Headline

Petrol Price May Crash to N300/Litre If…– Modular Refineries

The pump price of Premium Motor Spirit, popularly called petrol, should drop to about N300/litre upon the commencement of massive production by the Dangote Petroleum Refinery and other indigenous producers, operators of modular refineries stated on Sunday.

However, they pointed out that this would be achieve when the government ensures the provision of adequate crude oil to local refiners, stressing that refineries abroad were ripping off Nigeria.

Speaking under the aegis of the Crude Oil Refinery Owners Association of Nigeria, they explained that what happened to the cost of diesel after Dangote started producing it, would happen to petrol price once it is being produced massively in Nigeria.

CORAN is a registered association of modular and conventional refinery companies in Nigeria.

“A lot of companies today benefit from the importation of petroleum products at the expense of Nigerians,” the Publicity Secretary, CORAN, Eche Idoko, stated.

He told The PUNCH that “if we begin to produce PMS today in large volumes, provided there is adequate crude oil supply, I can assure that we should be able to buy PMS at N300/litre as the pump price.

“Why make Nigerians buy it at almost N700/litre when you know that if you allow refineries work the price will come down? Is it because you want to satisfy the global refiners abroad that are making so much from us?”

When told that there are arguments that it is not possible to have such a drop in price because crude oil, the raw material for PMS, is price in dollars, the CORAN official insisted that petrol price would crash once it is being produced massively by indigenous refiners.

He said, “We were selling diesel for N1,700 to N1,800/litre, but as soon as Dangote refinery started production he brought down the price to N1,200/litre. What other proofs do you need?

“As I speak to you now there is every tendency that before December diesel price will drop further. The only reason reason why diesel is not doing below N1,000/litre is because of our exchange rate.

READ ALSO: Nigeria Secures Additional $925m In oil-backed Loan From Afreximbank

“If the exchange rate drops, diesel will drop below the N1,000/litre price. Now the exchange rate concern is because Dangote imports crude. If he is not importing, the exchange rate may not have so much effect, though he is still buying crude in dollars (in Nigeria) anyway.”

On May 18, 2024, The PUNCH reported that Africa’s richest man, Aliko Dangote, stated that following the laid-down plans of the Dangote refinery, Nigeria would no longer need to import petrol starting June this year.

Dangote had also stated that his refinery could meet West Africa’s petrol and diesel needs, as well as the continent’s aviation fuel demand. He spoke at the Africa CEO Forum Annual Summit in Kigali, expressing optimism about transforming Africa’s energy landscape.

“Right now, Nigeria has no cause to import anything apart from gasoline (petrol) and by sometime in June, within the next four or five weeks, Nigeria shouldn’t import anything like gasoline; not one drop of a litre,” the billionaire had declared.

Also, Dangote had earlier in the year crashed the pump price of diesel to N1,200/litre when the commodity was selling at between N1,700 and N1,800/litre at the time.

He further dropped the price to below N1,000/litre, but could not sustain this price due to the rise in exchange rate. The refinery eventually returned the price to the initial rate of N1,200/litre.

Speaking on Sunday, the CORAN spokesperson stated that this was why the modular refiners had been calling for the sale of crude oil at the naira equivalent of the dollar rate.

“We have told them (government) that even the dollars that you are asking us to use and buy this product, it is detrimental to the country. Strengthen the naira. We will buy at the international market rate, but at a naira equivalent.

READ ALSO: Internet Fraudster Jailed 2 Years For Swindling An American Woman

“These are the issues and they know these things but we can’t explain why they really can’t take decisions to change these concerns.

“Get crude to local refineries, allow crude purchase in naira equivalent, make the environment business-friendly and watch locally produced petroleum product prices crash,” Idoko stated.

Nigeria currently has 25 licensed modular refineries. Five of them are operating and producing diesel, kerosene, black oil and naphtha. About 10 are under various stages of completion, while the others have received licences to establish.

Operators of modular refineries earlier stated that aside from the five that are in operation currently, the remaining plants are embattled due to the major challenge of crude oil unavailability, a development that has stalled funding from financiers.

“Only about five of our members have completed their refineries. The others are having a major challenge.

“This challenge is that the people who are supposed to finance them have not disbursed financing for construction because they want some level of guarantee.

“A guarantee that if they finish the refinery, they are going to get feedstock, which, of course, is crude oil,” Idoko had explained.

Oil marketers also believe that the cost of petrol should be lower than its current price once its production begins in Nigeria.

They welcomed the comment of Dangote that his refinery should start pumping out petrol this month, and expressed hope that the cost would be less than the price which the Nigerian National Petroleum Company Limited currently sells.

“We expect a reduced price for locally produced PMS, as I’ve earlier told you,” the National President, Independent Petroleum Marketers Association of Nigeria, Abubakar Maigandi, stated.

Maigandi, while speaking from Saudi Arabia with The PUNCH, also stated no date has been communicated to marketers on when Dangote would release petrol to the market. Officials of Dangote refinery have remained mute on this.

“It is a welcome development if the refinery can start releasing PMS this month because as marketers we are currently set to start buying the product from the plant,” Maigandi stated.

The IPMAN president earlier stated that marketers were discussing with the managers of the plant, but not specifically on petrol pricing.

READ ALSO: Education: Reps Want National Curriculum Review

“We have been discussing, but not about the price of petrol yet, rather on other matters such as the registration of members for the purchase of petrol and diesel from the refinery.

“It is true that we have started buying diesel from them, but you have to register with the company first. So a general registration is ongoing,” he explained.

Maigandi, however, stated that though marketers had yet to receive the projected price for petrol from the plant, dealers would want to see a PMS price of about N500/litre from the Dangote refinery.

“We are looking at having it (PMS) at any price below the NNPC rate. The price which NNPC sells petrol is N565.50/litre, so we are expecting something below that price, maybe around N500/litre,” Maigandi stated.

The oil dealers also joined in the call for the provision of crude oil to local refiners, stressing that this would impact positively on the prices of refined petroleum products.

“Of course, it is important for crude to be made available to local refineries because this will surely affect petroleum products’ prices positively,” the IPMAN president stated.

Regulators speak

The spokesperson of the Nigerian Midstream and Downstream Petroleum Regulatory Authority, George Ene-Ita, said he was sure that the government has guidelines for the provision of feedstock (crude) to indigenous refiners.

Ene-Ita promised to provide additional information on the matter, as he stated that he could not give further details at the time he was contacted by our correspondent.

Recall that the Chief Executive of the Nigerian Upstream Petroleum Regulatory Commission, Gbenga Komolafe, had earlier promised that the government would ensure that crude oil was supplied to domestic refiners.

He stated that in compliance with the provisions of Section 109(2) of the Petroleum Industry Act 2021, the NUPRC in a landmark move, had developed a template guiding the activities for Domestic Crude Oil Supply Obligation.

“The commission in conjunction with relevant stakeholders from NNPC Upstream Investment Management Services, representatives of Crude Oil/Condensate Producers, Crude Oil Refinery-Owners Association of Nigeria, and Dangote Petroleum Refinery came up with the template for the buy-in of all.

“This is in a bid to foster a seamless implementation of the DCSO and ensure consistent supply of crude oil to domestic refineries,” Komolafe had stated.

Headline

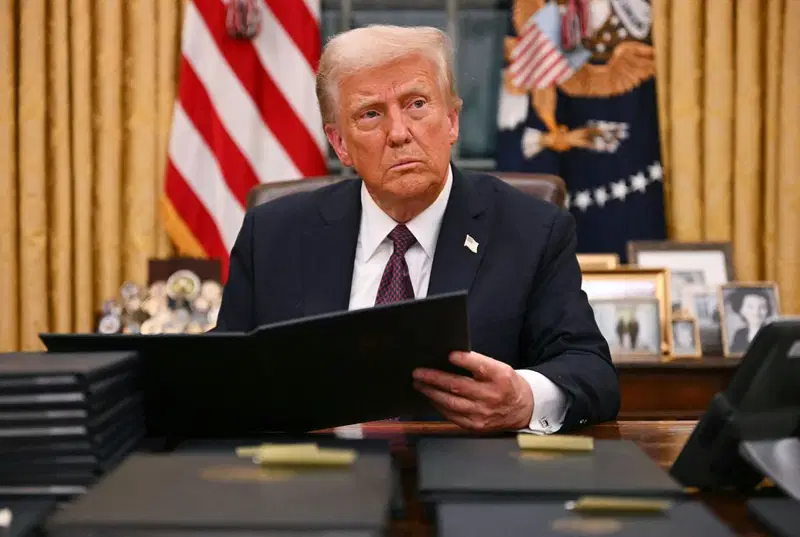

Russia, China Afraid Of US Under My Administration — Trump

United States President, Donald Trump, has said Russia and China fear the United States because of the strength of his administration, arguing that American global influence is driven primarily by its military power and leadership.

Trump, in a post on Truth Social on Wednesday stated that rival powers would not take NATO seriously without the United States, claiming the alliance lacks deterrent force in the absence of American involvement.

He expressed doubts about whether NATO members would come to the aid of the US in a real crisis, despite Washington’s continued commitment to the alliance.

READ ALSO:Trump To Withdraw US From 66 UN, International Organisations

The president credited his leadership with rebuilding the US military during his first term and sustaining its strength, describing this as the key reason adversaries show respect and caution toward the country.

He maintained that America’s military dominance has played a central role in preserving global stability and saving lives.

Trump also argued that his administration forced NATO members to increase defence spending, saying many allies had previously failed to meet financial commitments while relying heavily on the US.

READ ALSO:Insecurity: US Congressman Riley Moore Reveals Trump’s Mission In Nigeria

He added that his actions helped prevent further escalation in Eastern Europe and contributed to the resolution of multiple conflicts.

According to Trump, the United States remains the only nation that commands genuine fear and respect from both Russia and China, a position he attributed to his administration’s approach to defence, diplomacy, and global leadership.

“He wrote partly, “The only Nation that China and Russia fear and respect is the DJT REBUILT U.S.A. MAKE AMERICA GREAT AGAIN!!! President DJT.”

Headline

Trump To Withdraw US From 66 UN, International Organisations

United States President, Donald Trump, has announced plans to withdraw the US from 66 United Nations and international organisations, including key global bodies focused on climate change, peace and democracy.

The decision was disclosed in a presidential memorandum released by the White House on Wednesday evening, following a review of which “organizations, conventions, and treaties are contrary to the interests of the United States.”

According to Trump, the move will see the US end its participation in the affected organisations and cut all related funding.

A list shared by the White House showed that 35 of the organisations are non-UN bodies, including the Intergovernmental Panel on Climate Change (IPCC), the International Institute for Democracy and Electoral Assistance, and the International Union for Conservation of Nature.

READ ALSO:Trump’s Airstrikes: Halt Military Cooperation With US Immediately – Sheikh Gumi Tells Tinubu Govt

Although listed as a non-UN body by the White House, the IPCC is a United Nations organisation that brings together leading scientists to assess climate change evidence and provide periodic reports to guide political leaders.

The memorandum also announced the US withdrawal from 31 UN entities, including the UN Framework Convention on Climate Change (UNFCCC), the UN Democracy Fund, and the UN Population Fund (UNFPA), which focuses on maternal and child health.

Several of the targeted UN bodies are involved in protecting vulnerable groups during armed conflicts, including the UN Office of the Special Representative of the Secretary-General for Children and Armed Conflict.

Reacting to the announcement, UN spokesperson Stephane Dujarric said in a note to correspondents on Wednesday evening that the organisation expected to issue a response by Thursday morning.

Despite repeatedly stating his desire to limit US involvement in UN forums, Trump has continued to exert influence on international decision-making.

READ ALSO:Trump Using FBI To ‘Intimidate’ Congress, US Lawmakers Cry Out

In October last year, he threatened to impose sanctions on diplomats who formally adopted a levy on polluting shipping fuels that had already been agreed to at an earlier meeting, a move that stalled the deal for 12 months.

The Trump administration also sanctioned UN special rapporteur Francesca Albanese after she released a report detailing the role of international and US companies in Israel’s genocidal war on Gaza.

During his first term in 2017, Trump similarly threatened to cut aid to countries that supported a draft UN resolution condemning the US decision to recognise Jerusalem as Israel’s capital.

As a permanent member of the UN Security Council, the US wields significant influence at the United Nations, including veto power, which it has repeatedly used to block efforts to end Israel’s war on Gaza before later mediating a ceasefire.

(Aljazeera)

Headline

UK Supported US Mission To Seize Russian-flagged Oil Tanker – Defense Ministry

The British Ministry of Defence said on Wednesday that it provided support to the United States in its operation to seize a Russian-flagged oil tanker in the North Atlantic.

US seized the tanker, which was being shadowed by a Russian submarine on Wednesday, after pursuing it for more than two weeks across the Atlantic as part of Washington’s efforts to block Venezuelan oil exports.

According to Britain, its armed forces gave pre-planned operational support, including basing following a US request for assistance.

READ ALSO:UK Introduces Powers To Seize Phones, SIM Cards From Illegal Migrants

The UK also said a military vessel provided support for the US forces pursuing the tanker, and the Royal Air Force provided surveillance support from the air.

Defence Secretary John Healey stated that the operation targeted a vessel with a nefarious history linked to Russian and Iranian sanctions evasion networks.

“This action formed part of global efforts to crack down on sanctions busting,” he said in a statement.

READ ALSO:Venezuelan Deportees: US Embassy Gives Reason For Reducing Visa Validity For Nigerians

According to him, the US was Britain’s closest defence and security partner.

“The depth of our defence relationship with the US is an essential part of our security, and today’s seamlessly executed operation shows just how well this works in practice,” he added.

The British government said that the Bella-1 tanker, now renamed Marinera, is sanctioned by the US under its counter-Iran sanctions,

The MoD statement said the support was provided in full compliance with international law.

News4 days ago

News4 days agoWhat I Saw After A Lady Undressed Herself — Pastor Adeboye

Headline4 days ago

Headline4 days agoPROPHECY: Primate Ayodele Reveals Trump’s Plot Against Tinubu

Metro4 days ago

Metro4 days agoArmed Robbers Shot PoS Operator To Death In Edo

Metro3 days ago

Metro3 days agoAAU Disowns Students Over Protest

Business3 days ago

Business3 days agoNNPCL Reduces Fuel Price Again

Metro4 days ago

Metro4 days agoJoint Task Force Kills 23 Bandits Fleeing Kano After Attacks

Politics4 days ago

Politics4 days ago2027: Rivers APC Pledges To Follow Wike’s Instructions

Metro3 days ago

Metro3 days agoEdo: Suspected Kidnappers Kill Victim, Hold On To Elder Brother

Metro3 days ago

Metro3 days agoNine Soldiers Feared Dead In Borno IED Explosion

Metro4 days ago

Metro4 days agoGunmen Demand N200m Ransom For Kidnapped Brothers In Edo