannabis, Arrests Suspected Trafficker In Edo

Headline3 days ago

Headline3 days agoAircraft Crashes In Owerri With Four Persons Onboard

News4 days ago

News4 days agoEx-Nigerian Amb., Igali, To Deliver Keynote Address As IPF Holds Ijaw Media Conference

Business3 days ago

Business3 days ago9th FirstBank Digital Xperience Centre Launched In UNIBEN