Headline

Malabu: Nigeria Loses $1.7 Billion JP Morgan Case

Nigeria on Tuesday lost its $1.7 billion claim against JP Morgan Chase Bank over the transfer of proceeds from the sale of OPL 245 in the controversial Malabu oil deal.

Judge Sara Cockerill ruled Tuesday that the Nigerian government couldn’t show that it had been defrauded in the case.

In the suit, Nigeria is claiming more than $1.7 billion for the bank’s role in the controversial deal. Nigeria also alleges that JP Morgan was “grossly negligent” in its decision to transfer funds paid by oil giants Shell and Eni into an escrow account controlled by a former Nigerian oil minister, Dan Etete.

Earlier in February, Nigerian lawyer, Roger Masefield, argued that the nation’s case rested on proving that there was fraud and JP Morgan was aware of the risk of fraud.

“The evidence of fraud is little short of overwhelming,” the lawyer told the court.

READ ALSO: Aircraft Maintenance: Nigeria Lost N1.25 Trillion In 2021 To Other African Countries

“Under its Quincecare duty, the bank was entitled to refuse to pay for as long as it had reasonable grounds for believing its customer was being defrauded.”

Quincecare refers to a legal precedent whereby the bank should not pay out if it believes its client will be defrauded by making the payment.

Judge Cockerill said Tuesday that by the time of the 2013 payments, the bank was “on notice of a risk” of fraud.

“There was a risk – but it was, on the evidence, no more than a possibility based on a slim foundation,” the judge ruled.

Background

The OPL deal details how Shell and Italy’s Eni in 2011 paid the Nigerian government of then president Goodluck Jonathan a combined $1.3 billion for an oil block. Of that amount $875 million was paid to Malabu Oil & Gas, a company controlled by former oil minister Dan Etete.

Mr Etete had awarded Malabu the rights to the block in 1998 when he was Nigeria’s oil minister.

Within weeks of the deal in April 2011, half of Malabu’s money was allegedly packed into bags and paid out to Nigerian government officials and Western oil executives as cash bribes.

The deal has also spawned further lawsuits, including efforts by a new presidential regime in Nigeria to recover assets. A panel of judges in Milan acquitted the companies and executives, who all denied any wrongdoing, of bribery last March. Prosecutors have however appealed the ruling.

Classified documents from Britain’s financial crime agency seen by this newspaper revealed how it allowed JP Morgan to pay $875 million of suspicious funds to Mr Etete, a former Nigerian oil minister widely known as a convicted money launderer.

The documents, rarely seen Suspicious Activity Reports (SARs), were filed by the banking giant’s London branch as it raised concerns about huge payments it was being asked to make by the Nigerian government to Mr Etete.

The reports were filed in 2011 and 2013 to the UK’s Financial Intelligence Unit (FIU), which at that time sat within the now defunct Serious Organised Crime Agency.

Trial

The trial opened in February with details of the claim by Mr Masefield, who argued that the bank failed in its Quincecare duty.

READ ALSO: 2023 Presidency: Atiku Speaks On Picking Running Mate

Damages sought by Nigeria include cash sent to Mr Etete’s company, Malabu Oil and Gas, around $875 million paid in three installments in 2011 and 2013, plus interest, taking the total to over $1.7 billion.

But Bloomberg reports Tuesday that the London High Court judge said no such breach took place.

“The Federal Republic of Nigeria is naturally disappointed by the outcome of the judgment and will be reviewing it carefully before considering next steps,” a spokesman told Bloomberg. He added that the Nigerian government will continue its fight against fraud and corruption and to work to recover funds for the people of Nigeria.

JP Morgan in a statement said that the judgment reflects its commitment to acting with high professional standards in every country it operates in. The bank added that the judgement also shows how “we are prepared to robustly defend our actions and reputation when they are called into question.”

PREMIUM TIMES.

Headline

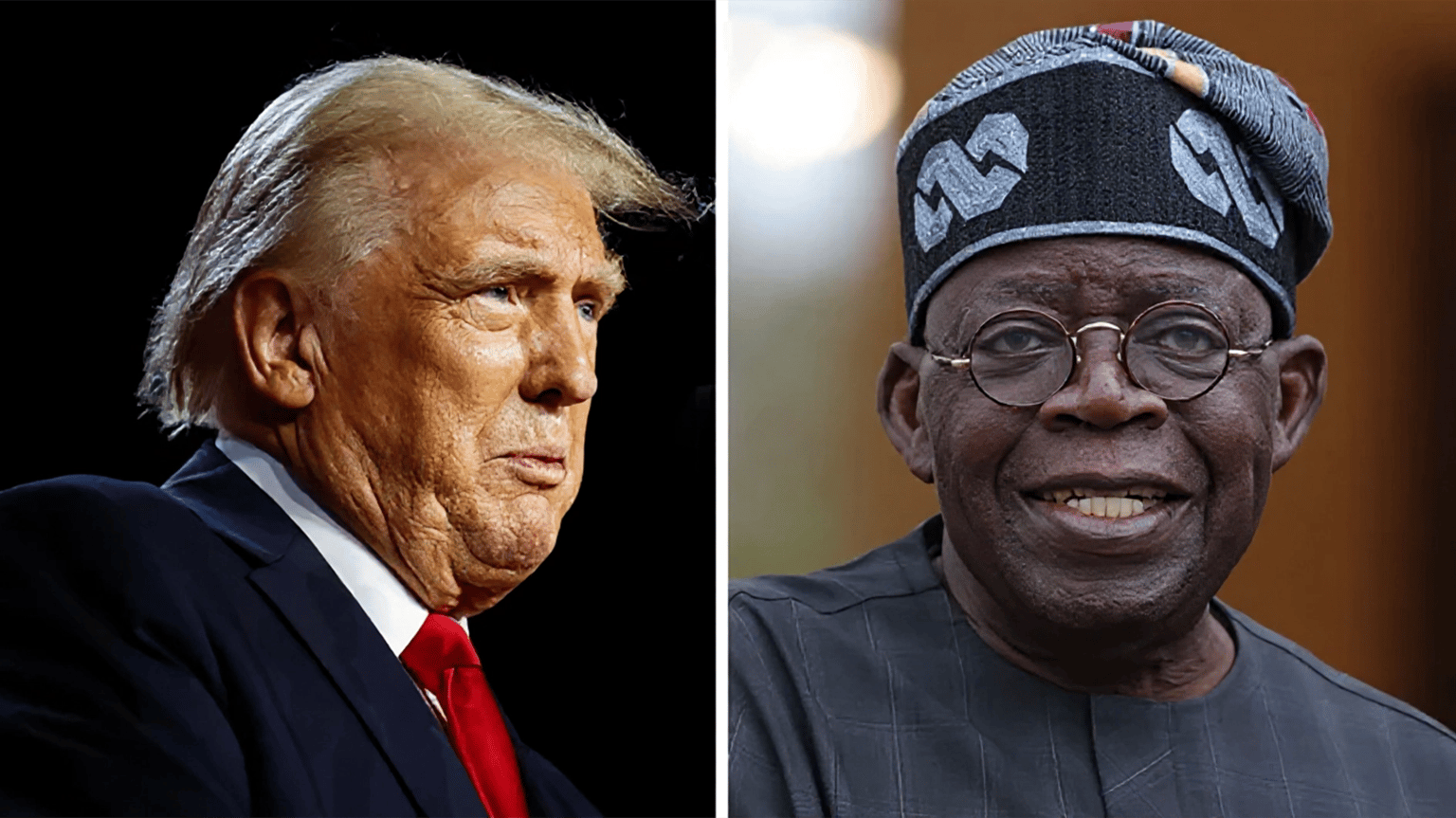

Trump Warns Of More Strikes In Nigeria If Attacks On Christians Continue

US President Donald Trump has warned that he could authorise additional military strikes in Nigeria if attacks against Christians continue, citing the security situation in the West African nation as a key concern.

In an interview with the New York Times on Thursday, Trump was asked whether the Christmas Day strikes in Sokoto State, which targeted Islamist militants, were intended as part of a broader campaign. “I’d love to make it a one-time strike. But if they continue to kill Christians, it will be a many-time strike,” he said.

READ ALSO:Russia, China Afraid Of US Under My Administration — Trump

Trump’s comments follow his 2025 designation of Nigeria as a “country of particular concern” due to what he described as an “existential threat” to its Christian population. The remarks have drawn criticism from Nigerian officials, who insist that jihadist groups target people regardless of religion. “Muslims, Christians and those of no faith alike” are affected, a government spokesperson said, rejecting claims that Christians are being singled out.

When pressed about reports that most victims of jihadist groups in Nigeria are Muslims, Trump responded, “I think that Muslims are being killed also in Nigeria. But it’s mostly Christians.” Nigeria, with a population exceeding 230 million, is roughly evenly divided between Christians in the south and Muslims in the north.

The December strikes targeted camps run by a jihadist group known as Lakurawa in Sokoto, a largely Muslim region near the border with Niger. Both the US and Nigerian authorities have linked the militants to Islamic State-affiliated groups in the Sahel, although the IS has not formally claimed any association with Lakurawa. Details of casualties from the strikes remain unclear, as neither government has provided official figures.

Nigeria’s Foreign Minister Yusuf Maitama Tuggar said the operation was a “joint effort” and emphasised that it was not motivated by religion. He confirmed that the strikes had the approval of President Bola Tinubu and included

participation by Nigerian armed forces. Addressing the timing of the strikes, Tuggar added that they were unrelated to Christmas, though Trump described them as a “Christmas present”.

Headline

Science Discovers Why Hungry, Broke Men Prefer Bigger Breasts

A scientific study has found that men who feel financially insecure or hungry are more likely to find larger female breasts attractive.

The research was published in the peer-reviewed journal PLOS ONE and was conducted by psychologists Viren Swami and Martin J. Tovée.

The study examined whether breast size acts as a signal of fat reserves and access to resources, and whether men facing resource insecurity rate larger breast sizes as more attractive than men who feel economically secure.

Researchers carried out two separate studies across Malaysia and the United Kingdom.

In the first study, 266 men from three areas in Malaysia were assessed. The locations represented low, medium and high socioeconomic backgrounds. Participants were shown rotating computer-generated images of women with different breast sizes and asked to rate which they found most attractive.

READ ALSO:Wike: Why Removing Fubara Will Be Difficult – Ex-Commissioner

The findings showed a clear socioeconomic pattern.

Men from low-income rural areas preferred larger breasts.

Men from middle-income towns preferred medium to large breasts.

Men from high-income urban areas preferred smaller to medium breasts.

PLOS ONE study showing how hunger and financial insecurity affect men’s breast size preferences

Cover page of a PLOS ONE study examining how resource insecurity influences men’s breast size preferences. Source: PLOS ONE

As stated in the study, “Men from relatively low socioeconomic sites rated larger breast sizes as more physically attractive than did participants in moderate socioeconomic sites, who in turn rated larger breast sizes as more attractive than individuals in a high socioeconomic site.”

READ ALSO:Rare 1937 ‘Hobbit’ Discovered In House Clearance Sells For $57,000

The researchers noted that the lower a man’s financial security, the stronger his preference for larger breast size.

The second study focused on hunger rather than income.

In Britain, 124 male university students were divided into two groups. Sixty-six participants were classified as hungry, while 58 had recently eaten. Both groups viewed the same breast size images under identical conditions.

Hungry men consistently rated larger breasts as more attractive than men who were full.

READ ALSO:‘I Discovered My Husband Was Sterile 5 Yrs After We Got Married’

According to the researchers, “Hungry men rated a significantly larger breast size as more physically attractive than did the satiated group. Taken together, these studies provide evidence that resource security impacts upon men’s attractiveness ratings based on women’s breast size.”

The researchers explained that these shifts suggest attraction is not fixed but responsive to immediate conditions.

They noted that men experiencing hunger or financial pressure may place greater value on physical traits that signal access to resources or stability.

The study added that temporary states such as hunger can shape attraction in the same way long-term economic conditions do, reinforcing the idea that social and environmental factors play a key role in how physical attractiveness is judged.

Headline

Man With Lengthy Criminal Record Shoots Nigerian To Death Inside Bus In Canada

A 40-year-old man with an extensive criminal history has been charged with first-degree murder after a Nigerian national was shot dead on a GO bus at the Yorkdale GO Bus Terminal in Toronto, marking the city’s first homicide of 2026.

Toronto Police, in a statement on their website, said officers were called to the terminal, near Yorkdale Road and Allen Road, at about 7 p.m. on Sunday, January 4, following reports of a shooting. Investigators allege that both the suspect and the victim boarded a GO bus at the terminal, where the suspect shot the victim before fleeing the scene on foot.

According to the statement, officers arrived to find a man suffering from a gunshot wound, but despite carrying out life-saving measures, the Nigerian was pronounced dead at the scene.

The victim was later identified as Osemwengie Irorere, a 46-year-old man from Nigeria, the Toronto police said in a later statement.

READ ALSO:Canada Flags Nigeria, 16 African Countries As High-risk In New Travel Advisory

Local media reports noted that an eyewitness who was seated just behind the victim said the bus had been dark and crowded as passengers waited to depart when a single gunshot rang out.

“I assumed it was a popped tyre or something, but immediately after, a guy sitting in front of me got up, shoved his hands in his pocket and ran off the bus,” the witness said, requesting anonymity for safety reasons.

“Right after, I stood up and I looked at the seat in front of me and I saw a guy, bleeding,” he added, saying he could smell smoke in the air after the shot was fired.

Police said the suspect was located and arrested a short time later near the Yorkdale subway station, and a firearm was recovered.

READ ALSO:Nigerian Musician Dies In Canada

The accused has been identified as Tyrel Gibson, 40, of Toronto. He appeared at the Toronto Regional Bail Centre on Monday, January 5.

Court documents show that Gibson has a lengthy criminal record dating back to 2000, with nearly two dozen charges. He has previously been convicted of offences including attempted murder and firearm-related crimes. In 2015, he pleaded guilty to aggravated assault, using a firearm, possession of a firearm with ammunition and possession of an unauthorised firearm and was handed a lifetime weapons prohibition. He was sentenced to eight years in prison in 2017, although it remains unclear how much of that term he served.

News4 days ago

News4 days agoHow To Calculate Your Taxable Income

Metro4 days ago

Metro4 days agoEdo widow-lawyer Diabolically Blinded Over Contract Seeks Okpebholo’s Intervention

Headline4 days ago

Headline4 days agoRussia Deploys Navy To Guard Venezuelan Oil Tanker Chased By US In Atlantic

Entertainment4 days ago

Entertainment4 days agoVIDEO: ‘Baba Oko Bournvita,’ Portable Drags His Father, Alleges Bad Parenting, Extortion

Politics3 days ago

Politics3 days agoAPC Leaders, Tinubu/Shettima Group Call For Wike’s Removal As FCT Minister

News3 days ago

News3 days agoExpert Identify Foods That Increase Hypertension Medication’s Effectiveness

Politics4 days ago

Politics4 days ago2027: Details Of PDP Leaders, Jonathan’s Meeting Emerge

Metro4 days ago

Metro4 days agoJUST IN: Court Grants Malami, Wife, Son N500m Bail Each

Headline2 days ago

Headline2 days agoScience Discovers Why Hungry, Broke Men Prefer Bigger Breasts

Politics2 days ago

Politics2 days agoWike A ‘Pestilence’ On Rivers, I Resigned Because Of It – Ex-Commissioner