News

Lateef Agboola: The Man Osun NUJ Secretary’s Cap Fit

“Whether the union will run a peaceful and smooth tenure, all depends on him. The union to face one crisis or the other will be to an extent determined by him. He is the middle man; he is the interface between the union and the members. He is likewise the interface between the union and the general public.”

The above quote from a colleague of mine recently gives credence to the role the secretary office plays in an organisation or union partucularly the Nigeria Union of Journalists (NUJ). NUJ is a body without a Public Relations Officer hence the secretary bears the burden of that office and that of his primary office (secretary). He is the brainbox of the Union. This is why this office must be entrusted on someone with the ability and experience. Someone who has the charisma, professional skills, and the human relations and not on ‘who know man or long leg.’

As members of the Nigeria Union of Journalists (NUJ), Osun State council warm up to elect members of executives that will pilot affairs of the Union for the next three years, Lateef Agboola is the man best fit for the secretary office. He is capable and reliable and likewise accountable.

READ ALSO: Poem: Lord, Please Bless Ebi, Preserve Him

Lateef is no accidental journalist. He is a well trained and professional journalist. He is a graduate of mass communication and Masters degree holder of Communication Art. So, Lateef is no push aside or push over person in the field of journalism.

Lateef, popularly called CLAM, has all the experience needed to take Osun NUJ to a greater heights. He is not a new comer or toddler in running the affairs of any union. This journalist cum musician (Fuji music) is a well experienced person in the position he is currently vying for at the state level. He had served as secretary of his chapel two times and presently serving as vice chairman of the same chapel. If Leteef is not good and capable, members of his chapel wouldn’t have entrusted him that sensitive position for two times and now the vice chairman. Least I forget, Lateef is a staff of the state-owned broadcast outfit (Osun State Broadcasting Corporation (OSBC), Osogbo, a leading broadcasting firm in the state and Southwest at large.

Lateef Agboola for secretary, Osun NUJ

Giving Lateef Agboola the secretary office is putting a round peg in a round hole. Lateef Agboola is the right man; no one amongst his co-contestants can do it better than he does. Lateef can deliver. He has the human relations; he has the skills. 2010 was the year I had opportunity to work with this man as intern in the state-owned broadcast station, but after leaving the station for several years, Lateef and I relationship is still very cordial and intact. This tells how friendly this man is! This is the type of person Osun NUJ needs as secretary.

READ ALSO: You Came, You Saw, You Conquered; Congratulations ASP David Ajousi

NUJ secretary office is a sensitive one that must be occupied by someone like Leteef. Someone who is friendly and has a listening hear like Lateef Agboola. Someone who will be ready to welcome and listen to the least member when he or she has something to say. Someone who can speak for the least member when the need arises.

Interestingly, Lateef is not just a journalist or Fuji artiste, the Lateef I know is an activist. For the short period I worked alongside with him, I saw this in him. He will never allow you to be denied of what is due for you. As an intern back then, I can recall many instances where he exhibited this even in assignment but time will not permit me to list such instances. He makes sure what was given to full staff was given to us as intern. Lateef is a team player that everyone loves to work with back then. He will definitely speak for Osun NUJ members if given the opportunity.

Yoruba bo woni, bi awo’o ka’ju ilu, yiya ni o ya. Awo Lateef kaju ilu. Eje ki Lati se; Lati lo le se.

Agboola Lateef is the right man for the secretary position. He had handle this office at the chapel level, he performed excellently. Please entrust him the state council’s office. Lateef will not disappoint you. He is up to the task.

READ ALSO: Edo Varsity Acquires First Of Its Kind CANVAS LMS/AIS, Trains Staff On Its Usage

Osun NUJ members, as you walk towards the polling boot, please put Lateef Agboola of OSBC at the back of your mind and cast your votes for him.

A vote for Lateef Agboola is a vote for accountability, transparency and equity.

Joseph Kanjo, a journalist, online publisher, wishing Osun NUJ members a peaceful election.

editor@infodailyng.com

News

Senate Confirms Ex-CDS Musa As Defence Minister After Five-hour Screening

The Senate on Wednesday confirmed the appointment of a former Chief of Defence Staff, Gen. Christopher Musa (retd.), as Nigeria’s new Minister of Defence following a rigorous five-hour screening by lawmakers.

During the confirmation hearing, Musa faced tough questions on recent security lapses, including the withdrawal of troops from Government Comprehensive Girls Secondary School, Maga, in Kebbi State, shortly before the abduction of schoolgirls on November 17.

The incident sparked national outrage.

Musa assured the Senate that he would immediately set up a full-scale investigation into the troop withdrawal once he assumes office.

He also vowed to probe the recent killing of a brigade commander in Borno State, Brigadier General Musa Uba, and other attacks targeting military officers.

READ ALSO:Senate Confirms New FCC Chairman, Approves 37 Commissioners

He said, “It is very unfortunate and really painful. I want to assure Nigerians that we will not stand by and have terrorists have the capacity to do such.

“We are going to go after them fully, working together with all the security agencies and Ministries, Departments and Agencies (of government). We are going to investigate fully.

“The Armed Forces have a way, and then from the defence, we are going to make sure that we continue with the oversight over their activities.”

The nominee highlighted gaps within the armed forces and called for enhanced funding, strengthened community engagement, and coordinated inter-agency operations.

READ ALSO:Senate Backs Death Penalty For Kidnappers, Informants, Others

He also emphasised the need to protect schools through the Safe Schools Initiative and a zero-tolerance approach to terrorism and banditry.

The screening session saw moments of tension in the chamber.

Senator Sani Musa (APC, Niger East) suggested Musa be allowed to “take a bow and go,” prompting protests from lawmakers, including Senator Garba Maidoki (PDP, Kebbi South).

Senate President, Godswill Akpabio, intervened, urging a thorough screening and noting that Nigerians and the international community were closely watching the process.

READ ALSO:Senate Recommends Death Penalty For Kidnappers

Musa, nominated on Tuesday by President Bola Tinubu following the resignation of Defence Minister, Badaru Mohammed, on health grounds, pledged to prioritise the protection of lives and national territory.

“I pledge to do my best to ensure that Nigeria is secure and safe.

“We need the support of everyone, every Nigerian, working together as a team, because it’s going to be a team effort.

“The enemies we are dealing with are evil forces that don’t mean well for this country and have no respect for human lives… If we don’t work together, we will allow them to perpetrate the evil acts they have been doing,” he said.

His confirmation comes amid heightened concerns over nationwide kidnappings, insurgency and mass abductions.

News

NUC Gets €3m Loan To Start ICT Projects In Varsities

This initiative, known as the Blueprint-ICT-Dev Project, aims to upgrade digital infrastructure, strengthen ICT capabilities, and promote digital literacy in these institutions.

The National Universities Commission says it has received €3m as the first tranche of the $40 million loan secured from the French Development Agency to support Information, Communication and Technology projects in 10 selected universities across the country.

Executive Secretary of the commission, Abdullahi Ribadu, announced this during the inaugural meeting of the 13th NUC Board on Wednesday at the commission’s headquarters in Abuja.

Ribadu noted that since he assumed office about a year ago, the commission has pushed forward initiatives centred on research, entrepreneurship, digital transformation and skills development across Nigerian universities.

“We have secured $40 million loan from the French Development Agency for the ICT Blueprint Project in 10 selected universities. We have strengthened – only yesterday, the director confirmed to me that the first tranche of €3m has been deposited in our CBN account to kick-start the process.

“We have strengthened internal financial management, expanded access to university education through the licensing of new private universities, and approved new programmes and units.

READ ALSO:Panic In Delta Female School Over False Herdsmen Attack

“We have also supported the take-off of publicly funded universities, expanded open and distance learning centres, and continued system-wide quality assurance exercises. Currently, the 2025 Accreditation Exercise is ongoing.

“These priorities continue to form the foundation of the Commission’s direction, and I am seeking your support in advancing them,” he said.

Ribadu assured the board of the commission’s full cooperation, saying the management stands ready to draw from the members’ expertise.

“We will rely on your wisdom to guide us as we carry out our duties. I am confident that your collective experience will strengthen the commission’s capacity to guide the Nigerian university system at a time when higher education continues to evolve.

“We also look forward to using your networks to help advance projects and partnerships that will benefit the Commission and the entire university system,” he added.

READ ALSO:NUC Begins Nationwide Recruitment, Opens Application Portal

On his part, Chairman of the 13th NUC Board, Emeritus Professor Oluremi Aina, thanked President Bola Tinubu for his sustained support for the university sector.

He said the board is assuming its mandate at a time of transition for higher education, with global standards rising and expectations increasing.

Aina outlined five central pillars that will guide the Board’s work, covering performance evaluation, improved university rankings, digital literacy, research and institutional reforms.

He said, “As we settle into this assignment, but permit me to present what I call five pillars that I believe will help guide our stewardship. One, evaluation of NUC performance.

“We must examine in detail the Act that buffered and laid the foundation for the NUC. We also need to be conversant with the various amendments to the act, its vision and mission, guiding principles and ethics.

READ ALSO:ABU Makes Clarifications On Alleged Production Of Nuclear Weapons

“Then we must study the commission’s operational challenges and landmark achievements. Going forward, we should compare ourselves against global standards, not sentiments, not history, and where we fall short, how we fall short, and why we must adjust boldly. Two, aligning with the renewed hope agenda of the present administration, the president has made education a pillar of national rebirth with the establishment of the fund and other initiatives.

“The signal sent to the world is that Nigeria is ready to reset and rebuild. Through our assignment, we must lead other key stakeholders in the higher education sector. In pragmatically resolving the naughty and nagging agitation of the academic staff union and other university unions.

“Advancements must also be made to enhance digital literacy and especially the use of artificial intelligence, AI, as tools to strategically reposition the universities nationally and internationally. Overall, it will also be a priority for the 13th board to work with the management for radical improvements in both the global and webometric ranking of our universities.”

He added, “Three, identifying and dismantling obstacles to university quality. Governance deficiencies, fund constraints, research stagnation, et cetera, must no longer be accepted as normal. Our duty is to reform and make progress, not to manage decline.

READ ALSO:Nine Countries With Nuclear Weapons In The World

“Four, reviewing existing funding and exploring new channels for sustainable funding. Nigerian universities cannot thrive on ingenuity alone. The board must intensify the research for alternative funding sources. Strengthen utilisation and explore emerging and local opportunities.

“And five, investing in the welfare and capacity of NUC staff and regulatory infrastructure. The system cannot overperform its operators. Credible accreditation and monitoring require strengthened conditions of service and protected regulatory independence.”

Aina added that the board would fully leverage technology in its operations.

“We will seek to leverage technology to ease our burden through the adoption of digital platforms for the advancement of our collective objectives. And I have a charge for the board.

READ ALSO:US Says Strikes ‘Devastated’ Iran’s Nuclear Program

“This board, in whom I am well-pleased, carries with it the weight of expectations and aspirations of the Nigerian people,” he said.

Earlier this year, the French Development Agency provided a €38 million credit facility to the National Universities Commission to support the digital transformation of 10 federal universities in Nigeria.

This initiative, known as the Blueprint-ICT-Dev Project, aims to upgrade digital infrastructure, strengthen ICT capabilities, and promote digital literacy in these institutions.

News

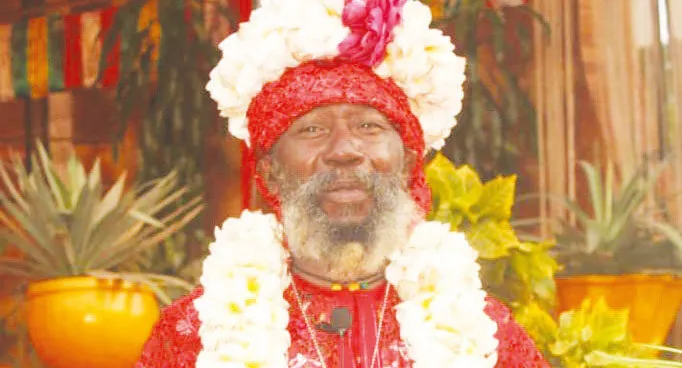

Satguru Maharaj Pledges To Facilitates Kanu Release If…

The founder of One Love Family, Satguru Maharaj Ji, has vowed to get the incarcerated leader of the proscribed Igbo group, Indigenous People of Biafra, Nnamdi Kanu, released if the Biafra radio and sit-at-home order are stopped.

Maharaj Ji stated this while speaking in an interview granted to his temple’s in-house radio on Wednesday.

According to him, the IPOB leader was culpable of the terrorism charges levelled against him, and anyone guilty is liable to a death sentence.

He said, “We are, however, grateful that the matter has been put on hold in the sense that, by the accusations, it is always going to be death, looking at the level of crimes attached to him, with the way and manner the constitution is written. Anybody who is accused of doing such a thing (terrorism) is sentenced to death. It is only out of grace that Kanu was able to escape.

READ ALSO:Court Threatens To Foreclose Kanu If He Fails To Open Defence

“So now it has to be by political settlement before he (Kanu) can be released, and it will be addressed in so many ways. For anyone advocating for his pardon, they have to take positive steps. In other words, they must not do so with empty hands; they should stop the Biafra radio wherever it is. Secondly, the sit-at-home order should be stopped, and the judgment should be accepted while the Igbo elders go behind the scenes to analyse and explain to the President.

“Today, the Igbos have been brought to the central realms of politics by Tinubu. And the Northern caliphate is not happy about it. They are not excited about the commission they were given…They should stop the propaganda that the East is about to be Islamised. When those are done, I know how to watch it out, Kanu will come out. I will help facilitate his release.“

The cleric joined the likes of Abia State governor, Alex Otti, activist Omoyele Sowore, and other South-East leaders to intensify efforts to secure the release of detained Kanu through a political arrangement, assuring residents of the region that “all hope is not lost.”

On Tuesday, Otti met Tinubu at the State House, Abuja, after visiting Kanu in the Sokoto prison facility, where the IPOB leader is serving his sentence.

READ ALSO:Nnamdi Kanu Files Fresh Motion, Asks Court To Strike Out All Charges

Otti’s meeting with the President is believed to be part of ongoing engagements aimed at securing the release of the detained Kanu.

Recall that Kanu bagged a life sentence instead of the death penalty after the presiding judge, Justice James Omotosho, handed down the sentence on counts one, two, four, five, and six.

The judge also handed Kanu a 20-year jail term on count three, with no option of fine, and a five-year jail term on count seven, with no option of fine.

Justice Omotosho delivered the judgment after convicting Kanu on all seven counts of terrorism offences.

News2 days ago

News2 days agoBREAKING: Ex-CDS Musa meets Tinubu At Aso Villa

News4 days ago

News4 days agoInsecurity: What Sheikh Gumi Told Me After Visiting Bandits Hideouts — Obasanjo

News5 days ago

News5 days ago(VIDEO) Obasanjo To Tinubu: Why Are We Negotiating With Bandits?

Politics4 days ago

Politics4 days agoTinubu Sends Ex-INEC Chair, Former Oyo First Lady, 30 Additional Ambassadorial Nominees To Senate

News5 days ago

News5 days agoVIDEO: Jonathan Breaks Silence On Guinea-Bissau’s Military Takeover

Entertainment5 days ago

Entertainment5 days agoOrganizers Cancel Burna Boy’s US Shows After Fans Refused To Buy Tickets

News4 days ago

News4 days agoFULL LIST: Wike revokes land belonging to Ilorin Emir, Lamido, Fayose, Iyabo Obasanjo, Others In Abuja

News3 days ago

News3 days agoMOWAA: Why I Will Not Appear Before Edo Assembly Panel — Obaseki

Headline4 days ago

Headline4 days agoUS: Four Killed, 10 Others Wounded In California Shooting

Metro5 days ago

Metro5 days agoArmy, Air Force Crush ISWAP Fighters After Failed Chibok Attack