Crime

N700m Fraud: ‘We Did Not Charge Anenih Alongside Ize-Iyamu, Others’ – EFCC

Published

4 years agoon

By

Editor

The Economic and Financial Crimes Commission (EFCC) has said that Chief Tony Anenih was not charged along side Pastor Osagie Ize-Iyamu and four others for alleged laundering of N700m

The commission said it only charged five persons and that the name of Chief Anenih only appeared to enable it present the facts the way it is.

Counsel to the EFCC, Aso Larry, said this why adopting his written address on motion filed by the defendants that the charges against them were no longer competent since Chief Anenih is dead.

READ ALSO: Involve Women In Governance, NILOWV Charges Bauchi PDP

Pastor Ize-Iyamu, Mr. Lucky Imasuen, Tony Azigbemi, Efe Erimuoghae Anthony and Chief Dan Orbih were arraigned on an eight-count charge of conspiracy to commit money laundering to the tune of N700 million.

The Commission said the offence contravened section 18(a) of the Money Laundering (Prohibition) Act 2011 as amended which is punishable under section 15(3) of the same Act.

The EFCC alleged that the defendants were arraigned for receiving N700 Million prior to the 2015 general elections, from former Minister of Petroleum, Mrs Diezani Alison-Madueke.

READ ALSO: The Crowning Of Shekau

Ize-Iyamu and four others are, however, challenging the competence of the charges preferred against them by the EFCC.

At the resumed hearing, Larry said the defendants were alive to face trial, noting that the argument was a ploy to delay taking of plea by the defendants.

According to him, it was not the defendants that should state the way and manner they should be charged, noting that it was not possible to amend the charges because Chief Anenih is no more.

“We have a right to fair hearing. The proof of evidence is before your Lordship. Chief Anenih is not charged. His name appearing does not affect them taking plea. Our duty is to present the fact the way it is”.

Earlier, Counsel to the defendants while adopting written addresses urged the court to dismiss the EFCC’s reply based on incompetence.

READ ALSO: Naira Marley Tackles EFCC Over Phone Content

Kingsley Obamogie, Counsel to the first defendant, urged the court to strike out the charge because the EFCC filed its reply out of time and that there was no reply from the EFCC as it was not signed.

He said it was the height of incongruity for a Counsel to affix his stamp and another Counsel will sign it.

On his part, Counsel to the 4th defendant, Ferdinand Orbih, urged the court to strike out the charge for gross incompetence.

He said the prosecution ought to have amended the charge to remove all irrelevant content as the court was not set up to deal with frivolities.

According to him, there was no dispute to the fact that Chief Anenih was dead.

READ ALSO: Breaking: Veteran Yorubas Actor Is Dead

The Presiding Judge, Justice Mohammed Umar, however, adjourned to March 26, for ruling on whether the trial will continue.

You may like

Why Police Detained Yahaya Bello’s ADC, Security Details Revelead

JUST IN: Court Clears Ex-AGF Adoke Of Money Laundering Charges

EFCC Declares Ex-Kogi gov, Yahaya Bello Wanted

Ex-Gov Bello Absent In Court, EFCC Mulls Military Option For Arrest

Yahaya Bello: AGF Talks Tough, Warns Against Obstruction Of EFCC Operation

Court Restrains EFCC From Arresting, Detaining Yahaya Bello

A 50-years old man, Edo Omusi, has been declared wanted by the police in Benin City, the capital of Edo State, for disappearing after being ‘caught’ in a same s*x act in Ogiso community.

A source close to the police in the state, told our correspondent that the suspect, and one of his male friends, whose name was not given, were sighted at an undisclosed location by some youths as they were comitting the act.

Under Nigerian Laws, any person caught in the gay act is liable to 14 years in prison and if found by the community could be killed.

The duo were said to have been deeply engrossed in the act when they were found but before the person who saw them in the , “sinful and abominable act”, went for back up, they had escaped the location.

The incident which occurred on 25/4/23 at Ogiso area of the town almost threw the community into a turmoil as irate youths welding sticks and cudgels rampaged the community in search of the duo to lynch them.

It was also learnt that worried by the trend the youths in the community had to set up a surveillance team to monitor his movements. It was on one of the surveillance trips that he was reportedly caught on the fateful day, with the unidentified male partner.

It was gathered since the community reported the incident to the police, the whereabouts of the suspect, Edo Omusi has since remained unknown by all and sundry.

Speaking on the development, a top Police official confirmed the matter and explained that the Crime Investigation Department of the command is working round the clock to arrest the suspect, having declared him a wanted person.

Crime

Man, 41, Sent To Prison For Groping Woman’s Breast

Published

1 year agoon

April 14, 2023By

Editor

A Badagry Magistrates’ Court, Lagos, on Friday, ordered the remand of a 41-year-old man, Ibrahim Lemo, for groping the breast of a woman.

The court heard that Lemo beat up his victim, Zainab Babalola, when she demanded he stopped the unlawful act

Chief Magistrate Fadahunsi Adefioye remanded Lemo after he pleaded guilty to a two count bordering on assault.

READ ALSO: Prophet Bags 21 Years Imprisonment For Defiling 10-year-old Step Daughter

Adefioye ordered that the defendant should be remanded in Awhajigoh Correctional Centre, Badagry.

He adjourned the case until April 14 for facts and sentencing.

Earlier, the prosecutor, ASP. Clément Okuoimose, told the court that the defendant committed the offences on April 6 at 2.30 p.m. at Badagry Roundabout shopping complex, Badagry, Lagos.

Okuoimose said Lemo without lawful excuse pressed the breast of the complainant, Zainab Babalola.

READ ALSO: JUST IN: Court Remands Ex-Imo Deputy Gov In Prison

He said the defendant also hit the complainant on her left eye and caused her harm after she asked him not to touch her again.

The prosecutor said the offences contravened Sections 134 and 170 of the Criminal Law of Lagos State, 2015.

(NAN)

Crime

Hushpuppi’s Associate, Woodberry, Pleads Guilty, Forfeits $8m, Assets

Published

1 year agoon

April 13, 2023By

Editor

Olalekan Jacob Ponle, known as Mr Woodberry, has pleaded guilty to wire fraud.

He also agreed to forfeit $8 million in proceeds of wire fraud as well as luxury cars and watches to the foreign government.

Woodberry, a known associate of the now-imprisoned internet fraudster, Ramon Abbas, better known as Hushpuppi, recently in a plea declaration submitted at the United States District Court of the Northern District of Illinois Eastern Division on April 6, pleaded guilty to count one of the indictments, the Peoples Gazette reports.

According to his plea agreement, he is required to pay back the sum of $8 million he fraudulently received from the seven companies that he scammed.

READ ALSO: Calls For Abba Kyari’s Arrest Heighten As Reactions Trail Hushpuppi’s ‘Bribery’ Allegation

“Defendant understands that by pleading guilty, he will subject to forfeiture to the United States all right, title, and interest that he has in any property constituting or derived from proceeds obtained, directly or indirectly, as a result of the offence,” stated the document containing Mr Ponle’s signed plea declaration.

Woodberry was also asked to waive his rights to the luxury cars, and designer watches he had stashed in Dubai.

The high-end automobiles include Rolls Royce Cullinan with vehicle no J9153, Lamborghini Urus (N4973) and Mercedes-Benz G-class (G68816).

Other items seized are four Rolex watches, one Patek Philippe watch, three Audemars Piguet watches, three gold and diamond-studded earrings, and six gold neck chains.

READ ALSO:Hushpuppi Sentenced To 11 Years In Prison

Last year, he forfeited 151.8 Bitcoin to the American government.

On June 10, 2020, Woodberry was arrested in Dubai alongside Ramon Hushpuppi Abbas, who is currently serving an 11-year sentence for a similar fraud charge.

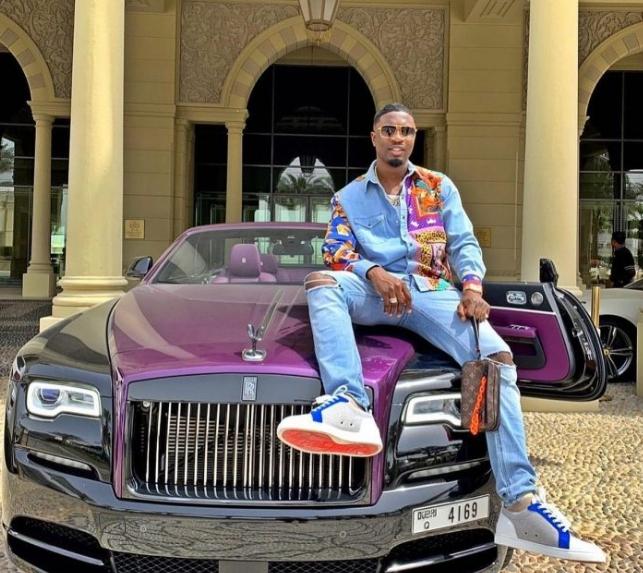

Prior to his arrest, Woodberry was known for rocking and flaunting expensive designer wear and showing off his illicit wealth to his massive Instagram followers, the majority of whom had no idea his luxury lifestyle was funded by cybercrime.

Why Police Detained Yahaya Bello’s ADC, Security Details Revelead

Aiyedatiwa, 15 Others Jostle For Ondo APC Gov Ticket Today

Grammy Winner Found Dead In Her Apartment

Trending

Metro5 days ago

Metro5 days agoJunior Pope: Photos From Funeral Of Makeup Artiste, Abigail Frederick

Metro3 days ago

Metro3 days agoTwo Soldiers Arrested For Allegedly Stealing Armoured Cables At Dangote Refinery In Lagos

News5 days ago

News5 days agoBREAKING: APC Suspends National Chairman Ganduje

Headline5 days ago

Headline5 days agoUS-based Nigerian Bodybuilder Dies 18 Days After Being Shot By Wife

Headline3 days ago

Headline3 days agoB-I-Z-A-R-E: Woman Wheels Dead Uncle’s Corpse Into Bank To “Sign Off” Loan In Her Name [VIDEO]

News4 days ago

News4 days agoBREAKING: FG Begins Disbursement Of N200bn Palliative Loans

Headline4 days ago

Headline4 days agoBill: MP Punched In The Face As Georgian Politicians Fight Dirty In Parliament [VIDEO]

News1 day ago

News1 day agoAPC Debunks Viral Video, Says Presidency Not After Ganduje

Metro4 days ago

Metro4 days agoTransformer Vandal Met Waterloo, Electrocuted In Benin

Metro4 days ago

Metro4 days agoDouble Tragedy As Man Punches Relative To Death During Father’s Burial