Business

Naira Redesign: Traders Decry Sudden Disappearance Of New N200, N500, N1,000 Notes

Published

1 year agoon

By

Editor

Barely one month after the reintroduction of old N200, N500 and N1,000 notes, some residents of Anambra have decried the unavailability of the new notes in many banks in the state.

Some of them told the News Agency of Nigeria (NAN) in Awka on Monday that they hardly complete transactions with new naira notes because they were not available.

This is even after the old currencies had been mopped up from circulation by the Central Bank of Nigeria (CBN) and unavailable for use by citizens for about two months before they were officially pumped into the system on Dec. 15, 2022.

The residents said it was surprising that they had to return to and rely on the reintroduced old notes because the new notes which were to replace them were not in circulation.

READ ALSO: Naira Redesign: Farmers Ask FG For Compensation Over Losses

NAN Correspondent who monitored the situation reports that cash transactions were largely done with old notes.

Mr James Nnaeto said that he had not been able to withdraw as low as N5,000 new notes from any bank but had regularly been paid in old notes since banks resumed disbursing them.

Nnaeto said he had noticed sudden disappearance of the new notes following the reintroduction of the new notes in March.

According to him, we are back to our normal lives, thank God for the return of the old notes.

“Apart from when I used old notes to buy new ones and when I paid high charges to get them, I have not seen them again, even the banks are not issuing them.

READ ALSO: Naira Scarcity May Affect Private Business In Q1 – Report

“The CBN is not prepared for that Policy because there is nothing that suggests that they were ready to replace the old currency notes with new ones,” he said.

Mrs Angela Molokwu, a trader, said she was almost going out of business because of lack of cash.

Molokwu said business was gradually regaining stability since the reintroduction of the old notes which had made transactions easy.

She said she had to resort to Point of Sale (PoS) operator services which had its challenges including delayed and failed transactions but pointed out that such services did not make for easy retail sale transactions.

“Thank God cash is back, people now use cash to buy what they want but it is with the old notes, I am not seeing the new notes as it should be.

READ ALSO: Cash-induced Recession Imminent, Experts Warn As Naira Scarcity Persists

“If I go to bank for withdrawal, it is the old naira notes they pay me with,” she said

On his part, Mr Osita Obi, Convener of Recovery Nigeria Project (RNP), a Civil Society group, said the country’s economy would have grinded to a halt if the old currency notes were not returned to circulation.

Obi, who said the ratio of new notes to old ones in circulation was around 25 :75, regretted that in spite of the assurances of the CBN that it had printed sufficient quantity of the redesigned notes, Nigerians could not use them freely five months after.

According to him, CBN is not ready; they have a lot of explanations to make to Nigerians.

“Where are the new notes they said they printed, how come we have the old notes which were withdrawn and reintroduced more in circulation now?

READ ALSO: Naira Scarcity: Disobedience To Supreme Court Ruling May Cause Breakdown Of Law, Order – ACF

“The policy somersault was to much for Nigerians, it was unnecessary; what it means is that Nigerians would have been stranded by now if the old notes were not returned, so why were they returned in the first place?

“Government should not be taking citizens for a ride,” he said.

Prof. Uche Nwogwugwu of the Department of Economics, Nnamdi Azikiwe University, Awka said the CBN naira redesign policy could not be described as economic because it was not planned nor did the outcome result in improved welfare of citizens.

Nwogwugwu opined that it was more of political considerations which the Apex Bank and the Federal Government should also consider the outcome and weigh if it justified the hardship citizens passed through.

He said rather than shrinking the economy, the CBN should expand liquidity or cash in circulation to accommodate increased demands due to increase in number and volume of businesses and population.

READ ALSO: Nigeria Becomes 2nd Country In The World To Approve Malaria Vaccine

The economist said the Dec. 31 deadline for complete phasing out of the old naira notes may not be achievable if the attitude adopted for implementation of the policy five months after the introduction was sustained.

“I still cannot tell the reason for that policy, only the CBN can do that, but all I can say is that it is not economic, if it was, it should have been well planned and the outcome cannot be hardship, so it must have been political.

“Money in circulation can never be enough, our economy is growing, so people need more money to transact.

” The currency redesign Policy almost killed the economy, the informal economy almost went into extinction and after all that, we are back to where we were.

“The new notes are no where to be found, we have more of old currency today, people are worse off and the way things are going, it is unlikely that the Dec. 31 deadline will be met,” he said.

You may like

Naira Redesign: Farmers Ask FG For Compensation Over Losses

Banks Confirm Receiving More Cash, Load ATMs

NLC Protests: CBN To Flood Banks With Old Naira Notes

NLC Gives FG 7-day-ultimatum Over Naira Scarcity

Naira Scarcity: Disobedience To Supreme Court Ruling May Cause Breakdown Of Law, Order – ACF

Naira Scarcity: Radio Presenter Slumps, Dies

Business

Customers Panic As CBN Bans Opay, Palmpay, Others’ New Accounts

Published

12 hours agoon

April 30, 2024By

Editor

Some bank customers have expressed panic as the Central Bank of Nigeria bans mobile money operators including fintech firms from onboarding new customers.

However, the Bank Customers Association of Nigeria backed the CBN directive.

The new directive will affect fintech companies such as OPay, Palmpay, Kuda Bank, and Moniepoint, from opening new accounts until further notice.

Reliable sources from three major fintechs who requested not to be mentioned as they were not permitted to speak, confirmed the development to The PUNCH on Monday.

The CBN’s move was linked to an ongoing audit of the Know-Your-Customer process of the fintechs, which have been under scrutiny in recent months over concerns around money laundering and terrorism financing.

It was gathered that the CBN had summoned some of the heads of fintechs to Abuja to discuss issues around KYC last week.

The CBN has not yet publicly commented on the directive to the fintech firms. The PUNCH’s attempts to reach the apex bank for comment were unsuccessful.

Several calls made to the telephone line of the CBN spokesperson, Hakama Ali Sidi, were not responded to as of the time of filing this report.

READ ALSO: CBN Sells Fresh Dollars To BDCs At N1,021/$

Also, the directive coincided with the court order that the Economic and Financial Crimes Commission (EFCC) obtained to freeze at least 1,146 bank accounts owned by various individuals and companies allegedly involved in illegal foreign exchange transactions.

The 85-page court order (document), which listed the bank account details suspected to be involved in illicit activities, was obtained by The PUNCH on Monday.

Justice Emeka Nwite, in a ruling on the ex-parte motion, moved by counsel for the anti-graft agency, Ekele Iheanacho, also granted the commission’s application to conclude the investigation within 90 days.

Part of the court document read, “That the applicant’s (EFCC) application is hereby granted as prayed.

“That an order of this honorable court is hereby made freezing the bank accounts stated in the schedule below, which accounts are owned by various individuals who are currently being investigated in a case involving the offenses of unauthorised dealing in foreign exchange, money laundering, and terrorism financing, to the extent that the investigation will be for a period of 90 (ninety) days.”

The EFCC, in the motion marked FHC/ABJ/CS/543/2024 dated and filed April 24 by Iheanacho, was heard by the judge the same day in the interest of national interest.

“The motion was brought pursuant to Section 44(2) and (K) of the 1999 Constitution; Section 34 of the EFCC Establishment Act 2004; Section 7(8) of the Money Laundering Prevention and Prohibition Act, 2022; and under the inherent jurisdiction of the court.”

The President of the Bank Customers Association of Nigeria, Uju Ogubunka, backed the CBN’s move to suspend new account opening on the affected platforms.

He told The PUNCH that the strict regulations that govern deposit money banks must apply to fintechs, and microfinance banks in order to ensure the integrity of the financial institutions.

READ ALSO: CBN Gives New Directive On Lending In Real Estate

He said, “Anything that can disrupt the system should not be permitted. If the platforms are being used for things that are against the regulations, I think the CBN decision is OK. I don’t see anything wrong with that. It behoves on the companies now to get their KYC right.

“Let them do what they are supposed to do. KYC applies to banks and other financial institutions that deposit money. It should also apply to them so that the regulators can understand what is going on and hold them accountable.”

On the other hand, Emmanuel Odunsi on X (formerly Twitter) welcomed the move, citing the need for better KYC processes to prevent scams and fraudulent activities.

“Their KYC isn’t that great. Lots of scammers are using their apps to defraud people.

“Most of the accounts were created by mining phone numbers, with subscribers’ permission. Almost every phone number has been linked to an account,” Odunsi said.

In October 2023, Fidelity Bank blocked transfers to OPay, Palmpay, Kuda, and Moniepoint due to concerns around KYC processes.

In response, the CBN introduced new KYC rules for all financial institutions in November 2023, which appeared to target fintech startups.

READ ALSO:JUST IN: CBN Gov Sacks Eight Directors, 32 Others

A source from Moniepoint said the company had complied with the directive, effectively halting new account creation on their platform. However, the source denied having anything to do with KYC.

“It’s just a regulation from the CBN, and we’ve complied. The real question is, why are fintechs always targeted,” he source argued.

“It has nothing to do with KYC; I am aware that the CBN communicated, but this particular issue dwells on accounts related to cryptocurrency transactions,” the source revealed.

The CBN has an ambitious target to increase overall financial inclusion to 95 per cent of the adult population by 2024.

With the new order, the target may be affected, as the company processes about 100 new accounts every day.

The source argued that fintechs had played significant roles in deepening financial inclusion in the country.

The company had deployed robust and reliable digital payment infrastructure that has facilitated an average monthly transaction value of $12bn for about 1.6 million businesses, it said last year.

READ ALSO: FULL LIST: 31 States Owe CBN N340bn Bailout Funds

A senior employee of PalmPay confirmed to The PUNCH that there was a CBN directive for fintechs to reassess their KYC processes.

This is causing a temporary pause in onboarding new customers, the source stated.

She clarified that the KYC review was a collaborative effort with the CBN, and fintechs were awaiting further instructions without a specified timeline for resolution.

Another source at OPay, who also declined to be named, said they were following the CBN’s directive and could not comment further.

“We don’t really have anything to say. It’s just a directive that we are following. The CBN has issued their directive.“

Fintech companies have faced increased regulatory scrutiny over their account opening processes.

Customers worry

However, some customers have also used social media, both on X (formerly Twitter) and Facebook, to express their worries and opinions on the matter.

Some customers are anxious about the safety of their funds, with Warisenibo Jumbo suggesting it’s best to transfer their money out of Opay.

Oye Niran wondered if their Moniepoint account was safe, stating, “Hope my Moniepoint account is safe.”

Larry Leanz questioned the rationale for keeping money on these platforms.

“But is it still safe to keep money there?, Leanz questioned.

The Central Bank of Nigeria (CBN) started fresh and direct sales of US dollars at N1,021 per dollar to Bureau De Change operators.

Nigeria’s apex bank disclosed this in a circular signed by its Director of Trade and Exchange Department Hassan Mahmud.

“We write to inform you of the sale of $10,000 by the Central Bank of Nigeria (CBN) to BDCs at the rate of N1,021/$1. The BDCs are in turn to sell to eligible end users at a spread of NOT MORE THAN 1.5 percent above the purchase price,” the circular posted on its website read.

READ ALSO: Tinubu Unveils African Counter-Terrorism Summit

“ALL eligible BDCs are therefore directed to commence payment of the Naira deposit to the underlisted CBN Naira Deposit Account Numbers from today, Monday, April 22, 2024, and submit confirmation of payment, with other necessary documentations, for disbursement of FX at the respective CBN Branches.”

CBN’s move is coming as the naira is recording a slight depreciation against the dollar after weeks of gains.

In late March, the bank also sold $10,000 to each of the eligible Bureau De Change (BDC) operators in the country at the rate of N1,251/$1.

READ ALSO: Mixed Reactions Trail Video Of Couple’s Customised N200 Notes

Like in the most recent sales, it warned BDCs against breaching terms of the dollar sales, vowing to sanction defaulters “including outright suspension from further participation in the sale”.

The fortunes of the naira have fallen sharply since President Bola Tinubu took over in May. Inflation figures have reached new highs and the cost of living hitting the rooftops.

Nigeria’s currency slid to about N1,900/$ some months ago at the parallel market. But in recent weeks, it has gained against the dollar.

The Nigerian authorities have also doubled down on their crackdown against cryptocurrency platform Binance and illegal BDCs.

On March 1, the CBN revoked the licences of 4,173 BDCs over compliance failures.

Olusegun Alebiosu has been appointed as the Acting Managing Director/Chief Executive Officer of First Bank of Nigeria Limited (FirstBank Group), effective April 2024.

Alebiosu steps into this pivotal role from his previous position as the Executive Director, Chief Risk Officer, and Executive Compliance Officer, a position he held since January 2022.

Alebiosu brings to the helm of FirstBank over 28 years of extensive experience in the banking and financial services industry. His expertise spans various domains including credit risk management, financial planning and control, corporate and commercial banking, agriculture financing, oil and gas, transportation, and project financing.

READ ALSO: JUST IN: Access Holdings Names New Acting CEO

Having embarked on his professional journey in 1991 with Oceanic Bank Plc. (now EcoBank Plc.), Alebiosu has held several notable positions in esteemed financial institutions.

Prior to joining FirstBank in 2016, he served as Chief Risk Officer at Coronation Merchant Bank Limited, Chief Credit Risk Officer at the African Development Bank Group, and Group Head of Credit Policy & Deputy Chief Credit Risk Officer at United Bank for Africa Plc.

Alebiosu’s academic credentials further enrich his professional profile. He is an alumnus of the Harvard School of Government and holds a Bachelor’s degree in Industrial Relations and Personnel Management. Additionally, he obtained a Master’s degree in International Law and Diplomacy from the University of Lagos, as well as a Master’s degree in Development Studies from the London School of Economics and Political Science.

READ ALSO: Meet Newly Appointed Union Bank CEO

A distinguished member of various professional bodies, including the Institute of Chartered Accountants (FCA), Nigeria Institute of Management (ANIM), and Chartered Institute of Bankers of Nigeria (CIBN), Alebiosu is renowned for his commitment to excellence and ethical practices in the banking sector.

Beyond his professional endeavors, Alebiosu is known for his passion for golf and adventure. He is happily married and a proud parent.

With Alebiosu’s appointment, FirstBank of Nigeria Limited anticipates continued growth and innovation under his leadership, reinforcing its position as a leading financial institution in Nigeria and beyond.

Tinubu, GEJ, Abdulsalami Abubakar, Others To Grace Igbinedion University 25th Anniversary

Edo Poll: Court Dismisses Suits Seeking Ighodalo’s Disqualification

JUST IN: FG Declares May 1, Public Holiday

Trending

Headline5 days ago

Headline5 days agoSaudi Arabia Opens First Alcohol Store, Nigerian Muslims React

Headline5 days ago

Headline5 days agoVIDEO: Meet Nigerian Pastor Who Predicted World Will End April 25

News5 days ago

News5 days ago243 Passengers Cheat Death As Air Peace Plane Makes Emergency Landing At Lagos Airport

News4 days ago

News4 days agoDSTV Price Hike: Five Alternatives Nigerians Are Opting For

Politics5 days ago

Politics5 days agoEdo Guber: PDP Unveils 200-member Campaign Council

News3 days ago

News3 days ago‘I Can’t Breathe’ – Black Man Cries As US Police Handcuffed, Pinned Him Down Till He Dies [VIDEO]

Politics5 days ago

Politics5 days ago‘You Either Sit Up Or Resign’ – Clark Writes Strong Worded Letter To PDP Ag National Chair

Metro5 days ago

Metro5 days agoOutrage As Kingsmen Flogged Anambra Man To Death [VIDEO]

News3 days ago

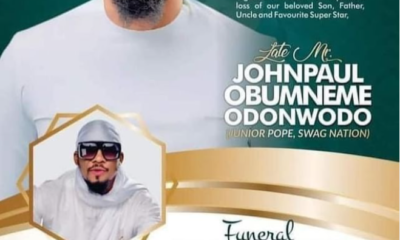

News3 days agoLate Actor, Junior Pope’s Funeral Arrangement Released

Metro4 days ago

Metro4 days agoTwo Fake Police Inspectors Arrested In Edo